When your brief and budget align, you are in a good position for future growth. A client brief specifying an accommodating budget gives the business a sense of direction to proceed further. As a client, it is your responsibility to frame the budget keeping in mind the kind of work you want to get done. The budget must be realistic to match the brief given. If not, the result would not match the expectation that would have.

Check out the 11 elements of a good brief!

Client-facing industries often ask their clients how much they are willing to spend? before starting the work. What they often get to hear in reply is You tell us or Propose some options and we will later select. The clients are often expected to understand the importance of having a budget.

Whether you’re playing chess or assisting in the growth of a firm, strategy is essential to making the best decisions. So, how do you decide what to do next when you don’t know what strategy is in play?

If you’re on a finance team, you can find yourself in this situation during budgeting season, putting together a budget without a clear understanding of the company’s aims and objectives. You’re left moving your pieces and resuming the game hasn’t changed, making crucial decisions on where to devote resources for operations and growth without any form of a roadmap.

Do you work as a freelancer and looking for ways to handle your finances as a freelancer, have a look at this.

As a result, budget alignment with business strategy and KPI or goal formulation is an important aspect of a successful budget—and crucial to accomplishing your organization’s objectives. It’s also how you make sure you have the correct resources and team in place as you work to achieve your overall goals, reallocating resources as needed.

The budget alignment will help your firm achieve its strategic goals, and that’s something everyone can agree on. So, how do you go about doing that?

What Are The Benefits Of Aligning Your Budget With Organizational Goals?

If you don’t currently have access to your organization’s roadmap, it’s time to start advocating for it—or perhaps asking for a seat at the table—so that your team can fully support your business objectives from start to finish. Consider the following three reasons why alignment should be a high priority for your firm this budgeting season:

1. You’ll reduce the amount of paperwork involved in budgeting.

When you achieve real alignment, your budget transitions from a task that must be completed to an operational extension of your broader strategic planning process.

2. You’ll make better resource allocation decisions.

Even in high-growth businesses, resources are limited, and squandering them is a bad business strategy. Every executive team will have to make difficult decisions about where to spend and where to trim, as well as which operational and growth projects are worthwhile. Budget alignment enables you to prioritize or create portfolio options for that spending, ensuring that financial allocation decisions are made in accordance with your company’s goals, rather than the loudest voice in the room.

3. When you need money, you’ll have more.

Your finance team won’t be able to model or advise on resource requirements, such as manpower, tools, and other resources unless they have a thorough understanding of your company’s strategy. When the time comes, teams will be scrambling, which can result in employee stress and slowed productivity or compel teams to change plans in silos to suit available resources rather than taking a holistic organization-wide strategy.

Without alignment, it’s simple to spread your resources too thinly across too many initiatives, resulting in a lack of cross-functional resources to get things done.

Budget Alignment In 3 Easy Steps

What is your company’s relationship between strategic planning and budgeting?

If your business’s strategic plan specifies where it wants to go, the correct budget should help you get there by allocating resources holistically to implement your plans. To verify that your budget meets your organization’s aims, do the following steps:

Step 1: Keep An Eye On The Big Picture

Whether you budget annually or on a rolling basis, your long-term strategy should serve as a checkpoint early in the process to ensure that the correct resources and activities are prioritized. Most corporate goals will take longer than a year to achieve, so even an annual budget won’t be able to account for everything. You’ll be able to ensure that strategy trickles down to feed your ongoing budgeting demands if you keep it front of mind during all of your team’s long-term planning.

Step 2: Involve Your Leaders As Soon As Possible

Getting your senior team involved early in the strategic planning process, as well as the subsequent budgeting process, is critical to ensuring your budget is fully aligned with your most recent corporate goals. This should, in theory, offer your team the transparency and insights they need to deploy resources appropriately.

Step 3: Track Your Progress And Do It Again

To better understand how your budget is assisting you in achieving your company’s goals, identify the indicators that are crucial to assessing success in your compa

ny’s goals. Both financial and non-financial measures will be critical in determining how well your budget is performing—and will provide you with the information you need to alter the next forecast or plan and make continuous modifications based on what works and what doesn’t. Visibility into these indicators and successes can also aid with budgeting buy-in and provide justification for aligning it with your plan.

