Invoicing is critical to a successful business, especially in a competitive market like South Africa. The right invoicing software can streamline your financial operations, ensure compliance with local tax laws, and improve your cash flow management.

With so many invoicing software options available, it’s crucial to choose one that fits your business needs and addresses the unique challenges of the South African market.

In this guide, we will explore the 10 best invoicing software options in South Africa, detailing their key features, pricing, and benefits to help you make an informed decision.

| Software | Starting Price | Trial Period | Free Plan |

| Refrens | R75/month | Yes | Yes |

| inv24.co.za | R149/month | No | Yes |

| Genio | R93/month | No | No |

| Omni Account | R840/month | 14 days | No |

| Xero | R217/month | 30 days | No |

| QuickBooks | R264/month | 30 days | No |

| Sage Software | R200/month | 30 days | No |

| payPod | R35/month | 30 days | Yes |

| Zoho | Free | 14 days | Yes |

| FreshBooks | R85/month | 30 days | No |

Features to consider while choosing Invoicing software

When choosing invoicing software in South Africa, it’s essential to consider features aligning with local business practices and compliance requirements. Here are the key features to consider:

- Tax Compliance (VAT Integration): Ensure the software supports South African VAT regulations, including VAT rates, tax invoice formatting, and automatic VAT calculations.

- Multi-Currency Support: For international clients, look for software that supports multiple currencies and exchange rate management.

- Customizable Invoices: The ability to customize invoices with your logo, brand colors, and specific fields relevant to your business.

- Payment Gateways Integration: Integration with popular South African payment gateways like PayFast, PayGate, and Yoco to streamline payment collection.

- Automated Reminders: Features that allow you to send automated payment reminders to clients for outstanding invoices.

- Mobile Access: Access to the software via mobile apps to manage invoicing on the go.

- Reporting and Analytics: Detailed reporting features that help you track invoice status, payments received, and outstanding amounts, providing insights into your cash flow.

- Secure Data Storage: Ensure the software provides secure, cloud-based data storage with regular backups to protect sensitive financial information.

- Integration with Accounting Software: Seamless integration with popular accounting software like Xero, QuickBooks, or Sage, to simplify financial management.

- User-Friendly Interface: A simple and intuitive interface that doesn’t require extensive training for you or your staff.

- Customer Support: Access to reliable customer support, preferably with local knowledge, to assist with any issues or questions.

- Scalability: The ability to scale with your business as it grows, offering additional features or higher limits as needed.

Choosing software that aligns with these features will ensure it meets the specific needs of your business in South Africa, helping you manage invoicing efficiently and compliantly.

Detailed Analysis of 10 Best Invoicing Software in South Africa

1. Refrens

Refrens is the go-to business operating software for over 150,000 users across 178 countries. Designed to streamline and enhance business operations, Refrens offers a comprehensive suite of tools that include invoicing, accounting, inventory management, expense management, sales CRM, client and vendor management, and more.

With Refrens, you can effortlessly create essential business documents such as invoices, quotations, proforma invoices, sales and purchase orders, credit and debit notes, delivery challans, expenditure records, and payment receipts.

Key Features:

- Invoice Management: Create and send multiple invoices at once using Refrens online invoice generator, saving your time when managing large volumes of clients/projects. Share these invoices via email, or WhatsApp, and effortlessly handle transactions in multiple currencies.

- Customization: Personalize your invoices to match your brand’s identity with customizable templates, allowing you to adjust fonts, colors, sizes, scripts, letterheads, and footers to create a professional look. You can also add additional notes, early payment discounts, attachments, and more.

- VAT compliance: Automatically calculate VAT and generate detailed reports, simplifying tax compliance.

- Automated Payment Reminders: Set up automatic reminders to notify clients of upcoming or overdue payments for steady cash flow without manual follow-ups.

- Recurring Invoice: Set up recurring invoices for regular clients, and automate the billing process for ongoing projects or subscriptions, ensuring you never miss a payment cycle.

- Automatically Create Vouchers & Pass Journal Entries: Automate your accounting process by generating vouchers and journal entries as soon as an invoice or expense is created, reducing manual bookkeeping efforts.

- Expense Management: Easily track and manage business expenses, and access detailed reports.

- Insightful Reports: Generate comprehensive financial reports, such as profit and loss statements, balance sheets, daybook reports, client statements, and more.

- Multi-User Management: Add your sales team or accounting team seamlessly, with tailored access across your business data.

- Audit Trails: Track all the changes made to your document with a detailed audit trail feature.

Bonus:

Beyond invoicing, Refrens provides a suite of additional tools with integrated automation. For instance, its powerful sales CRM allows you to track leads and manage pipelines effortlessly. The platform also includes comprehensive client and vendor management features, along with detailed reports for both.

