Key Takeaways

– A Bill of Supply is a document issued by certain businesses under GST when no tax is charged, such as by Composition Dealers, exporters, or suppliers of exempt goods/services.

– Its purpose is to provide proof of the transaction while ensuring GST compliance for non-taxable supplies.

Unlike a Tax Invoice, a Bill of Supply does not include tax details and is used for transactions where tax is not applicable.

– It must include mandatory details, such as supplier and buyer information, a unique serial number, and the nature of the goods or services supplied.

– Special provisions under GST allow relaxations for specific sectors, such as banking, insurance, and low-value transactions, simplifying compliance.

– Issuing a Bill of Supply ensures better compliance, minimizes operational complexity, and provides clarity in documentation for both sellers and buyers.

– To create a GST-compliant Bill of Supply, businesses must ensure accurate and complete information, adhering to legal requirements.

In the fast-paced world of business, proper documentation is crucial for smooth operations and compliance. Among the key documents under the Goods and Services Tax (GST) regime, the Bill of Supply plays a vital role yet is often misunderstood. Used for exempt supplies or by Composition Scheme dealers, it ensures compliance for transactions where GST cannot be charged.

This guide simplifies the Bill of Supply, covering its purpose, who should issue it, required fields, differences from Tax Invoices, special cases, benefits, and practical tips. Whether you’re new to GST or an experienced professional, this blog equips you with essential insights.

What is a Bill of Supply?

A Bill of Supply is a legally recognized document under India’s Goods and Services Tax (GST) regime. Businesses issue it for transactions where GST does not apply or cannot be charged. Unlike a Tax Invoice, a Bill of Supply does not include details of tax rates or amounts because it is meant for non-taxable transactions.

Simply put, it is used to validate and record transactions where the seller is not authorized to collect GST from the buyer. This could include:

- The sale of exempt goods and services.

- Transactions made by businesses registered under the Composition Scheme.

- Exports that qualify as zero-rated supplies.

The Bill of Supply ensures that such transactions are recorded accurately, providing a transparent mechanism for both sellers and buyers. It also helps businesses maintain compliance with GST rules, avoiding potential penalties or disputes with tax authorities.

Why Is a Bill of Supply Important?

- Legal Validation: It serves as proof of a transaction where GST is not levied.

- Compliance with GST Laws: Ensures that businesses adhere to the requirements for exempt or composition scheme supplies.

- Transparency: Clearly states that no GST has been charged, preventing confusion or disputes between the buyer and seller.

When Is a Bill of Supply Issued?

A Bill of Supply must be issued in the following scenarios:

- Exempt Goods or Services: When a registered business sells goods or services that are exempt from GST, such as raw agricultural products or handloom items, a Bill of Supply is issued instead of a Tax Invoice.

- Composition Scheme Dealers: Businesses registered under the Composition Scheme cannot collect GST from their customers. Therefore, they are required to issue a Bill of Supply instead of a Tax Invoice.

- Exports: Although exports are zero-rated, meaning they attract a 0% GST rate, a Bill of Supply is issued to document such transactions.

Key Features of a Bill of Supply

- No Tax Information: Unlike a Tax Invoice, a Bill of Supply does not mention tax rates or amounts since GST is not applicable.

- Simplified Format: It includes only the essential details of the transaction, making it easier to prepare and manage.

- Transparency: Helps businesses clearly communicate the nature of the transaction to the buyer, avoiding confusion over tax applicability.

The Bill of Supply is an essential tool for businesses dealing in exempt or non-taxable goods and services, as it ensures accurate record-keeping and compliance with GST regulations.

Who Needs to Issue a Bill of Supply?

The issuance of a Bill of Supply is mandatory for specific types of businesses and transactions under the Goods and Services Tax (GST) regime. This document plays a critical role in ensuring compliance and transparency for transactions where GST is not applicable. Let’s break down who is required to issue a Bill of Supply and why.

