Managing finances is one of the most critical aspects of running a business, and having the right invoicing software can simplify everything from billing clients to staying compliant with Singapore’s financial regulations.

Whether you’re a freelancer, small business owner, or part of a larger enterprise, finding software that suits your needs can save you time, reduce errors, and streamline your operations.

In this blog, we explore the Best Invoicing Software in Singapore, each offering essential features like Peppol e-invoicing compliance, multi-currency support, and automation tools to help businesses of all sizes thrive.

| Software | Starting Price | Trial Period | Free version |

|---|---|---|---|

| Refrens | $115/year | ✔️ | ✔️ |

| QuickBooks | $294/year | ✔️ | ❌ |

| Xero | $468/year | ✔️ | ❌ |

| FreshBooks | $180/year | ✔️ | ❌ |

| HashMicro | Custom | – | – |

| Voloplay | Custom | – | – |

| Highnix | Custom | – | – |

| Chargebee | Custom | – | ✔️ |

| Zoho Invoice | Free | – | ✔️ |

Key Features to Look for in Invoicing Software for Singapore Businesses

- Peppol E-Invoicing Compliance: Ensure the software supports the Peppol network for seamless, compliant e-invoicing, as required by IRAS.

- Multi-Currency Support: If your business deals with international clients, invoicing software with multi-currency capabilities is crucial to managing currency conversions and foreign transactions.

- Recurring Invoicing: Look for automation tools to set up recurring invoices and reminders for regular clients, saving time and improving cash flow.

- Customizable Templates: The ability to create branded invoices with customizable fields ensures a professional appearance and fits your business needs.

- Payment Integration: Software with integrated payment gateways (e.g., PayNow or credit card support) simplifies payment collection and speeds up cash flow.

- Audit Trails: Transparency is key, so ensure the software provides a detailed audit trail for tracking changes to invoices and transactions.

- Expense and Inventory Management: Some invoicing tools integrate with expense tracking and inventory management, which helps manage your overall finances in one place.

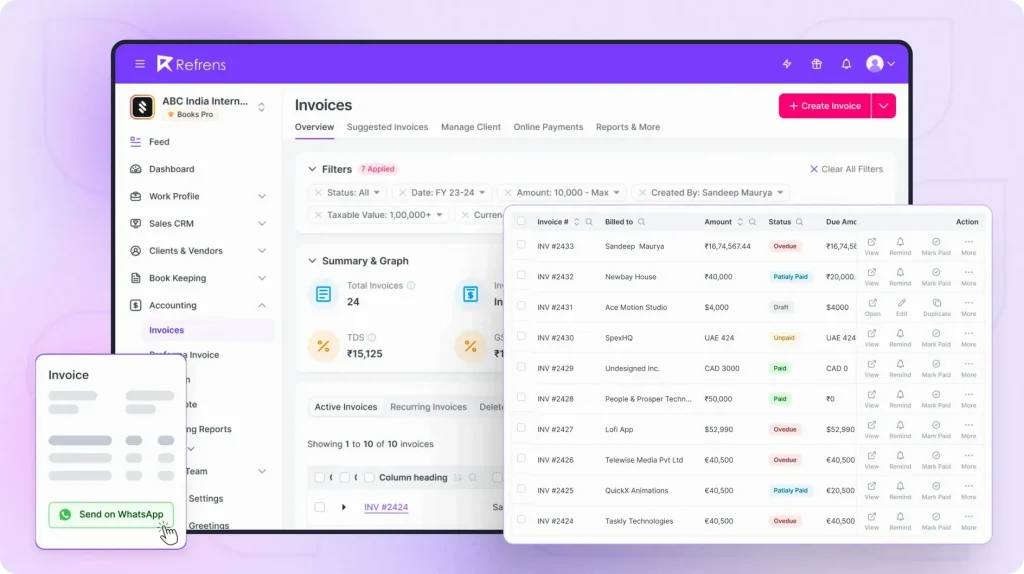

1. Refrens

Refrens is a comprehensive invoicing management platform designed for all sorts of businesses. It simplifies essential tasks such as accounting, inventory, and expense tracking while allowing users to efficiently create and manage invoices, quotations, and purchase orders.

Trusted by 150,000 users in 178 countries, Refrens offers powerful tools for client management and international payments, making it an ideal all-in-one solution for businesses seeking streamlined financial operations.

Features:

- Customization: Personalize invoices with customizable templates to reflect your brand identity.

- One-Click Invoice Conversion: Convert approved quotations into invoices or turn invoices into credit notes or purchase orders with a single click, streamlining your workflow.

- Automated Payment Reminders: Set up automated reminders via email or WhatsApp to ensure timely client payments and improve cash flow.

- Recurring Billing: Automate recurring invoices to save time and ensure consistent cash flow for services billed regularly.

- Invoice API: Effortlessly generate invoices for your website or app using the Refrens Invoice API.

- Audit Trail: Keep a detailed audit trail of all invoice-related actions to ensure transparency and accountability.

- Expense Tracking & Management: Track and categorize all business expenses in one place, simplifying expense monitoring.

