10 Best Accounting Software in Australia In today’s competitive business environment, having the right accounting software can be a game changer for companies of all sizes.

Australian businesses, in particular, need solutions that simplify compliance with GST and BAS regulations while also offering a full suite of features like invoicing, expense tracking, and payroll management.

In this blog, we’ll explore the top accounting software solutions in Australia, highlighting their key features, pricing, and how they can benefit your business.

| Software | Starting Price | Trial Period | Free version |

|---|---|---|---|

| Refrens | $214/year | ✔️ | ✔️ |

| MYOB | $336/year | ✔️ | ❌ |

| Reckon One | $72/year | ✔️ | ❌ |

| QuickBooks | $270/year | ✔️ | ❌ |

| FreshBooks | $510/year | ✔️ | ❌ |

| Zoho Books | $198/year | ✔️ | ✔️ |

| Xero | $420/year | ✔️ | ❌ |

| Kashoo | $107/year | – | ❌ |

| Netsuite | Custom | – | – |

| Sage Intacct | Custom | – | – |

Key Features to Look for in Accounting Software for Australian Businesses:

- GST and BAS Compliance: Automates GST calculations and simplifies BAS lodgment with the ATO for easy tax compliance.

- Invoicing: Create professional invoices with recurring billing and integrate with payment gateways for automated reminders.

- Expense Management: Easily track and categorize expenses, upload receipts, and manage budgets for effective cost control.

- Accounts Payable & Receivable: Manage supplier payments, customer invoicing, and overdue collections efficiently.

- Financial Reporting: Generate customizable reports, including profit and loss, balance sheets, and cash flow statements.

- Bank Reconciliation: Automatically match bank transactions with accounting records for seamless reconciliation.

- Multi-Currency Support: Handles multiple currencies and automatic conversions for businesses with international clients.

- Inventory Management: Track stock levels, orders, and costs, ensuring efficient inventory control.

- Integration Capabilities: Seamlessly connect with CRM, ERP, and local payment systems for efficient operations.

- Data Security: Protects financial data with encryption and secure access controls.

1. Refrens

Refrens is a trusted accounting and invoicing solution designed for businesses in Australia, serving over 150,000 users worldwide. The platform simplifies financial management by offering a complete set of tools for invoicing, accounting, inventory, sales, and expense tracking. With Refrens, businesses can easily create essential financial documents like invoices, quotes, purchase orders, and credit notes, making it a perfect choice for businesses in Australia.

Key Features:

- Invoicing: Easily create and manage invoices with features like multi-currency support, recurring invoicing automation, and automatic payment reminders.

- Customization: Personalize invoices with customizable templates to align with your brand’s identity.

- Audit Trail: Ensure transparency and accountability with a detailed audit trail tracking all invoice actions.

- Invoice API: Generate invoices directly from your website or app using Refrens’ Invoice API for seamless integration.

- Advanced Accounting & Bookkeeping: Automatically generate ledgers, journal entries, and vouchers, while producing key financial reports such as Balance Sheets, Profit & Loss statements, and Trial Balances for thorough financial tracking.

- Reports & Analytics: Access a wide range of in-depth financial reports, including balance sheets, profit & loss statements, payment reports, and more to gain critical insights into your business performance.

- Third-Party Integrations: Connect seamlessly with external platforms like Shopify, Facebook, and Instagram to streamline your operations and enhance workflow.

- Multi-User & Multi-Business: Easily manage multiple businesses and add team members with customizable roles and permissions for streamlined collaboration.

Additional Features:

Refrens offers advanced reporting, real-time inventory tracking, expense management, and sales CRM for efficient lead and client management.

Pricing:

- Basic Plan: $0

- Books Essential: $214/year

- Books Pro: $447/year

Pros:

- User-friendly interface makes invoicing, expense tracking, and financial reporting easy for small businesses and freelancers.

- Customization options allow branded invoices and tailored templates for a professional appearance.

- Automation features like recurring invoicing, payment reminders, and quote-to-invoice conversion save time and improve efficiency.

Cons:

- Internet dependency can be inconvenient in areas with poor connectivity.

2. MYOB

MYOB is a versatile accounting solution designed to make business management easier for companies of all sizes. Its cloud-based platform automates invoicing, simplifies expense tracking, and handles payroll efficiently. With MYOB, managing GST, lodging BAS, and staying on top of your financials becomes hassle-free. Plus, it integrates directly with your bank accounts, ensuring accurate and real-time reporting for better financial insights.

Features:

- Invoicing: Generate professional, tailored invoices from anywhere. Keep tabs on payments, and automatically remind clients who still owe you.

- Expenses: Track your expenses effortlessly by snapping receipt photos, forwarding bills from your email, and getting tax-ready with ease.

- Tax and GST: Automatically calculate GST and simplify your BAS preparation and lodgment directly with the Australian Taxation Office (ATO).

- Bank Account Integration: Sync your bank accounts, allowing transactions to flow seamlessly into MYOB for up-to-the-minute financial visibility.

- Job Tracking: Monitor the profitability of individual projects, helping you focus on the most lucrative tasks.

- Inventory Management: Stay on top of stock levels, simplify reordering, and prevent stock shortages with real-time inventory monitoring.

