Invoicing is an essential function for any business, ensuring smooth cash flow and precise financial tracking. For U.S. businesses, the right invoicing software can streamline operations by automating tasks, managing tax compliance, and offering features like recurring billing and instant payment notifications.

With options catering to various sectors—from SMEs and large enterprises to freelancers and non-profits—these tools are designed to meet different business needs.

This guide on the 10 Best Invoicing Software for U.S. businesses highlights key features, pricing models, and what makes each solution ideal for improving financial management and enhancing efficiency.

| Software | Starting Price | Trial Period | Free version |

|---|---|---|---|

| Refrens | $90/year | ✔️ | ✔️ |

| Bill | $228/year | ❌ | ❌ |

| Square Invoice | $240/year | ❌ | ✔️ |

| QuickBooks | $420/year | ✔️ | ❌ |

| Invoice2go | $71/year | – | ❌ |

| FreshBooks | $204/year | ✔️ | ❌ |

| Xero | $180/year | ✔️ | ❌ |

| Wave | Custom | – | ✔️ |

| Zoho Invoice | Free | – | ✔️ |

| Stripe | Custom | – | – |

Essential Invoicing Software Features for U.S. Businesses

- Customizable Invoices: Create professional, branded invoices by adding custom fields, and logos, and adjusting columns to match your business needs.

- Multi-Currency Support: Seamlessly handles international transactions with automatic currency conversion, making it easier to invoice global clients.

- Tax Compliance: Automatically calculate federal and state taxes, including sales tax, ensuring all invoices are compliant with U.S. tax regulations.

- Recurring Invoicing: Set up automated recurring invoices for regular services, eliminating the need for manual billing and ensuring timely payments.

- Payment Integration: Integrate with multiple payment gateways like credit cards, PayPal, and bank transfers, simplifying the payment process for clients.

- Expense Tracking: Track and categorize business expenses alongside invoicing, offering a complete view of your financial health in one platform.

- Mobile Access: Manage invoices, send reminders, and track payments on the go using a mobile-friendly platform or app.

- Client Management: Keep detailed client records, track payment histories, and automate reminders for outstanding invoices to maintain cash flow.

- Reporting & Analytics: Generate comprehensive reports on revenue, outstanding invoices, and payment trends, offering valuable insights into your business.

- Data Security: Ensure sensitive financial data is protected with encryption, secure cloud backups, and robust security measures for peace of mind.

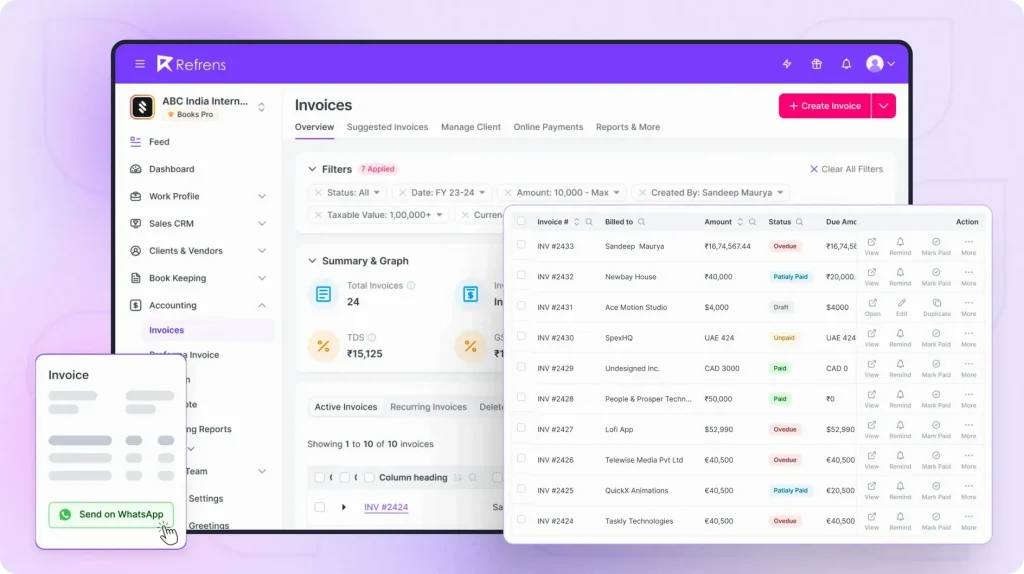

1. Refrens

Refrens is a versatile invoicing software designed for small and medium-sized businesses and consultants. It simplifies invoicing by offering customizable templates, integrated CRM, and seamless payment tracking.

Users can also manage quotations, recurring invoices, and multi-currency transactions, making Refrens a comprehensive solution for financial management. Trusted by over 150,000 users globally, Refrens enhances invoicing efficiency while ensuring accurate financial data.

Key Features:

- Customizable Invoices: Design personalized, branded invoices using flexible templates with options to add your logo and custom fields.

- One-Click Invoice Sharing: Send invoices instantly via email, WhatsApp, PDF, or shareable links with just one click.

- One Click Conversion: Convert quotes into invoices or credit/debit notes easily, simplifying transaction management.

- Recurring Invoices: Automate invoicing for recurring clients, reducing manual effort and ensuring consistent cash flow.

- Automated Payment Reminders: Set up automatic reminders for clients to notify them of outstanding invoices, streamlining collections.

- Multi-Currency Invoicing: Supports multi-currency invoicing, allowing users to handle global clients with automatic currency conversions.

- Audit Trails: Maintain a detailed log of invoice changes, offering transparency and accountability within your team.

- Comprehensive Reporting & Analytics: Access detailed reports such as profit and loss, client statements, and expense summaries for real-time business insights.

- Expense Management: Easily track and manage your business expenses, keeping accurate records alongside your invoicing and financial data.

- Automatic Accounting: Automatically update your accounting records when invoices, expenses, and payments are processed, saving time and reducing manual data entry.

- Invoice API Integration: Generate invoices directly from your website or app using Refrens’ Invoice API, seamlessly integrating invoicing into your workflow.

- Third-Party Integrations: Boost productivity by integrating with platforms like WhatsApp, Shopify, and Facebook, streamlining communication and workflows.

