GSTR-2B is an important GST document that shows a summary of all the purchases a company has made, based on what its suppliers have reported. By understanding GSTR-2B, you can ensure you’re getting the right tax credits and staying on top of your GST responsibilities.

This guide will explain GSTR-2B, including why it’s important, what it includes, and how it compares to other GST forms.

What is GSTR-2B?

GSTR 2B is a monthly auto-generated statement provided to businesses under the Goods and Services Tax (GST) system. It shows details of the purchases and the input tax credit (ITC) a business can claim for a particular month. In simple words, it helps businesses know how much tax they’ve already paid on their purchases that they can adjust against their sales tax.

This statement is created automatically based on the information provided by the suppliers (the sellers you’ve bought goods or services from). It includes details like the invoices, debit notes, and credit notes that were filed by the suppliers in their returns.

GSTR-2B was made available to businesses starting in August 2020, providing an efficient and reliable way to manage input tax credits.

GSTR-2B is a ready-made summary that shows businesses how much tax credit they can claim, without the need for manual calculations. Once it’s generated, the information stays the same, making it easier to track taxes and avoid mistakes when claiming tax credits.

Importance and Benefits of GSTR-2B

GSTR-2B plays a crucial role in helping businesses manage their taxes efficiently. Here’s why it’s important and beneficial:

- Helps in Claiming Accurate Input Tax Credit (ITC)

One of the most significant benefits of GSTR-2B is that it simplifies the process of claiming ITC. Since it’s an auto-generated statement, you get a clear picture of how much tax credit you’re eligible to claim based on the purchases you made. This eliminates the need for manual calculations and reduces the chances of errors. - Improves Compliance

By providing a ready-made list of all the invoices and credit available, GSTR-2B helps businesses stay compliant with GST regulations. When you have all the details at hand, it becomes easier to file your returns correctly and avoid penalties or legal issues. - Reduces Reconciliation Efforts

Earlier, businesses had to manually reconcile their purchase records with the suppliers’ sales details. GSTR-2B automatically matches these details, making it easy for businesses to compare and verify the information. This reduces the effort and time spent on reconciliation. - Fixed Data – No Changes Once Generated

One of the standout features of GSTR-2B is that it doesn’t change once it’s generated for the month. This fixed nature ensures that there’s no confusion or unexpected modifications in the tax credit. You can rely on it to plan your tax filings with certainty. - Ensures Accurate Matching

GSTR-2B, being based on the suppliers’ filed returns, ensures accurate matching between your input tax credit claims and the tax filed by your suppliers. This promotes seamless tax processing and reduces the likelihood of disputes.

GSTR-2B provides businesses with an easy-to-use, accurate, and efficient tool for managing their input tax credit. Its auto-generated nature, fixed data, and reconciliation features not only save time and reduce errors but also enhance compliance and financial planning. By utilizing GSTR-2B, businesses can streamline their tax processes and focus on growth.

Features of GSTR-2B

GSTR-2B has several key features that make it a valuable tool for businesses under the GST system. Here are some of the main features:

- Auto-Generated Every Month

GSTR-2B is automatically generated each month for every taxpayer, providing them with a ready-to-use summary of their eligible input tax credit. This eliminates the need for businesses to manually calculate and track the ITC, saving time and reducing errors in tax filing. - Invoice and Document Details

The statement includes detailed information about the invoices, credit notes, and debit notes filed by suppliers. Businesses can easily access these details to verify the accuracy of their input tax credit claims and ensure proper reconciliation with their purchase records. - Fixed Data Once Generated

Once GSTR-2B is created for a specific month, the data in the statement remains fixed. Unlike other forms, GSTR-2B cannot be altered after its generation. This feature offers businesses a consistent and reliable source of tax information for that particular period, ensuring accuracy in their tax claims and preventing discrepancies in ITC. - Detailed Information on ITC

GSTR-2B provides detailed information about the input tax credit you can claim. It breaks down the ITC into different categories, such as:- Eligible ITC (the amount you can claim)

- Ineligible ITC (the amount you can’t claim)

- ITC that is available on reverse charge (where you have to pay tax on behalf of the supplier). This clarity helps you know exactly what part of the tax you can use.