Additional Features:

MYOB equips businesses with financial reporting tools for deeper insights into performance. It also supports multi-currency management with automatic currency conversions. Plus, integrated job tracking and cash flow tools help streamline resource management and better prepare for future expenses.

Pricing:

- MYOB Business Lite: $28/month

- MYOB Business Pro: $40/month

- MYOB AccountRight Plus: $70/month

- MYOB AccountRight Premier: $109/month

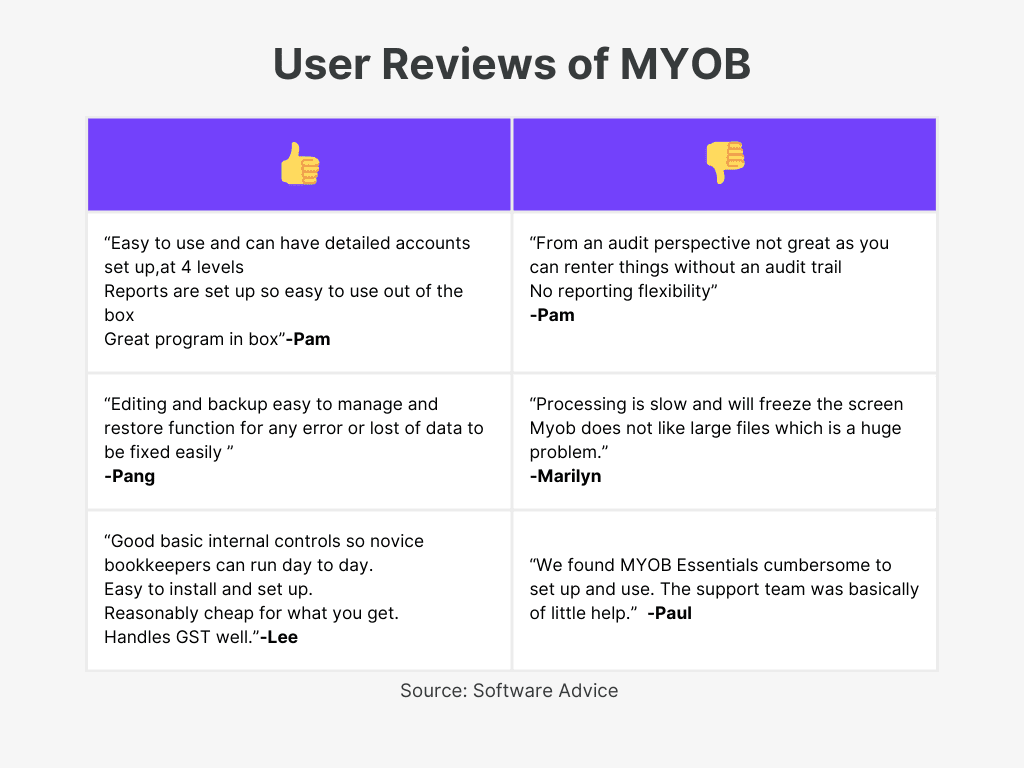

User Reviews:

3. Reckon One

Reckon One is an affordable accounting software tailored for small businesses in Australia. It offers essential tools for managing cash flow, payroll, and invoicing. Users can monitor day-to-day business activities, track GST, and generate real-time reports. The software allows unlimited users and integrates with bank transactions for seamless management.

Features:

- Real-time cash flow monitoring: Gain immediate clarity on your net business position with live cash flow tracking.

- Bank Reconciliation: Automatically reconcile your bank transactions to keep your financial records up to date.

- Comprehensive reporting: Generate detailed financial reports to monitor your business’s performance and make informed decisions.

- Budget Management: Create and manage budgets, allowing better financial planning and control.

- GST tracking: Effortlessly manage GST calculations and track tax obligations for accurate BAS preparation.

- Unlimited users: Share your books with your team or accountants without restrictions on the number of users.

- Invoicing: Create and send professional invoices, ensuring timely payments from clients.

Additional Features:

Reckon One also offers customizable financial reports that help businesses make informed decisions. It supports multiple users, allowing collaboration with accountants or other team members. With the platform’s cloud-based storage, your data is securely stored in Australia, and Reckon offers free data migration for new users.

Pricing:

- Reckon One (Accounting Basics): $6/month

- 30-day free trial available

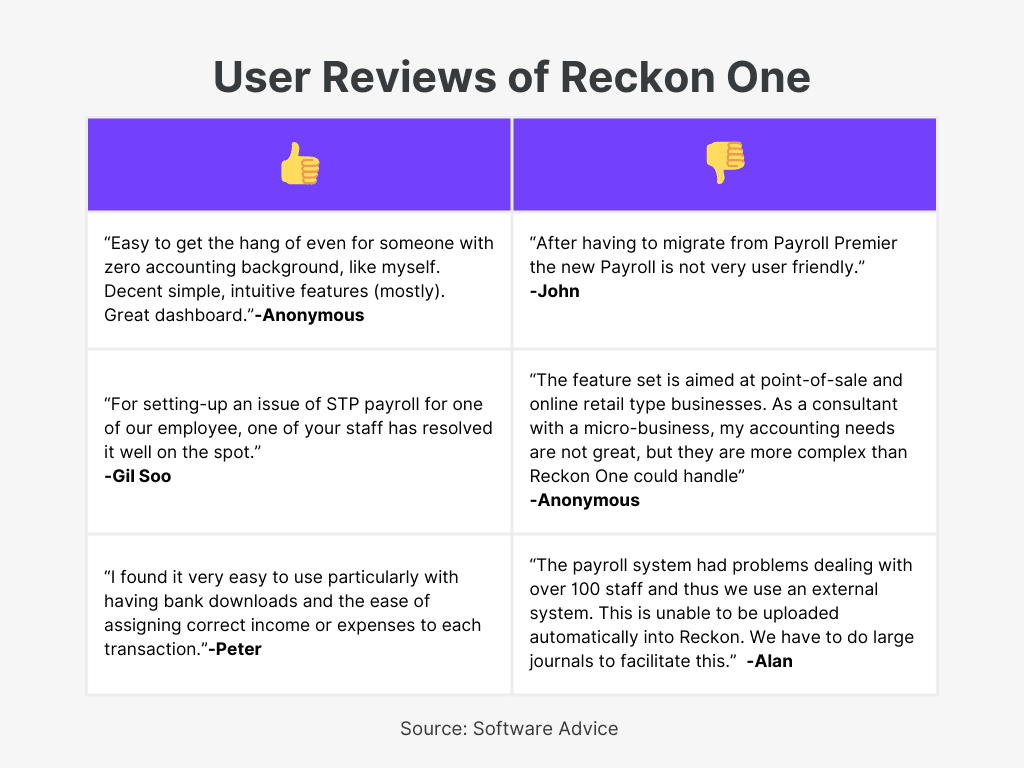

User Reviews:

4. QuickBooks

QuickBooks is a popular cloud-based accounting software designed to meet the needs of small businesses and sole traders. It simplifies financial management with features like invoicing, payroll, and real-time cash flow tracking. QuickBooks integrates with bank accounts, providing accurate financial reports and supporting GST and BAS compliance.

Features:

- Invoicing: Create and send custom invoices with built-in tracking and payment options, helping you get paid faster.

- Automated expenses: Track and categorize expenses automatically, simplifying expense management and ensuring accurate tax filings.

- Payroll management: Manage payroll efficiently, including Single Touch Payroll (STP), superannuation, and ATO obligations in one place.

- GST & BAS tracking: Monitor and track GST liabilities, and easily lodge BAS directly through QuickBooks.

- Cash flow insights: View real-time cash flow from connected bank accounts, helping you make informed business decisions.

- Financial reporting: Generate insightful reports that provide a clear view of your business performance for better decision-making.

- Multi-currency support: Manage international transactions with ease, converting foreign currencies automatically with real-time exchange rates.

Additional Features:

QuickBooks enables businesses to efficiently manage suppliers and inventory while offering features like project tracking, budget management, and workflow automation. With seamless integration to over 500 apps, it provides a high level of flexibility and customization. Additionally, users can easily back up and restore their data, ensuring both security and business continuity.

Pricing:

- Essentials Plan: $22.50/month

- Plus Plan: $30/month

- Advanced Plan: $55/month

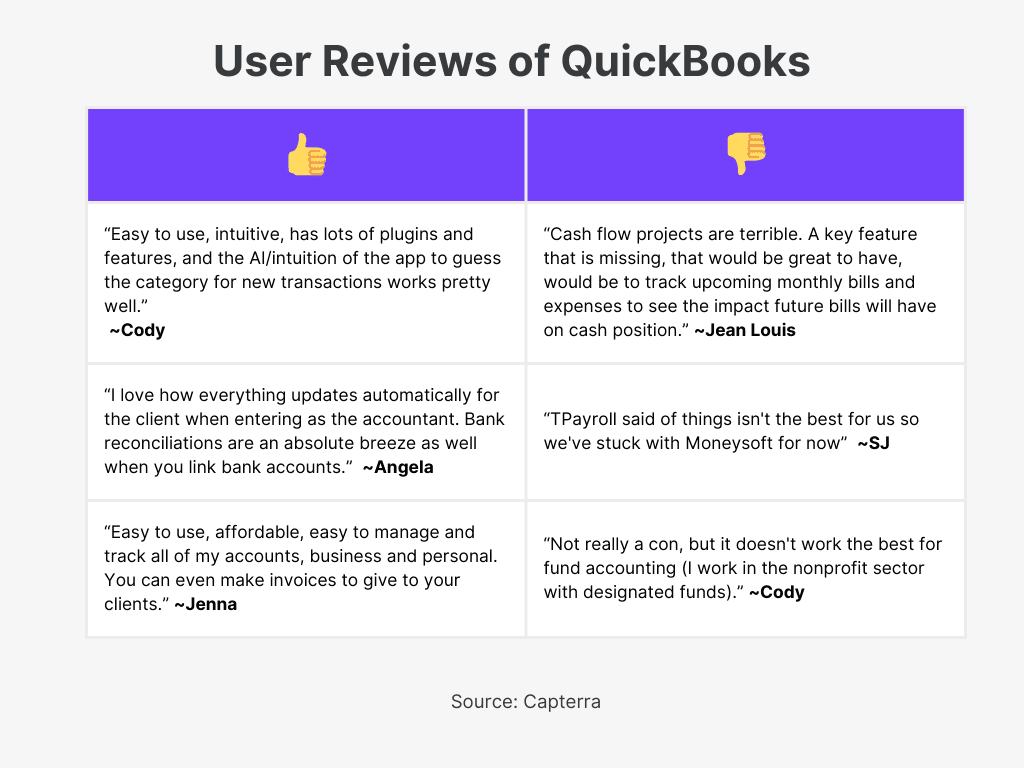

User Reviews:

5. Sage Intacct

Sage Intacct is a cloud-based financial management software tailored for medium to large businesses. It offers powerful tools for multi-entity management, real-time reporting, and automation of key processes like accounts payable and receivable. Designed to improve finance team productivity, Sage Intacct scales as your business grows and provides in-depth insights for decision-making.

Features:

- Accounts Payable Automation: Supports efficient workflows across the entire AP cycle, reducing processing times and manual errors.

- Accounts Receivable Automation: Automates key steps in invoicing and collections, allowing a more manageable cash cycle.

- Cash Management: Monitors multiple accounts with tools for real-time visibility, helping streamline tracking and reconciliation.

- General Ledger: Consolidates data across entities, currencies, and geographies, for quick access to comprehensive financial overviews.

- Order Management: Handles high-volume quote-to-cash cycles, aiding in the management of complex transactions.

- Purchasing: Structures workflows with built-in transaction approvals.

- Multi-Entity Insights: Provides insights tailored for multi-entity businesses.

Additional Features:

Sage Intacct offers robust reporting and dashboards that give real-time insights into business performance. It also integrates seamlessly with other solutions like Salesforce. The platform supports dynamic allocations and fixed assets management, enabling businesses to automate key financial processes and make data-driven decisions.

Pricing:

Pricing is available upon request with custom plans depending on business needs

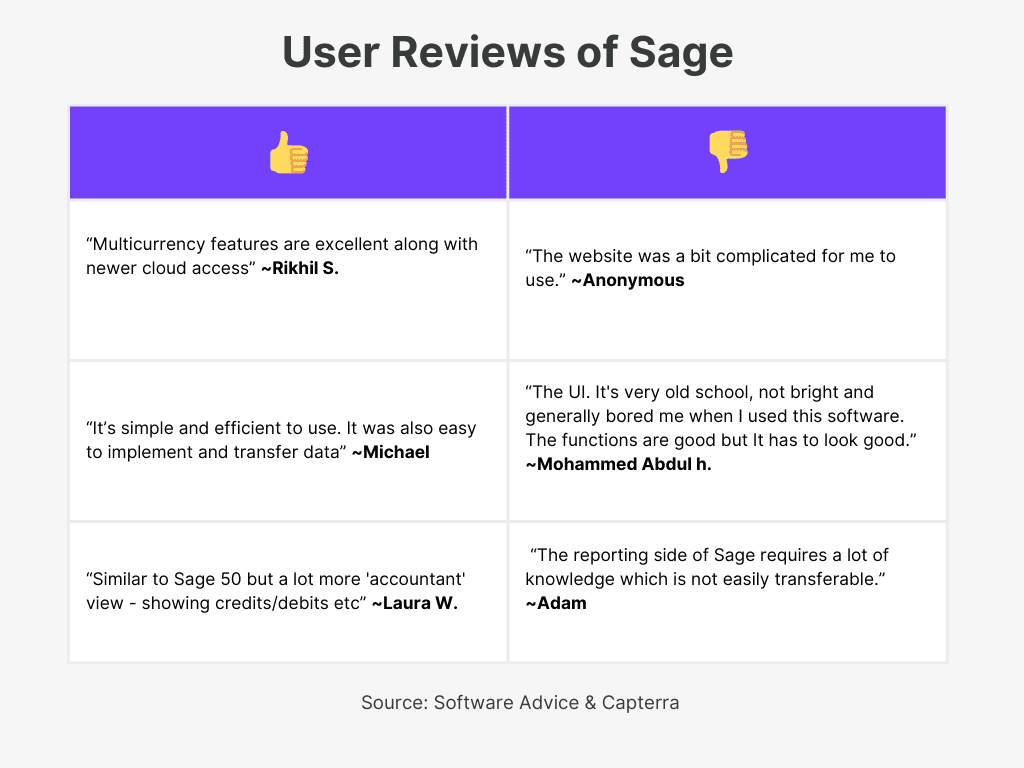

User Reviews :

6. FreshBooks

FreshBooks is a cloud-based accounting solution tailored for freelancers, small businesses, and self-employed professionals. It streamlines bookkeeping tasks with tools for invoicing, expense tracking, and project management. FreshBooks helps users stay compliant, create comprehensive financial reports, and seamlessly collaborate with accountants for smoother tax filing and informed business decisions.

Features:

- Invoicing: Design professional, personalized invoices and accelerate payments with built-in payment solutions and tracking features.

- Expense Tracking: Easily upload receipts, automatically track expenses from your bank, and categorize them for smoother tax filing.

- Time Tracking: Record billable hours for projects and quickly turn them into invoices for your clients.