- Multi-User Support: Manage multiple users with role-based access, ensuring secure collaboration across teams.

Additional Features:

Refrens integrates a sales CRM for managing leads and pipelines, automates inventory tracking, and provides detailed financial reporting. The platform is user-friendly, with 24/7 support and cloud-based access, making it ideal for businesses looking to streamline invoicing and sales processes.

Pricing:

- Basic Plan: Free

- Books Essential Plan: $90/year

- Books Pro Plan: $225/year

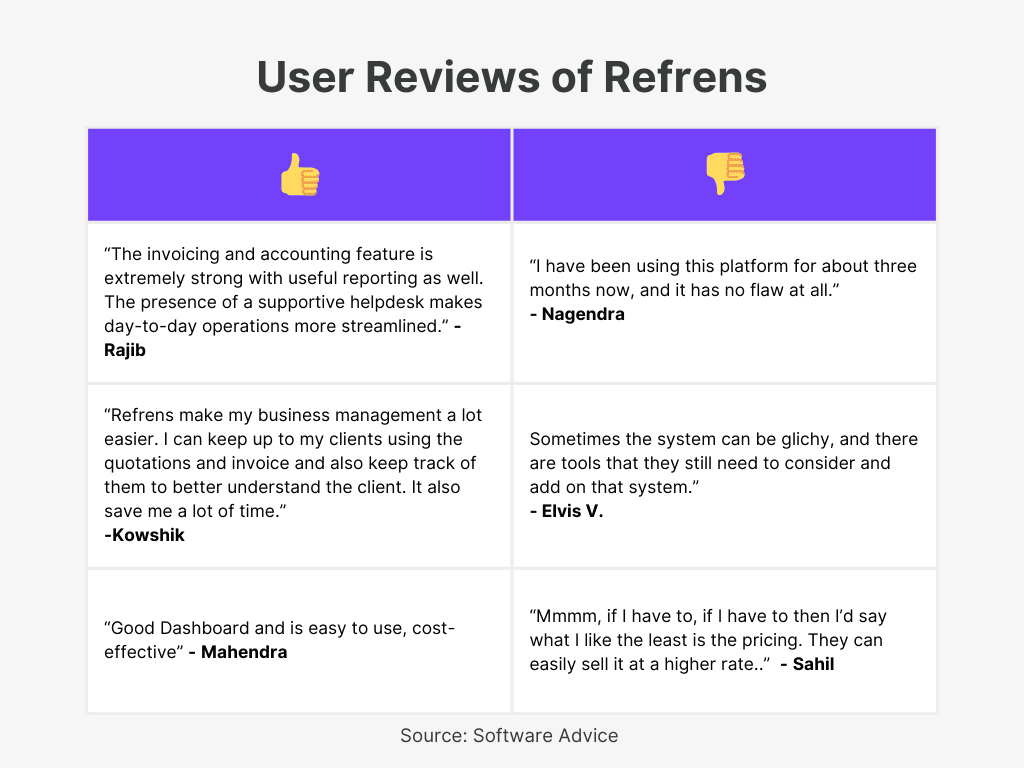

User Reviews:

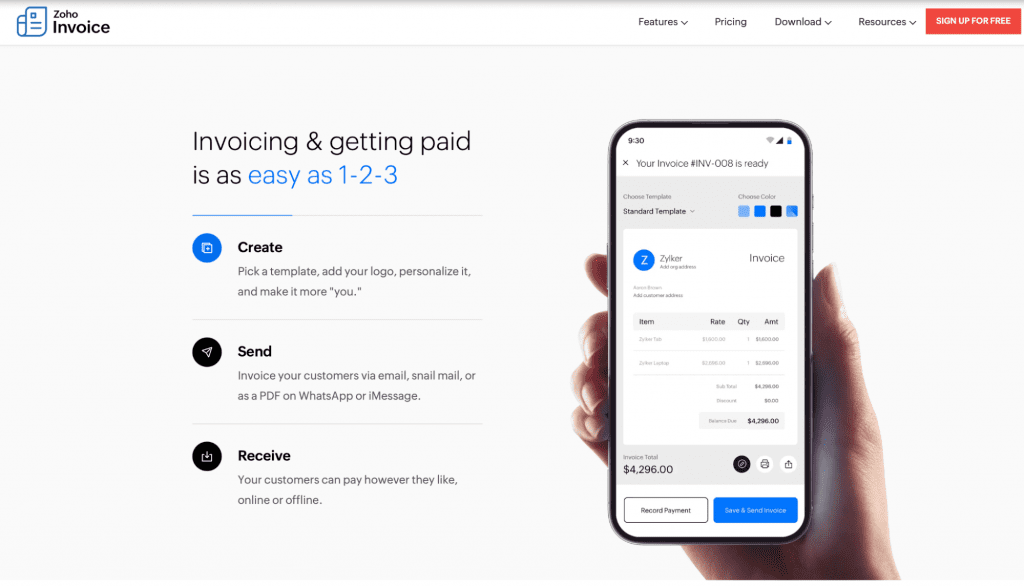

2. Zoho Invoice

Zoho Invoice is a powerful, easy-to-use recurring invoicing software designed for freelancers and small businesses. It offers customizable invoicing templates, time tracking, and expense management, helping businesses streamline their billing processes.

Key Features:

- Customizable Invoices: Create professional invoices with customizable templates that reflect your brand identity.

- Time Tracking: Accurately track project hours and bill clients based on the time worked, improving billing transparency.

- Expense Management: Record and categorize all business expenses, ensuring you keep track of billable and non-billable costs.

- Customer Portal: Provide clients with a portal to view invoices, make payments, and approve quotes, enhancing the client experience.

- Payment Reminders: Automate payment reminders to ensure timely payments from clients, reducing the risk of delayed payments.

- Quote to Invoice Conversion: Convert accepted quotes into invoices with a single click, simplifying the invoicing process.

- Mobile App: Access all invoicing features on the go through Zoho Invoice’s mobile app, available on multiple platforms.

Additional Features:

Zoho Invoice integrates seamlessly with other Zoho apps like Zoho Books, Zoho CRM, and Zoho Expense, making it a versatile tool for business management. Its cloud-based infrastructure ensures real-time synchronization across devices, offering flexibility and ease of use. With SSL encryption and GDPR compliance, Zoho Invoice guarantees secure data handling.

