Efficient financial management is key to smooth business operations and compliance with Singapore’s local regulations. As businesses handle invoicing, tax filing, and expense tracking, the need for intuitive and powerful accounting software has never been greater. With features like Peppol e-invoicing, multi-currency support, and real-time reporting, these tools can streamline financial processes.

This blog highlights the Best Accounting Software in Singapore, offering tailored solutions to help businesses manage their accounting and focus on growth.

| Software | Starting Price | Trial Period | Free version |

|---|---|---|---|

| Refrens | $115/year |  |  |

| MYOB | $372/year |  |  |

| Smart Cursor | $480/year | – | – |

| QuickBooks | $324/year |  |  |

| Zoho Books | $120/year |  |  |

| FreshBooks | $114/year |  |  |

| Highnix | Custom | – | – |

| SAP | Custom | – | – |

| HashMicro | Custom | – | – |

| NetSuite | Custom | – | – |

Essential Accounting Software Features for Singapore Businesses

- Peppol E-Invoicing Integration: Compliance with Singapore’s Peppol e-invoicing network is crucial for smooth invoicing and tax filing, ensuring businesses meet IRAS requirements.

- GST Compliance: The software should automatically calculate Goods and Services Tax (GST) and generate reports like GST F5 for easy submission to IRAS.

- Multi-Currency Support: With many businesses handling international transactions, the software should facilitate seamless multi-currency invoicing and automatic currency conversion.

- Cloud-Based Access: Cloud-based solutions enable remote access, allowing businesses to manage their finances anytime, anywhere, which is especially useful for remote teams.

- Automation: Recurring invoicing, payment reminders, and expense tracking should be automated to save time and reduce manual errors.

- Bank Reconciliation: Automatic import and reconciliation of bank transactions help businesses maintain up-to-date financial records without manual effort.

- Comprehensive Reporting: The ability to generate reports like profit and loss statements, balance sheets, and cash flow reports is essential for analyzing business performance and making informed decisions.

- Inventory Management: For businesses that deal with stock, having built-in inventory management that tracks stock levels and links them to accounting is a must.

- Audit Trails: Maintaining transparency is essential, so choose software that offers a comprehensive audit trail to track all modifications made to invoices and transactions.

- Security & Data Privacy: Strong encryption, regular backups, and access control are vital to safeguarding sensitive financial data.

1. Refrens

Trusted by over 150,000 businesses in 170+ countries, Refrens is an ideal cloud-based platform designed for, all types of businesses, providing a comprehensive suite of tools to manage invoicing, quotations, payments, and accounting.

Refrens simplifies business processes with features such as inventory management, expense tracking, and customizable reporting, all within a user-friendly interface.

Key Features:

- Invoicing: Create customizable invoices with automatic tax calculations, professional templates, and multi-currency options.

- Recurring Invoices: Automate recurring invoicing and set up payment reminders for timely payments.

- Advanced Accounting & Bookkeeping: Automate ledgers, journal entries, and vouchers, with essential financial reports like Balance Sheet, Profit & Loss, and Trial Balance for full financial oversight.

- Client Management: Manage multiple clients, and track their payments, projects, and invoices in a centralized dashboard for efficient workflow.

- Expense Management: Track and manage expenses like salaries, reimbursements, utility bills, and more, with detailed status updates for better financial control.

- Third-Party Integration: Seamlessly integrate with platforms like Shopify, Facebook, and Instagram to streamline workflows and enhance business operations.

- Quotation to Invoice Conversion: Convert approved quotations into invoices with a single click, streamlining the process.

- Audit Trails: Maintain transparency by tracking all changes made to invoices through an audit trail feature.

- Multi-Users & Multi-Business: Manage multiple businesses and add team members with ease, assigning roles and permissions for efficient team collaboration.

Additional Features:

Refrens offers inventory management, and supports multi-user functionality, enabling businesses to add team members and assign roles. It also integrates with a sales CRM, providing a comprehensive solution for managing sales pipelines.

