Managing finances efficiently is critical to running any business, and having the right invoicing software can make a huge difference. Whether you are a small startup or a large enterprise in Indonesia, selecting software that suits your needs will save you time, improve cash flow, and streamline operations.

With many choices available, focusing on solutions that meet local tax regulations, support multi-currency transactions, and integrate seamlessly with Indonesian payment gateways is essential.

This guide explores Indonesia’s best invoicing software options, providing a comprehensive overview of their key features, pricing, and benefits.

| Software | Starting Price | Trial Period | Free version |

|---|---|---|---|

| Refrens | Rp550.000/year | ✔️ | ✔️ |

| Mekari Jurnal | Custom | ✔️ | ❌ |

| Zoho Invoice | Free | – | ✔️ |

| Zahir | Custom | ✔️ | ❌ |

| HashMicro | Custom | – | – |

| QuickBooks | $205/year | ✔️ | ❌ |

| Xero | $348/year | ✔️ | ❌ |

Key Features to Consider When Choosing Invoicing Software in Indonesia:

When selecting invoicing software in Indonesia, it’s essential to focus on features that comply with local regulations and suit business needs. Here are the key features to consider

- VAT Compliance (PPN Integration): Ensure the software supports Indonesian VAT (PPN) regulations, including automatic VAT calculations, proper tax invoice formatting, and NPWP details.

- Customizable Invoices: Choose software that allows customization of invoices with your logo, branding, and fields specific to your business.

- Local Payment Gateway Integration: Look for software that integrates with popular Indonesian payment gateways like Midtrans, Doku, or Xendit, making it easier to collect payments online.

- Invoice API: Ensure the software provides an API that allows you to integrate invoicing into your website or app, streamlining billing processes.

- Real-Time Reporting & Analytics: Choose software that offers real-time reports on invoice status, sales performance, and cash flow to help you make informed business decisions.

- User-Friendly Interface: A simple, intuitive interface that’s easy to navigate without requiring extensive training for you or your staff.

- Real-Time Resource and Cost Tracking: The software should enable real-time monitoring of resources and operational costs, helping you stay on top of stock levels and manage expenses efficiently.

- Secure Data Storage & Backup: Ensure that your financial data is securely stored in the cloud with automatic backups to protect against data loss.

- Client Management: The software should help manage client information, payment history, and outstanding invoices to enhance client interactions and improve relationships.

- Integration with Accounting Software: Make sure the invoicing software integrates with the accounting platform to streamline financial management.

- Audit Trails: Keep a detailed record of any changes made to invoices, providing transparency and accountability in your business processes.

- Scalability: As your business grows, the software should offer the ability to scale, with additional features or higher capacity as needed.