- Advanced Reporting & Analytics: Access customizable reports like client, payment profit and loss, and balance sheets to make data-driven business decisions.

- Multi-User Support: Manage multiple users with role-based access, ensuring secure collaboration across teams.

Additional Features:

Features like inventory management, CRM integration, vendor management, multi-user access, third-party integrations, secure profile controls, scheduling, and auto-assist tools enhance the overall invoicing and accounting experience.

Pricing:

- Basic Plan: Free

- Books Essential: $115/ year

- Books Pro: $240/year

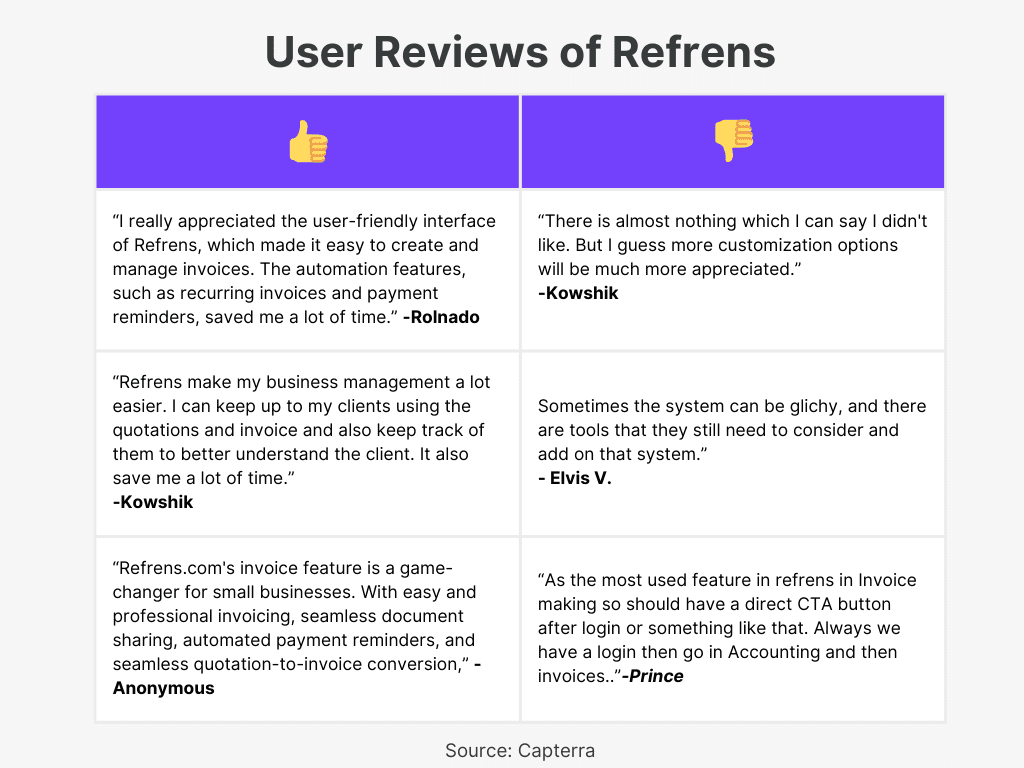

User Reviews:

2. GnuCash

GnuCash is a free accounting software for personal and small-business financial management. It offers essential features like double-entry accounting, small-business accounting, and scheduled transactions. GnuCash is available on multiple platforms, including Linux, Windows, and macOS, ensuring flexibility for users.

Key Features:

- Double-Entry Accounting: Maintains accurate financial records by following the professional standard of double-entry bookkeeping.

- Stock and Mutual Fund Accounts: Track investments with support for stock, bond, and mutual fund accounts.

- Small-Business Accounting: Manage accounts payable, receivable, and payroll, tailored specifically for small businesses.

- Reports and Graphs: Generate detailed financial reports and graphical representations for better insights into your finances.

- QIF/OFX/HBCI Import: Easily import financial data from different sources, including bank accounts and credit card statements.

- Scheduled Transactions: Automate recurring payments like bills or income, ensuring you never miss a transaction.

- Transaction Matching: Match imported transactions with existing records to avoid duplicates and ensure accuracy.

Additional Features:

GnuCash also provides multi-currency support and customizable financial calculations for more advanced users. Its reporting tools offer customizable graphs, making financial tracking intuitive. GnuCash is actively developed by volunteers, with open-source access for contributors.

