Understanding the Goods and Services Tax (GST) can be tricky for many businesses, especially when it comes to keeping up with filing deadlines. One important notice to be aware of is the GSTR 3A, which is sent by the GST authorities to remind taxpayers that they haven’t filed their returns on time. Ignoring this notice can lead to serious issues, like penalties and even legal trouble.

In this blog, we will explain what GSTR 3A is and why it matters. We’ll look at who gets this notice, how it’s issued, and what important details it contains. We’ll also share steps you should take if you receive a GSTR 3A notice, the consequences of not responding, and tips to avoid getting such notices in the future. By the end of this blog, you’ll have a clear understanding of GSTR 3A, helping you stay on top of your GST responsibilities and avoid any unnecessary stress.

What is GSTR 3A?

GSTR 3A is a notice issued by GST authorities to taxpayers who have failed to file their GST returns on time. It is important to understand that GSTR 3A is not a return like GSTR-1 or GSTR-3B; instead, it is a formal notice generated by the tax department to alert businesses about their non-compliance with GST filing regulations.

The main purpose of GSTR 3A is to remind and notify taxpayers that they have missed the deadline for filing their GST returns, such as GSTR-3B or GSTR-4. This notice urges them to complete their filings immediately and pay any pending taxes, along with applicable interest or penalties, to avoid further legal action or financial consequences.

By issuing GSTR 3A, the tax authorities aim to ensure that businesses comply with their GST obligations, and it serves as an early warning for those who have not yet filed their returns. Ignoring this notice can lead to additional penalties, and in some cases, the tax authorities may initiate assessment proceedings under Section 62 of the GST Act, which could increase the taxpayer’s liability.

Issuance of GSTR 3A Notice

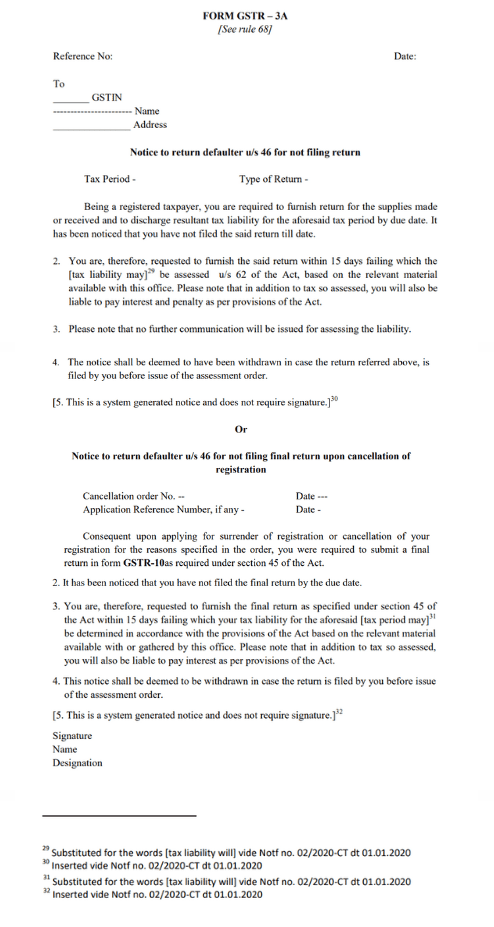

GSTR 3A notices are issued by the GST authorities when a taxpayer fails to file their required GST returns by the due date. This notice is generated automatically by the system under Section 46 of the CGST Act, 2017 and Rule 68 of the CGST Rules, which govern the filing and submission of GST returns.

The notice is typically sent to taxpayers who are supposed to file returns like GSTR-3B, GSTR-4, or any other applicable return but have missed the deadline. It acts as a reminder, giving the taxpayer a chance to fulfill their filing obligations before any further action is taken by the authorities.

Who Will Receive a GSTR 3A Notice?

Any registered taxpayer who fails to file their GST returns on time may receive a GSTR 3A notice. This includes regular taxpayers, composition taxpayers, and even casual taxable persons. Essentially, if you are required to file GST returns and do not meet the deadlines, you will likely receive this notice.

Timing of Issuance

The notice is usually issued soon after the due date for filing the GST return has passed. It gives the taxpayer a 15-day window to file the overdue return and pay any applicable taxes, interest, and penalties to avoid further legal or financial consequences.