Comprehensive Review of the Top Invoicing Software in Indonesia

1. Refrens

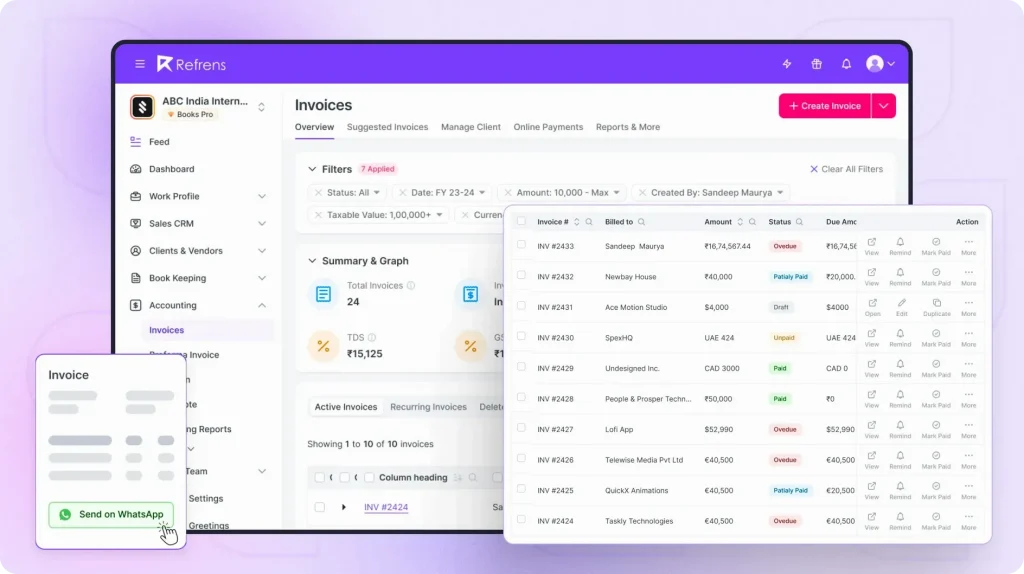

Refrens is a trusted platform used by over 150,000 businesses worldwide, including Indonesia. It offers an all-in-one solution for invoicing, accounting, and financial management, designed to simplify daily business tasks. With Refrens, you can easily create invoices, manage expenses, track inventory, and handle client and vendor relationships—all in one place. Its user-friendly interface ensures that even complex financial processes are handled efficiently.

Key Features:

- Customizable Invoices & Branding: Create branded, professional invoices with customizable templates, and invoice international clients using multi-currency support.

- Effortless Invoice Sharing: Share invoices seamlessly via email, PDF, WhatsApp, or direct links with just one click.

- Seamless Invoice Conversion: Easily convert quotations to invoices, and invoices to credit notes or sales orders, simplifying your transaction management with just one click.

- Automatic Payment Reminders: Set up automated reminders to notify customers about pending payments, ensuring timely collections.

- Recurring Invoices: Automate recurring invoicing for regular services, ensuring consistent cash flow without the need for manual input.

- Audit Trails: Keep a detailed log of all changes made to invoices, providing full visibility and accountability for your team.

- Comprehensive Reporting & Analytics: Access customizable reports like profit and loss, client activity, and expense summaries for real-time business insights.

- Expense Management: Easily track and manage your business expenses, keeping accurate records alongside your invoicing and financial data.

- Automatic Accounting: Refrens automatically update your accounting records when invoices, expenses, and payments are processed, saving time and reducing manual data entry.

- Invoice API: Quickly generate invoices for your website or app with Refrens’ Invoice API, integrating your invoicing system into your workflow.

- Third-Party Integrations: Seamlessly integrate with platforms like WhatsApp, Shopify, and Facebook to enhance your workflows and boost productivity.

- Multi-User & Multi-Business Support: Manage multiple businesses and users with role-based access, ensuring secure collaboration across teams.

Additional Features:

Refrens provides a comprehensive invoicing solution along with tools like sales CRM for lead tracking and pipeline management, plus streamlined client and vendor management. It also automates inventory management, seamlessly integrating with accounting to ensure accurate records of every transaction.

Pricing:

- Basic Plan: Rp 0

- Books Essential: Rp800.000/year

- Books Pro: Rp1.200.000/year

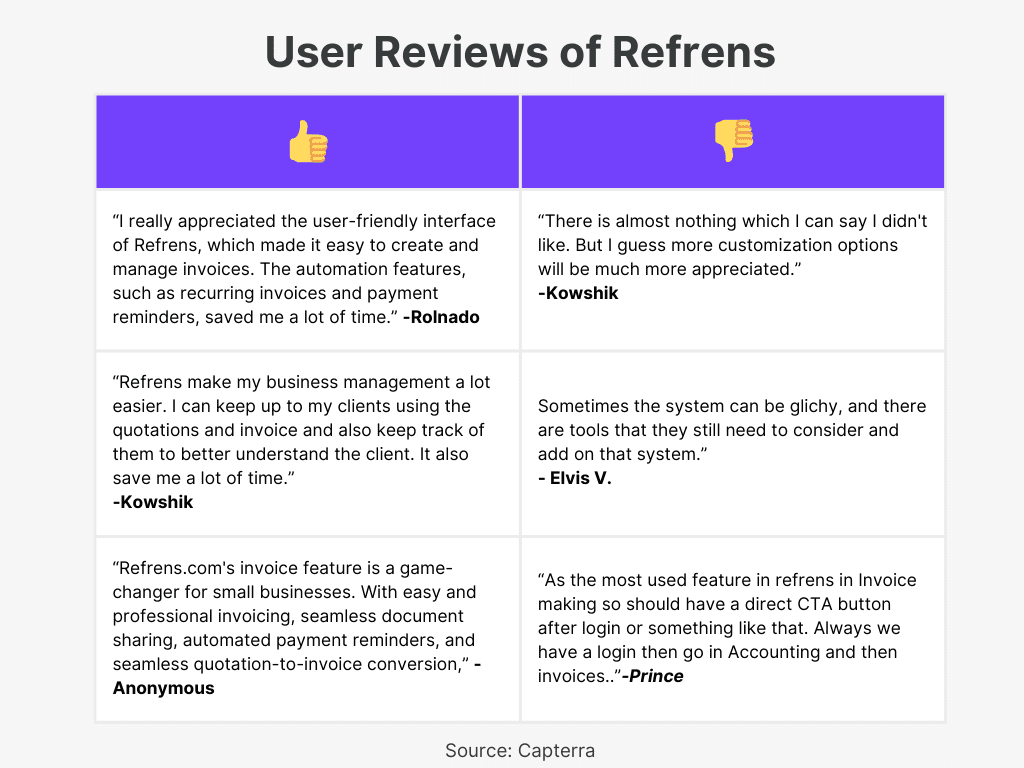

User Reviews:

2. Mekari Jurnal

Mekari Jurnal is a cloud-based invoicing software trusted by over 35,000 businesses across Southeast Asia. It provides centralized invoice management, real-time updates on payment statuses, and automated invoice scheduling. The software integrates with inventory management and Mekari Pay, offering a complete solution for businesses to streamline their invoicing process.

Key Features:

- Centralized Invoice Management: Track and manage all invoices from one dashboard for a streamlined invoicing experience.

- Automated Invoice Scheduling: Send invoices on time automatically, reducing the risk of late payments.

- Real-Time Payment Status: Keep payment statuses updated in real-time without manually tracking every transaction.

- Multi-Payment Method Support: Automates calculations for a variety of payment methods, making it flexible for different business needs.

- Invoice Templates: Choose from various invoice templates, making it quick and easy to create professional invoices.

- Mekari Pay Integration: Manage bills and payments in one place, ensuring smooth payment processes.

- Inventory Integration: Ensure that invoices and inventory align automatically, helping businesses track stock levels accurately.

Additional Features:

Mekari Jurnal offers a user-friendly interface, making it easy to learn and operate. It also provides systematic invoice records to ensure no documents are overlooked. With its seamless platform integration, businesses can manage invoicing, payments, and inventory without any hassle.

Pricing:

- Free Trial available

- Basic plan: Contact sales for pricing

- Premium plan: Contact sales for pricing

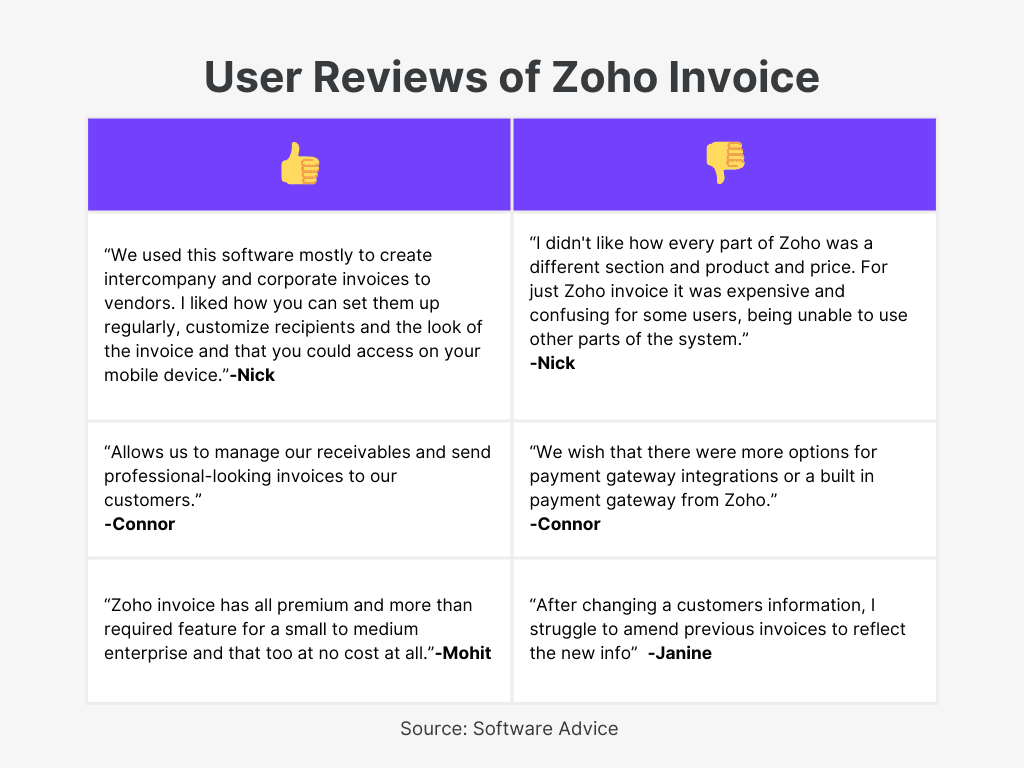

3. Zoho Invoice

Zoho Invoice is a free, feature-rich invoicing software designed for small businesses. It allows users to create, customize, and send professional invoices, track payments, and automate recurring billing. With mobile access and integrations with Zoho’s ecosystem, Zoho Invoice ensures seamless financial management on the go.

Key Features:

- Customizable Invoice Templates: Personalize invoice templates with your business logo and branding for a professional look.

- Recurring Invoices: Set up invoices to be sent automatically at regular intervals for recurring transactions.

- Time Tracking and Billing: Track project hours and convert them into accurate, billable invoices.

- Client Portal: Offer customers a self-service portal to view invoices, make payments, and download statements.

- Expense Tracking: Categorize and convert billable expenses into invoices with ease.

- Automated Payment Reminders: Automatically send reminders to customers for pending payments.

- Multi-language Support: Invoice customers in their preferred language, making communication easier.

Additional Features:

Zoho Invoice offers more than invoicing, with features like expense categorization, project tracking, and timesheet management. It also includes a self-service portal for customers and provides sales and expense analytics.

Pricing:

- Free for all users.

User Reviews:

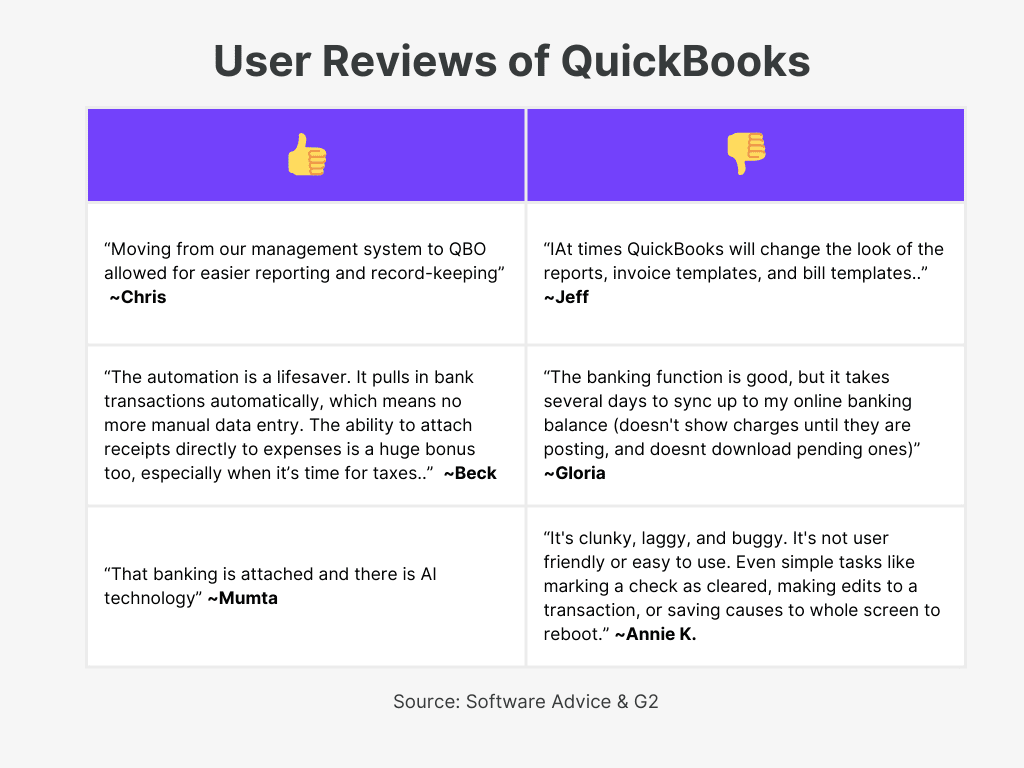

4. QuickBooks

QuickBooks is an industry-leading invoicing software designed for small and medium-sized businesses. It helps users create customized invoices, track payments, and manage expenses seamlessly. With features like progress invoicing and multi-currency support, QuickBooks makes managing finances easier for global businesses.

Key Features:

- Customizable Invoices: Personalize your invoices with logos, colors, and payment details, and add VAT, discounts, and shipping.

- Progress Invoicing: Split large projects into multiple invoices based on project milestones or percentage completion.

- Automated Recurring Invoices: Set up recurring invoices to be sent automatically for regular transactions, saving time.

- Multi-Currency Support: Easily manage and send invoices in multiple currencies to international clients.

- Payment Tracking: Track the status of invoices and send automatic reminders to late-paying clients.

- Mobile Access: Create, send, and manage invoices from any device, allowing on-the-go invoicing.

- Reports & Analytics: Gain insights into your business with detailed financial reports and real-time analytics.

Additional Features:

QuickBooks integrates with various payment gateways to facilitate smooth online payments. It also offers inventory tracking, project profitability analysis, and expense management. Users can manage bills, set up budgets, and automate workflows for improved efficiency.

Pricing:

- Simple Start: $205/year

- Essentials: $300/year

- Plus: $430/year

- Advanced: $820/year

User Reviews:

5. Zahir

Zahir Simply Invoice is a cloud-based invoicing solution created by PT Zahir International, designed specifically for Indonesian businesses. With over 26 years of experience in the software industry, Zahir has built a strong reputation for its easy-to-use interface and reliable invoicing tools.

This software allows businesses to create and send invoices instantly from any device, whether desktop or mobile. It’s trusted by hundreds of thousands of entrepreneurs across Indonesia, making it one of the most popular invoicing solutions in the region.

Key Features:

- Instant Invoice Creation: Quickly create and send professional invoices to your customers, ensuring fast payment turnaround.

- Intuitive Interface: The software’s simple and visually appealing design makes it easy to navigate for users of all skill levels.

- Customizable Invoices: Tailor your invoices with company logos, colors, and styles to reflect your brand and make a lasting impression.