Pricing:

- Free, open-source software (GNU GPL licensed)

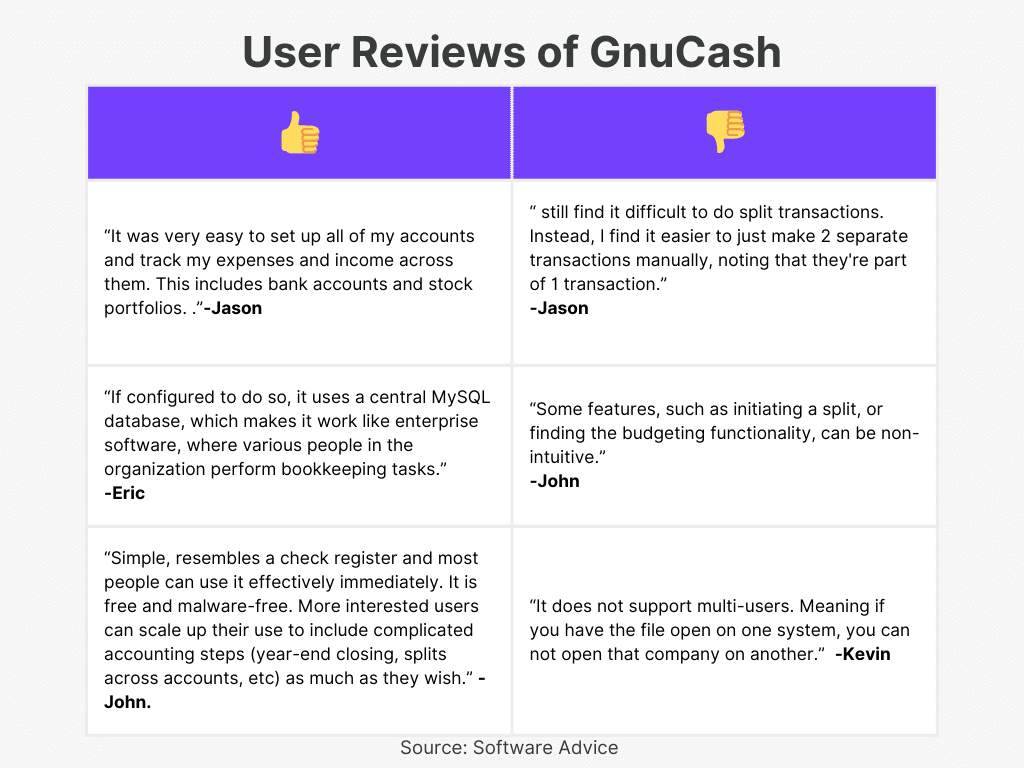

User Reviews:

3. HashMicro

HashMicro is an all-in-one ERP solution provider, offering powerful invoicing software that streamlines the invoicing process for businesses in Singapore. It features automatic invoicing, online payment integration, and tax management, making it easier for companies to manage their cash flow and payments. HashMicro supports multi-industry businesses with a customizable and scalable platform.

Key Features:

- Automatic Invoicing: Create and send invoices automatically with personalized templates for different clients, helping you save time.

- Online Payment Integration: Enables seamless payments through various online gateways, ensuring quicker transactions.

- Tax Management: Automatically calculates and applies taxes such as VAT, simplifying tax filing and compliance.

- Invoice Approval & Validation: Easily manage approvals and validate invoices with special discounts or pricing rules.

- Real-Time Invoice Reporting: Get insights into unpaid invoices and monitor the financial status of your business through comprehensive reporting.

- Credit Limit Management: Set customized credit limits for clients based on your business needs, improving financial control.

- Invoice Scheduling: Schedule recurring invoices for regular customers, ensuring timely payments and reducing manual effort.

Additional Features:

HashMicro also integrates with accounting systems and CRM modules to automate accounts receivable and payable, reducing manual work. Its reporting tools provide a real-time overview of cash flow, and the software can be customized to suit the unique needs of any business.

Pricing:

Custom pricing for large businesses.

