Here’s a question: Would 2018 you believe it if someone told you that working from home completely, hybrid work, or transitioning to freelancing is the norm come 2019? Probably not, because traditional employment methods have conditioned us to believe that working in the office is the only way to be productive, right?

Freelancing, in particular, is popularly called the ‘future of work,’ undoubtedly because it allows workers more work-life balance, the ability to manage schedules, work from home, and more work opportunities outside their home country. Even students can start freelancing as a side hustle.

According to a study conducted by Payoneer from 2,000 respondents in 100 countries, 30 percent saw the demand for their services go up, and 45 percent indicated that the demand stayed constant without slowing down despite historical levels of traditional unemployment.

With the increasing demand for freelancing comes the growing pressure on freelancers to manage finances, including bookkeeping, cash flow, and taxes. In this article, we will discuss why freelancers need to hire accountants, what they are for, and how they can help.

The role of accountants for freelancers

The surge in demand has also skyrocketed the job opportunities for freelancers. According to Upwork, the most in-demand skills for freelancers include machine learning, automation, SEO, mobile application development, and data analytics.

Freelancers who have multiple clients on their shoulders already find it difficult to juggle their heavy workload, and the huge pressure of properly managing their finances to avoid legal issues adding to that burden is enough to drive one to the edge.

This is where accountants come in.

For example, year-end tax or quarterly tax dues are highly complicated to navigate, especially for people who are not well-versed with intensive tax regulations. Having an accountant around can help you comply with your tax dues to avoid penalties and surcharges.

Five reasons why freelancers need accountants

If you still need more reasons to justify why you need to hire an accountant, here’s a straightforward answer: they help keep your business growing. Here’s how accountants can help you and your business grow with their professional skills:

Monitor the inflow and outflow of your money

Freelancers with multiple clients tend to have multiple banking accounts as well. Different clients may require different payment methods in different currencies.

Monitoring the inflow of cash may be particularly tricky, especially when you have multiple clients paying you in different currencies on different platforms. To get an idea of your overall earnings, you need to convert those payments into your local currency and transfer them to one business account for centralization.

Hiring an accountant will help you identify the gains and losses on these foreign currency conversion transactions, as well as determine the best time to convert your other currency payments to local currency for maximum profits.

At the same time, accountants can help monitor regular business expenses from your bank accounts, like tax payments, payroll, business permit dues, and many more.

Freelancers are also at risk of negative cash flow if they do not adequately monitor their cash performance. In this case, accountants can advise you to turn to viable and less costly financing options, like traditional bank loans, personal loans, freight factoring, or accounts receivable factoring.

Keep track of your financial records

Keeping track of not just cash but your overall financial situation can be a heavy burden, especially when you have no knowledge of accounting or bookkeeping.

By hiring accountants, they will help you properly keep track of your financial records either through simple Excel sheets or through bookkeeping software. These financial records will help you assess the financial standing and performance of your business—from your monthly profit net income to your total net value.

Andrew Pierce, CEO at LLC Attorney, emphasizes the importance of maintaining proper and accurate financial records. “Many people think that freelancers can easily get away from financial and legal obligations because many of them don’t have a fixed employer-employee relationship like traditional employees do,” he says. “Many of them get away, but the legal ramifications of not reporting your earnings to the government is tantamount to a federal crime.”

Do payroll

Freelancers often work independently. However, they are not limited to working independently and can seek help doing specific tasks.

When a freelancer decides to hire employees, or fellow freelancers, to complete a job, accountants can assist in computing their hours worked and salary.

It is essential, however, to determine whether seeking help from other people is an ‘employment contract’ or a ‘freelance contract.’ An employment contract will require freelancers to get an Employee Identification Number (EIN), create compensation plans, withhold taxes, and remit to the IRS.

Facilitate computation and payment of taxes

Taxes are a complicated topic to navigate, even for accountants. Most accountants specializing in taxation are called tax accountants and are generally paid higher than those without specialization.

Freelancing income and expenses, however, are usually straightforward, and any accountant can compute freelancer taxes.

Hiring an accountant will help you correctly and adequately identify which and how much of your salary and income is subject to applicable tax rates.

Freelancer taxes are often categorized as self-employed taxes, which means that freelancers are responsible for paying their taxes, compared to employees who are subject to withholding taxes by their employers.