You’ll be able to create better alignment into your budgeting process and set your organization on the correct path to strategic growth if you keep an eye on the long term and measure along the way.

Remember that budget-to-strategic alignment isn’t just a “good to have.” It can make all the difference in whether or not your organization fulfills its wider objectives—and how quickly it does so.

Why Is It Important To Align Planning And Budgeting?

Your strategic plan is your company’s vision of where it wants to go. It’s a lofty goal, but not one that’s out of reach. A well-thought-out strategy will tell you where you’re heading and how you’re going to get there.

Your business budget should direct you in allocating resources to carry out that objective. It ensures that the resources you require — staff, investments, equipment, and so on – are on hand to deliver you to your destination.

It’s easy to get caught up in ensuring that money is provided for operations and minor projects that don’t flow into the overall goal throughout the budgeting process. It’s also simple to devise a strategy that tries to achieve everything at once and fails due to a shortage of resources. Strategic planning and budgeting help to guarantee that these two are in sync, and it is via these processes that a business achieves its goals.

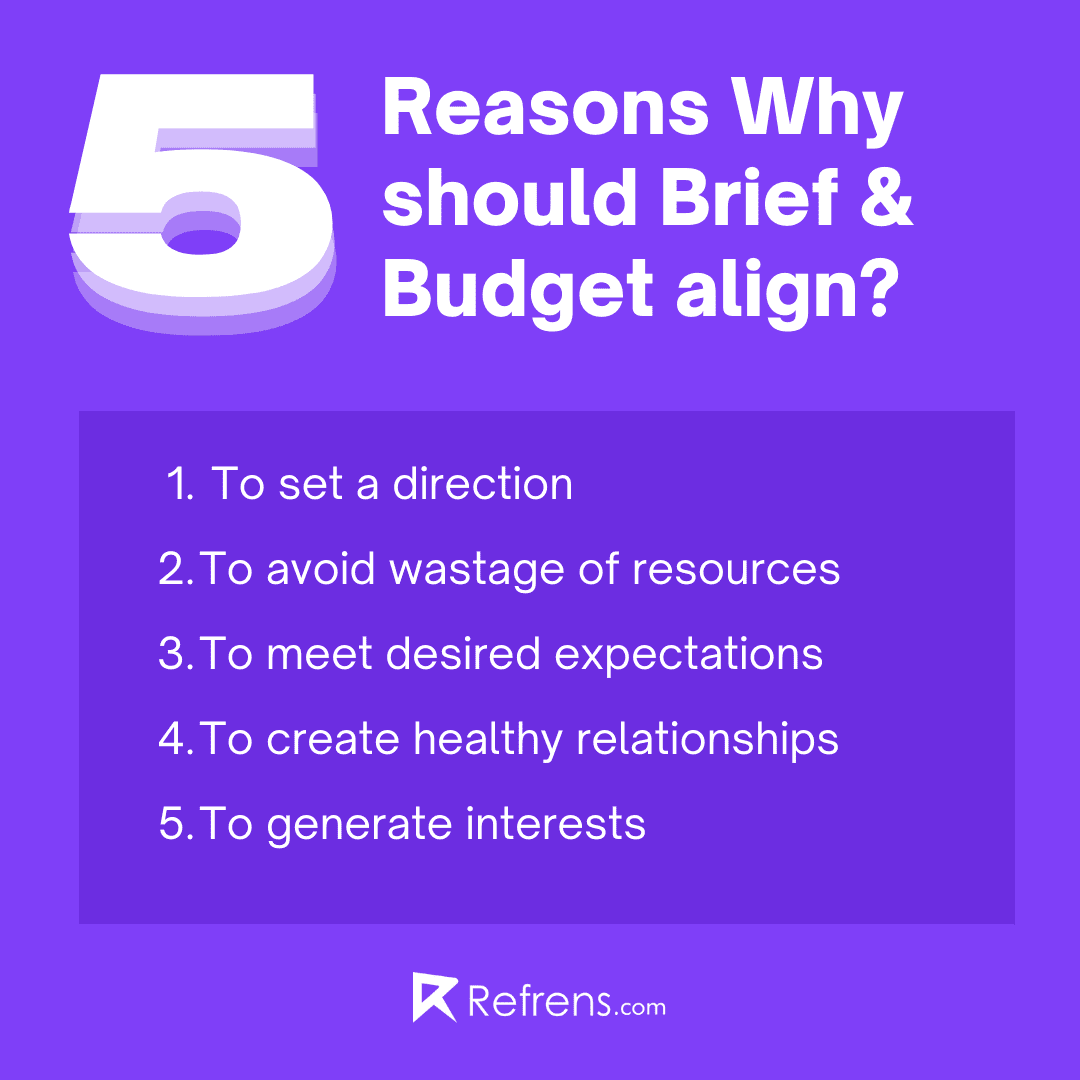

Reasons Why Brief And Budget Should Align?

To Set A Direction

Lack of a specified budget from the client is like driving a car without knowing the directions. To avoid ending up with a disaster, mentioning the budget in alignment with the brief can provide a sense of direction to the company while taking future steps. Refrainment from doing so can create chaos. The company and the client can start moving in different directions, and hence achieve an unsatisfactory result.

Avoid Wastage Of Resources

When the budget is not aligned with the brief, a lot of resources including huge amounts of time and energy get wasted. The company starts following the idea mentioned in the brief and ends with figuring out that it costs way more than expected. Not keeping your budget enough according to the idea will eventually result in compromised quality of work. With the fear that the vendor will spend a whole lot, many customers avoid mentioning the amount they are willing to spend in the brief. Customers first wanting the company to present proposals leads to a waste of their resources and increases their work.

Meet Desired Expectations