1. Composition Dealers

Businesses registered under the Composition Scheme are among the primary entities required to issue a Bill of Supply. The Composition Scheme is designed for small businesses with an annual turnover of up to Rs. 1.5 crores (or Rs. 75 lakhs in the northeastern and hill states). It simplifies GST compliance by allowing such businesses to pay a fixed percentage of their turnover as tax instead of calculating GST on every transaction.

Why They Issue a Bill of Supply:

- Composition dealers cannot collect GST from their customers or issue Tax Invoices.

- Instead, they must issue a Bill of Supply, clearly stating that they are not eligible to collect taxes.

Mandatory Statement on the Bill of Supply:

“Composition taxable person not eligible to collect taxes on supplies.”

2. Exporters

Exporters are another category of businesses that must issue a Bill of Supply. Exports are classified as zero-rated supplies under GST, which means they attract a 0% GST rate.

Why They Issue a Bill of Supply:

- Exporters are not required to charge GST on their invoices.

- Instead, they issue a Bill of Supply to document export transactions.

Mandatory Declarations for Exporters:

- “Supply meant for export under bond/Letter of Undertaking without payment of IGST.”

- “Supply meant for export on payment of IGST.”

These declarations are essential for claiming tax refunds or exemptions for zero-rated supplies.

3. Suppliers of Exempt Goods or Services

Businesses that deal in exempt goods and services are required to issue a Bill of Supply instead of a Tax Invoice. Exempt supplies include goods and services that fall outside the purview of GST or attract a nil GST rate.

Examples of Exempt Goods and Services:

- Unprocessed agricultural products.

- Educational services.

- Healthcare services.

Why They Issue a Bill of Supply:

- GST is not applicable to exempt supplies.

- The Bill of Supply serves as legal proof of the transaction.