Additionally, Refrens centralizes all your business operations with its extensive inventory and expense management system, which seamlessly integrates with accounting features. This ensures that every purchase or sale automatically updates your inventory, expenses, and voucher books.

Pricing:

- Basic: Access essential features for free

- Books Essential: R700/year

- Books Pro: R1650/year

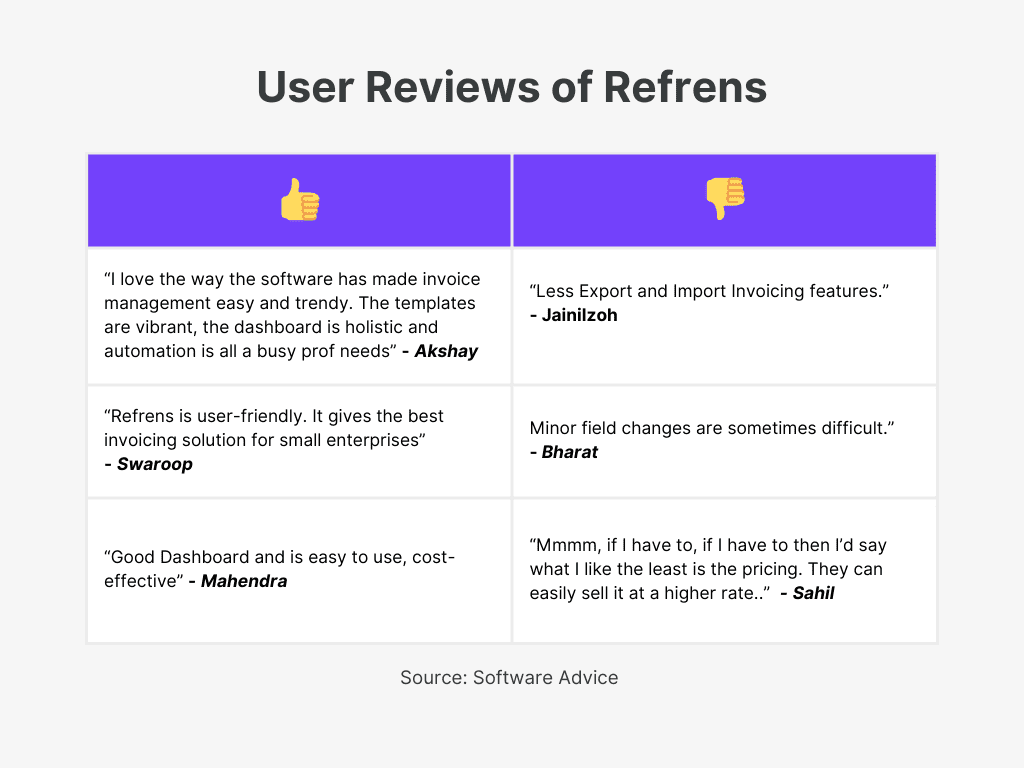

Ratings:

- Capterra: 4.8⭐/5

- G2: 4.6⭐/5

- Get App: 4.8⭐/5

- Software Advice: 5⭐/5

2. inv24.co.za

Inv24 offers a reliable, easy-to-use invoicing platform for businesses in South Africa. Trusted by over 40,000 small businesses since 2008, Inv24 simplifies financial processes with tools for quick invoice creation, customer management, inventory handling, and insightful statistics.

Inv24’s user-friendly interface makes it accessible even for those with minimal accounting knowledge. Offering robust features like online invoicing, price quotes, and payment reminders—all in a free version—Inv24 ensures small businesses in South Africa can manage their invoicing efficiently and affordably.

Key Features:

- Quick Invoicing: Create professional invoices in seconds with minimal effort.

- Customer Management: Manage your client database effortlessly with a simple interface.

- Inventory Tracking: Maintain a detailed database of your products and services.

- Data Insights: Access useful statistics to understand your business performance.

- Payment Reminders: Automate reminders to ensure timely payments.

- Invoice Templates: Choose from a wide range of customizable invoice templates.

- Email Delivery: Send invoices directly to clients via email for instant delivery.

Bonus:

In addition to its core functionalities, Inv24 provides a range of other tools specifically designed for small businesses, including a clear, user-friendly interface, tools for creating price quotes and estimates, and account statements.

Pricing Plans:

- Free Plan: with limited features

- Premium: R149/month

Ratings:

- G2: 4⭐/5

3. Genio

Our invoicing software is designed to revolutionize your billing procedures, offering a seamless and efficient solution for businesses in South Africa. With user-friendly features that simplify invoice generation, delivery, and monitoring, this software ensures you can manage your financial transactions effortlessly online. With Genio, you can experience a streamlined invoicing process that saves your time and enhances your productivity.

Key Features:

- Invoice Templates: Access a variety of free invoice templates tailored to your business needs.