Pricing:

- Basic Plan: Free

- Books Essential: $115/year

- Books Pro: $240/year

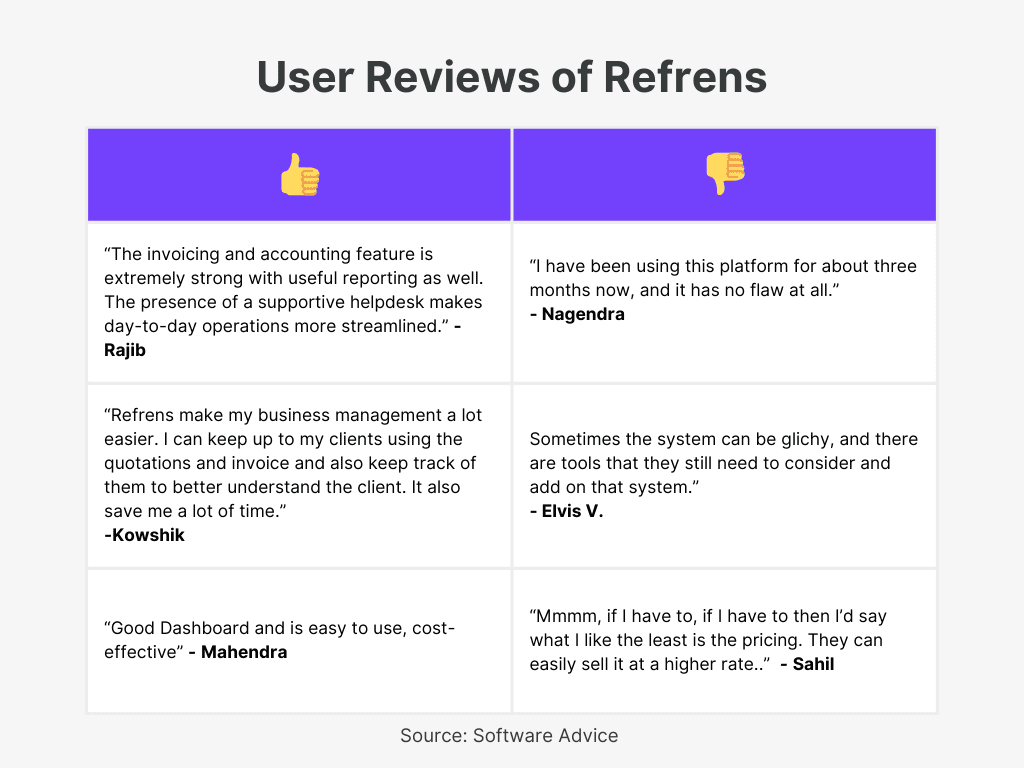

User Reviews:

2. Highnix

Highnix ERP is a cloud-based invoicing system designed specifically for SMEs, offering seamless Peppol e-invoicing capabilities. The system integrates easily with third-party applications and supports a range of business functions from inventory and sales management to accounting, making it an ideal solution for businesses looking to scale efficiently.

Key Features:

- Peppol E-Invoicing Integration: Enables businesses to send and receive invoices through the Peppol network for faster, more efficient transactions

- Customizable ERP Modules: Offers flexibility to choose modules like accounting, HR, inventory, and more to suit business needs

- Expense and Inventory Tracking: Manage inventory linked to the cost of goods sold and track all expenses for accurate financial reporting

- Multi-Currency Support: Handle transactions in multiple currencies, making it easier for businesses with international clients

- Seamless API Integration: Allows integration with third-party apps, enhancing workflow and reducing customization costs

- Data Backup and 2FA Security: Daily backups and two-factor authentication ensure data security and compliance

- Dynamic PayNow QR Code: Generates unique QR codes on invoices to facilitate easy and error-free payments

Additional Features:

Highnix ERP supports third-party HR, payroll, POS, and CRM system integrations. It also provides compliance with Singapore’s IRAS and ACRA standards, offering peace of mind to businesses. The cloud-based system is accessible across multiple devices, and users can switch between languages as needed.

Pricing:

- Subscription License: Contact for pricing

- Perpetual License: Available with customization options

3. MYOB

MYOB Business is a cloud-based accounting software tailored for small to large businesses in Singapore. It offers essential tools for managing invoicing, expenses, payroll, and GST tracking. With real-time data sync and mobile access, businesses can operate seamlessly from any device. MYOB also integrates with multiple banking and financial apps, streamlining operations for efficiency.

Key Features:

- Invoicing & Quotes: Create and send professional invoices and quotes directly from the platform, helping businesses get paid faster.

- Expense Tracking: Easily track expenses, scan receipts, and match them with bank transactions, ensuring accurate financial records.

- GST Compliance: MYOB handles GST calculations and allows businesses to easily lodge their BAS (Business Activity Statement).

- Payroll Management: Manage payroll for up to two employees, with additional options for more, ensuring compliance with local regulations.

- Job Tracking: Track jobs and projects to maintain profitability and keep track of all costs associated with each project.

- Bank Integration: Connect up to two bank accounts, automating reconciliation and transaction matching.