- Automated Bank Reconciliation: Streamline reconciliation by syncing bank transactions, keeping your financial records current.

- Double-Entry Accounting: Stay organized for tax season with tools like a customizable Chart of Accounts, General Ledger, and Balance Sheet.

- Project Management: Oversee project progress, time, and team collaboration all in one place.

- Client Communication: Handle proposals, estimates, invoices, and all client interactions directly through FreshBooks.

Additional Features:

FreshBooks offers detailed financial reports like Profit & Loss and Cash Flow, along with credit tracking for applying prepayments to future invoices. It integrates with over 100 apps and facilitates easy collaboration with accountants for seamless financial management.

Pricing:

- Lite Plan: $17/month

- Plus Plan: $30/month

- Premium Plan: $55/month

- Free 30-day trial available

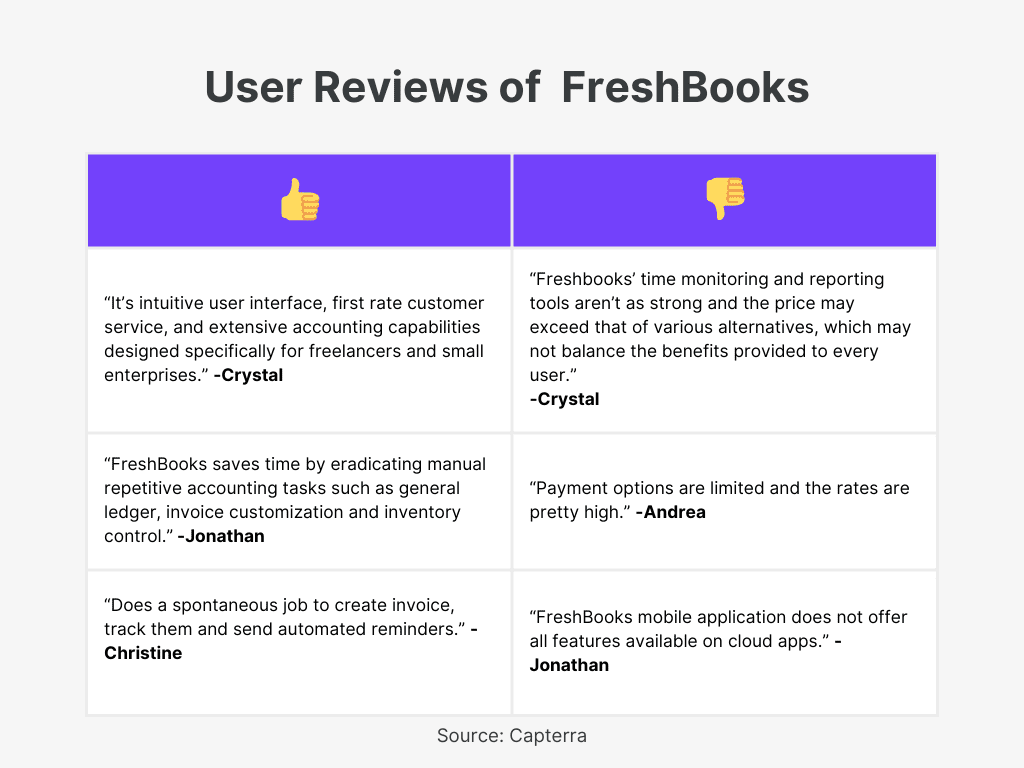

User Reviews:

7. ZohoBooks

Zoho Books is a cloud-based accounting software built to streamline your business finances. It automates workflows, ensures GST compliance, and fosters collaboration across teams. Equipped with tools for invoicing, expense tracking, and project management, Zoho Books is perfect for businesses looking for a flexible and scalable solution that easily integrates with other Zoho applications.

Features:

- Invoicing: Create and send GST-compliant invoices within seconds, allowing your customers to pay online for faster payments.

- Expense tracking: Upload receipts, track business expenses, and categorize them for tax season.

- Banking integration: Automatically fetch bank transactions and reconcile accounts in real time, keeping your finances up to date.

- Project management: Track billable hours and manage projects, converting timesheets into invoices.

- GST compliance: Zoho Books ensures that all transactions are GST-compliant, with BAS reports ready for tax season.

- Role-based access: Add colleagues and accountants to your organization, granting them customized access to manage accounts, view reports, or log time.

- Automation: Automate recurring transactions, set up payment reminders, and streamline other workflows to save time.

Additional Features:

Zoho Books integrates with Zoho CRM, Zoho Projects, and other Zoho apps for a seamless business experience. It also offers customizable reports, purchase orders, and inventory tracking. With a customer portal, clients can view and manage their transactions, while the vendor portal enables vendors to self-manage their dealings with your business.