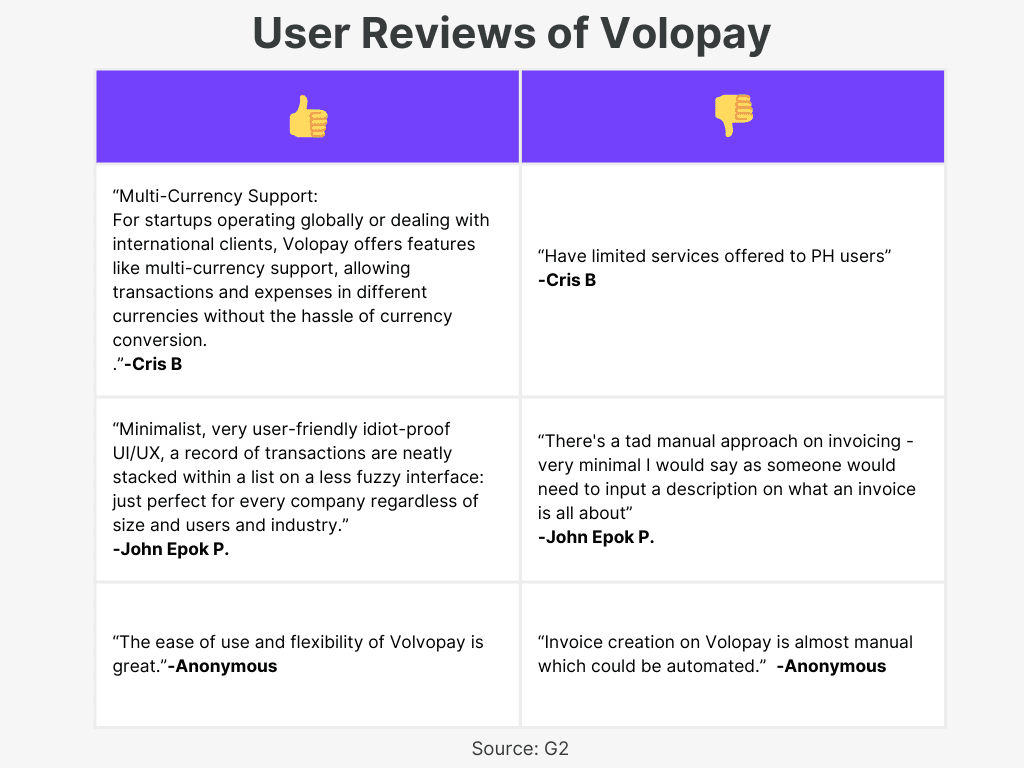

4. Voloplay

Volopay is a robust invoicing software designed to streamline invoice management, vendor payments, and expense reporting. It offers automated processes that eliminate the need for manual tasks, improving efficiency and reducing costs. With built-in invoice tracking and approval workflows, managing payables becomes faster and more accurate.

Key Features

- Optical Character Recognition (OCR): Automatically scan and upload invoices, reducing manual data entry efforts.

- Bulk Invoice Upload: Upload multiple invoices simultaneously, speeding up the invoicing process.

- Invoice Tracking: Track invoice statuses in real-time, receiving notifications for approvals and payments.

- Expense Reporting Integration: Automatically log and store expense reports with the accounts payable module for streamlined financial management.

- Vendor Management: Add and manage vendor profiles with detailed information, allowing for easy payments and vendor accountability.

- Multi-Currency Support: Make payments to vendors globally with support for multiple currencies.

- Mobile Accessibility: Approve invoices and manage accounts payable on the go with mobile app alerts.

Additional Features:

Volopay also offers advanced automation features for vendor payouts and accounting integrations, which help businesses reconcile accounts faster. Users can set up custom approval workflows for better invoice validation and flag duplicate payments automatically.

Pricing:

Custom pricing

User Reviews:

5. Highnix

Highnix ERP is a cloud-based Enterprise Resource Planning (ERP) software designed specifically for small and medium enterprises (SMEs) in Singapore. It integrates essential business functions such as inventory, sales, and accounting while supporting the government’s digital invoicing initiative, InvoiceNow (previously known as Peppol E-invoice). With its robust system architecture, Highnix ERP offers scalable solutions to meet the needs of growing businesses.

Key Features:

- InvoiceNow (Peppol E-Invoice) Integration: Seamlessly manage electronic invoicing, enabling businesses to send and receive invoices securely across the Peppol network.

- Cloud-Based Accessibility: You can access your ERP system from any device, whether mobile, tablet, or desktop, ensuring seamless operations for remote or hybrid workforces.

- Comprehensive Inventory Management: Tracks inventory movements and links with sales and finance modules, providing accurate reporting and control over inventory assets.

- Multi-Currency Transactions: Supports multiple currencies for global business operations, ensuring smooth handling of journal entries and financial reporting.

- API Integration: Easily integrates with third-party applications, allowing businesses to choose the best front-end solutions while reducing customization costs.

Additional Features:

Highnix ERP offers secure data backup with X.509 encryption, two-factor authentication (2FA) for enhanced security, and multi-language support, making it ideal for SMEs with international branches. It also includes built-in training resources for continuous staff education.

Pricing:

- Perpetual License: Includes customization and integration options.

- Subscription License: Suitable for businesses with tight budgets.

6. QuickBooks Intuit

QuickBooks is a popular cloud-based invoicing and accounting software designed for small to medium-sized businesses. It offers easy-to-use tools for creating professional invoices, tracking income and expenses, and managing your finances all in one place. With automation features like progress invoicing and recurring billing, QuickBooks helps streamline business operations. It’s also compliant with e-Invoicing standards in Singapore, making it an ideal choice for businesses.

Features:

- Custom Professional Invoices: Create customized invoices with your logo, and colors, and add VAT, discounts, shipping, and billable expenses, giving a professional touch.

- Automated Recurring Invoices: Set up recurring invoices for clients who require regular billing, saving you time on repeated tasks.

- Progress Invoicing: For larger projects, split the amount into multiple invoices based on project milestones or percentage completion.

- Automatic Invoice Reminders: Automatically send follow-up reminders to clients with overdue payments, improving cash flow management.

- Multi-Currency and Multi-Language Support: Send invoices in various currencies and languages, catering to international clients and easing cross-border transactions.

Additional Features:

QuickBooks offers integration with various payment gateways, and mobile accessibility through its app. It allows for invoice tracking and client communication via WhatsApp, helping businesses stay connected with their clients anywhere, anytime.