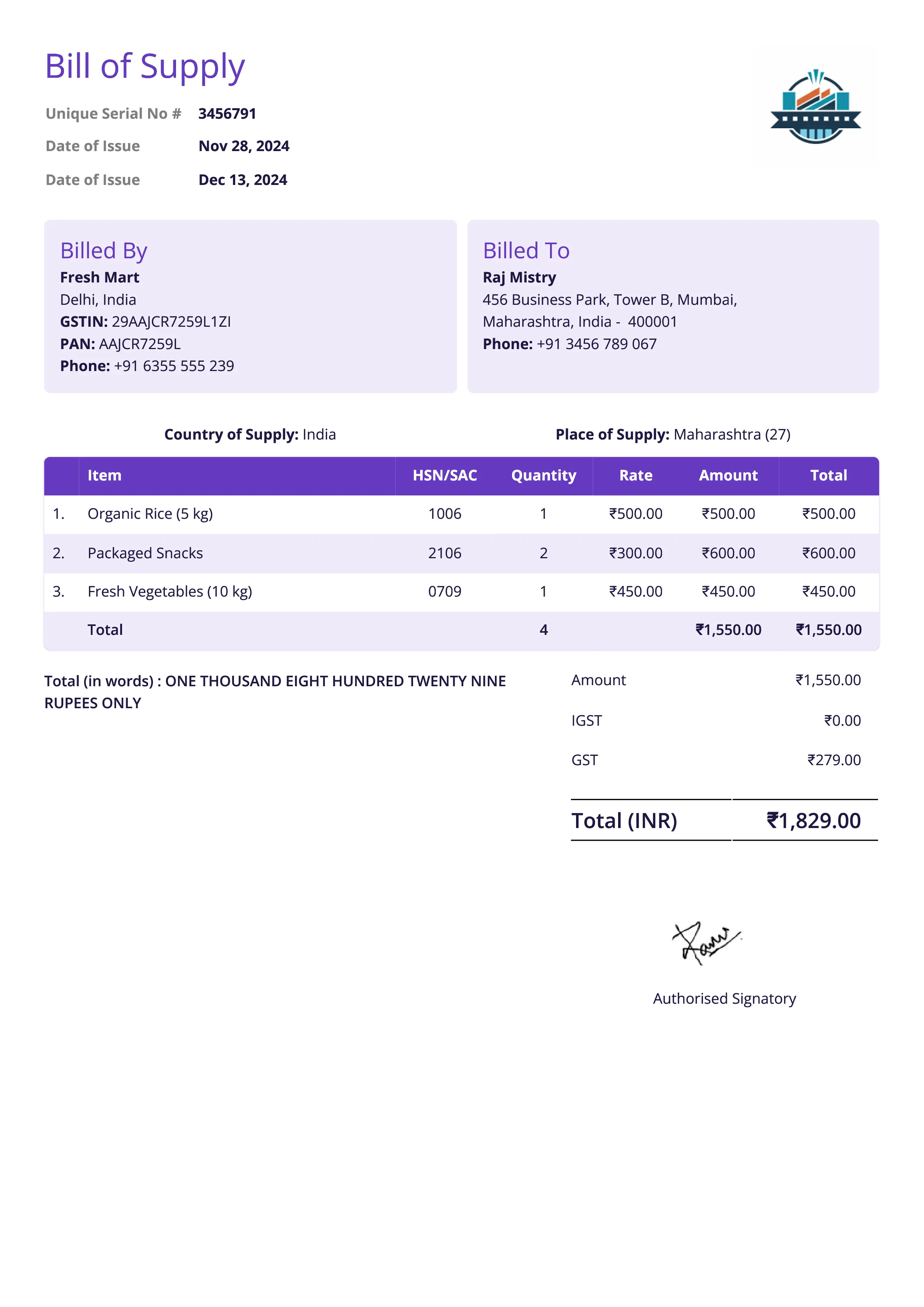

What Should a Bill of Supply Contain?

A Bill of Supply must include specific details mandated under GST law to ensure compliance and provide clarity for both the supplier and the recipient. These details are essential for making the document valid and legally acceptable. Let’s break down the mandatory components of a Bill of Supply.

Mandatory Fields in a Bill of Supply

- Supplier’s Information:

- Name, address, and GSTIN (Goods and Services Tax Identification Number) of the supplier.

- Unique Serial Number:

- A consecutive number not exceeding 16 characters.

- The serial number can include alphabets, numerals, and special characters like hyphens (“-”) or slashes (“/”).

- It must be unique for each financial year.

- Date of Issue:

- The exact date when the Bill of Supply is issued.

- Recipient’s Information (if applicable):

- Name, address, and GSTIN or Unique Identity Number (UIN) of the recipient, if the recipient is registered under GST.

- HSN Code or SAC Code:

- HSN (Harmonized System of Nomenclature) code for goods.

- SAC (Services Accounting Code) for services.

- The number of digits in the HSN code depends on the supplier’s turnover:

- Below Rs. 1.5 crores: HSN code not mandatory.

- Rs. 1.5–5 crores: 2-digit HSN code.

- Above Rs. 5 crores: 4-digit HSN code.

- Description of Goods or Services:

- A clear and concise description of the goods or services supplied.

- Value of Supply:

- The total value of goods or services after accounting for any discounts or abatements.

- Signature:

- A physical signature or digital signature of the supplier or their authorized representative.

- For electronic Bills of Supply, signatures may not be required as per specific GST provisions.

Additional Provisions

- Non-Taxable Supply: If a transaction is non-taxable (e.g., petroleum or alcohol), any invoice issued under another law can be treated as a Bill of Supply under GST.

- Electronic Bills of Supply: The document does not require a physical signature if issued electronically, as per the Information Technology Act, 2000.

Key Differences Between a Bill of Supply and a Tax Invoice

Understanding the difference between a Bill of Supply and a Tax Invoice is essential for businesses to ensure compliance with GST laws. While both documents serve as evidence of transactions, their purposes, fields, and applicability differ significantly. Let’s break down these differences in detail.

1. Purpose

- Bill of Supply: Used for transactions where GST is not applicable or cannot be charged, such as exempt goods/services or by composition dealers.

- Tax Invoice: Issued when GST is applicable on the sale of taxable goods or services. It enables the buyer to claim Input Tax Credit (ITC).