- Multi-Device Access: Access your accounting data from any browser or mobile device, ensuring business continuity on the go.

Additional Features:

MYOB integrates with over 350 apps, allowing businesses to expand functionality by connecting to tools like Shopify, Excel, and banking platforms. The software supports real-time data backup in the cloud, ensuring your information is always secure and accessible. Moreover, MYOB’s intuitive dashboard provides a clear overview of your business’s financial health.

Pricing:

- MYOB Business Lite: $31/month

- MYOB Business Pro: $58/month

- MYOB Business AccountRight Plus: $141/month

- MYOB Business AccountRight Premier: $177/month

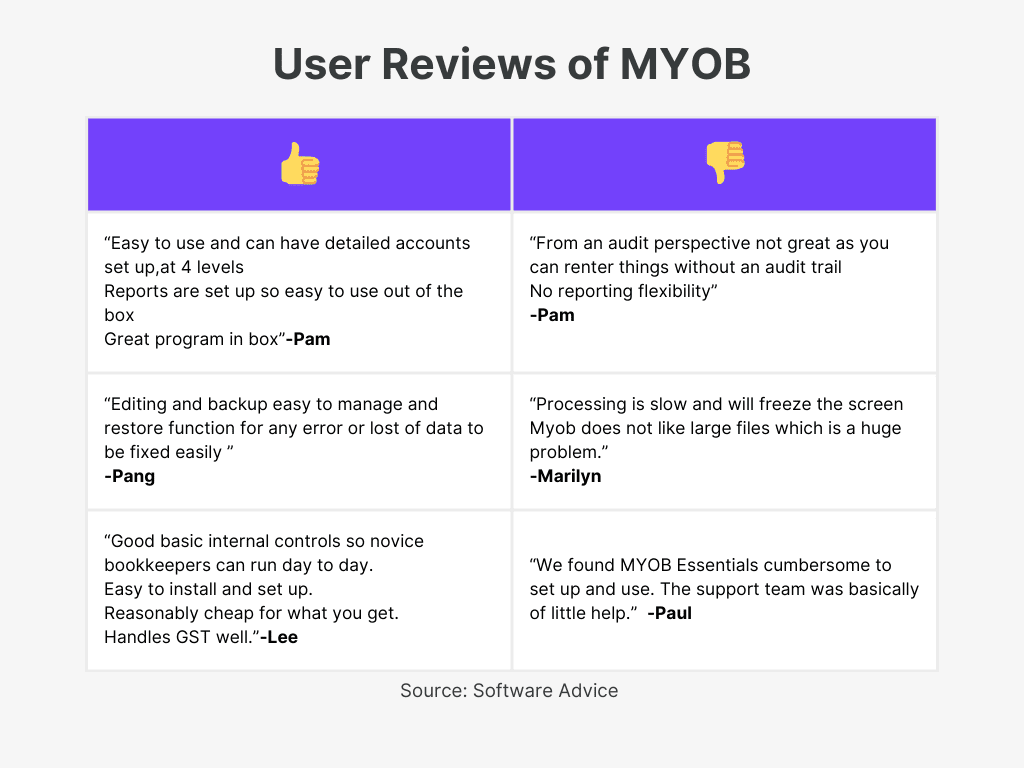

User Reviews:

4. SAP

SAP S/4HANA Cloud is a robust, enterprise-level cloud ERP solution designed to streamline financial management for businesses of all sizes. Its advanced features cover everything from financial planning and analysis to treasury and tax management, making it ideal for companies looking for comprehensive accounting tools. SAP S/4HANA offers seamless integration, machine learning capabilities, and real-time insights.

Key Features:

- Financial Planning and Analysis: Manage budgeting, forecasting, and analysis in real-time to ensure accurate financial planning.

- Accounting and Financial Close: Automate and streamline the accounting process to quickly close books and improve reporting accuracy.

- Tax Management: Comply with local and global tax regulations using automated tax calculation and reporting features.

- Treasury Management: Manage cash flows and liquidity in real-time with advanced treasury management tools.

- Quote-to-Cash Management: Simplify the sales cycle, from quoting to receiving payments, with integrated billing and revenue management.

- Embedded Analytics: Get AI-driven insights and embedded analytics to predict financial outcomes and make informed decisions.

- Granular Profitability Analysis: Track profitability at a granular level, including specific projects, products, or regions.

Additional Features:

SAP S/4HANA Cloud also offers real-time reporting, sustainability tracking, and seamless integration with SAP’s broader ecosystem, including SAP Analytics Cloud and SAP Business ByDesign, making it a scalable solution for growing businesses.