Pricing:

- Free Plan: For businesses with revenue under 50K AUD per annum

- Standard Plan: $16.50/month

- Professional Plan: $33/month

- Premium Plan: $44/month

- Elite Plan: $181.50/month

- Ultimate Plan: $319/month

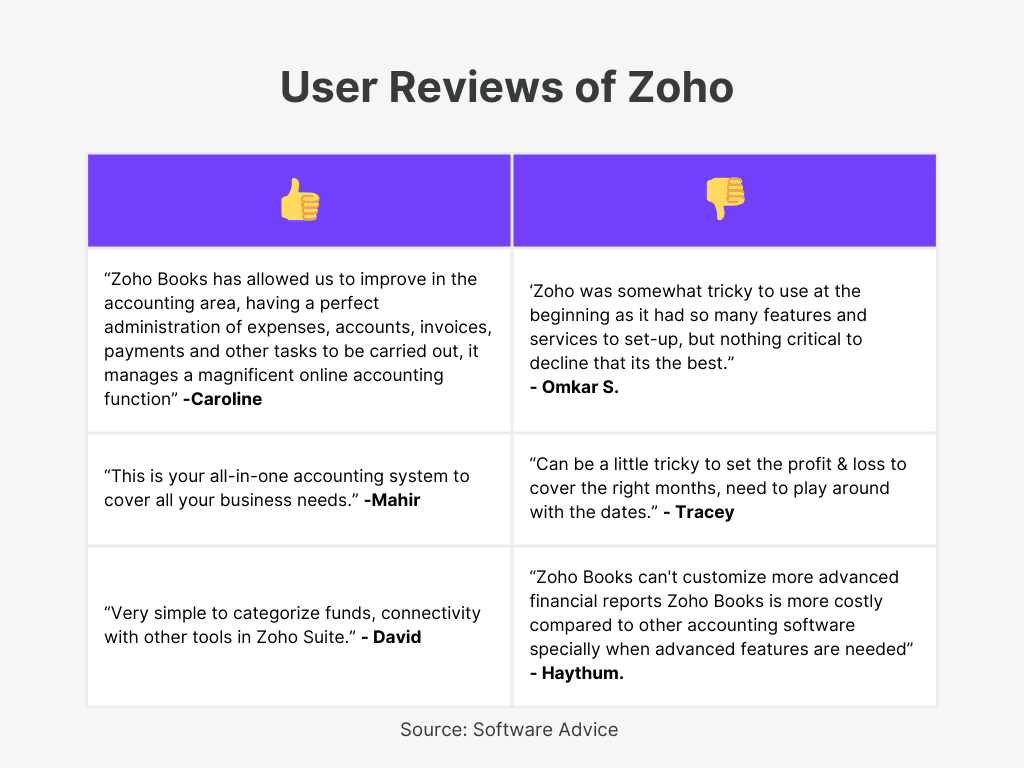

User Reviews:

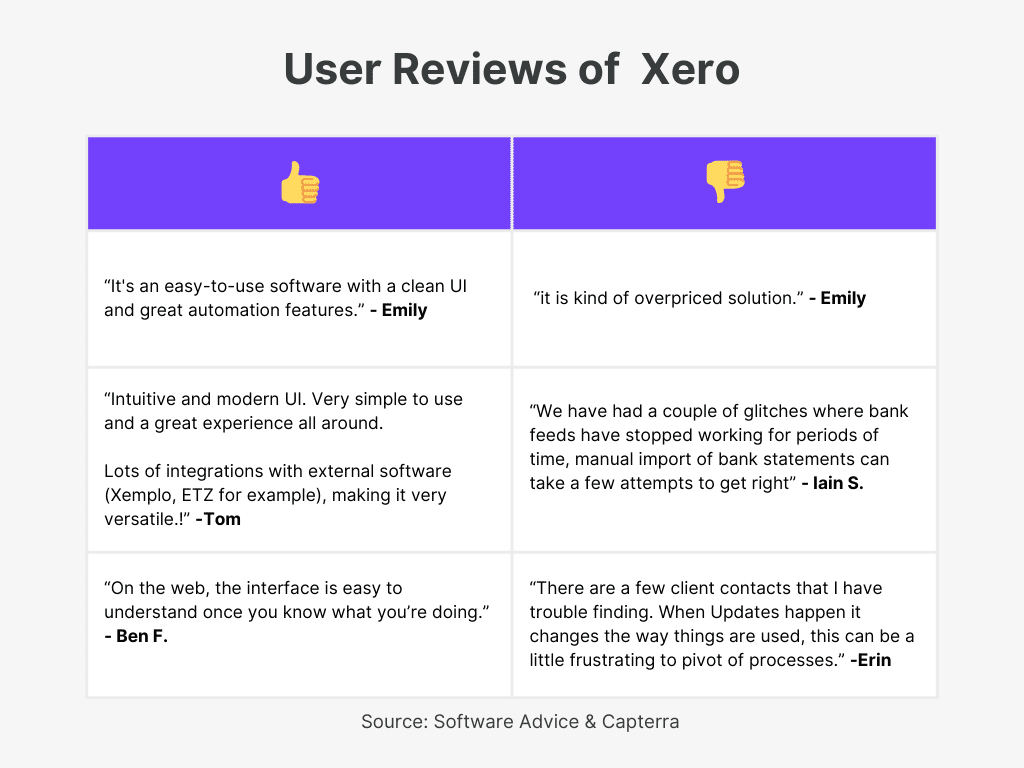

8. Xero

Xero is a cloud-based accounting software designed for small businesses in Australia. It simplifies financial management by automating tasks like invoicing, expense tracking, and reporting. Xero connects directly with your bank for real-time transaction updates and offers customizable tools to manage everything from payroll to GST returns.