Pricing:

- Free Forever: Unlimited invoicing, expense tracking, and client management at no cost

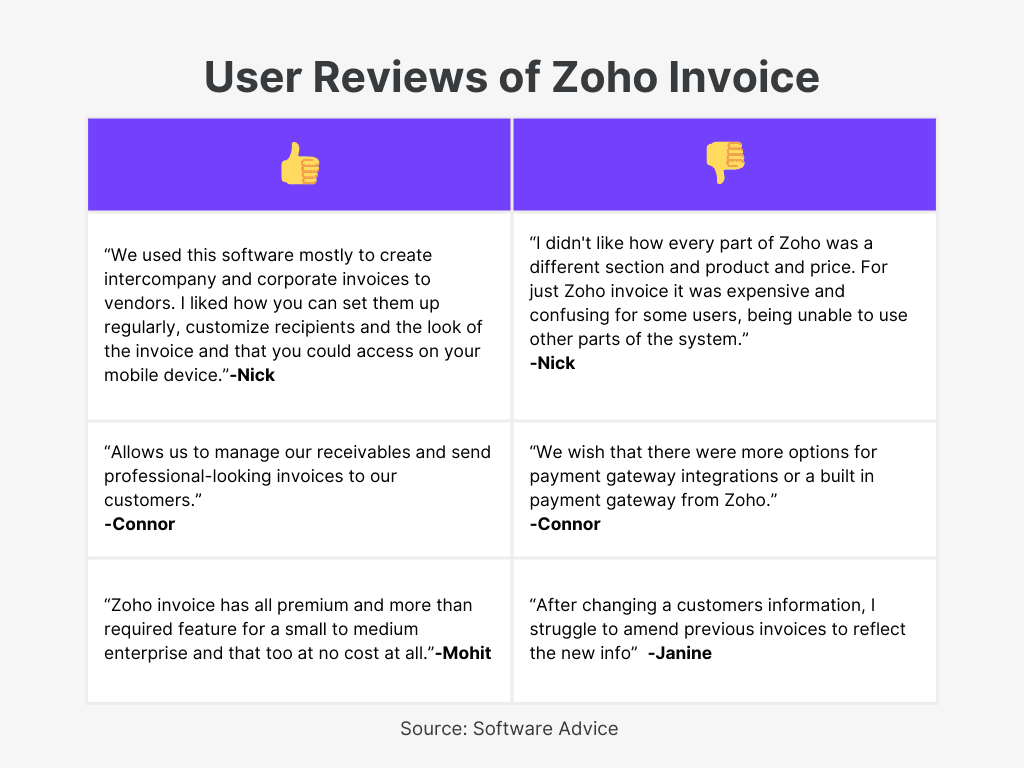

User Reviews:

3. BILL

BILL is a comprehensive financial operations platform designed to streamline accounts payable (AP), accounts receivable (AR), spend management, and expense control. It helps businesses automate billing processes, manage budgets, and track spending through a unified interface. The platform integrates seamlessly with popular accounting software, allowing businesses to optimize cash flow and financial management.

Key Features:

- Accounts Payable Automation: Simplify your AP process from bill creation to approval and payment, saving time and reducing errors.

- Accounts Receivable Management: Automate invoice creation, send payment reminders, and receive payments online, improving cash flow.

- Spend & Expense Control: Set budgets, track expenses, and manage credit lines with the integrated BILL Divvy Corporate Card.

- Integrated Platform: Access AP, AR, spend, and expense management through one login, providing a comprehensive view of your financial operations.

- Mobile App: Manage payments, approvals, and expenses on the go with BILL’s mobile app for real-time access.

- Real-Time Sync: Sync all financial data with leading accounting software like QuickBooks, Xero, and Oracle Netsuite for seamless financial tracking.

- Automated Approvals: Implement multi-step approvals to control spending and improve financial accountability across the organization.

Additional Features:

BILL offers additional tools such as reporting insights for better financial analysis and ACH international payment options. It also provides rewards and virtual card options through the BILL Divvy Corporate Card to streamline reimbursements and expense management. Businesses can leverage BILL’s AI-based automation to further optimize operational efficiency.

Pricing:

- Essentials: $19/user/month

- Team: $55/user/month

- Corporate: $79/user/month

- Enterprise: Custom Pricing

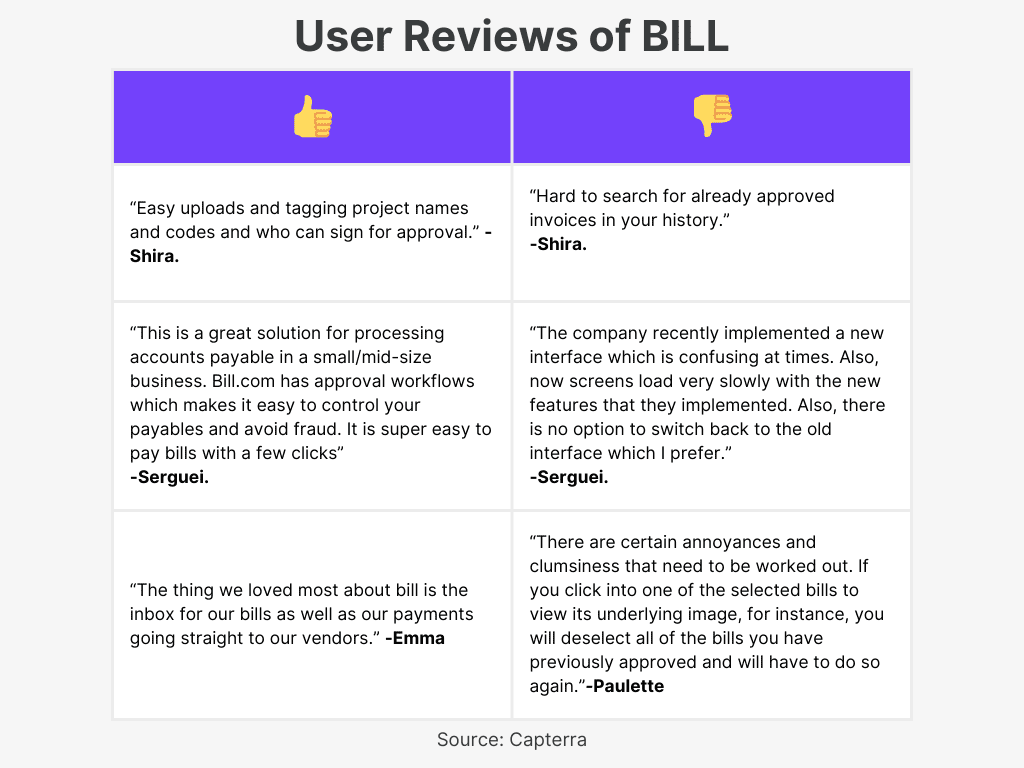

User Reviews:

4. Square Invoice

Square Invoices is an all-in-one invoicing generation solution designed to help businesses get paid faster and manage their financial operations efficiently. It allows users to send estimates, create contracts, and track payments, all while offering customizable options for branding.

Key Features:

- Customizable Invoices: Create professional invoices with custom layouts, logos, and brand colors to reflect your unique business identity.

- Flexible Payment Options: Offer customers a wide range of payment methods, including credit card, Apple Pay, Google Pay, ACH bank transfers, and Afterpay.

- Automated Reminders: Automate recurring billing and payment reminders, reducing the time spent chasing payments.

- Real-Time Tracking: Monitor when invoices are sent, reviewed, and paid from any device, ensuring you stay on top of your receivables.

- Estimates & Contracts: Provide detailed estimates and secure commitments with e-signature contracts, helping close deals faster.

- Project Tracking: Manage projects from start to finish, keep track of milestones, and store important documents in one central location.

- Reports & Insights: Gain detailed insights into your business performance, tracking payments, invoices, and customer data to make informed decisions.

Additional Features:

Square Invoices supports multi-package estimates, milestone-based payments, and auto-conversion of accepted estimates into contracts. Its mobile app allows you to manage invoices and payments on the go, while its integration with accounting software like QuickBooks ensures seamless financial tracking.

Pricing:

- Free Plan: $0/month

- Plus Plan: $20/month

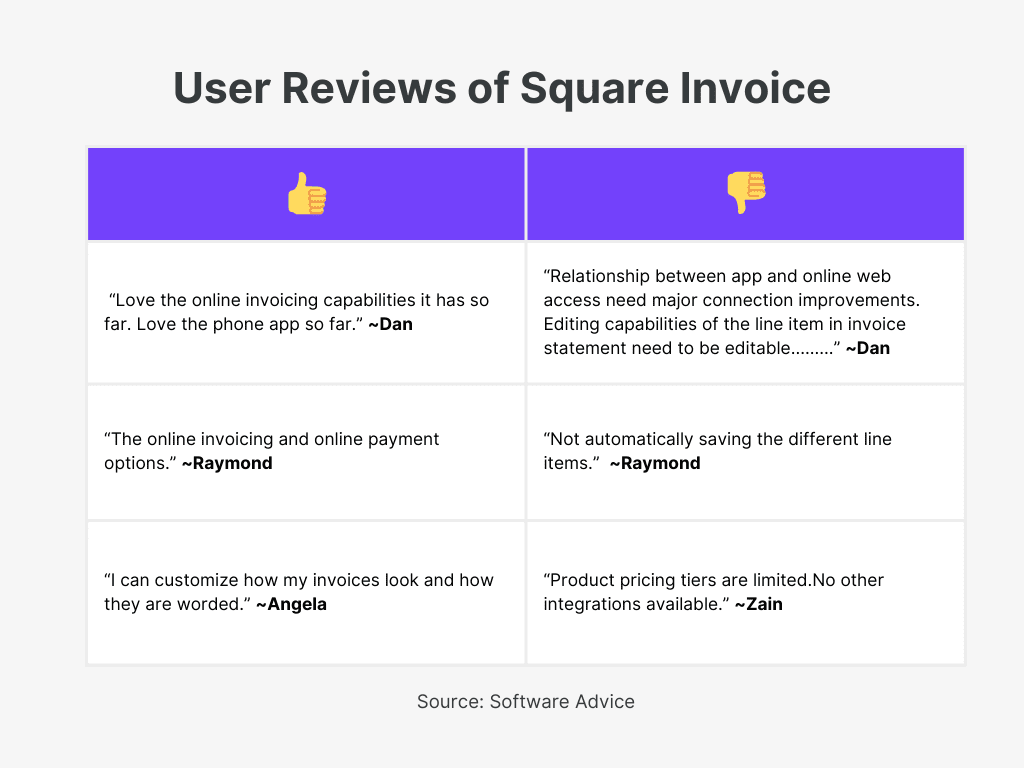

User Reviews:

5. QuickBooks

QuickBooks Online is a leading small business invoicing software offering an easy-to-use invoicing system that helps businesses get paid faster. With customizable invoice templates, automated payment tracking, and seamless integration with payment methods, QuickBooks Online simplifies bookkeeping and streamlines financial operations, making it an essential tool for business growth.

Key Features:

- Customizable Invoices: Create and personalize professional invoices with your logo and brand colors, giving your business a consistent look.

- Invoice Reminder Software: Automatically tracks payments and sends reminders to clients, helping you reduce the time spent on follow-ups.

- Recurring Invoices: Set up invoices to auto-send daily, weekly, or monthly, ensuring timely billing for regular services.

- Progress Invoicing: Easily send multiple invoices for projects based on milestones or percentage of work completed, ensuring consistent cash flow.

- Real-Time Payment Tracking: Monitor when invoices are sent, reviewed, and paid directly from your mobile or desktop device, helping you stay on top of your accounts.

- Multiple Payment Options: Accept various payment methods like credit cards, ACH, Apple Pay, PayPal, and Venmo to accommodate your customers’ preferences.

- Dispute Protection: Safeguard your business with QuickBooks’ payment dispute protection, covering up to $25,000 annually.

Additional Features:

QuickBooks Online automates bookkeeping by matching payments with invoices in real-time, ensuring that your financial records stay organized. It integrates with multiple sales channels and offers powerful reporting tools that give you valuable insights into your business’s performance.