Format and Contents of GSTR 3A Notice

When a GSTR 3A notice is issued, it contains specific information that informs the taxpayer about the missed returns and the actions they need to take. This notice serves as a formal communication from the GST authorities, providing clear instructions on how to comply.

Key Details Included in the Notice:

- Taxpayer Information: The notice will include the taxpayer’s GSTIN (Goods and Services Tax Identification Number), legal name, and trade name (if applicable). This ensures the notice is directed to the correct business entity.

- Period of Non-Compliance: The notice specifies the period for which the taxpayer has not filed their return. For example, it might mention that the GSTR-3B for a particular month or quarter is overdue.

- Return Type: The notice will mention which return has not been filed. It could be GSTR-3B for regular taxpayers or GSTR-4 for composition taxpayers, depending on the taxpayer’s filing category.

- Action to Be Taken: Clear instructions on filing the pending returns are provided. The notice urges the taxpayer to submit their overdue GST returns within 15 days from the date of the notice.

- Penalties and Late Fees: The notice outlines the late fees, penalties, and interest that have accrued due to non-filing. This allows the taxpayer to understand the financial consequences of the delay and encourages prompt compliance.

- Legal Provisions: A reference to Section 46 of the CGST Act and Rule 68 is typically included to explain the legal basis for issuing the notice and the taxpayer’s obligations.

Sample Format of a GSTR 3A Notice:

While the content may vary slightly depending on the taxpayer’s status and the missed return, the format generally includes the following:

- Heading: “Notice for Non-filing of GST Returns” or similar.

- Taxpayer Details: GSTIN, Name, Address.

- Period of Default: Specific month(s) or quarter(s) for which the returns are pending.

- Due Date: Mention of the original due date for filing the return.

- Action Required: Instructions to file the return within 15 days.

- Penalties: Details of late fees and interest that will apply.

- Legal Reference: Citation of the relevant laws governing non-compliance.

Understanding the format and contents of the notice helps businesses know exactly what needs to be done to rectify the situation and avoid further penalties.

Actions to Take After Receiving a GSTR 3A Notice

Once a taxpayer receives a GSTR 3A notice, it is crucial to take prompt action to avoid further legal or financial consequences. The notice is essentially a warning, giving taxpayers a window of opportunity to rectify their non-compliance by filing the required returns and paying any pending taxes, penalties, and interest.

Here are the steps taxpayers should take after receiving a GSTR 3A notice:

1. Review the Notice Carefully

- The first step is to thoroughly review the details of the notice, including the period for which the returns were not filed, the type of return that is due (e.g., GSTR-3B, GSTR-4), and the deadline to comply.

- Ensure that the GSTIN and other details in the notice are correct and that the notice is indeed applicable to your business.

2. File the Overdue Return

- Log in to the GST portal using your credentials, navigate to the appropriate section, and file the overdue return for the period specified in the notice. For example, if you missed filing GSTR-3B for a certain month, you need to file that return immediately.

- Ensure that you enter accurate details for outward supplies, input tax credits, and any other relevant data in the return.

3. Pay Any Outstanding Tax, Interest, and Late Fees

- Calculate the total amount due, including any outstanding tax liabilities, late fees, and interest as specified in the notice.

- You can use the “Liabilities” section of the GST portal to determine the exact amount due. Make the necessary payments to clear the outstanding liabilities.

4. Respond Within 15 Days

- The notice typically allows a window of 15 days for the taxpayer to file the overdue returns and settle any pending dues. It is important to act within this time frame to avoid further penalties or legal proceedings.

5. Avoid Further Non-Compliance

- After responding to the GSTR-3A notice, ensure that you file future GST returns on time to avoid receiving similar notices in the future. Regular compliance with GST filing deadlines will help your business avoid penalties and interest charges.

6. Consult a Professional if Necessary

- If you’re unsure about how to file the overdue return, calculate penalties, or respond to the notice, it may be wise to consult a GST consultant or tax professional. They can help ensure that you follow the correct procedure and avoid errors in the filing process.