Features:

- Invoicing: Create and send invoices quickly, and track payments to ensure you get paid on time.

- Expense management: Easily track and categorize expenses, and keep your business finances organized and tax-ready.

- Bank reconciliation: Automatically import bank transactions into Xero, making it easier to reconcile accounts daily.

- Project tracking: Manage your projects by tracking time and expenses, converting them into invoices effortlessly.

- GST returns: Simplify tax compliance by generating GST reports and lodging returns directly through Xero.

- Collaboration: Collaborate with your accountant or team in real-time, ensuring everyone has access to up-to-date financial information.

- Mobile app: Manage your business on the go with Xero’s mobile app, which allows you to send invoices, track expenses, and more.

Additional Features:

Xero offers integration with over 1,000 third-party apps, making it highly flexible for various business needs. The platform provides insightful financial reports, cash flow tracking, and tools to automate tasks like payroll. Users can also take advantage of Xero’s app store for additional features like payment processing and inventory management.

Pricing:

- Ignite Plan: $35/month

- Grow Plan: $70/month

- Comprehensive Plan: $90/month

- Ultimate Plan: $115/month

User Reviews:

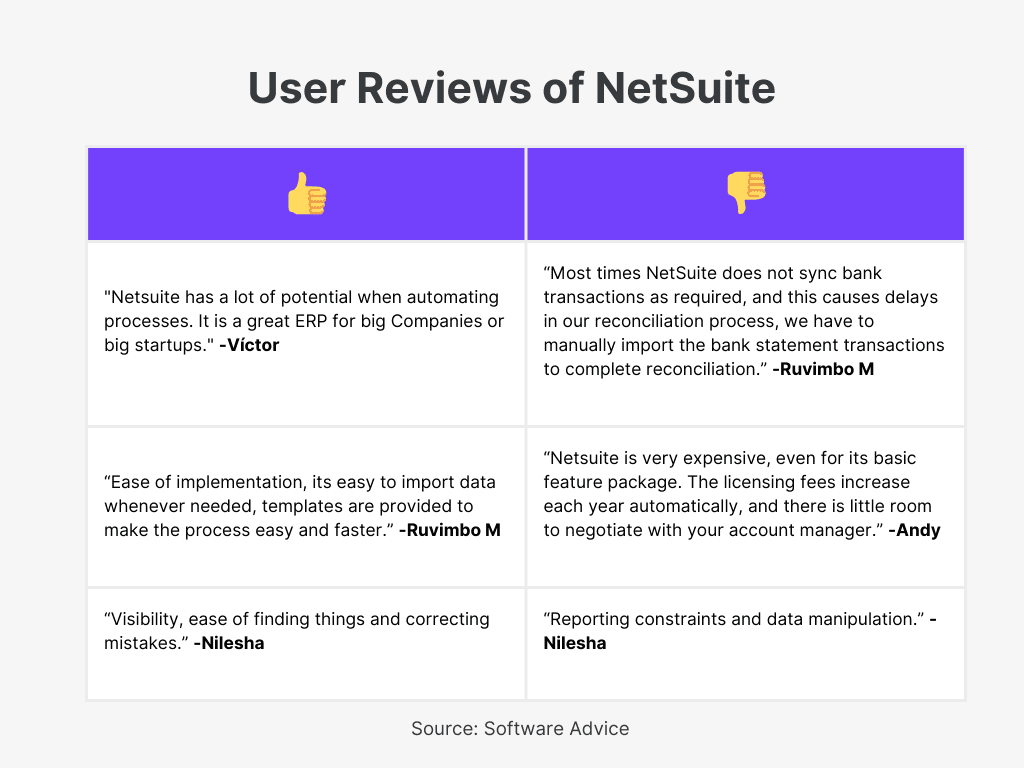

9. NetSuite

NetSuite is a cloud-based accounting software designed to streamline financial management for businesses of all sizes. It offers powerful tools for automating processes like accounts receivable and payable, tax management, and financial reporting.

With real-time insights and embedded AI capabilities, NetSuite helps businesses improve financial controls, close faster, and ensure compliance with regulatory standards such as GAAP and ASC 606.

Features:

- General Ledger: Enhanced audit trails, customizable account types, and transaction reports, ensuring accurate financial records.

- Cash Management: Provides real-time visibility into cash positions, tracking multiple accounts and ensuring optimized cash flow management.

- Accounts Receivable & Accounts Payable: Automates invoicing, collections, and payment processes.

- Tax Management: Streamlines tax compliance by automating tax calculations and filing processes, reducing the risk of errors.

- Fixed Assets Management: Manages fixed asset lifecycle, from acquisition to disposal, while automating depreciation schedules.

- Close Management: Accelerates the financial close process with automated workflows.

- Account Reconciliation: Simplifies bank reconciliation by automatically matching transactions, eliminating discrepancies, and ensuring data accuracy.

Additional Features:

NetSuite integrates with financial, HR, and e-commerce tools, offering role-based dashboards and real-time financial insights. Its cloud platform enables remote access and cross-department collaboration, while also ensuring regulatory compliance.