2. Applicability

- Bill of Supply: Mandatory for:

- Exempt supplies (e.g., agricultural produce, healthcare services).

- Suppliers registered under the Composition Scheme who cannot collect GST.

- Zero-rated supplies like exports (without tax liability).

- Tax Invoice: Mandatory for:

- Taxable supplies where GST is charged.

- Enabling the buyer to claim ITC for taxable purchases.

3. Tax Details

- Bill of Supply:

- Does not include tax rates or amounts since no GST is charged.

- Tax Invoice:

- Includes the applicable GST rates and tax amounts (CGST, SGST, or IGST).

4. Input Tax Credit (ITC)

- Bill of Supply:

- No ITC can be claimed as it is used for non-taxable supplies.

- Tax Invoice:

- ITC can be claimed based on the tax paid on the goods or services, as reflected in the invoice.

5. Mandatory Fields

| Field | Bill of Supply | Tax Invoice |

| Supplier’s GSTIN | Yes | Yes |

| Invoice Number | Yes (unique and consecutive) | Yes (unique and consecutive) |

| HSN/SAC Code | Yes (based on turnover) | Yes |

| Tax Rates and Amounts | Not required | Mandatory |

| ITC Claim Details | Not applicable | Mandatory |

| Recipient’s Information | Optional for small transactions | Mandatory for transactions over Rs. 50,000 |

| Reverse Charge Applicability | Not applicable | Mandatory if applicable |

6. Example Scenarios

- Bill of Supply Example:

- A farmer selling raw, unprocessed rice (exempt from GST) issues a Bill of Supply to document the transaction.

- Tax Invoice Example:

- A retailer selling electronics (taxable under GST) issues a Tax Invoice with GST details, enabling the buyer to claim ITC.

7. Why These Differences Matter

- Helps businesses determine the correct document to issue for specific transactions.

- Ensures transparency and compliance with GST laws.

- Reduces the risk of penalties or disputes during audits.

Quick Comparison Table

| Aspect | Bill of Supply | Tax Invoice |

| Applicable For | Exempt supplies and Composition Scheme | Taxable supplies |

| Includes Tax Rate/Amount | No | Yes |

| Enables ITC | No | Yes |

| Mandatory for Buyers Above Rs. 50,000 | No | Yes |

| Reverse Charge Information | Not applicable | Mandatory |

Why These Fields Matter

- They ensure the Bill of Supply is comprehensive and compliant with GST laws.

- Mandatory fields provide a clear record for accounting, audits, and compliance checks.

Special Cases and Relaxations in Issuing a Bill of Supply

The Goods and Services Tax (GST) framework includes certain special cases and relaxations for businesses when issuing a Bill of Supply. These provisions aim to simplify the process for sectors with unique requirements and small-value transactions. Let’s explore these special cases and their practical implications.

1. No Bill of Supply for Low-Value Transactions

- If the value of goods or services is less than Rs. 200, businesses are not required to issue a Bill of Supply for each transaction.

Example:

A florist sells bouquets worth ₹150 to unregistered customers throughout the day. The florist does not need to create the bill of supply for this transaction.