Consequences of Ignoring the GSTR-3A Notice:

If a taxpayer fails to respond to the notice within 15 days, the GST authorities may initiate further actions, such as issuing an assessment order under Section 62 of the CGST Act. This could result in higher penalties and additional legal action, which could increase the overall tax liability.

By responding quickly and accurately to a GSTR-3A notice, businesses can avoid additional complications and ensure that they remain compliant with GST laws.

Consequences of Not Responding to GSTR-3A

Failing to respond to a GSTR-3A notice within the stipulated time frame can lead to serious consequences for a taxpayer. If the taxpayer does not file the overdue returns and settle the outstanding dues within 15 days of receiving the notice, the GST authorities are empowered to take further legal and financial actions.

Here’s what can happen if the taxpayer ignores the GSTR-3A notice:

1. Assessment Under Section 62 of the CGST Act

- If the taxpayer does not file the required returns within the 15-day window provided by the GSTR-3A notice, the tax authorities can initiate proceedings under Section 62 of the CGST Act.

- Under this section, the GST officer is authorized to conduct a best judgment assessment, which means they will assess the taxpayer’s liability based on the available information, even if the taxpayer has not filed the return.

2. Penalties and Late Fees

- Ignoring the notice will result in the accumulation of late fees and penalties. The late fee for not filing GST returns is generally ₹200 per day (₹100 CGST + ₹100 SGST), subject to a maximum cap until the returns are filed.

- Additionally, the taxpayer will be liable to pay interest at 18% per annum on the outstanding tax amount from the due date until the actual date of payment.

3. Provisional Tax Assessment

- In the case of non-compliance, the authorities may issue a provisional tax assessment. This provisional assessment means that even without the taxpayer’s input, the GST authorities will determine the amount of tax payable based on the information available from other sources.

- The taxpayer will be held responsible for paying this assessed amount, which may include higher tax liabilities due to the lack of accurate data.

4. Seizure of Goods or Property

- Under extreme circumstances, if the taxpayer still fails to comply after the assessment order is passed, the GST authorities may resort to more stringent measures like seizing goods, property, or bank accounts to recover the tax dues.

5. Cancellation of GST Registration

- Ignoring GSTR-3A notices and repeated non-compliance can also lead to the cancellation of GST registration. If the taxpayer continues to disregard the GST filing requirements, the authorities may issue a show-cause notice for cancellation of the taxpayer’s GST registration.

- Once GST registration is canceled, the taxpayer is no longer authorized to collect or pay GST, which could disrupt business operations.

6. Legal Proceedings

- Persistent failure to comply with GST regulations can lead to legal proceedings. In cases of willful tax evasion, the tax authorities may impose severe penalties, which could include criminal prosecution under the CGST Act, along with hefty fines or imprisonment, depending on the severity of the violation.

7. Impact on ITC Eligibility

- Non-filing of GST returns also impacts the taxpayer’s Input Tax Credit (ITC) eligibility. If returns are not filed on time, the taxpayer’s ITC claims may be denied, leading to a loss of tax benefits.

Resolution After the 15-Day Period

- In some cases, the taxpayer may still be allowed to file the overdue returns after the 15-day period, but this must be done before the assessment order is passed. If the return is filed during this period, the GSTR-3A notice may be withdrawn and penalties may be reduced.

In conclusion, ignoring a GSTR-3A notice can lead to serious financial and legal consequences. It is always advisable to address the notice promptly, file the required returns, and pay the necessary dues to avoid escalation.

Penalties and Late Fees for Non-Filers

Failure to file GST returns within the due date not only triggers a GSTR-3A notice but also results in the imposition of penalties, late fees, and interest on the outstanding tax amount. These charges are put in place to encourage timely compliance and ensure that taxpayers fulfill their GST obligations.

Here’s a breakdown of the penalties and late fees that apply when a taxpayer fails to file GST returns on time:

1. Late Fees for Non-Filing of Returns

- As per GST law, late fees are imposed on taxpayers who do not file their returns by the due date. The late fees are calculated per day from the due date until the return is filed.

- The standard late fee for non-filing of GST returns is:

- ₹100 per day under CGST (Central Goods and Services Tax).

- ₹100 per day under SGST (State Goods and Services Tax).

- This brings the total to ₹200 per day (₹100 CGST + ₹100 SGST).