Pricing:

- Custom pricing based on business needs and modules.

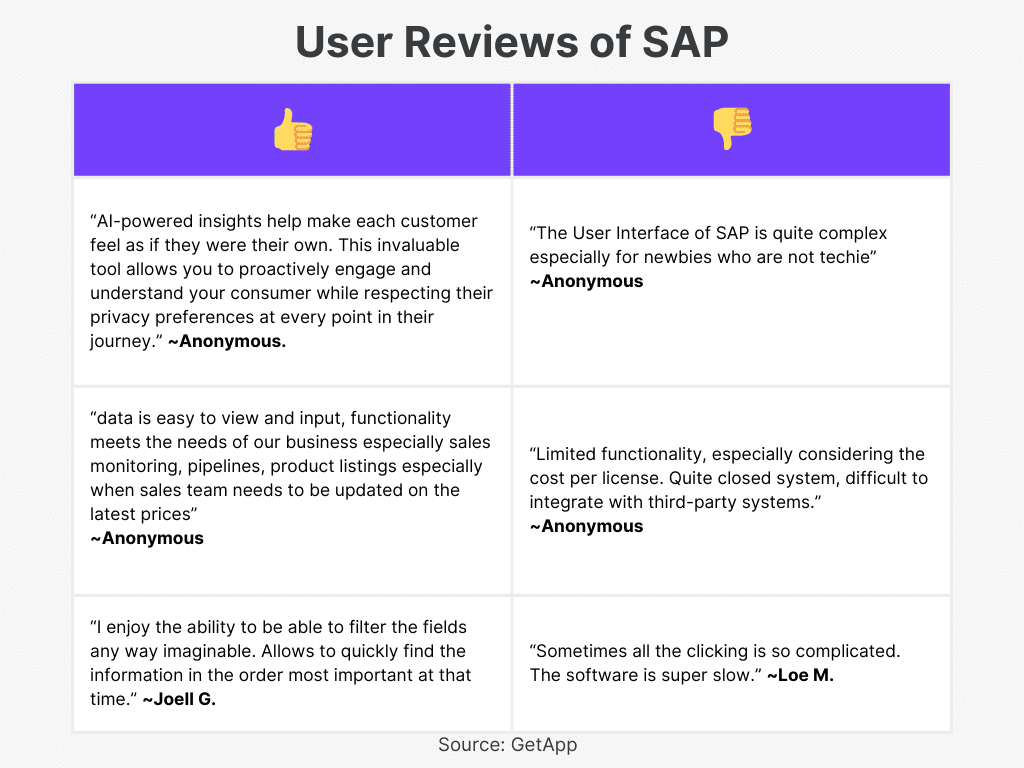

User Reviews:

5. HashMicro

HashMicro offers a comprehensive cloud-based accounting solution for Singapore enterprises, tailored to meet the financial management needs of SMEs. Equipped with essential accounting features such as cash flow management and bank reconciliation, HashMicro is Peppol e-invoicing ready, enabling seamless invoice management on the Singapore Peppol network.

Key Features:

- Financial Dashboard: Provides a real-time overview of your business’s financial health, tracking income, cash balances, and accounts receivable/payable.

- Cash Flow Forecasting: Offers accurate forecasting tools for monitoring future income and expenditures to improve financial planning.

- Bank Reconciliation: Automates the importing and reconciling of bank transactions, reducing manual errors and improving efficiency.

- Accrual & Amortization: Automates the process of calculating accruals and amortizations, reducing manual calculations and human errors.

- Peppol e-Invoicing: Integrated with the Singapore Peppol e-Invoicing network for seamless invoice creation and management.

- Analytical Reporting: Generate detailed financial reports such as income statements, balance sheets, and cash flow reports within seconds.

- Inventory Integration: Integrates seamlessly with the Inventory Management System to streamline stock-taking and cost-calculation processes.

Additional Features:

HashMicro’s accounting system also offers integration with CRM, purchasing, and sales systems to maintain a healthy cash flow and optimize procurement costs. The system is designed to be scalable and customizable for businesses of different sizes, ensuring seamless upgrades.

Pricing:

Custom pricing is available based on business needs.

6. Smart Cursor

SmartCursors offers a cloud-based accounting solution designed to manage accounting, finance, and business performance for multiple entities. It provides businesses with intuitive tools for handling invoices, vendor management, and cash flow, all within a single platform.