- Easy Reconciliation

GSTR-2B makes it easier to reconcile your purchases with the records of your suppliers. Since the statement shows all the invoices and credit notes filed by your suppliers, you can easily match these with your records. This reduces the chances of mismatches and disputes. - Supports Multiple Types of Transactions

GSTR-2B includes various types of transactions, such as:- Invoices

- Credit notes

- Debit notes

- Imports of goods or services

- Separate ITC for Imports

GSTR-2B also includes details of the input tax credit you can claim on imported goods or services. This feature helps businesses that deal with international suppliers by giving them a clear idea of the credit available on imports. - Availability Before Filing Date

The GSTR-2B statement is generated around the 14th of every month. This gives businesses enough time to review the statement and check the available tax credit before filing their GSTR-3B return (which is typically due on the 20th of the month).

Categories of GSTR-2B

GSTR-2B organizes your tax information into two main categories to help you manage your Input Tax Credit (ITC) efficiently:

1. ITC Available

This category includes all the input tax credit (ITC) that you are eligible to claim for the specific month. It is further divided into different sub-categories to provide more clarity on how the ITC can be utilized. These sub-categories include:

- ITC on Inward Supplies (other than imports and reverse charge): This covers the tax credit available on goods and services purchased from domestic suppliers. It’s the most common type of ITC that businesses claim.

- ITC on Inward Supplies subject to Reverse Charge: In some cases, you (the buyer) are responsible for paying GST on behalf of your supplier. The tax you pay under this reverse charge mechanism is also eligible for ITC and is listed in this sub-category.

- ITC on Imports of Goods: If you import goods from outside the country, the GST paid on these imports is eligible for ITC. This section shows the available credit for such imported goods.

- ITC on Imports of Services: For services imported from foreign suppliers, the GST paid can also be claimed as ITC. This sub-category helps businesses that rely on international service providers.

2. ITC Not Available

This category includes all the input tax credit that you cannot claim for various reasons. GSTR-2B helps businesses avoid errors by clearly marking the ITC that is ineligible. The reasons for ineligibility may include:

- Non-GST Supplies: If you’ve purchased goods or services that are exempt from GST, the input tax paid on these purchases cannot be claimed as ITC.

- Blocked Credits: Certain types of expenses, such as personal expenses or motor vehicle purchases (unless used for a specific purpose like transportation), are blocked by GST law and cannot be claimed as ITC. This section will highlight such blocked credits.

- ITC Beyond the Time Limit:There is a time limit within which businesses need to claim their ITC. If you miss this deadline, the credit becomes ineligible and will be listed under this category.

By organizing the ITC into these two main categories, GSTR-2B gives businesses a clear view of what input tax they can claim and what they cannot. This classification ensures that businesses stay compliant with GST rules and claim only the eligible credits, making the tax filing process smoother and error-free.

Generation and Availability

Here’s how the generation process works and when it becomes available:

- GSTR-2B is auto-generated on the 12th day of each month. Auto-Generation on the 12th of Every Month

The data used to generate it comes from the returns filed by your suppliers in forms like GSTR-1, GSTR-5, and GSTR-6 for the previous month. This means, by the 12th of the current month, the system creates the GSTR-2B statement for your purchases from the previous month. - Availability Before Filing GSTR-3B

Once GSTR-2B is generated, it becomes available for you to view and download on the GST portal. It’s provided well before the deadline for filing your GSTR-3B (which is usually on the 20th of the month). This gives you plenty of time to review your available input tax credit (ITC) and ensure everything is accurate before submitting your GSTR-3B. - Consistent Monthly Cycle

Since GSTR-2B is generated on the 12th of each month and remains fixed for that month, businesses can rely on this consistent cycle for planning their tax filings. The auto-generated statement covers all the transactions from the previous month, giving a complete and accurate picture of the ITC available for that period. - No Changes Once Generated

One of the key features of GSTR-2B is that the data remains fixed after it is generated. This means that once the statement is available on the 12th, the figures won’t change, even if the suppliers make changes or corrections to their returns later. This stability ensures that businesses can confidently use the data for claiming ITC without worrying about any modifications later. - Accessible Through GST Portal

GSTR-2B can be easily accessed and downloaded from the GST portal. You simply need to log in, navigate to the GSTR-2B section, and download the statement for the relevant month. This makes it convenient for businesses to regularly check their tax credit status and file accurate returns.

How to Access GSTR-2B on the GST Portal

Step 1: Visit the GST Portal

Go to the official GST website at www.gst.gov.in.