Pricing:

- Simple Start: $35/month

- Essentials: $65/month

- Plus: $99/month

- Advanced: $235/month

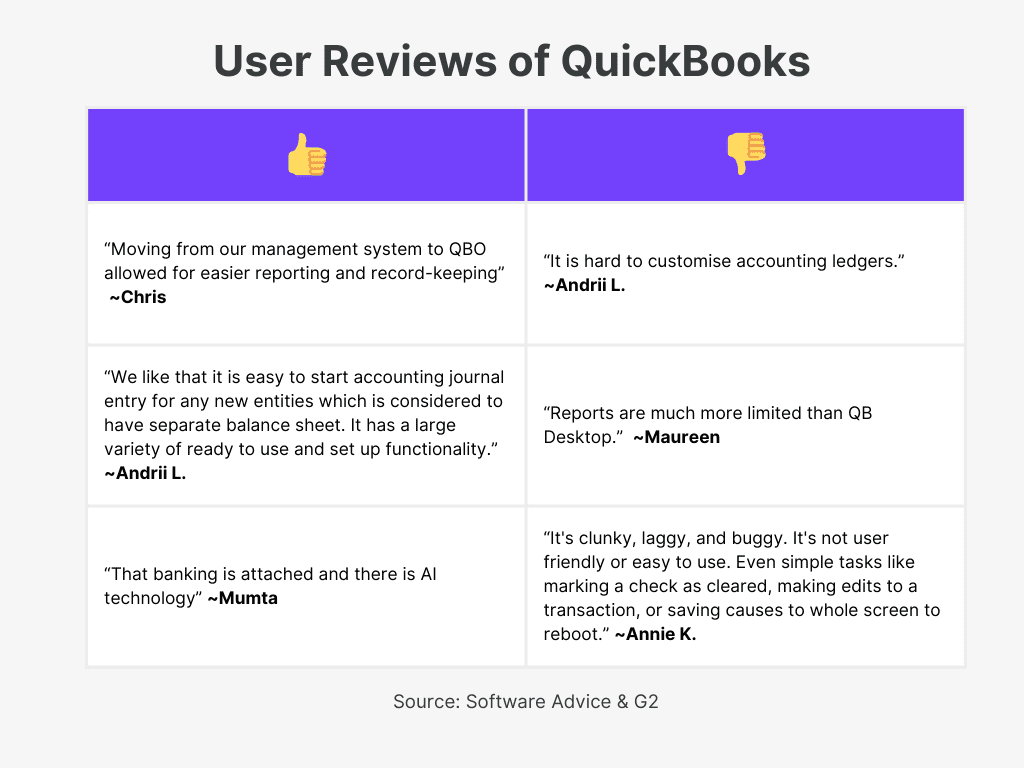

User Reviews:

6. Invoice2go

Invoice2go is an intuitive invoicing software designed for freelancers and small businesses to create and send professional invoices quickly. It offers customizable templates, instant invoicing, and payment tracking features to help businesses manage their billing efficiently. Invoice2go also integrates with multiple payment platforms, making it easier to receive payments on time.

Key Features:

- Customizable Invoices: Personalize invoices with your logo, brand colors, and layout to maintain a professional and consistent appearance.

- Instant Invoicing: Send invoices immediately after completing a job via email, SMS, WhatsApp, or Facebook Messenger for faster payments.

- Status Tracking & Reminders: Track the status of invoices and set up automated reminders to ensure timely payments from clients.

- Time Tracking: Keep track of billable hours and easily add them to invoices, ensuring accurate billing for time-based work.

- Client Approvals: Streamline the process by getting online client approvals and deposits, automatically converting them into invoices.

- Project Management Software: Manage projects from estimates to completion, adding appointments and tracking billable hours for comprehensive billing.

- Mobile Access: Send invoices, track payments, and manage clients on the go with the Invoice2go mobile app.

Additional Features:

Invoice2go integrates with platforms like QuickBooks and Xero, making accounting and bookkeeping easy. It also offers project and client management tools, allowing users to schedule appointments, generate estimates, and maintain project timelines. The software supports multiple payment options, including bank transfers and card payments, providing flexibility for both clients and businesses.

Pricing:

- Starter: $5.99/month

- Professional: $9.99/month

- Premium: $39.99/month

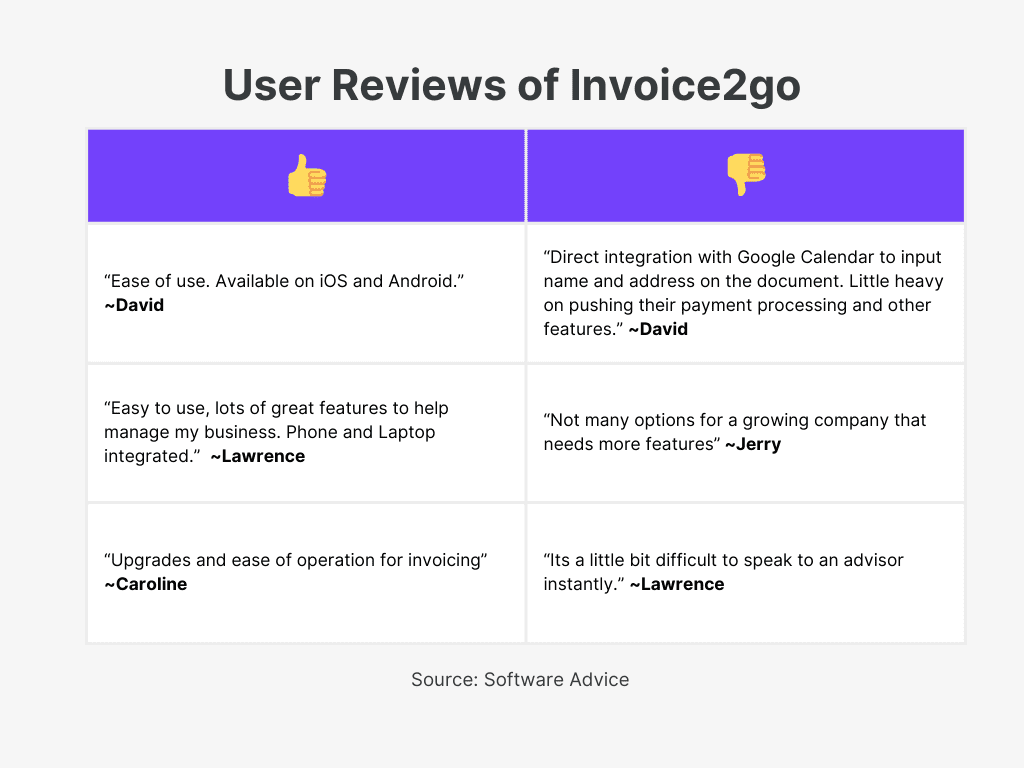

User Reviews:

7. FreshBooks

FreshBooks is a popular cloud-based invoicing software tailored for small businesses, freelancers, and self-employed professionals. It simplifies invoicing, expense tracking, and project management, helping businesses get paid faster and manage their finances more efficiently. With features like automated invoicing and payment processing, FreshBooks ensures that businesses can focus more on their work and less on their accounting.

Key Features:

- Customizable Invoices: Create professional invoices in seconds by adding your logo, colors, and personalized messages, making your invoices reflect your brand.

- Automated Invoicing: Set up recurring invoices and automatic payment reminders to ensure timely billing and collection without manual intervention.

- Payment Tracking: Accept credit cards, ACH, and other payment methods directly through invoices, making payments fast and secure.

- Time and Expense Tracking: Easily track billable hours and project expenses, automatically adding them to your invoices for accurate billing.

- Project Management: Manage client projects, collaborate with team members, and keep track of timelines, hours, and project milestones in one place.

- Retainers and Deposits: Request deposits upfront and manage retainers, ensuring stable cash flow and accurate financial forecasting.

- Comprehensive Reporting: Generate detailed financial reports to keep track of expenses, payments, and project profitability, offering insights into your business performance.

Additional Features:

FreshBooks integrates with multiple business tools like G Suite, Stripe, and PayPal, offering seamless functionality across various platforms. Its mobile app allows users to send invoices, track payments, and manage projects from anywhere. FreshBooks also provides automatic tax calculations to simplify billing for global clients.

Pricing:

- Lite: $17/month (Up to 5 billable clients).

- Plus: $30/month (Up to 50 billable clients).

- Premium: $55/month (Unlimited billable clients).

- Select: Custom pricing for businesses with complex needs.

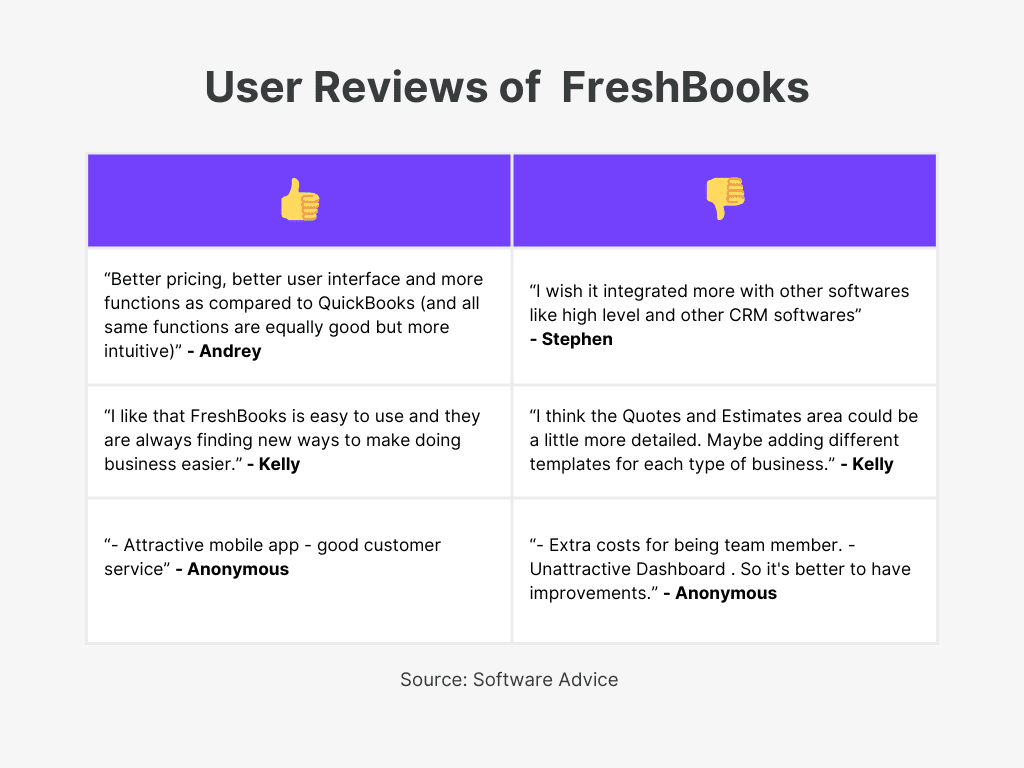

User Reviews:

8. Wave

Wave is a free invoicing and accounting software designed for small businesses and freelancers. It offers professional invoicing features with integrated payment processing, allowing businesses to create and send invoices quickly. Wave’s platform automatically syncs invoicing and payment data with its accounting features, making bookkeeping effortless and helping businesses stay organized.

Key Features:

- Professional Invoices: Create and send professional-looking invoices in seconds, making it easy to maintain a polished business image.

- Recurring Billing: Set up recurring invoices and automatic payments for repeat customers, reducing the hassle of chasing payments.

- Integrated Payments: Accept payments via credit cards, bank transfers (ACH/EFT), and Apple Pay with a simple Pay Now button on invoices.

- Mobile Invoicing: Send invoices on the go using Wave’s mobile app, available on iOS and Android devices.

- Automated Bookkeeping: Wave automatically syncs payment information with its free accounting software, saving time on manual data entry.

- Invoice Tracking: Receive notifications when invoices are viewed, due, or paid, helping you manage cash flow and payment timelines.

- Customer Management: Keep all customer information in one place, making it easy to track communications, payments, and invoices.