- Mobile Invoices: Generate and send invoices directly from your mobile device, anywhere, anytime.

- Invoice Generator: Create professional invoices quickly and easily with our intuitive invoice generator.

- Pricing Flexibility: Customize your pricing options to fit your specific billing requirements.

- Tax and Discount Management: Effortlessly add taxes and discounts to your invoices with just a few clicks.

- Currency Support: Work with multiple currencies to cater to your international clients.

- Download Options: Download your invoices in multiple formats, including PDF, for easy sharing and storage.

Bonus:

In addition to the core features, Genio offers advanced functionalities such as automated reminders for overdue payments, detailed financial reports for better financial analysis and decision-making, and secure data storage for safeguarding sensitive business information.

Pricing Plans:

- Grow: $5/month

- Premium: $30/month

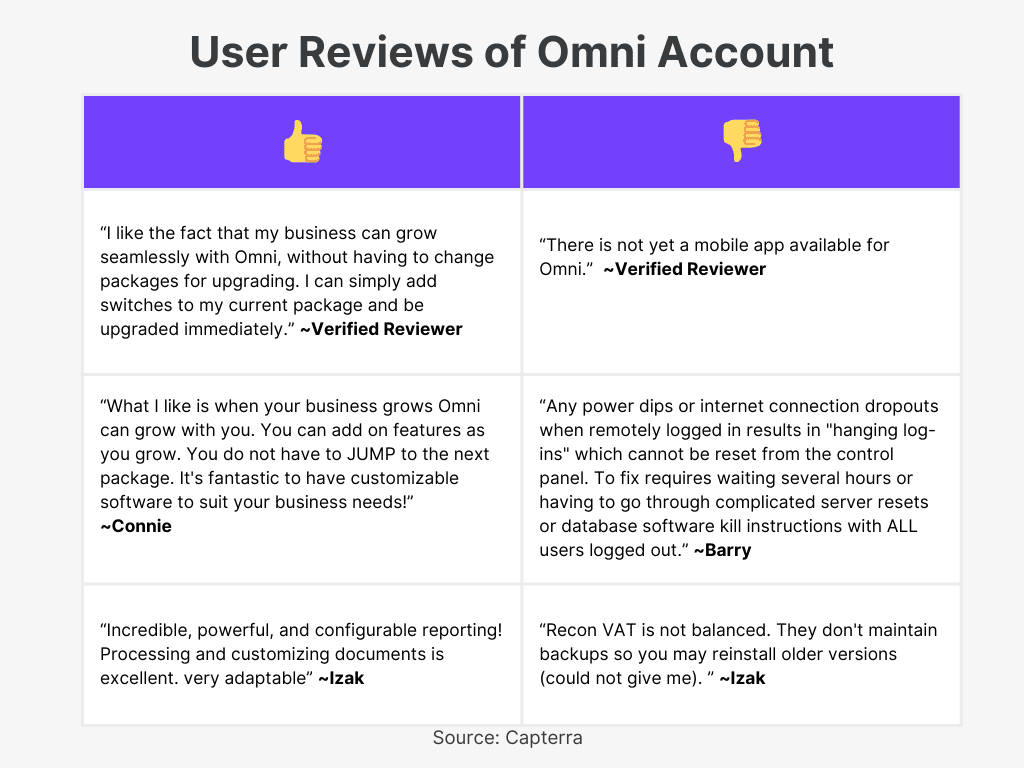

4. Omni Accounts

Omni ERP & Accounting Software is a powerful, all-in-one solution designed for businesses of all sizes. It integrates essential business functions into a centralized system, enhancing operational efficiency and ensuring real-time data accessibility across departments.

With over 35 years of experience and 42,000 satisfied users, the software is a trusted partner in streamlining business operations, from inventory management to job costing and sales tracking.

Key Features:

- Modular Pricing: Pay only for the features you use with the unique pricing model.

- Proven Stability: Enjoy unparalleled system reliability with a track record of smooth, uninterrupted operations.

- Hands-On Support: Benefit from exceptional local support, from setup to ongoing specialist assistance.

- Comprehensive Reporting: Make data-driven decisions with holistic reporting features across all business functions.

- Real-Time Data: Access reliable, traceable, and up-to-date information to enhance decision-making.

- Task Automation: Save time with automated routine tasks, allowing your team to focus on strategic goals.

- Customizable Add-Ons: Tailor the software with add-ons like Advanced Inventory Control and Job Costing to fit your business needs.

Bonus:

Omni ERP offers a wide range of additional features, including multi-currency management, vehicle loading, and scheduling, and API integration for enhanced data collection and automation.