To give you an idea of how an accountant will generally compute your tax dues:

Estimate your tax liability.

As a freelancer, you must also pay taxes at regular intervals, usually quarterly. Any lack or excess of taxes paid upon computation of the annual tax due will be paid or refunded to you. In this case, accountants will help you estimate how much taxes you owe for a specific quarter so you don’t have to pay too much annual income tax due by the end of the year.

Compute your regular income tax

Your regular income tax is based on your gross income, less applicable deductions. What makes tax reporting so complicated for freelancers, in particular, is that you may be required to fill up different IRS forms per income declared from each client.

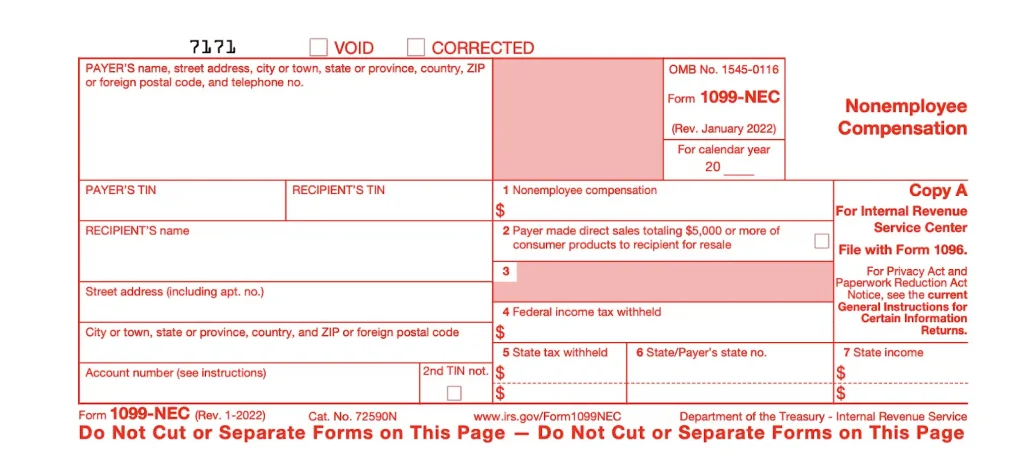

For example, if you have three clients, you may need to fill out three 1099-NEC forms, which will declare self-employment or non-employee compensation income. If you received international payments through PayPal or other third-party processors, you may need to fill out a 1099-K. Additionally, if you’re managing payments to international contractors, understanding how to pay international employees correctly is crucial to avoid compliance issues.

If you received a 1099-NEC from your client, you need to include all the amounts in all these 1099-NECs on your annual tax return because the client who gave you the 1099-NEC has most likely reported the amount they paid, your profit, to the IRS. Any discrepancy between the declared amount of your client and your reported income is equivalent to subsequent tax audit and penalty payments.