Additional Features:

Wave offers additional tools like the ability to accept credit card payments over the phone or in person. Its invoicing system integrates seamlessly with its accounting platform, ensuring that businesses have a clear overview of their finances without switching between tools. It provides a simple fee structure for payments, with no hidden costs.

Pricing:

- Free: Unlimited invoicing, accounting, and receipt tracking.

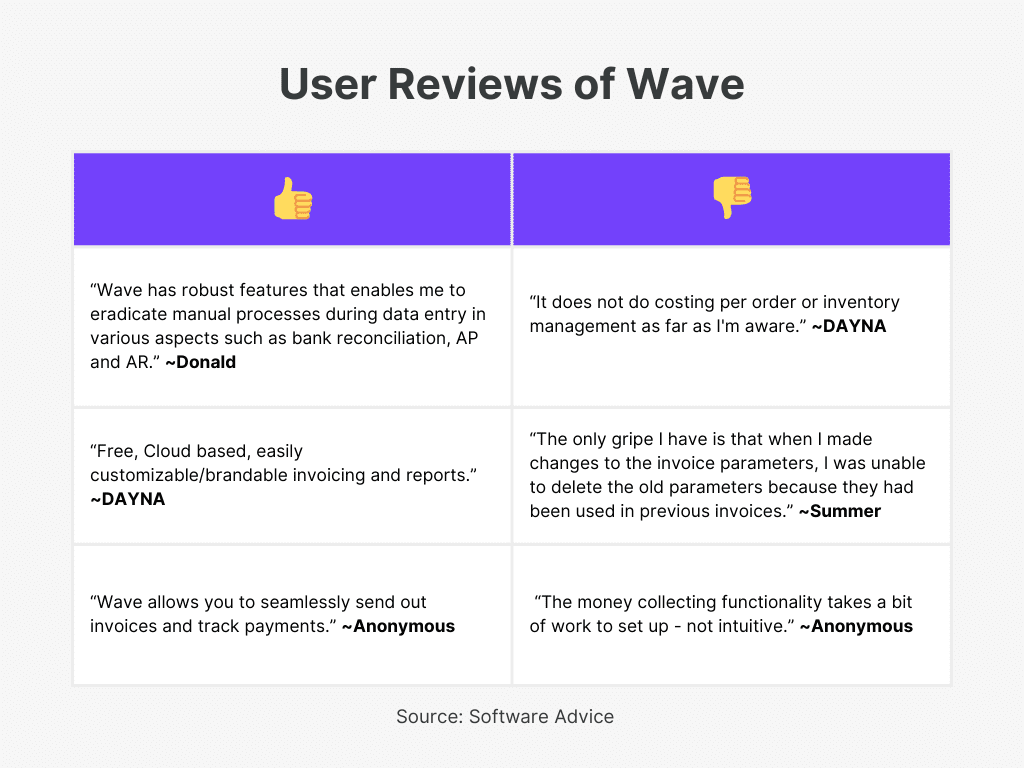

User Reviews:

9. Xero

Xero is a cloud-based accounting software designed to help small businesses manage their finances effortlessly. With features that automate tasks such as invoicing and bank reconciliation, Xero is an all-in-one solution for business owners looking to simplify accounting and gain valuable insights from their financial data.

Key Features:

- Cloud Accounting: Manage your finances securely from anywhere with Xero’s cloud-based platform, giving you access to real-time financial data.

- Automated Bank Reconciliation: Save time by automating the process of reconciling transactions, helping you keep your financial records up to date.

- Invoicing: Create and send professional invoices in minutes, with automatic payment reminders to ensure timely collection.

- Smart Reporting: Access customizable reports that provide insights into cash flow and business performance, helping you make informed decisions.

- Mobile Access: Use Xero’s mobile app to manage your accounts, send invoices, and track expenses on the go.

- Hubdoc Integration: Automatically capture and digitize receipts, bills, and other financial documents with Hubdoc for easy record-keeping.

- Multi-Currency Support: For businesses dealing with international clients, Xero supports transactions in multiple currencies, with real-time exchange rate updates.

Additional Features:

Xero integrates with hundreds of business apps, making it a versatile platform for industries such as construction, retail, and real estate. Its inventory management feature helps you track stock levels, while payroll functionality ensures that you can manage employee payments with ease. Xero’s partner program for accountants and bookkeepers helps professionals offer better services to their clients.

Pricing:

- Early: $15/month (Best for sole traders and new businesses).

- Growing: $42/month (Ideal for growing small businesses).

- Established: $78/month (For established businesses needing advanced features).