- The maximum late fee is capped at ₹5,000 for regular returns like GSTR-3B.

- For taxpayers who fall under the composition scheme (filing GSTR-4), the late fee is:

- ₹50 per day (₹25 CGST + ₹25 SGST), with a maximum limit of ₹2,000.

- Note: There is no late fee for IGST (Integrated Goods and Services Tax) separately, as it is shared between the central and state governments.

2. Interest on Late Payment of GST

- Along with late fees, interest is charged on the outstanding tax liability. The interest is calculated at 18% per annum on the amount of tax that remains unpaid.

- The interest is calculated from the day after the due date until the date when the taxpayer pays the outstanding amount. This interest applies to both CGST and SGST, and it is compounded daily.

3. Penalties for Non-Compliance

- In addition to late fees and interest, non-filers may also be subject to penalties if the non-compliance continues or if the taxpayer repeatedly fails to file returns even after receiving notices.

- The tax authorities have the power to levy an additional monetary penalty if they believe the non-compliance is intentional or severe. This penalty is separate from the late fees and interest charges.

- Section 62 of the CGST Act also provides that if the taxpayer does not file the return within the 15-day window after receiving a GSTR-3A notice, the tax authorities can assess the tax liability through a best judgment assessment. This could result in a higher tax liability, increasing the penalties even further.

4. Waiver or Reduction of Late Fees

- In some cases, the government may announce waivers or reductions in late fees to encourage taxpayers to become compliant. These waivers are typically announced during special amnesty schemes or in response to specific circumstances (e.g., natural disasters or pandemics).

- Taxpayers should regularly check for any such announcements, as these schemes can help reduce their overall liabilities.

5. How to Avoid Penalties and Late Fees

- The best way to avoid penalties and late fees is to ensure that GST returns are filed on time. Regular reminders, automating tax payments, and keeping proper records can help businesses stay compliant.

- Taxpayers can also avoid higher penalties by responding promptly to GSTR-3A notices and filing overdue returns within the 15-day window provided by the notice.

By understanding the penalties and fees associated with late filing, businesses can appreciate the importance of timely compliance with GST regulations. Ignoring the notice or delaying the filing will only increase the financial burden in the form of late fees, interest, and potential penalties.

6. What Happens if My GST Registration is Canceled?

When your GST registration is canceled, it means you are no longer legally permitted to collect GST from your customers or claim Input Tax Credit (ITC) on any purchases. This can significantly impact your business, as it removes the ability to pass on tax benefits and manage input credits.

- Upon cancellation, you are required to file GSTR-10, the final return, which serves to settle all pending liabilities and ensure proper closure of your GST account.

- If you intend to restart operations within the GST framework, you will need to apply for a fresh registration. Failing to do so may lead to penalties and affect your ability to conduct business legally.

Can Returns Be Filed After 15 Days?

Yes, it is possible to file GST returns even after the 15-day window provided in the GSTR-3A notice, but there are important consequences and steps to keep in mind.

1. Filing After 15 Days But Before Assessment Order

- If the taxpayer fails to file the return within 15 days of receiving the GSTR-3A notice, they still have a window of opportunity to file the overdue return before the assessment order is issued under Section 62 of the CGST Act.

- In such cases, the GSTR-3A notice can be withdrawn once the return is filed and the pending tax, late fees, and interest are paid. This allows the taxpayer to avoid the harsher penalties and assessments that come with non-compliance.

2. Assessment Under Section 62

- If the return is not filed within the 15-day period and the taxpayer still does not take action, the GST authorities may initiate a best judgment assessment under Section 62.

- This means that the tax authorities will estimate the taxpayer’s liability based on the available data, such as outward supplies, sales records, or any information provided by third parties. The tax authority will issue an assessment order, and this amount is usually higher than what the taxpayer would owe if they filed the return themselves.

- Once the assessment order is issued, the taxpayer will be liable to pay this assessed amount, along with additional penalties and interest.

3. Penalties After 15 Days

- If the return is not filed within 15 days, the taxpayer may face additional penalties. The late fees and interest will continue to accumulate on the unpaid taxes.

- The late fees continue to accrue until the return is filed, and the interest on the outstanding tax liability (at 18% per annum) will keep adding up daily.