Pricing Plans:

- Trader: R840/month

- POS: R2399/month

- Business: R2399/month

- Business Pro: R4099/month

- Enterprise: R7799/month

- Premium: R14756/month

Ratings:

- Capterra: 4.5⭐/5

- Get App: 5⭐/5

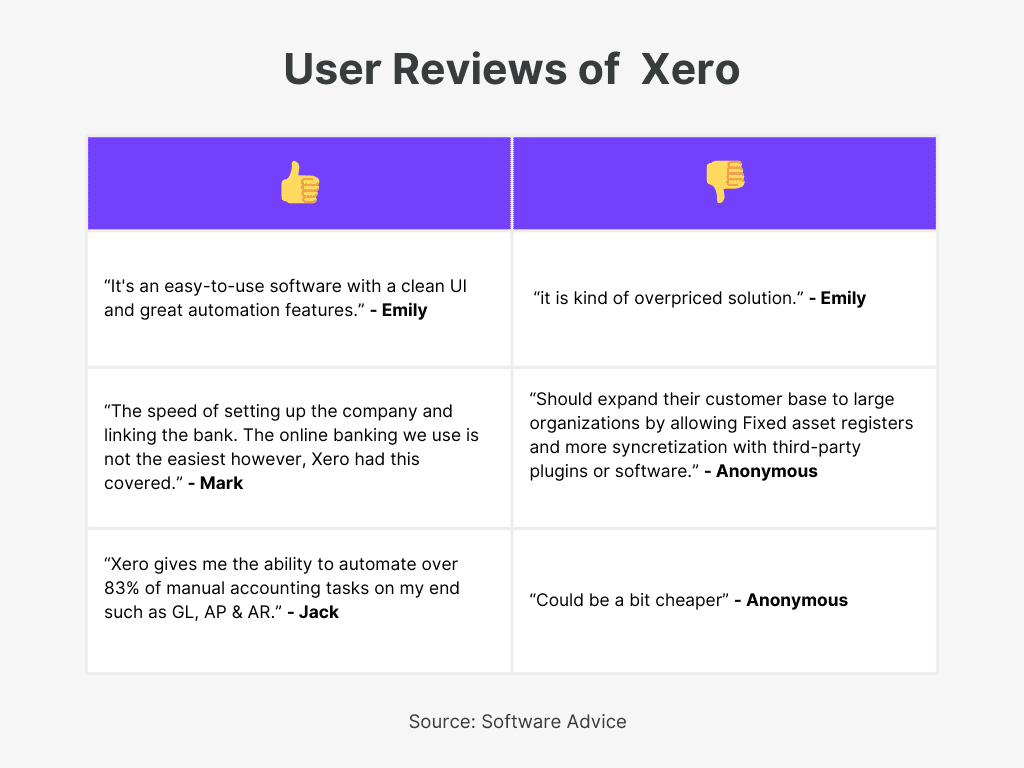

5. Xero

Xero is a top cloud-based accounting software, popular among small businesses, accountants, and bookkeepers for its user-friendly interface and robust features. Ideal for businesses of all sizes, Xero offers flexibility and scalability, making it perfect for managing invoices, expenses, and cash flow efficiently.

Xero offers comprehensive tools that cater to various business needs, including bill payments, expense claims, and bank connections. The software’s seamless integration with third-party apps allows users to customize their experience, enhancing productivity and workflow.

Key Features:

- Invoice Management: Create, send, and track invoices effortlessly, ensuring timely payments.

- Pay Bills: Manage and pay your bills on time, reducing the risk of late payments.

- Claim Expenses: Easily track and claim expenses, keeping your finances organized.

- Bank Connections: Link your bank accounts for automatic reconciliation and real-time transaction updates.

- Customizable Reports: Generate and customize financial reports tailored to your business needs.

- App Integrations: Seamlessly integrate with a wide range of apps to expand Xero’s functionality.

- 24/7 Support: Access round-the-clock online support to resolve any issues or queries.

Bonus:

Xero offers a range of additional features designed to streamline business operations. These include accepting payments via credit card debit card, and seamless bank connections for efficient reconciliation.

Users can manage expenses, track projects, and handle payroll with ease, while also benefiting from robust reporting, inventory management, and multi-currency accounting. With tools for VAT returns, data capture, and contact management, it simplifies your financial management and enhances productivity on the go.