- Automation for Time Efficiency: Automate recurring invoices and reminders, helping businesses save valuable time and reduce the risk of errors.

- Mobile-Friendly Access: Available on both desktop and mobile platforms, allowing you to manage your invoicing on the go through the browser or mobile apps.

- Local Currency and Language Support: Designed specifically for Indonesian businesses, Zahir offers localized support, including language options and compliance with local regulations.

- Secure Data Storage: Your invoice data is securely stored on the cloud, ensuring accessibility and protection against data loss.

Additional Features:

Zahir Simply Invoice integrates with comprehensive business management tools, including real-time financial reporting, debt management, and inventory control. It offers detailed invoicing overviews for efficient payment tracking and cash flow management. Tailored to various industries, Zahir also provides strong after-sales support, including free training and assistance.

Pricing:

- Free trial available for new users.

- Contact Zahir’s sales team for detailed pricing plans tailored to your business needs.

6. HashMicro

HashMicro Invoicing Software is a comprehensive tool designed for businesses of all sizes in Indonesia. It automates invoice generation and management, ensuring timely payments and streamlining the billing process. This cloud-based software allows businesses to track invoices, manage costs, and customize templates, helping improve cash flow and financial management.

Key Features:

- Invoice Generation – Create professional invoices with customizable templates, tailored for different clients.

- Tax & Discount Management – Automatically calculate taxes and discounts for each invoice to simplify financial calculations.

- Online Payment Management – Offer your clients multiple online payment options for fast and secure transactions.

- Credit Limit Management – Set customized credit limits for each client, ensuring better control over billing processes.

- Invoice Approval & Validation – Streamline the approval and validation of invoices with built-in workflows.

- Real-Time Invoice Reporting – Keep track of invoice statuses and unpaid bills, allowing for efficient cash flow monitoring.

- Accounting System Integration – Seamlessly connect with your online accounting software to automate accounts payable and receivable.

Additional Features:

HashMicro e-Invoicing integrates with CRM, purchasing systems, and other business tools for a unified invoicing experience. It supports multiple currencies, handles recurring invoices, and ensures compliance with local tax regulations.

Pricing:

- Basic Plan: Custom pricing based on business needs

- Pro Plan: Custom pricing based on business needs

- Enterprise Plan: Tailored for large enterprises requiring advanced features

7. Xero

Xero is a leading cloud-based invoicing software designed for small businesses, accountants, and bookkeepers. It offers a range of tools that simplify financial management, from sending invoices to tracking expenses. Xero is known for its seamless integrations with various apps, allowing businesses to tailor the platform to their specific needs and scale as they grow.

Key Features:

- Invoicing – Create and send professional invoices to clients and receive payments quickly through integrated payment gateways.

- Expense Management – Track and categorize expenses effortlessly to stay on top of your business’s cash flow.

- Bank Connections – Connect your bank accounts for real-time transaction syncing, ensuring up-to-date financial data.

- Payroll Management – Manage employee payroll, including tax deductions, directly within the platform.

- Inventory Management – Keep track of your product inventory in real time, making it easier to manage stock levels.

- Bill Payments – Schedule and pay bills on time, keeping track of upcoming payments and vendor details.

- App Integrations – Xero integrates with numerous third-party apps, making it easy to extend its functionality based on your business needs.

Additional Features:

Xero also supports multi-currency transactions, customizable reporting, and automated tax calculations. Its mobile app allows you to manage your finances on the go, while 24/7 support ensures help is always available.