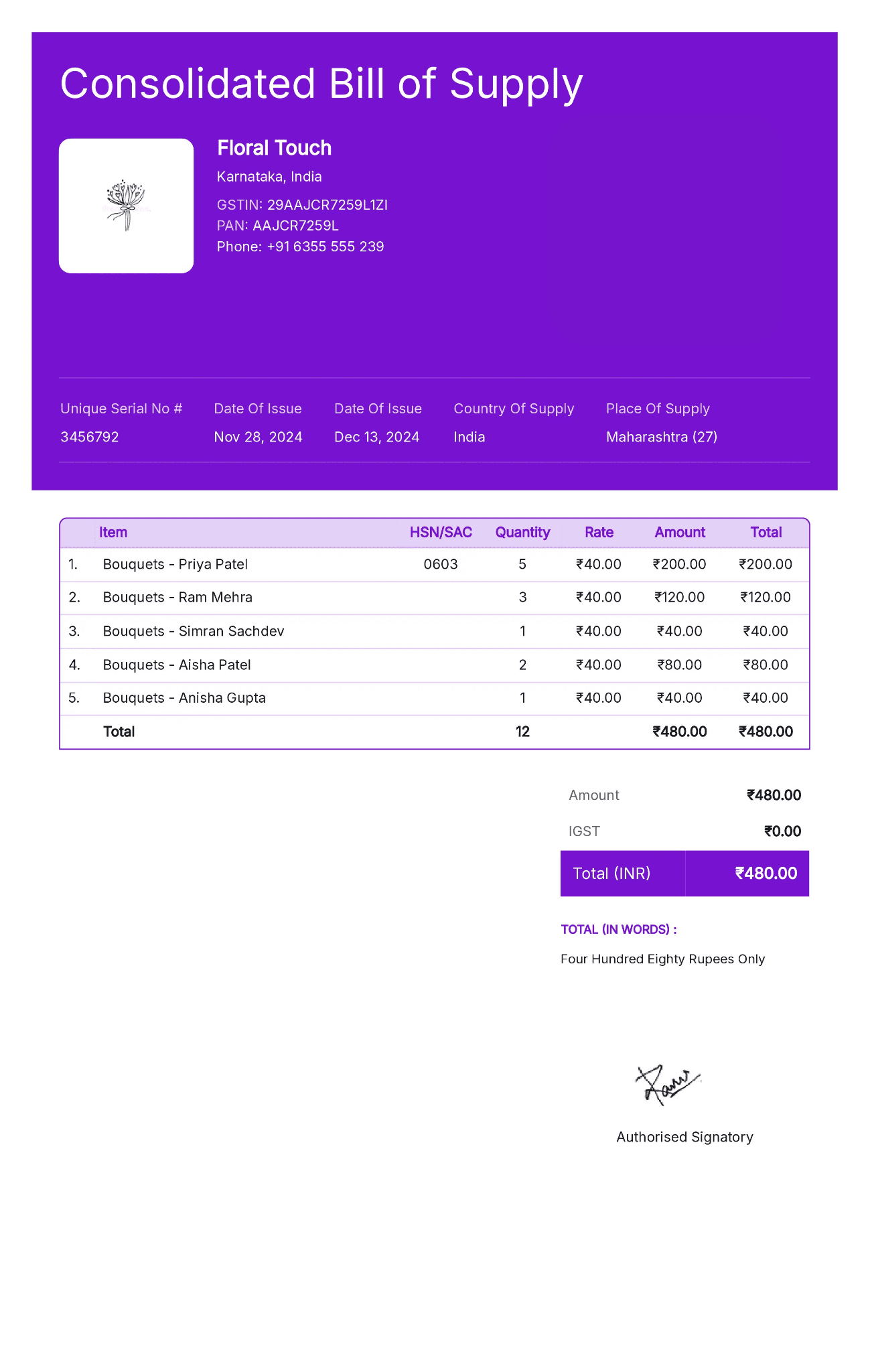

2. Consolidated Bill of Supply

- For transactions where the value of goods or services is under Rs. 1200, a separate Bill of Supply is not required unless the buyer requests one. Instead, a single consolidated Bill of Supply can be issued to each customer at the close of the day.

Example:

The same florist sells bouquets worth ₹150 each to five different unregistered customers throughout the day. Instead of issuing five separate Bills of Supply, the florist can issue a single consolidated Bill of Supply for ₹750 at the end of the day.

3. Electronic Bills of Supply

- When a Bill of Supply is issued electronically, no physical or digital signature is required.

- This provision simplifies compliance for businesses using software or e-commerce platforms to generate invoices.

Legal Basis: This relaxation is provided under the Information Technology Act, 2000, which validates electronic records.

4. Simplified Formats for High-Volume Sectors

Certain sectors with high transaction volumes have been given relaxations regarding the format of the Bill of Supply. This is particularly beneficial for businesses in:

- Banking.