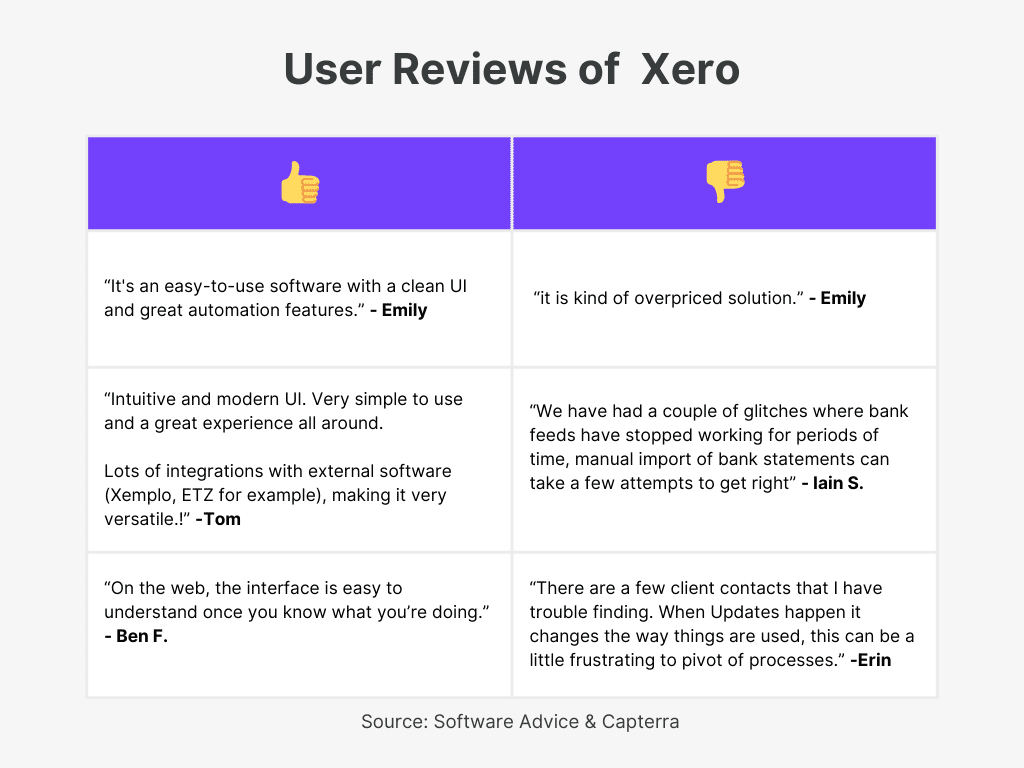

User Reviews:

10. Stripe

Stripe is a robust invoicing and accounting software designed to streamline financial operations for businesses of all sizes. It supports global payments, automates invoicing and billing, and provides developer-friendly tools for custom integration. Stripe helps businesses manage payments, prevent fraud, and handle complex subscription billing models effortlessly.

Key Features:

- Global Payments: Accept payments in 135+ currencies and offer 100+ local payment methods for smooth international transactions.

- Invoicing: Create and send custom invoices quickly. Automation helps you manage accounts receivable and payment tracking.

- Subscription Billing: Supports usage-based, tiered, and flat-fee billing models, perfect for subscription-based businesses.

- Developer Tools: Access powerful APIs to customize and automate financial processes for your unique business needs.

- Custom Reporting: Generate detailed financial reports with Stripe Sigma, allowing for tailored business insights.

- Tax Automation: Automate sales tax and VAT collection for seamless compliance with global tax regulations.

Additional Features:

Stripe’s scalability makes it a great fit for growing businesses. The platform integrates with popular software like Xero, Salesforce, and QuickBooks, providing a unified system for financial operations. With added tools for managing virtual cards and capital financing, Stripe offers comprehensive financial solutions.

Pricing:

Custom Price.

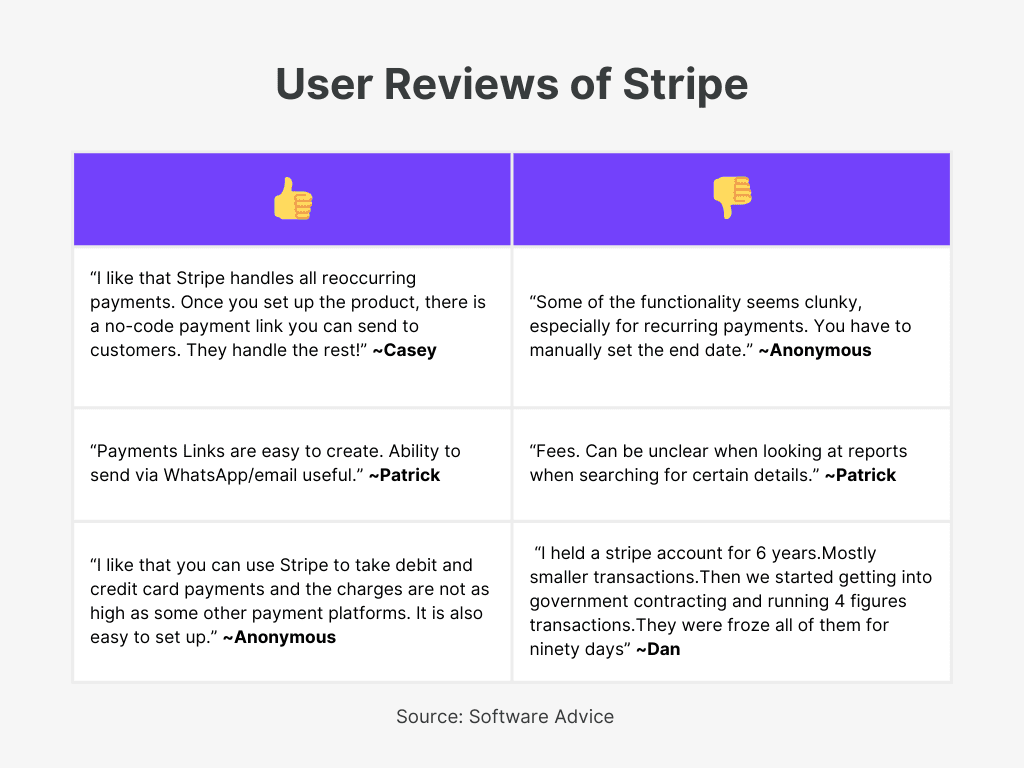

User Reviews:

Factors to Consider When Choosing the Best Invoicing Software for Your Business

- Identify Your Business Needs: Analyze your company’s size and transaction volume. Larger businesses may require more advanced features, while smaller ones benefit from straightforward, affordable options.

- Simplicity and Usability: Choose software with a user-friendly, intuitive interface that makes it easy for your team to adopt and use efficiently.

- Customizable Invoice Templates: Ensure the platform offers invoice customization, allowing you to tailor the design to reflect your brand’s identity and professionalism.

- Integration with Other Systems: Opt for software that integrates smoothly with your existing tools, ensuring a seamless and connected workflow.

- Strong Data Security Measures: Prioritize software that offers robust encryption and security protocols to protect your financial data from potential cyber threats.

- Reliable Customer Support: Make sure the provider offers fast, responsive customer service to help you resolve any issues as quickly as possible.

- Cost and Value for Money: Consider the software’s pricing structure to ensure it fits within your budget while delivering essential features for your business.

- Compliance with Regulations: Verify that the software adheres to local tax regulations and laws to simplify your tax reporting and ensure compliance.

Conclusion

The right invoicing software can greatly improve your business operations by ensuring timely payments and smooth financial management. The tools highlighted above cater to different needs, offering essential features like automated billing, payment tracking, and tax compliance.

With the right solution in place, your invoicing process will be streamlined, allowing you to save time, reduce errors, and focus on growing your business efficiently.