Pricing:

- Simple Start: $294/year

- Essentials: $457/year

- Plus: $610/year

- Advanced: $1177/year

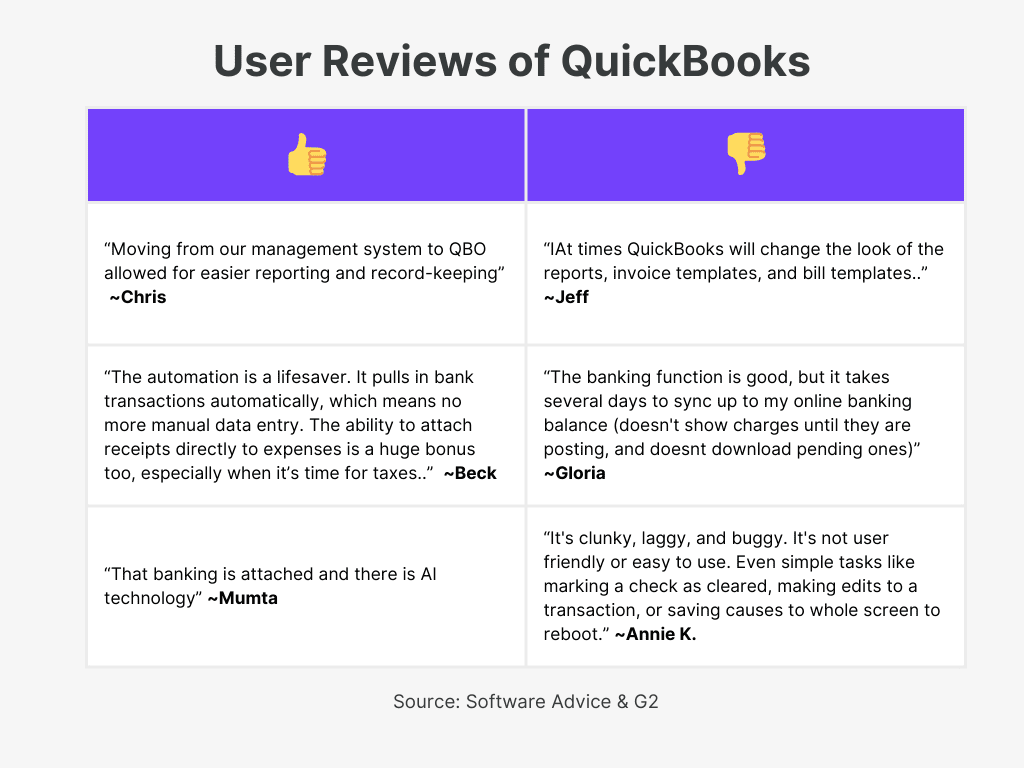

User Reviews:

7. Zoho Invoice

Zoho Invoice is a powerful invoicing software designed for freelancers and small businesses looking to streamline their billing processes. It allows users to create professional invoices quickly and offers features for tracking payments, expenses, and project management.

Features:

- Professional Invoicing: Easily create tax-compliant invoices in one click, ensuring that your billing is both accurate and professional.

- Payment Integration: Accept payments through various methods, including credit cards, e-wallets, and ACH transfers, making it convenient for your clients.

- Automated Reminders: Set up automated payment reminders to help ensure timely payments and reduce the need for follow-up communications.

- Customizable Templates: Modify invoice templates to align with your brand identity, giving your invoices a personal touch.

- Expense Tracking: Record and manage expenses seamlessly, helping you keep track of your financials and maintain accurate accounts.

- Recurring Invoices: Generate recurring invoices effortlessly, saving time on regular billing cycles and ensuring consistency.

- Self-Service Portal: Provide a self-service customer portal where clients can view and pay invoices, enhancing customer satisfaction and ease of access.

Additional Features:

In addition to these features, Zoho Invoice offers project management tools, time tracking, and integrations with Zoho CRM and Analytics for enhanced functionality. Its mobile app allows users to access their invoices on the go, providing flexibility and convenience.

Pricing:

- Free Plan: For freelancers and small business owners

- Advanced Plans: Custom pricing based on additional features and business needs

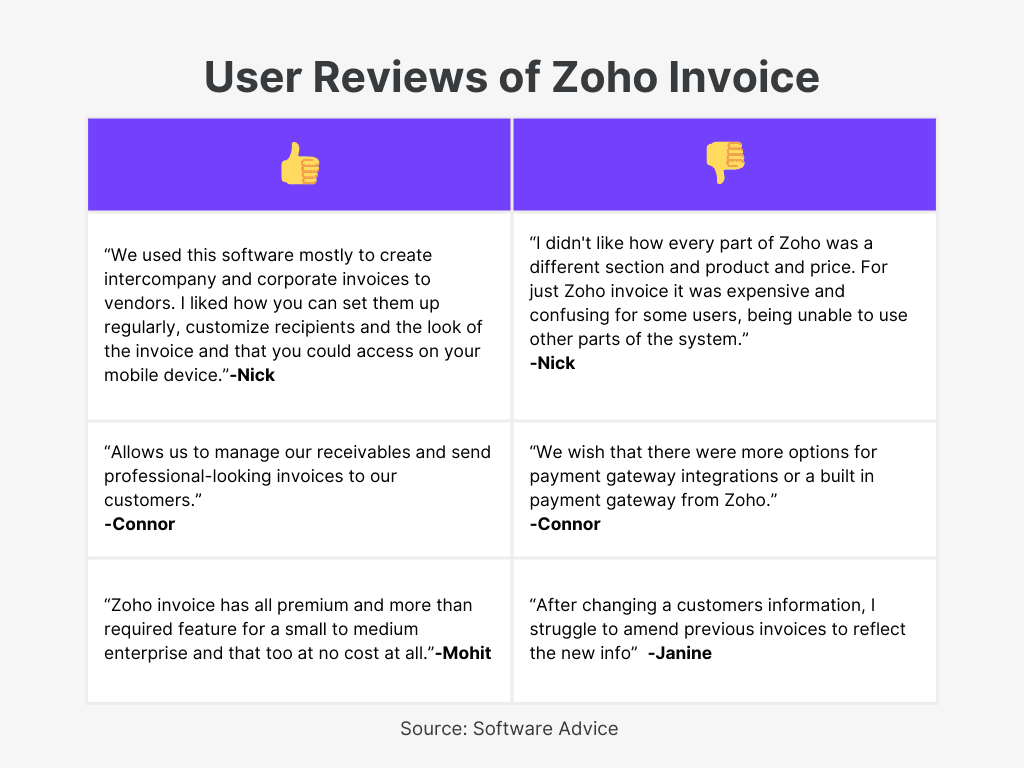

User Reviews:

8. FreshBooks

FreshBooks is an intuitive invoicing software designed to simplify billing for small businesses, saving you up to 550 hours a year. With features like automated invoicing, expense tracking, and client communication, FreshBooks helps streamline your financial processes. It offers easy customization for professional invoices and a variety of payment options to get you paid faster. Enjoy seamless integration with projects, time tracking, and reporting tools, making it an excellent choice for freelancers and small business owners.

Features:

- Professional Invoices: Create visually appealing invoices in seconds, complete with your branding and logo, ensuring you present your business professionally.

- Automated Payment Reminders: Set up automatic reminders for overdue invoices, which reduces the hassle of chasing clients for payments and keeps your cash flow steady.

- Multiple Payment Options: Accept credit cards, ACH transfers, and other payment methods, allowing clients to pay in the way that suits them best, speeding up the payment process.

- Expense Tracking: Easily track expenses and attach receipts to invoices, ensuring that all billable hours and costs are accounted for and included in client invoices.

- Recurring Invoices: Automate billing for clients with regular payments, saving you time and ensuring you don’t miss any income.

- Project Management: Manage projects efficiently by assigning billable hours and tracking time, so you can keep clients informed and maintain control over your workload.

- Reporting Tools: Generate detailed financial reports to gain insights into your business performance, helping you make informed decisions for growth.

Additional Features:

FreshBooks also allows you to customize payment terms, preview invoices before sending, and manage invoices via a mobile app. The software supports multiple currencies and provides instant updates when invoices are viewed and paid.

Pricing:

- Lite Plan: $15/month (up to 5 clients)

- Plus Plan: $25/month (up to 50 clients)

- Premium Plan: $50/month (up to 500 clients)

- Custom Plan: Contact for pricing (for larger businesses)

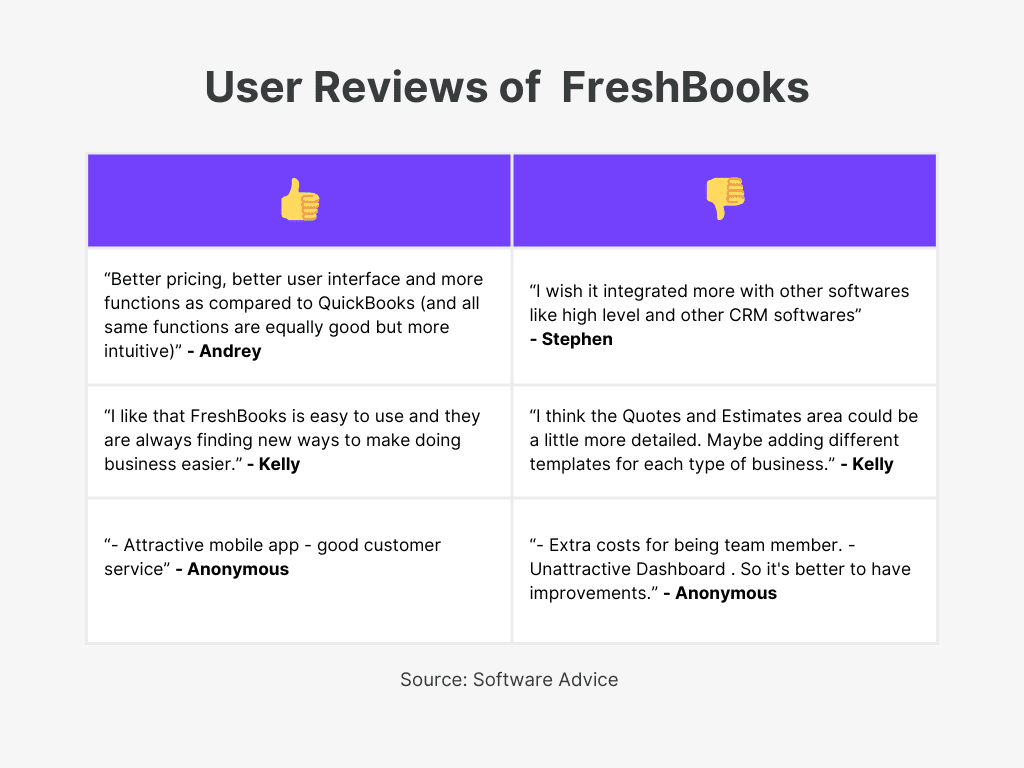

User Reviews:

9. Chargebee

Chargebee is a leading subscription management and invoicing platform designed to streamline billing processes for high-growth businesses. It supports various monetization strategies with features like billing automation, payment processing, and revenue recognition. Chargebee’s powerful integrations ensure smooth and accurate management of subscriptions and recurring payments.

Key Features:

- Subscription Management: Automate every aspect of subscription operations, from sign-up to reconciliation, ensuring a smooth experience.

- Billing Automation: Set up and manage recurring billing and invoicing, reducing manual efforts and ensuring timely payments.

- Revenue Recognition: Accurately recognize revenue and remain GAAP-compliant, making audits hassle-free and improving financial transparency.

- Multiple Payment Gateways: Integrates with 30+ payment gateways to provide flexible payment methods for customers across the globe.

- Quote-to-Cash Automation: Automates the entire quote-to-cash process, ensuring faster and more accurate billing cycles.

- Deferred Revenue Reporting: Provides detailed reports on deferred revenue, allowing better financial forecasting and planning.

- Churn Reporting: Helps predict and reduce customer churn by analyzing customer data, allowing businesses to retain more customers.

Additional Features:

Chargebee offers extensive API integrations, allowing seamless connections with CRM systems and other software. It also enables flexible pricing models for businesses of all sizes. Chargebee’s enterprise-grade security ensures that all transactions comply with the latest regulatory standards, offering 99.9% uptime and PCI-DSS Level 1 compliance for secure transactions.

Pricing:

Custom pricing

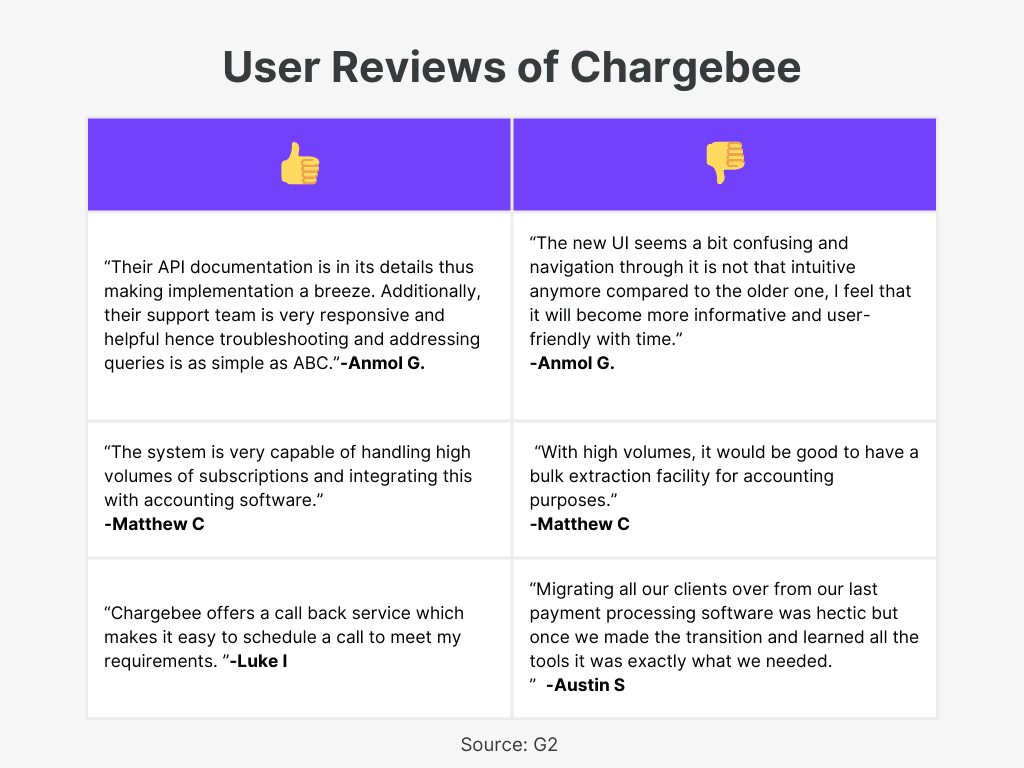

User Reviews:

10. Xero

Xero is an intuitive online invoicing software tailored for small businesses. It simplifies the invoicing process by enabling users to send invoices, set up automatic payment reminders, and offer multiple payment options—all from the desktop or mobile app. With Xero, businesses can customize their invoices, automate routine tasks, and manage payments more effectively.