Key Features:

- Multiple Entity Management: Manage the accounting and finances of multiple entities with features like cross-billing, payments, and consolidated financial tracking

- Customer Management: Handle recurring invoices, credit notes, discounts, and GST seamlessly for effective sales and collection management

- Vendor Management: Track vendor bills, claims, and payment cycles for better cash flow management

- Cash Flow Management: Get a real-time overview of deposits, withdrawals, and transfers with an interactive cash flow manager

- Multi-Currency Platform: Automatically record and track multi-currency transactions, ensuring smooth global operations

- Online Dashboard: Access real-time financial data through an interactive dashboard that consolidates key performance insights

- Analytics Integration: Add analytics capabilities for insights on customers, vendors, and financial performance, using drill-down options on historical data

Additional Features:

SmartCursors also supports collaboration with visual reports that can be shared with your team. The platform’s analytics app enhances productivity by providing KPI insights and compliance control, allowing businesses to make informed decisions.

Pricing:

- SGD 40/month for a single entity, up to 3 users

- SGD 120/month for up to 5 entities, 3 users

- Analytics add-on: SGD 5 for a single entity, SGD 25 for multi-entity

7. QuickBooks

QuickBooks is a popular cloud-based accounting software solution designed to help small businesses and freelancers manage their finances easily. It simplifies invoicing, expense tracking, and financial reporting, offering a seamless solution to stay organized and efficient in business operations.

Key Features:

- Invoicing: Create and send professional custom invoices, track payments, and send automatic reminders

- Expense Tracking: Organize and categorize your expenses in one place to prepare for tax time easily

- Bank Integration: Sync your bank accounts to automatically import transactions and reconcile them with your accounts

- Multi-Currency Support: Manage transactions in different currencies, making it easier for businesses with international operations

- Cash Flow Management: Get a real-time view of your cash flow, allowing for better financial planning

- Mobile App: Manage your business finances on the go with the QuickBooks mobile app, ensuring access to all your data anytime, anywhere

- GST & VAT Tracking: Automatically calculate GST on income and expenses, and stay compliant with tax laws

Additional Features:

QuickBooks also supports inventory management and advanced reports that provide insights into business profitability.It offers unlimited customer support and is integrated with government grants like the Productivity Solutions Grant (PSG) for cost-saving software installation.

Pricing:

- Simple Start: $27/month

- Essentials: $42/month

- Plus: $56/month

- Advanced: $109/month

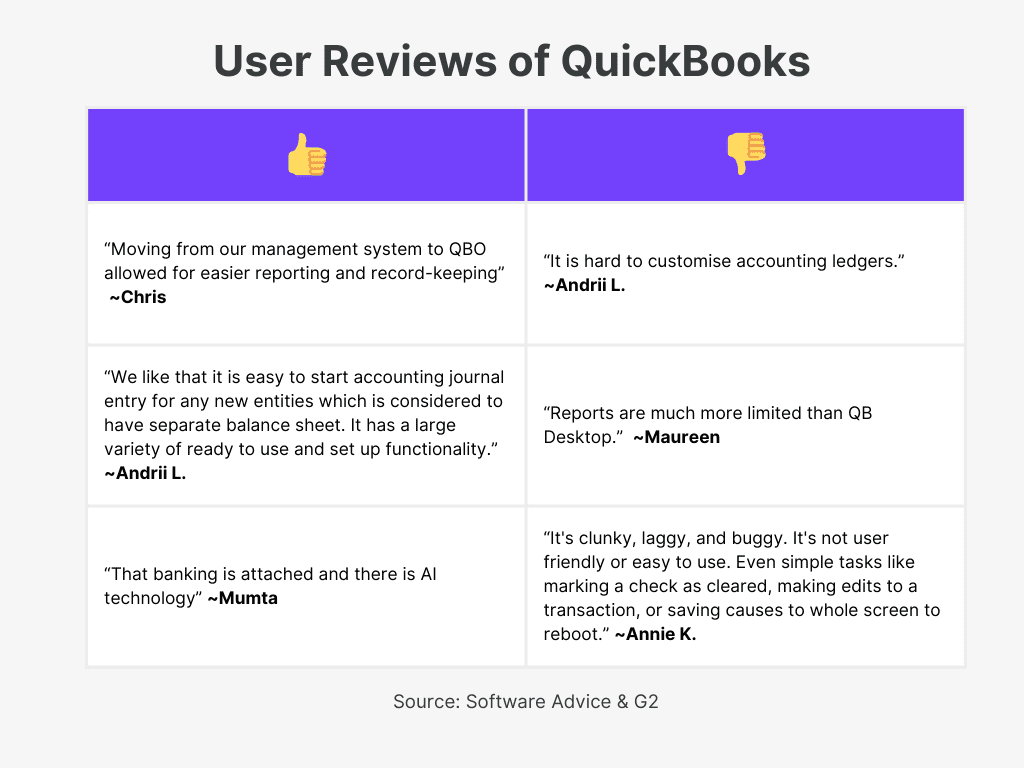

User Reviews:

8. Zoho Books

Zoho Books is a comprehensive cloud-based accounting software designed to help growing businesses manage their finances effectively. The platform offers features such as invoicing, expense tracking, and reporting, making it suitable for small to mid-sized companies and freelancers.