Pricing:

- Starter Plan: $29/month

- Standard Plan: $46/month

- Premium Plan: $62/month

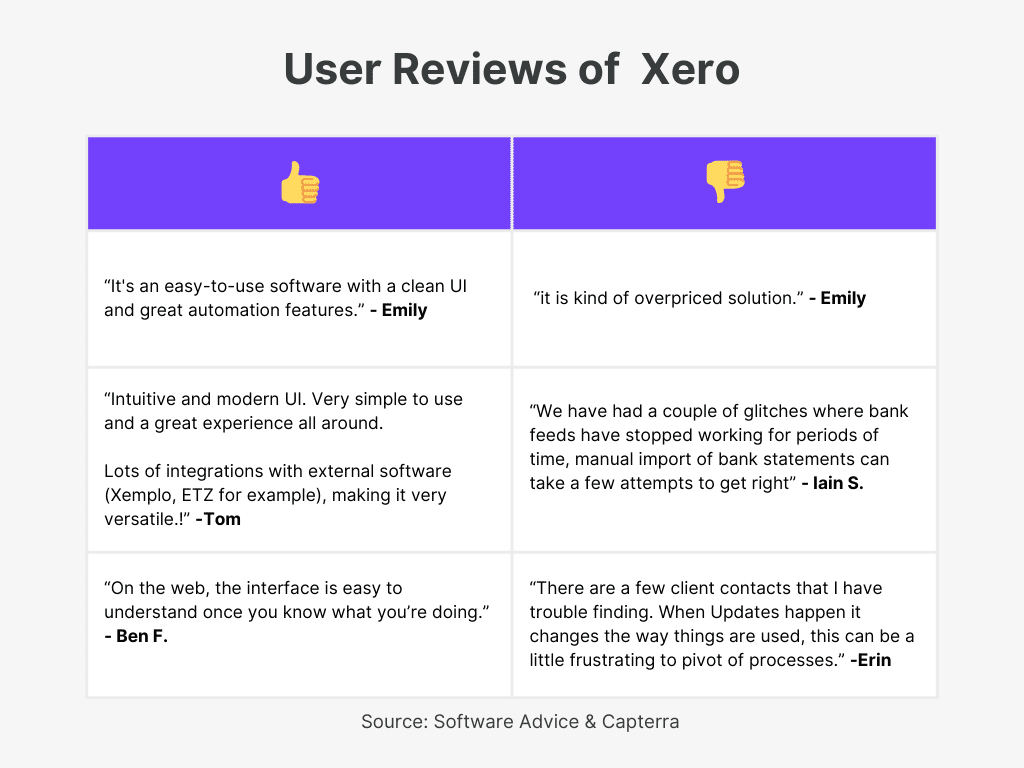

User Reviews:

How to Choose the Best Invoicing Software for Your Business in Indonesia

- Assess Your Business Needs: Identify what your business requires—larger companies handling high volumes of transactions may need advanced systems, while smaller businesses can benefit from simpler, cost-effective software to boost productivity.

- Ease of Use: Prioritize software with an intuitive interface that’s easy to use and doesn’t require extensive training for you or your team.

- Customization Options: Ensure the software allows you to customize invoices to match your brand, including adding your logo, colors, and business-specific fields.

- Integration with Existing Systems: Choose software that integrates smoothly with your existing tools, like accounting or inventory management systems, to streamline your operations.

- Security Features: Opt for software with strong security measures, such as data encryption and cloud backups, to protect your financial data from potential breaches.

- Reliable Support Services: Check if the provider offers responsive customer support, ensuring that you can get assistance whenever you face any issues.

- Cost and Features: Balance the cost of the software with its feature set, ensuring it fits within your budget while still meeting your business’s invoicing needs.

- Compliance with Local Regulations: Make sure the software is fully compliant with Indonesian tax laws, including automatic PPN calculations and other local financial standards, to avoid any legal complications.

Conclusion

Selecting the right invoicing software is a strategic move that can enhance your financial management, streamline processes, and ensure compliance with Indonesian tax laws.

From customizable invoicing options to secure data handling and real-time reporting, the tools highlighted here offer various solutions tailored to different business sizes and needs.

As your business evolves, investing in scalable software that grows with you will help maintain operational efficiency and set the foundation for long-term financial success.