Step 2: Log In to Your Account

Click on the “Login” button located in the top-right corner of the page. Enter your valid credentials, including your GSTIN (Goods and Services Tax Identification Number), username, and password. Complete the CAPTCHA verification and click “Login.”

Step 3: Navigate to the GSTR-2B Section

After logging in, go to the “Services” menu at the top of the dashboard. From the dropdown, select Returns > Returns Dashboard

Step 4: Select the Relevant Tax Period

Once you’re on the Returns Dashboard page, select the financial year and the month for which you want to view your GSTR-2B. After selecting the tax period, click on the “Search” button.

Step 5: Access GSTR-2B

In the list of available returns, you’ll see the “GSTR-2B” option. Click on the link to open your GSTR-2B statement.

Step 6: Download or View GSTR-2B

You can view the GSTR-2B statement directly on the GST portal by logging into your account. Additionally, there is an option to download the statement in either PDF or Excel format, allowing you to conduct further analysis or maintain it for record-keeping purposes.

Format of GSTR 2B

The format of GSTR-2B is divided into multiple sections, making it easy to understand the details of ITC, including purchases, imports, and reverse charge transactions.

Here’s a breakdown of the key sections in the format of GSTR-2B:

1. Taxpayer Information: The heading includes the basic details related to the taxpayer and the reporting period:

- GSTIN: The Goods and Services Tax Identification Number (GSTIN) of the registered business.

- Legal Name of the Taxpayer: The registered name of the business or individual under GST.

- Trade Name: The trade name of the business, if applicable.

- Return Period: The month and year for which the GSTR-2B is being generated.

2. Summary of Input Tax Credit (ITC): This section presents a summary of the Input Tax Credit (ITC) that is available and unavailable for the specified tax period It includes.

A. ITC Available

- Inward Supplies (Other than Imports and Reverse Charge): ITC available on domestic purchases.

- Inward Supplies Attracting Reverse Charge: ITC available on purchases under the reverse charge mechanism.

- Imports of Goods: ITC on the import of goods.

- Imports of Services: ITC on the import of services.

- Debit Notes: Any additional ITC available due to debit notes issued by suppliers.

B. ITC Not Available

- Inward Supplies (Other than Imports and Reverse Charge): ITC on purchases that cannot be claimed, including blocked credits.

- Inward Supplies Attracting Reverse Charge: Reverse charge ITC that is not eligible for credit.

- Imports of Goods: ITC on imported goods that is ineligible.

- Imports of Services: ITC on imported services that cannot be claimed.

- Blocked Credits: Certain credits, such as those related to personal use or ineligible items.

3. Details of ITC on Inward Supplies (Other than Reverse Charge and Imports): This section contains detailed information on domestic purchases, including:

- GSTIN of Supplier: The unique GSTIN of the supplier.

- Invoice/Document Type: Specifies whether the document is an invoice, debit note, or credit note.

- Document Number: The invoice or document number.

- Document Date: The date on which the invoice was issued.

- Taxable Value: The value of the goods or services excluding GST.

- IGST/CGST/SGST/UTGST Amounts: The GST amounts are segregated into Integrated GST (IGST), Central GST (CGST), State GST (SGST), or Union Territory GST (UTGST).

4. Details of ITC on Inward Supplies Attracting Reverse Charge: This section shows transactions where the buyer has paid GST under the reverse charge mechanism:

- GSTIN of Supplier: The supplier’s GSTIN for reverse charge transactions.

- Document Number and Date: The invoice or document details related to the reverse charge.

- Taxable Value: The value of the goods or services on which the reverse charge applies.

- IGST/CGST/SGST Amounts: The GST paid by the buyer under the reverse charge that is eligible for ITC.

5. Details of ITC on Imports: This section provides the details of ITC available on imports:

- IGST on Import of Goods: Reflects the IGST paid on imported goods.

- IGST on Import of Services: Shows the IGST paid on imported services.

6. Details of Credit/Debit Notes: This section contains information on credit and debit notes:

- Credit Notes: Adjustments made to reduce the tax liability, such as when goods are returned or discounts are applied.

- Debit Notes: Adjustments made to increase the tax liability, such as additional services or goods supplied after the original invoice was issued.