Pricing:

NetSuite’s subscription pricing includes an annual fee, which is scalable with optional modules and users, plus a one-time setup fee

User Reviews:

10. Kashoo

Kashoo Accounting is an easy-to-use cloud-based accounting software tailored for small businesses. It simplifies bookkeeping tasks such as invoicing, expense tracking, and automatic bank reconciliation, helping business owners stay organized and prepared for tax season.

Features:

- Invoicing: Create and send invoices quickly with automatic reminders and payment status updates for faster payments.

- Expense Management: Use OCR technology to scan and upload receipts, automatically categorizing them for easy tracking.

- Bank reconciliation: Automatically match transactions from your bank to invoices, ensuring your books are always up to date.

- Multi-currency support: Send invoices and receive payments in multiple currencies, making it easier to manage global transactions.

- Customization: Tailor categorization rules and branding to suit your business, ensuring your accounting process is personalized.

- Mobile access: Manage your business on the go with the TrulySmall mobile app, available on iOS and Android.

- Tax optimization: Transactions are categorized in IRS/CRA-approved categories, helping you prepare for tax filing stress-free.

Additional Features:

Kashoo offers seamless expense recording. The platform provides detailed financial reports, offering insights to help you make informed decisions. Your business data is always safe with secure data protection measures like two-factor authentication and encryption.

Pricing:

- Invoicing Plan: $8.99/month – Includes 5 free invoices, digital payments, and status tracking.

- Expense Tracking Plan: $8.99/month – Includes expense recording, budgeting, and receipt import.

- Accounting Plan: $20/month – Full automation of accounting, tax tracking, and essential reporting.

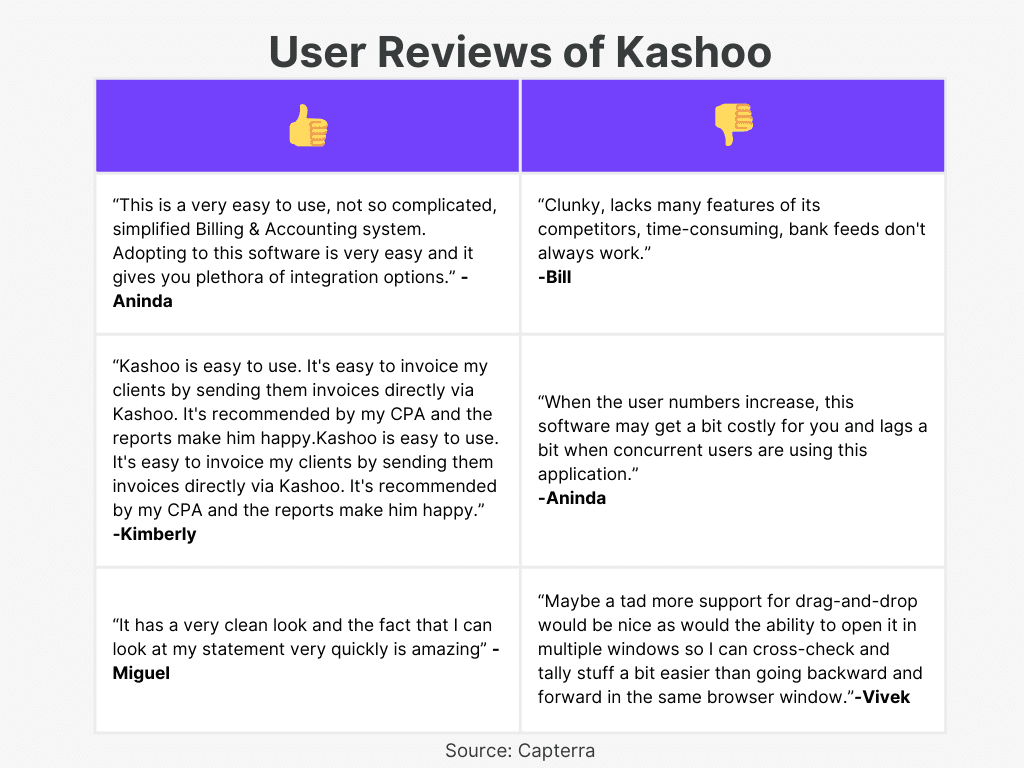

User Reviews:

Key Considerations When Selecting Accounting Software

- Core Features: Make sure the software includes vital tools like invoicing, expense management, financial reports, and payroll.

- User-Friendliness: Opt for a platform with an intuitive interface that’s easy for your team to navigate and use.

- Growth Potential: Pick a solution that can expand your business, allowing for more users and advanced features as your needs evolve.

- System Integrations: Check if the software connects with your other business tools, such as CRM, HR systems, or payment processors.

- Compliance and Reporting: Ensure it supports local tax regulations, such as GST, and offers flexible reporting options.

- Customer Assistance: Strong customer support is essential for quickly resolving any technical or user issues.

- Pricing: Assess the cost to make sure it aligns with your budget, without compromising on important functionality.

Conclusion

Cloud accounting software is crucial for efficient financial management and compliance. The 10 options highlighted offer various features to suit businesses of all sizes, from invoicing and tax filing to payroll and reporting.

When selecting a platform, consider your business needs, future growth, and how well it integrates with your current tools. The right choice can simplify processes and support your long-term financial success.