Key Features:

- Customizable Invoices: Create professional invoices with customizable templates, including the option to add your logo and set payment terms.

- Multiple Payment Options: Integrate third-party payment services like Stripe to accept debit, credit cards, and direct debit for faster payments.

- Automatic Payment Reminders: Schedule automated reminders before or after the due date, reducing the effort to chase overdue invoices.

- Mobile Invoicing: Create and send invoices directly from the Xero mobile app, with instant notifications when invoices are viewed or paid.

- Recurring Invoices: Set up repeating invoices for regular clients, saving time on manual entries for recurring services.

- InvoiceNow Integration: Seamlessly send e-invoices via InvoiceNow, complying with Singapore’s e-invoicing standards.

- Quotes to Invoices: Easily convert accepted quotes into invoices, streamlining the sales process.

Additional Features:

Xero also offers advanced reporting tools, expense management, and the ability to copy or template invoices for repeated use. It integrates with third-party apps for enhanced functionality and provides automated financial insights for better decision-making.

Pricing:

- Starter Plan: SGD 39/month

- Standard Plan: SGD 61/month

- Premium Plan: SGD 80/month

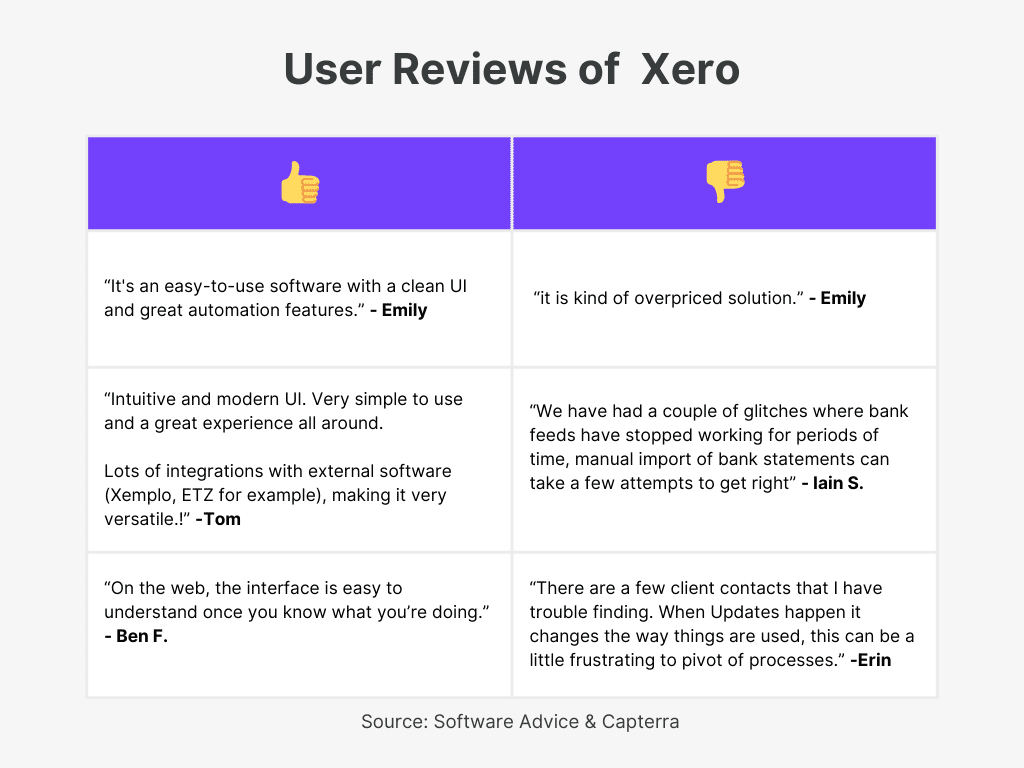

User Reviews:

How to Choose the Right Invoicing Software for Your Business

- Assess Business Needs: Determine your requirements—larger businesses may need advanced features, while smaller ones can opt for simpler, cost-effective solutions.

- Prioritize User-Friendliness: Choose software with an intuitive interface to minimize training time and enhance productivity.

- Customization Options: Ensure the software allows personalized, branded invoices through customizable templates.

- Integration Compatibility: Opt for software that integrates smoothly with your existing tools for seamless workflows.

- Data Security: Select a solution with strong security features, like data encryption, to protect your financial data.

- Support and Reliability: Ensure the provider offers reliable support to address any issues promptly.

- Consider Pricing: Choose a solution that fits your budget while offering essential features.

- Regulatory Compliance: Make sure the software complies with local tax laws and standards to avoid legal issues.

Conclusion

The right invoicing software can transform financial management for businesses in Singapore, making it more efficient and less stressful. With features like customizable invoices, payment gateway integration, and compliance with local regulations, these tools meet the unique needs of Singaporean businesses.

Choosing the right software ensures smooth invoicing, faster payments, and more focus on growing your business instead of managing paperwork. Whether a small startup or an established enterprise, these top invoicing options will fit your needs perfectly.