- Insurance.

- Passenger Transport.

These businesses are not required to include full customer details (e.g., address, serial numbers) on the Bill of Supply, streamlining the documentation process.

5. Deemed Bill of Supply

For certain non-taxable supplies, any invoice or document issued under another act can be considered a Bill of Supply under GST. This applies to goods and services outside the GST ambit, such as:

- Petroleum products.

- Alcohol for human consumption.

Example:

A petroleum company’s delivery invoice can be treated as a Bill of Supply for compliance purposes.

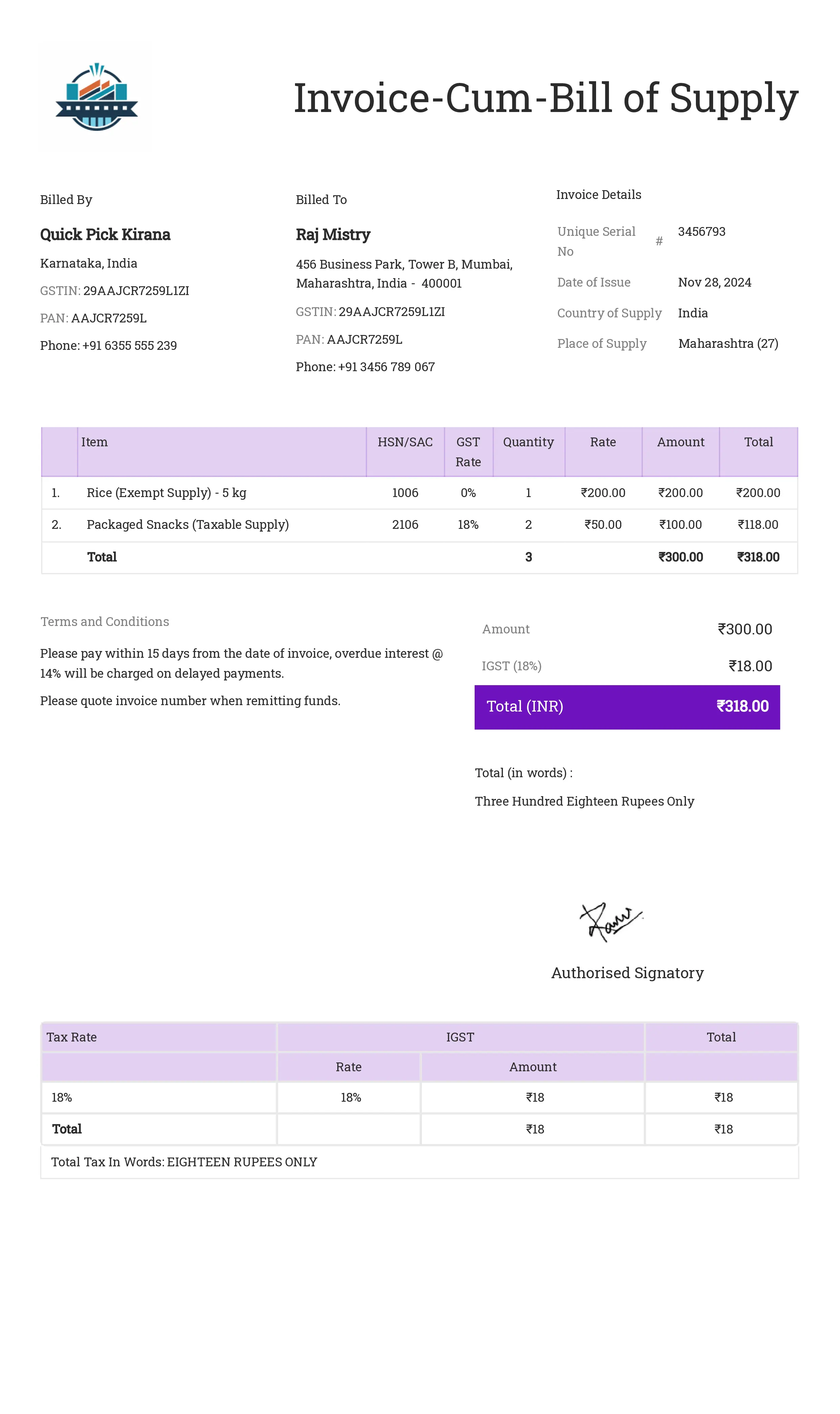

6. Invoice-Cum-Bill of Supply

- When a registered individual supplies both taxable and exempt items or services, they have the option to issue a single document that serves as both an invoice and a Bill of Supply