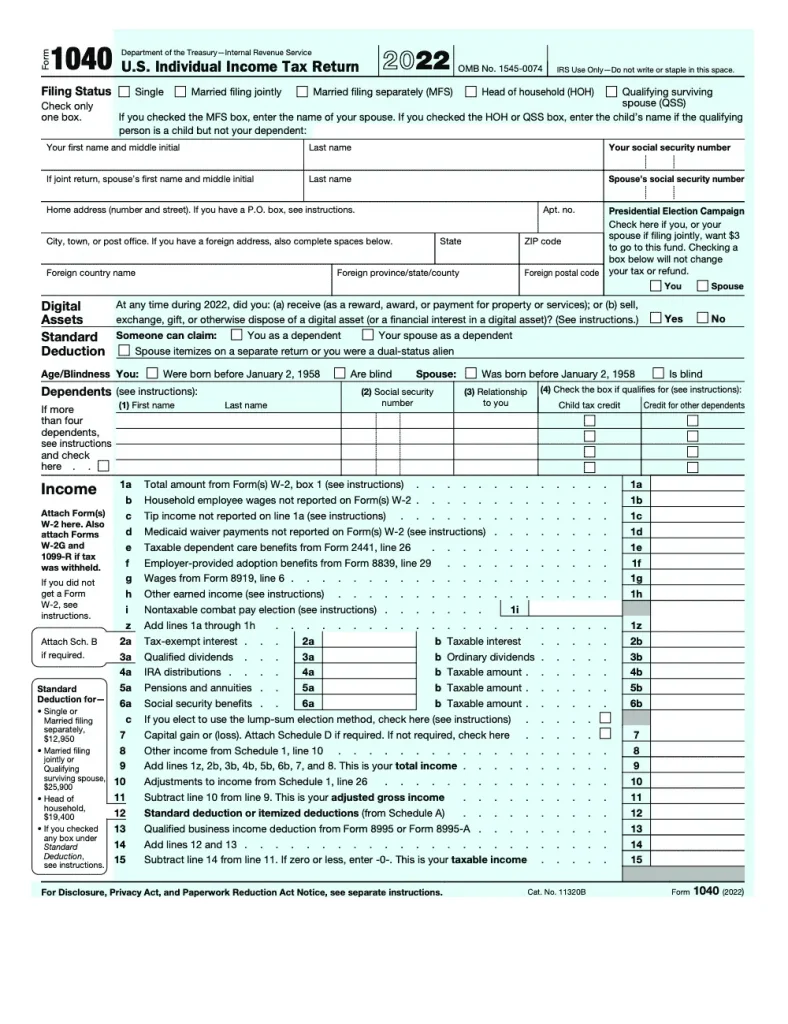

According to the IRS, a self-employed freelancer must file his or her income tax return using the form 1040 and 1040-SR if earnings are above $400 or if they meet any of the filing requirements listed in these guidelines.

Identifying qualified deductions for self-employed individuals

It is important to note that not all expenses are qualified as deductions from your gross income to arrive at your net taxable income. Only expenses related to the business or freelancing activity can be qualified for deduction, including, but not limited to:

- Credit card purchases ‘ordinary and necessary’ to the business

- Telephone and internet bills

- Salaries and wages

- Home office deduction

- Training and education expenses

- Health insurance premiums

- Self-employment tax deduction

- Retirement savings or 401(k)

Computing self-employed taxes

Self-employment taxes are paid on top of your regular income taxes as a self-employed individual. Because the state considers you an employer and an employee, the self-employment tax of 15.3 percent represents your Social Security and Medicare taxes.

Not only will hiring accountants help you make sure that you pay the correct taxes to avoid problems with the IRS, but they will also help find ways to maximize your tax savings by identifying qualified deductions you may not otherwise be aware of, like including your 401(k) in your deductible expenses.

Monitor your freelance business growth

People who do not know what accountants do can easily dismiss accounting work simply as counting money or numbers. However, an accountant’s work goes way above and beyond merely calculating your net income or your taxes.

Accountants act as financial advisors. As they determine your business’ profitability, accountants interpret these numbers into relevant data that can help expand and grow your business or freelancing career.

- Interpret your cash flow. Accountants can interpret a good cash flow ratio as the business being liquid and able to finance necessary expenses now and in the future. A bad or negative cash flow means that you spend more than you earn and that you may need help in getting more liquid cash either through bank loans or invoice financing.

- Interpret overall business performance or net worth. Your net value or net worth is computed by taking your total assets minus your liabilities. An accountant will help you interpret how you are performing as a freelancer and how you can improve your net worth over time.

- Help identify how to make the most of your time. As a freelancer, your most significant investment is your time. Whether you have one or multiple clients, it is essential to assess which client is not worth keeping and which isn’t. For example, you can ask your accountant to calculate the rate of return per hour for each client, including the corresponding expenses, whether or not to increase rates, and determine whether keeping multiple mid-paying clients or a few high-paying ones is better for you.

- Setting goals. Keeping an accountant around will help you determine and achieve your financial success and business goals. Accountants know how to budget, plan, and monitor business operations as a whole, so you can rest assured that you are not aimlessly shooting for a goal.

Wrapping up

Accountants aren’t just your math wizards. They don’t magically compute and create numbers out of thin air. In a freelancer setting, accountants help you understand where you are financially, assess your freelancing performance, and give advice on how you can further your freelancing career financially.

Being a freelancer can be an overwhelming task in and of itself. Having an accountant around to help you keep track of your finances, business performance, and compliance with relevant rules and regulations of the IRS will take away a substantial financial burden on your shoulders.