Key Features:

- Multi-Currency Transactions: Handle international business with multi-currency support, allowing you to manage foreign transactions and exchange rates.

- Invoice Management: Create and send professional, branded invoices, and set up recurring invoicing for regular transactions.

- Expense Tracking: Track and categorize expenses, set up recurring expenses, and streamline your business spending.

- Bank Reconciliation: Sync your bank transactions automatically and reconcile them with business transactions for accurate financial reporting.

- Inventory Management: Manage inventory by tracking stock levels, setting reorder points, and automating stock updates with each purchase or sale.

- Project Accounting: Track project expenses, assign budgets, and bill clients based on time spent or project milestones.

- Reports: Generate key financial reports such as profit & loss, balance sheets, and cash flow analysis to gain insights into your business’s financial health.

Additional Features:

Zoho Books also includes features like tax compliance, vendor management, and seamless integration with other Zoho apps, making it easy to manage your entire business operation from one platform. The platform offers workflow automation to help streamline recurring tasks and processes.

Pricing:

- Free Plan: $0/month (Limited to 1 user and 1 accountant)

- Standard Plan: $10/month

- Professional Plan: $20/month

- Premium Plan: $30/month

- Elite Plan: $100/month

- Ultimate Plan: $200/month

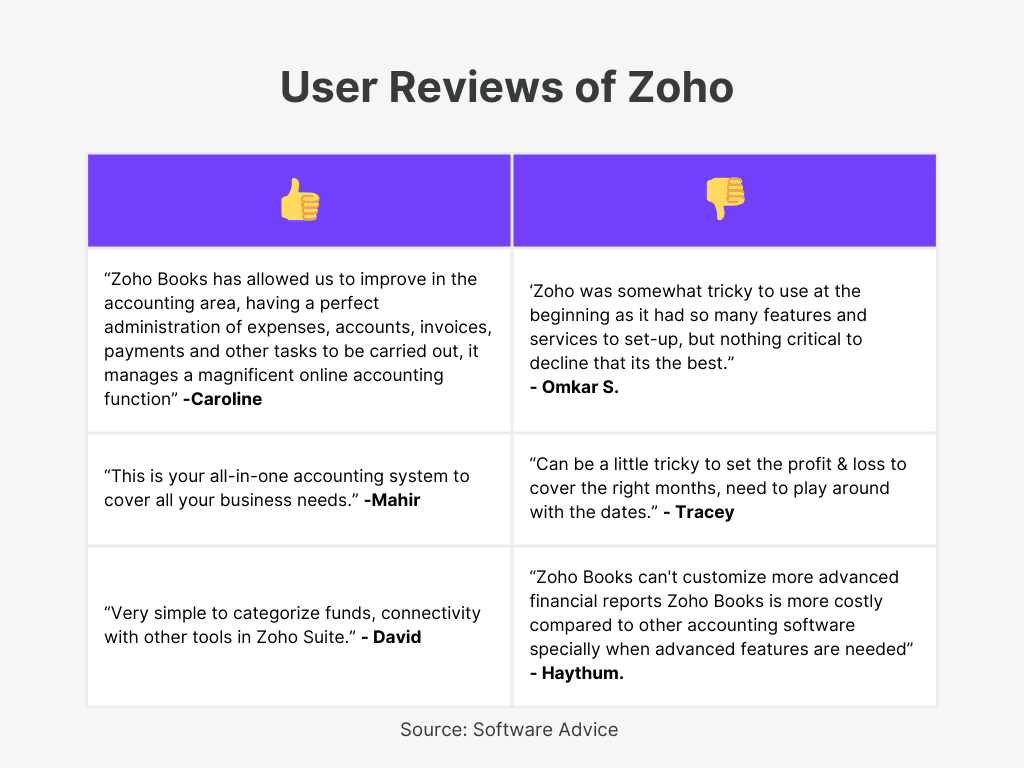

User Reviews:

9. Netsuite

NetSuite is a cloud-based accounting software designed to transform core financial operations with embedded AI capabilities. It provides comprehensive features such as accounts payable and receivable, tax management, and general ledger functionalities, all within an integrated ERP solution.