Example:

A grocery store sells rice (exempt) and packaged snacks (taxable) to a walk-in customer. Instead of issuing separate documents, the store can issue a single Invoice-Cum-Bill of Supply.

7. Relaxations for HSN and SAC Codes

- Turnover-Based HSN Code Requirement:

- Below Rs. 1.5 crores: No HSN code required.

- Between Rs. 1.5–5 crores: 2-digit HSN code required.

- Above Rs. 5 crores: 4-digit HSN code required.

- This relaxation makes it easier for small businesses to comply without worrying about technical classification details.

Why These Relaxations Matter

- Simplifies compliance for small businesses and high-transaction-volume sectors.

- Reduces paperwork and operational overhead.

- Ensures that even small or non-taxable transactions are documented without burdening businesses.

Benefits of Issuing a Bill of Supply

The Bill of Supply is more than just a regulatory requirement—it provides several operational and legal advantages for businesses, especially those dealing in exempt goods or services and registered under the Composition Scheme. Let’s delve into the key benefits of issuing a Bill of Supply.

1. Ensures GST Compliance

- By issuing a Bill of Supply, businesses comply with GST laws for transactions where GST is not applicable.

- This prevents potential penalties or disputes with tax authorities, ensuring smooth audits and inspections.

2. Transparent Documentation

- The Bill of Supply clearly states that no GST has been charged, reducing confusion between the buyer and seller.

- It communicates the nature of the transaction, ensuring transparency for both parties.

Example:

A farmer selling unprocessed rice (an exempt good) can use a Bill of Supply to confirm the transaction without GST implications.

3. Simplified Record-Keeping

- The Bill of Supply helps businesses maintain accurate records of exempt supplies or transactions under the Composition Scheme.

- It serves as an essential document for accounting, reconciliation, and tax filings.

Benefit for Small Businesses:

For small businesses under the Composition Scheme, it reduces the complexity of maintaining detailed GST records for every transaction.

4. Facilitates Accurate Reporting

- When preparing GST returns, a Bill of Supply ensures that exempt transactions or composition supplies are correctly reported in the relevant GST forms (e.g., GSTR-1 or GSTR-4 for composition dealers).

- This minimizes errors and ensures hassle-free compliance.

5. Reduces Disputes and Audits

- Clearly indicating that no GST has been charged minimizes the chances of disputes with customers or tax authorities over tax applicability.

- It also helps in cases of audits where documentation of exempt transactions is required.

6. Streamlined Business Operations

- The simplified format of the Bill of Supply makes it easier and faster to issue, reducing administrative workload for businesses.

- Businesses dealing in exempt goods or services can focus on operations without worrying about complex invoice formats.

Example:

A handicrafts supplier selling GST-exempt items can issue Bills of Supply quickly using GST-compliant software, saving time and effort.

7. Tailored for Small Businesses

- For businesses under the Composition Scheme, issuing a Bill of Supply instead of a Tax Invoice reduces compliance burdens.

- These businesses avoid the complexities of calculating and collecting GST, while still maintaining proper records of their transactions.

8. Supports E-Invoicing and Digital Transformation

- Electronic Bills of Supply simplify the process further by eliminating the need for physical signatures.

- Businesses can easily integrate the generation of Bills of Supply with their online accounting software or invoicing software, aligning with the push toward digitization.

9. Proof of Transaction

- The Bill of Supply acts as legal proof of a transaction for exempt goods or services.