7. ITC Reversal Summary: This section summarizes any reversals of input tax credit:

- Reversal Due to Credit Notes: When goods or services are returned, the ITC claimed earlier needs to be reversed, and this section highlights those details.

8. TDS/TCS Credits (if applicable): This section applies to businesses that are subject to Tax Deducted at Source (TDS) or Tax Collected at Source (TCS) under GST provisions:

- TDS Credit: The available credit from TDS.

- TCS Credit: The available credit from TCS.

9. Amendments (if any)

Any amendments or corrections made to invoices or transactions by the supplier in their subsequent returns will be reflected here. This helps the taxpayer track any changes and adjust their ITC claims accordingly.

GSTR-2B vs GSTR-3B

Here’s a simple comparison between GSTR-2B and GSTR-3B:

| Feature | GSTR-2B | GSTR-3B |

|---|---|---|

| What it is | A monthly statement that shows how much input tax credit (ITC) you can claim, based on what your suppliers have reported. | A monthly form you fill out to declare your tax liability, claim ITC, and pay taxes. |

| Purpose | Helps you know how much tax credit you can claim. | Used to report and pay your monthly GST after claiming ITC. |

| How it’s created | Automatically generated by the GST system on the 12th of every month. | You manually fill it out each month to declare your taxes. |

| Where the data comes from | Based on your suppliers’ filed returns (like GSTR-1, GSTR-5, and GSTR-6). | Based on your own sales and purchase records for the month. |

| ITC Claims | Shows you which ITC is available for the month (eligible and ineligible). | You claim ITC in this form based on your own records and cross-checking with GSTR-2B. |

| Can it be changed? | No, once it’s generated, it can’t be changed. | Yes, if you make a mistake, you can adjust it in future returns. |

| Why it’s useful | Helps you match your purchases with what your suppliers reported, so you know how much ITC you can claim. | Allows you to report your sales, claim ITC, and pay taxes for the month. |

| When it’s available | Available on the 12th of every month for your reference. | Must be filed by the 20th of every month. |

| Penalties | No penalty since it’s not something you file, but wrong ITC claims can lead to problems. | Penalties apply if you don’t file or pay taxes on time. |

| What it covers | Shows all your purchases as reported by your suppliers. | Includes your sales, purchases, and the taxes you owe. |

In short, GSTR-2B helps you see how much tax credit you can claim, while GSTR-3B is the form where you declare and pay your GST. Both are important for managing your taxes under GST.

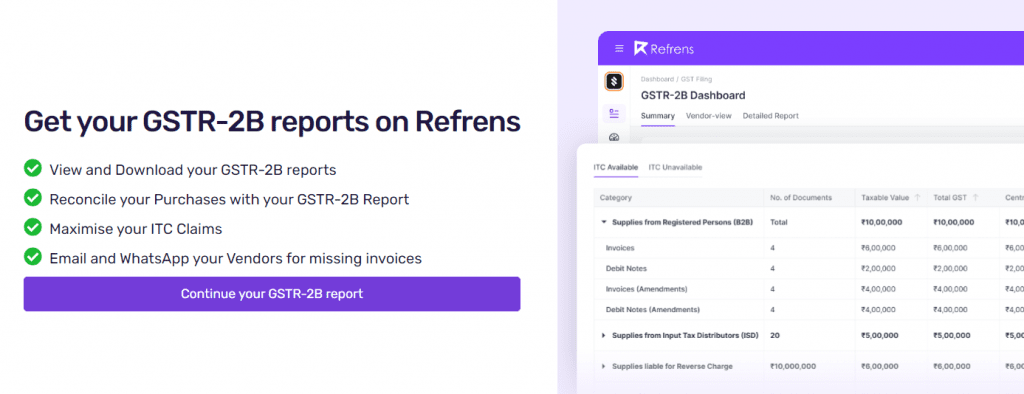

Download Your GSTR-2B Within Seconds!

Refrens is a powerful cloud-based accounting software built to simplify financial management for businesses of any size. Trusted by over 150,000 companies in 178 countries, it provides an all-in-one platform with a wide range of tools, including invoicing, accounting, inventory management, expense tracking, and client & vendor management.

Refrens makes it super simple to comply with GST regulations of the government. You can easily download your GSTR-2B with just a few clicks, and access a complete report showcasing all the Input Tax Credits (ITC) available to you, based on your supplier filings.