Key Features:

- General Ledger: Gain flexibility, enhanced audit trails, and custom reporting segments to manage diverse financial requirements.

- Cash Management: Real-time visibility into cash flow with seamless integration across all financial processes.

- Accounts Payable and Receivable: Automate payments, manage vendor bills, and streamline invoice processing with real-time data access.

- Tax Management: Ensure compliance with various tax regulations like ASC 606, GAAP, and SOX while managing global tax complexities.

- Fixed Assets Management: Track and manage fixed assets, depreciation, and accounting for all asset-related transactions.

- Account Reconciliation: Automate reconciliation processes to minimize errors and reduce manual workload.

- Close Management: Accelerate the financial close process and generate timely reports for regulatory compliance.

Additional Features:

NetSuite offers AI-driven automation, real-time metrics via role-based dashboards, and the ability to scale operations with integrated modules across HR, inventory, customer management, and eCommerce. It provides a unified platform to centralize all business operations, making it easier to manage growing companies.

Pricing:

- Core Platform: Annual license fee, including accounting capabilities

- Optional Modules: Add based on business requirements

- User Count: Scalable pricing depends on the number of users

- One-Time Implementation Fee: For initial setup and configuration

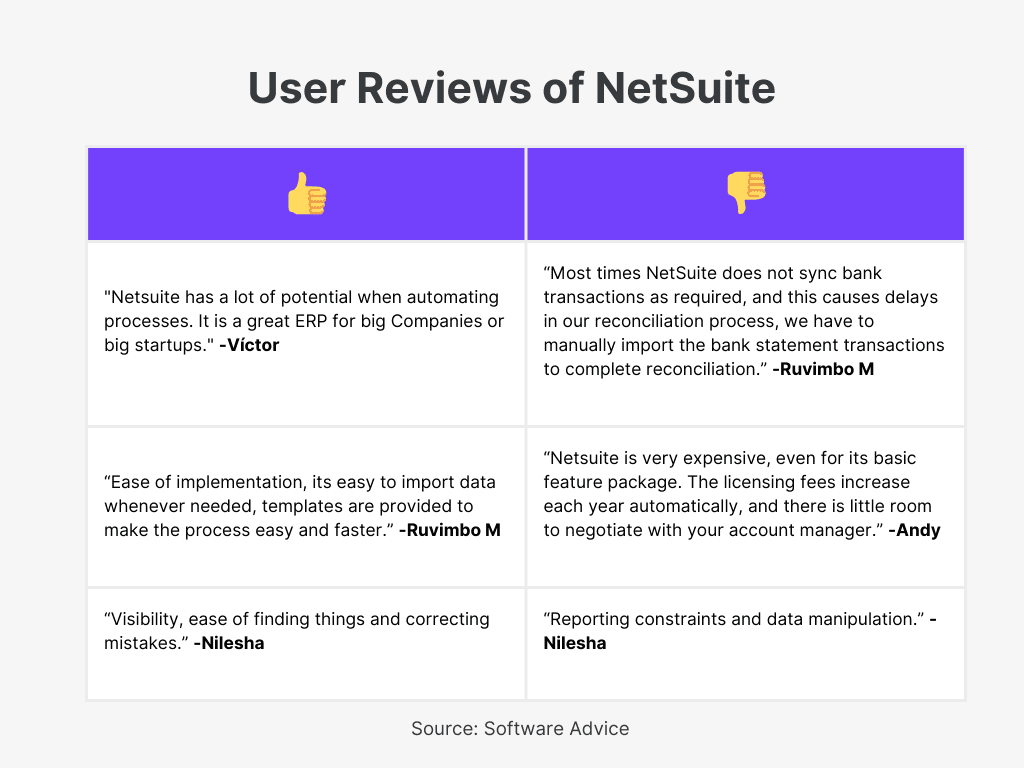

User Reviews:

10. FreshBooks

FreshBooks is a cloud-based accounting software tailored for freelancers, small businesses, and self-employed professionals. It offers intuitive tools for invoicing, time tracking, and managing business expenses, ensuring compliance and smooth financial operations as your business grows.

Key Features:

- Invoicing: Send unlimited professional invoices to clients, set up recurring invoices, and accept credit card and bank payments seamlessly.

- Expense Tracking: Automatically capture and categorize expenses by uploading receipts or importing data from your bank account.

- Time Tracking: Track time spent on client projects and integrate time logs directly into invoices.

- Payments: Accept online payments via credit card or ACH, making it easier to get paid faster and keep cash flow steady.