The company may provide a perfect solution, but it may go over the budget and leave you disappointed. With the budget and brief not complementing each other, many times the company may underestimate the limit of money they have and leave you hanging with a solution not meet your needs. If the budget is enough to meet the set goals, the firm can provide you with a suitable proposal. If that does not appeal to you, they can then still give alternate options that meet your needs as well as fit your budget and result in the effectiveness of work. Hence, it is better to have a figure in mind that accommodates your ideas to meet your desired expectations.

Create A Healthy Relationship

You don’t want to set yourself up for heated arguments in the future. The type of budget you mention should be enough for the company to execute your brief. Failure to do so can lead to reducing your chance of creating a long-lasting relationship. Not being open will obstruct the laying of trust and being honest with each other eventually. Only in a trusting relationship, you can communicate the gaps created freely due to the non-alignment of brief and budget. This will eventually result in a mutually beneficial output and a sustainable relationship.

Generate Interest

The company will always try to fit the most creative ideas in the given range of budget. They take the challenge of understanding your brief and presenting actionable ideas. With a clear set of steps, the company takes an interest in your project, and its employees are encouraged to work. If you have underestimated your budget according to your brief then the company may lose interest or feel less challenging when working with you.

Conclusion

When your brief and budget align, you are in a good position for future growth. A client brief specifying an accommodating budget gives the business a sense of direction to proceed further. As a client, it is your responsibility to frame the budget keeping in mind the kind of work you want to get done. The budget must be realistic to match the brief given. If not, the result would not match the expectation that would have.

To get the best possible outcome, you truly need to think of the budget when creating a brief. Ponder on some questions:

- How much are you willing to spend?

- What are the ideas and goals you want to achieve?

- Is the budget set enough to execute the brief and accomplish the goals?

- Can the company work with this budget range and provide multiple options?

- Have you considered the benchmark prices of the resources needed for the implementation of a brief in your budget?

Know how much your brief will cost you and create a realistic budget.

Read our blog on why vague briefs are not suitable for your project here.

Recommended Reads:

Top E-Invoicing Software in India: Detailed Analysis

Top 10 Inventory Invoice Software

Top 8 e-Way Bill Software

Top 7 Invoice Generator Software