- It provides a reliable trail for both the buyer and seller in case of any future reference or verification.

Example:

An exporter selling zero-rated goods can use a Bill of Supply to validate their export transaction without charging GST, helping in tax refund claims.

Why These Benefits Matter

- The Bill of Supply is not just a compliance document—it is a tool that simplifies operations, improves transparency, and reduces the administrative burden for businesses.

- By leveraging these benefits, businesses can focus more on growth and customer satisfaction while staying compliant with GST laws.

Step-by-Step Guide to Creating a Bill of Supply

Step 1: Use GST-Compliant Software

- Start by using software designed for GST compliance. This ensures that all mandatory fields are included and formats adhere to GST rules.

Step 2: Add Supplier Details

Include the following information about your business:

- Name and registered address.

- GSTIN (Goods and Services Tax Identification Number).

- Contact details, such as phone number or email (optional but recommended).

Step 3: Assign a Unique Serial Number

- Use a consecutive and unique serial number for each Bill of Supply.

- Ensure the number does not exceed 16 characters. It can include:

- Alphabets (e.g., “BOS”).

- Numerals (e.g., “001”).

- Special characters like hyphens (“-”) or slashes (“/”).

Step 4: Specify the Date

Clearly mention the date of issue for the Bill of Supply.

Step 5: Add Recipient Details

If the buyer is registered under GST, include:

- Name and address.

- GSTIN or UIN (Unique Identification Number). If the recipient is unregistered, these details are optional unless the transaction value exceeds Rs. 50,000.

Step 6: Provide Transaction Details

For goods:

- Include the HSN code based on your turnover:

- Below Rs. 1.5 crores: Not mandatory.

- Rs. 1.5–5 crores: 2-digit HSN code.

- Above Rs. 5 crores: 4-digit HSN code. For services:

- Include the SAC code (Services Accounting Code).

Add:

- Description of goods or services supplied.

- Quantity and unit of measurement (for goods).

- Value after accounting for discounts or abatements.

Step 7: Leave Out Tax Details

- Do not include tax rates or amounts, as GST is not applicable for transactions recorded in a Bill of Supply.

Step 8: Sign the Document

- If issuing a physical document, sign it manually.

- For electronic documents, use a digital signature or an auto-generated note stating: “This document is digitally generated and does not require a signature.”

Step 9: Use Digital Tools for Automation

- Automate repetitive tasks by integrating GST-compliant software with your accounting tools.

- Many platforms allow you to customize templates with your company’s logo and branding.

Common Mistakes to Avoid:

– Skipping Mandatory Fields: Ensure all required details (e.g., HSN/SAC codes, GSTIN) are included.

– Using Incorrect Formats: Follow GST guidelines for numbering and content.

– Adding Tax Details: Avoid including tax rates or amounts in a Bill of Supply.

Why Following These Steps is Important

- Ensures GST compliance and reduces the risk of penalties.

- Simplifies record-keeping and reporting for GST filings.

- Enhances transparency and trust with buyers.

Conclusion

A Bill of Supply is an essential document for businesses operating under the GST framework, particularly for those dealing with exempt goods or services and registered under the Composition Scheme. While it might seem like a straightforward document, ensuring compliance with all GST requirements is crucial to avoid penalties, simplify audits, and maintain transparency.

Key Takeaways for Businesses

- Always ensure that the Bill of Supply includes all mandatory details, such as HSN/SAC codes, supplier and recipient information, and a unique serial number.

- Use the right document for the right transaction. Issue a Bill of Supply for exempt or composition scheme supplies, and a Tax Invoice for taxable supplies.

- Take advantage of digital tools to automate the creation of Bills of Supply, ensuring efficiency and accuracy.

Actionable Insights

- For Small Businesses: Use GST-compliant software to simplify the issuance of Bills of Supply, reducing manual errors.

- For Exporters: Include mandatory declarations on your Bill of Supply to avoid delays in tax refunds.

- For High-Volume Sectors: Leverage relaxations such as consolidated bills or simplified formats to streamline documentation.