Ratings:

- G2: 4.3⭐/5

- Software Advice: 4.5⭐/5

- Get App: 4.4⭐/5

- Capterra: 4.4⭐/5

Pricing:

- Starter: R217.50/month

- Standard: R347.50/month

- Premium: R477.50/month

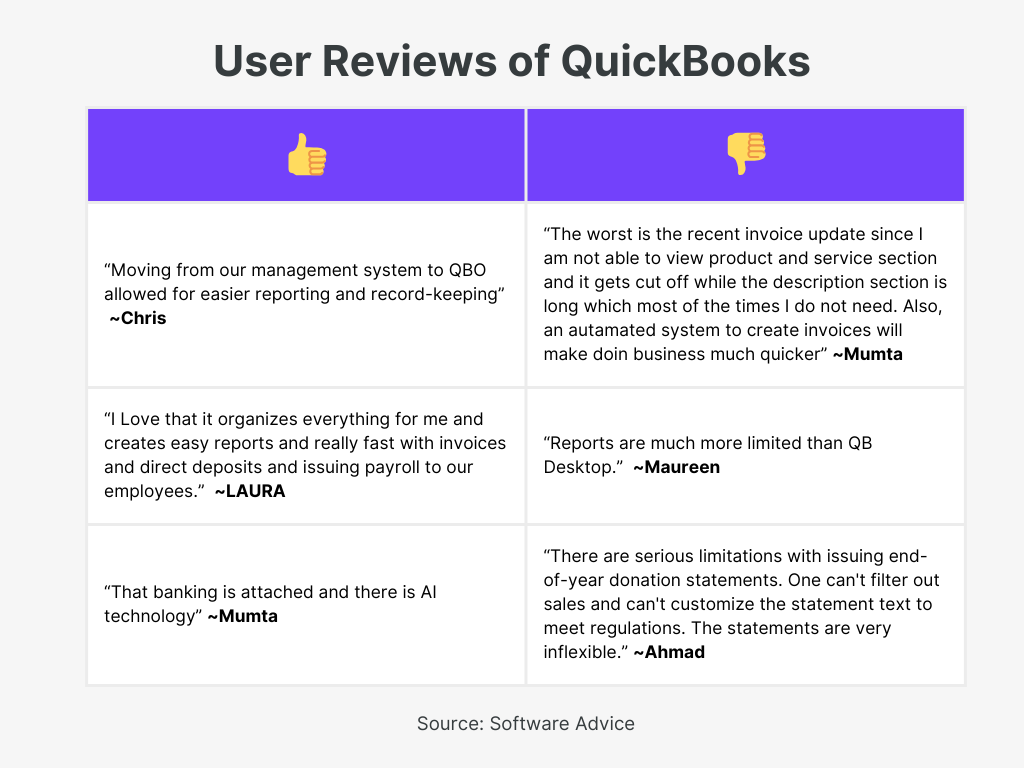

6. Quickbooks

QuickBooks is a powerful and intuitive cloud-based accounting software tailored for businesses in South Africa. Renowned for its smart and simple features, QuickBooks helps small businesses, accountants, and bookkeepers save time and streamline their financial operations.

QuickBooks simplifies financial management with a user-friendly interface for invoicing, expense tracking, and detailed reporting. Catering to businesses of all sizes, it offers flexible plans from basic invoicing to advanced financial tracking, making it an ideal choice for enhancing accounting practices and ensuring tax compliance.

Key Features:

- Custom Invoices: Create and send professional-looking invoices with customizable templates.

- Expense Tracking: Organize and categorize all your expenses in one place for easy tax preparation.

- Bank Feeds: Connect your bank accounts for automatic transaction updates and reduce manual errors.

- VAT Tracking: Easily track VAT on income and expenses to stay compliant with South African tax laws.

- Inventory Management: Manage inventory levels in real-time and stay on top of your orders.

- Mobile App: Access your finances anytime, anywhere with the QuickBooks mobile app.

- Insightful Reports: Generate a wide range of financial reports to monitor your business’s performance.

Bonus:

QuickBooks also offers integration with Payspace for seamless payroll management, making it easier to handle employee payments and related tax obligations. The software supports multi-currency transactions, making it a versatile option for businesses with international dealings.

Ratings:

- G2: 4⭐/5

- Software Advice: 4.5⭐/5

- Capterra: 4.3⭐/5

- Get App: 4.4/⭐5

Pricing:

- Simple Start: R264/month

- Essentials: R408/month

- Plus: R546/month

- Advanced: R1092/month

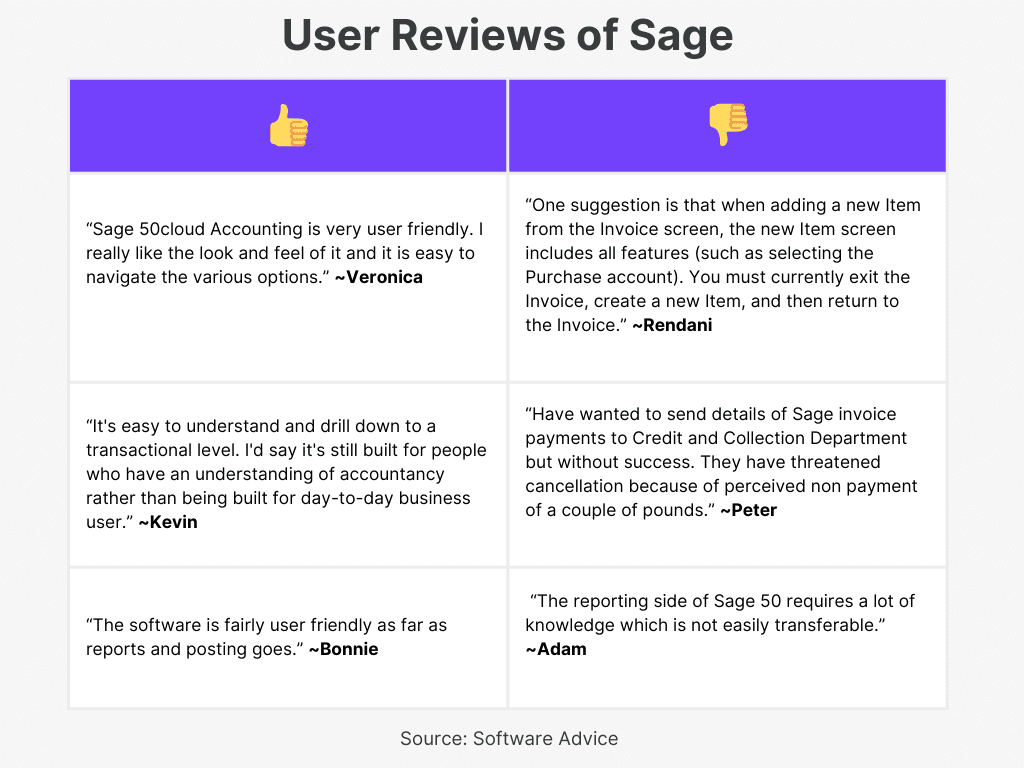

7. Sage Software

Our online invoicing software is designed to help businesses get paid faster and manage their cash flow more efficiently. By automating the invoicing process, you can focus on growing your business instead of chasing late payments.

Whether you’re a small business owner or running a medium-sized enterprise, our solution ensures your billing is accurate, timely, and stress-free.

Key Features:

- Automated Billing: Automatically create and send invoices, reducing manual effort and errors.

- Payment Reminders: Sends automatic reminders to clients about upcoming payment deadlines.

- Real-time Tracking: Access up-to-date information about your finances and cash flow anytime.

- Data Synchronization: Effortlessly sync your accounts and track payments in one integrated app.

- Customer Data Storage: Store customer details securely and generate invoices with ease.

- Error Reduction: Minimize the chance of costly mistakes with automated invoicing processes.

- Comprehensive Dashboard: Get complete visibility over your finances with an intuitive dashboard.

Bonus:

Sage software goes beyond just invoicing. It offers robust integration with accounting tools, enabling you to track expenses, manage accounts payable and receivable, and generate detailed financial reports.

Pricing Plans:

- Accounting Start: R200/month

- Accounting Standard: R370/month

Ratings:

- Capterra: 4.2⭐/5

- G2: 4.2⭐/5

8. PayPod

PayPod is an easy-to-use online invoicing software designed specifically for freelancers and small businesses in Africa. With payPod, you can create and send professional invoices and quotes from anywhere, without the need for software downloads. Enjoy seamless access to your financial documents with just an internet connection, making it simpler to manage your business on the go.

Key Features:

- Invoicing: Create professional invoices quickly with optional tax and discount calculations.

- Quotations: Effortlessly generate quotes with a quotation generator and convert them to invoices once accepted, streamlining your workflow and ensuring smooth transitions from proposals to payments.

- PDF Downloads: Download or email your invoices and quotes directly as PDFs.

- Recurring Invoices: Schedule invoices to be sent automatically at regular intervals.

- Statements: Generate detailed client statements from past transactions with ease.

- Credit Notes: Issue credit notes for returns or refunds to manage client balances.

- Accounting: Track income and expenses monthly and generate financial reports.

Bonus:

Beyond basic invoicing, payPod offers robust accounting tools, including expense tracking and financial reporting. You can also send delivery notes and client account statements without leaving the platform. For growing businesses, the premium plan allows you to invite additional users, making it a scalable solution for teams.

Pricing Plans:

- Free: No cost

- Plus: R35/month

- Premium: R99/month

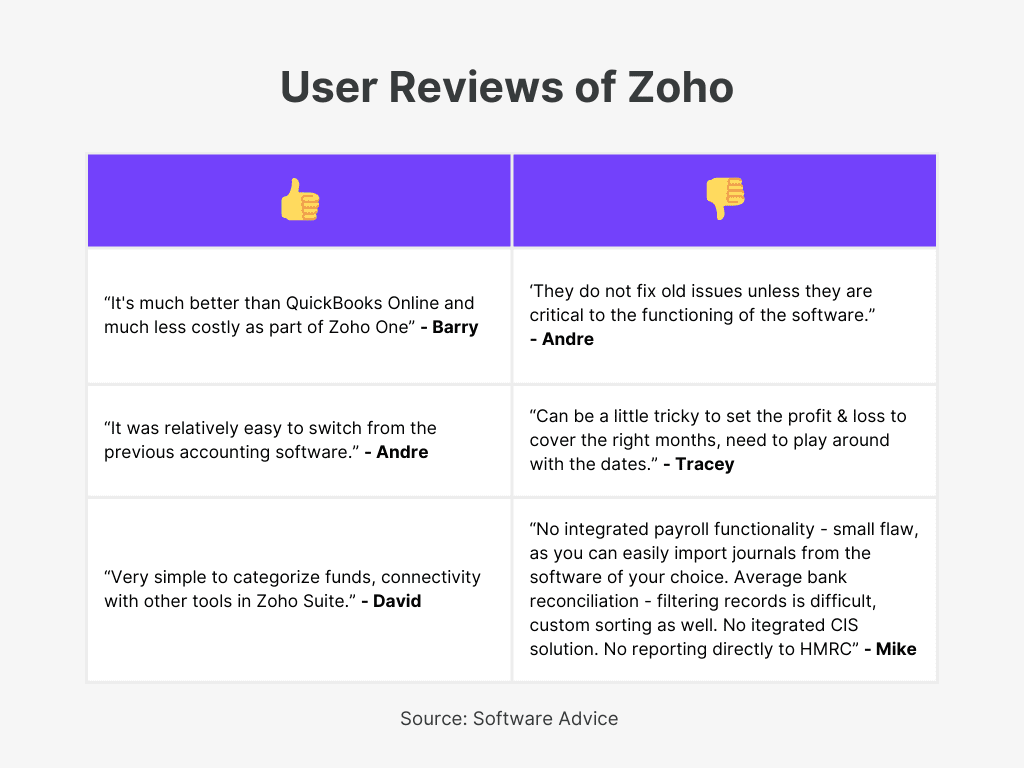

9. Zoho

Zoho Invoice is a trusted, professional invoicing software that allows you to quickly create and send invoices, helping you get paid faster. Loved by small businesses across South Africa, Zoho Invoice offers a seamless experience with features designed to simplify your invoicing process. Whether you’re a freelancer or a small business owner, you can start invoicing for free with Zoho Invoice.

Key Features:

- Tax Invoices: Create and send tax-compliant invoices online.

- Email & PDF Options: Easily email invoices or save them as PDF files.

- Custom Quotes: Generate polished business quotes to negotiate deals.

- Multiple Payment Options: Offer your customers various payment methods.

- Automated Reminders: Set up automatic payment reminders for clients.

- Branded Templates: Customize invoice templates to reflect your brand identity.

- Recurring Invoices: Generate and manage recurring invoices effortlessly.

Bonus:

Zoho Invoice goes beyond invoicing by offering expense categorization, project tracking, and timesheet maintenance. The platform also provides a self-service portal for your customers and insightful analytics on your sales and expenses. Zoho even has other products like CRM, Analytics, and Books for a fully integrated business solution.

Pricing Plans: Free

Ratings:

- G2: 4.1⭐/5

- Capterra: 4.3⭐/5

- Get app: 4.3⭐/5

- Software Advice: 4.5⭐/5

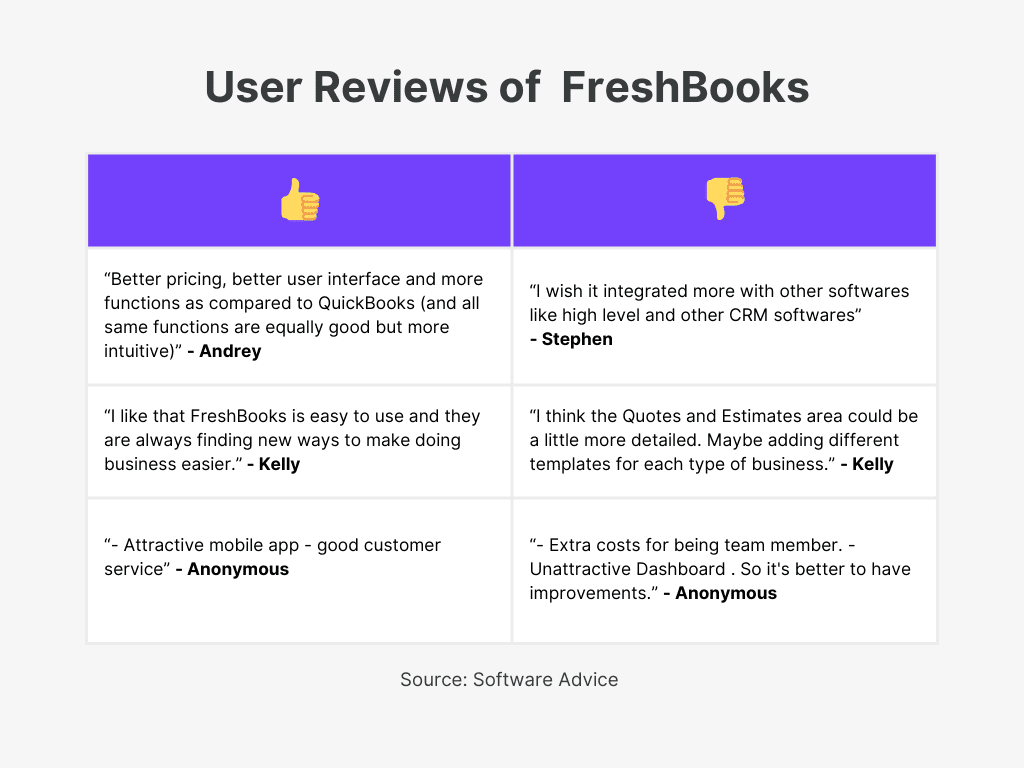

10. FreshBooks

FreshBooks is an intuitive accounting software designed to simplify your financial management. With user-friendly tools, it helps businesses and freelancers handle everything from invoicing to expenses, making the hard parts of accounting effortless. Trusted by millions worldwide, FreshBooks ensures that you can focus more on your business and less on numbers.

Key Features:

- Invoicing Made Easy: Create professional invoices in minutes with customizable options.

- Quick Billing: Automate payments with recurring invoices and late payment reminders.

- Expense Tracking: Manage expenses effortlessly with mobile receipt scanning and bank imports.

- Real-Time Accounting: Access powerful double-entry accounting tools for up-to-date financial insights.

- Payroll Integration: Streamline payroll processes with built-in solutions.

- Mileage Tracking: Easily log and track business mileage for accurate reporting.

- Advanced Reporting: Generate detailed financial reports to understand your business performance.

Bonus:

FreshBooks also offers advanced tools like project management, proposal creation, and client management to help you manage all aspects of your business. With seamless mobile access, you can stay connected and in control, no matter where your work takes you.

Pricing Plans:

- Lite: R85/month

- Plus: R150/month

- Premium: R350/month

- Select: Custom Pricing

Add-ons:

- Team Members: R147/user/month

Ratings:

- Capterra: 4.5⭐/5

- Software Advice: 4.5⭐/5

- G2: 4.5⭐/5

- Get app: 4.5⭐/5

- Software Suggest: 4.7⭐/5

Benefits of using invoicing software for your business

- Time Savings: Automates the creation and sending of invoices, reducing the time spent on manual processes and allowing you to focus on other business tasks.

- Improved Accuracy: Reduces human errors in calculations and data entry, ensuring that your invoices are accurate and compliant with financial regulations.

- Professional Appearance: Customizable invoice and quotation templates give your invoices a professional look, helping to reinforce your brand’s image and credibility.

- Faster Payments: Invoicing software often includes features like automated payment reminders and multiple payment options, encouraging clients to pay more quickly.

- Better Cash Flow Management: Helps you track invoices, manage due dates, and monitor outstanding payments, improving your cash flow and financial planning.

- Easy Access to Financial Data: Centralizes all your invoicing and payment data, making it easier to generate reports, analyze trends, and make informed business decisions.

- Compliance with Tax Regulations: Ensures that your invoices comply with local tax laws, such as VAT requirements, helping you avoid penalties and maintain good standing with tax authorities.

- Enhanced Security: Protects sensitive financial information with secure data storage and encryption, reducing the risk of fraud or data breaches.

- Scalability: Grows with your business, offering additional features or higher limits as your invoicing needs expand.

- Accessibility: Cloud-based invoicing software allows you to access your invoices from anywhere, using any device, making it convenient for remote work or on-the-go management.

- Integration with Other Tools: Seamlessly integrates with your accounting, CRM, and other business software, streamlining your entire financial workflow.

- Environmental Benefits: Reduces the need for paper invoices, contributing to a more sustainable and eco-friendly business practice.

- Enhanced Client Relationships: Provides a smooth, efficient billing process, which can improve client satisfaction and foster stronger business relationships.

Using invoicing software can significantly enhance the efficiency, accuracy, and professionalism of your invoicing process, ultimately benefiting your business’s overall financial health and client relationships.

Conclusion

Choosing the right invoicing software is more than just a technical decision; it’s a strategic move that can impact your business’s efficiency, compliance, and growth. The options we’ve discussed offer a range of features tailored to the needs of South African businesses, from VAT integration and multi-currency support to mobile access and automated reminders.

By selecting software that aligns with your specific requirements, you can streamline your invoicing process, reduce errors, and ultimately improve your cash flow management. Investing in the right invoicing software will not only save you time and resources but also enhance your professionalism, helping your business thrive in a competitive landscape.