- Bank Reconciliation: Automate bank reconciliation by importing transactions directly from your bank account.

- Reports: Generate comprehensive financial reports such as Profit & Loss, Cash Flow, and Balance Sheets for easy financial management.

- Client Management: Manage all your client profiles, payment histories, and credit tracking efficiently.

Additional Features:

FreshBooks also offers project profitability tracking, double-entry accounting, and automated late payment reminders. It integrates with various apps like payroll services, enabling a comprehensive solution for all your business accounting needs.

Pricing:

- Lite: $9.50/month

- Plus: $16.50/month

- Premium: $30.00/month

- Select: Custom pricing with added support and migration services.

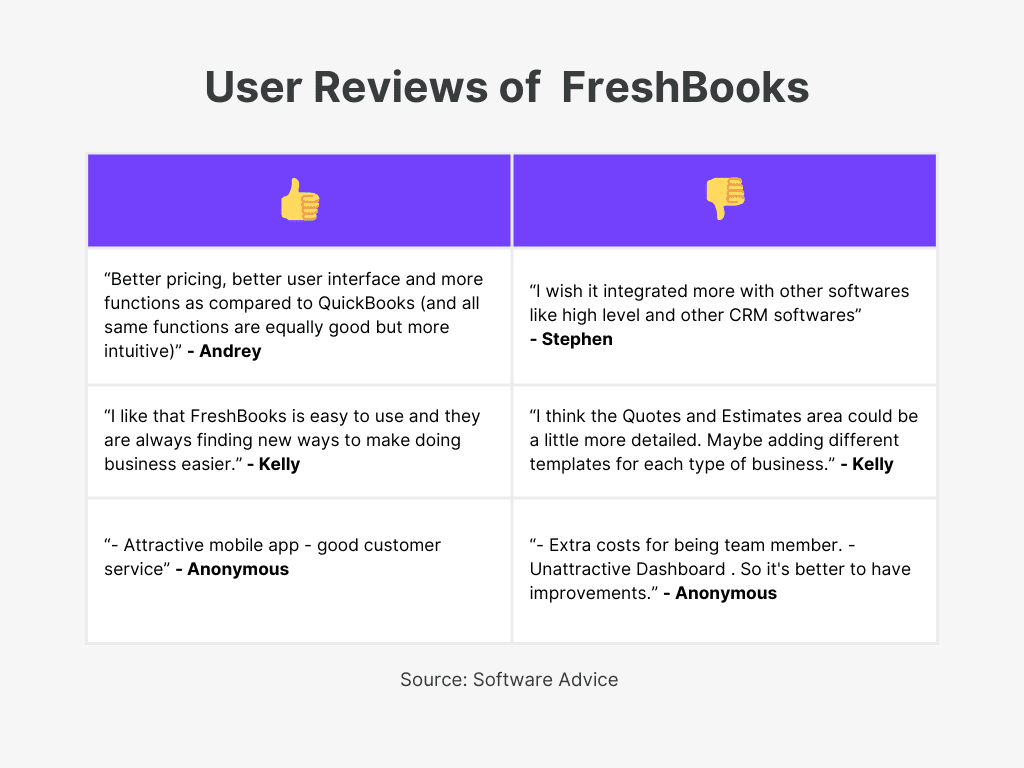

User Reviews:

When selecting the right accounting software for Singapore, consider the following factors:

- Compliance with Singapore Regulations: Ensure the software meets local standards, including GST filing and Peppol network support for IRAS e-invoicing.

- Scalability: Choose software that can grow with your business, offering multi-user access and advanced tools as you expand.

- Ease of Use: Opt for a user-friendly interface that requires minimal training and simplifies tasks like invoicing and reporting.

- Multi-Currency Support: If you deal internationally, look for software that supports multiple currencies and handles automatic conversions.

- Cloud-Based Access: Select cloud-based software for remote access from any location and device, especially useful for remote teams.

- Automation Features: Recurring invoicing, payment reminders, and expense tracking features are essential for reducing manual workload.

- Security & Data Privacy: Ensure strong data security protocols like encryption and regular backups to protect financial information.

- Cost & Pricing Structure: Evaluate the cost structure (subscription or one-time payment) to ensure it aligns with your budget and needs.

Conclusion

The success of a business hinges on effective financial management, and the right accounting software simplifies that process. Singaporean companies, from small enterprises to large organizations, have access to powerful tools that ensure compliance, automate tasks, and provide valuable financial insights.

The software featured here streamlines operations, allowing you to focus on what truly matters—scaling your business and succeeding in a competitive market.