4. Impact on GST Compliance Rating

- Delays in filing returns, especially after receiving a GSTR-3A notice, may negatively affect the taxpayer’s GST compliance rating. A low compliance rating can hurt the business’s reputation and may make it harder to engage in business with other GST-compliant companies.

5. Withdrawal of Notice

- If the taxpayer files the overdue returns and clears all outstanding liabilities, including late fees and interest, before the assessment order is passed, the tax authorities can withdraw the GSTR-3A notice. This means that no further legal action or penalties will be pursued.

- Timely action after receiving the notice, even if it exceeds the 15-day period, can help resolve the situation and prevent more serious consequences like tax assessments or legal action.

6. Consequences of Ignoring the Assessment Order

- If the taxpayer ignores the notice even after the assessment order is passed, the tax authorities can take recovery actions. This may include seizing the taxpayer’s goods or property, freezing bank accounts, or initiating legal proceedings to recover the dues.

- Additionally, continued non-compliance could lead to cancellation of GST registration, which can disrupt business operations.

7. Steps to File After 15 Days

- Log in to the GST portal: Access the portal and file the overdue returns for the specific period.

- Pay the outstanding tax: Along with the return, ensure that the correct tax amount is paid.

- Settle the late fees and interest: Calculate and pay the applicable late fees and interest that have accrued since the due date.

While filing the return after the 15-day window is allowed, it is always better to respond as soon as possible to avoid additional penalties and legal complications. The sooner the return is filed, the lower the financial burden on the taxpayer.

Payment of GST in Installments

In cases where a taxpayer is unable to pay their GST dues in one lump sum after receiving a GSTR-3A notice, the GST law allows them to request to pay their outstanding tax liabilities in installments. This option can be especially useful for businesses facing cash flow issues or other financial difficulties.

Here’s a step-by-step explanation of how installment payments work under the GST framework:

1. Eligibility for Paying GST in Installments

- Any taxpayer who is unable to pay the full amount of GST due after receiving a GSTR-3A notice can apply to the Commissioner to request paying the tax in installments.

- This is an option for taxpayers who need some financial relief and allows them to spread out their tax payments over a specified period.

2. Conditions for Installment Payment

- The taxpayer must apply for the installment payment option, and it is granted at the discretion of the Commissioner.

- A taxpayer can apply to pay the GST dues in up to 24 monthly installments, depending on the financial situation and approval from the tax authorities.

- If the taxpayer defaults on any installment, the remaining unpaid amount becomes due immediately, and the taxpayer will lose the benefit of paying in installments.

3. Interest on Installment Payments

- Even if the taxpayer is allowed to pay in installments, they will still be liable to pay interest on the outstanding balance. The interest is charged at a rate of 18% per annum on the unpaid tax.

- The interest accrues daily on the remaining balance and is included in the installment amounts.

4. Steps to Apply for Installment Payment

- Step 1: The taxpayer must submit a formal application to the jurisdictional GST Commissioner explaining their financial difficulties and inability to pay the dues in one go.

- Step 2: The Commissioner will review the application, assess the taxpayer’s financial position, and determine whether installment payments should be granted.

- Step 3: If approved, the taxpayer will receive a schedule of installments, detailing the amount due in each installment, along with the applicable interest.

5. Consequences of Missing an Installment

- If the taxpayer misses even a single installment, the entire unpaid tax liability becomes due immediately. In such cases, the authorities may take legal action to recover the full amount, including penalties and interest.

- Additionally, the taxpayer may lose the option to pay in installments for future tax periods.

6. Advantages of Paying in Installments

- Financial Relief: The installment option can ease the financial burden on businesses by spreading the tax liability over a longer period.

- Avoiding Legal Action: Paying in installments can help businesses avoid further legal action, including asset seizure, bank account freezing, or cancellation of GST registration.

- Compliance Maintenance: Opting for installments allows businesses to remain compliant with GST laws, even if they face cash flow issues.

7. Disadvantages of Paying in Installments

- Interest Accumulation: While paying in installments can ease immediate financial stress, the accumulation of interest can increase the total amount owed.

- Risk of Default: If the taxpayer defaults on even one installment, they may face stricter penalties and lose the option for future installment plans.

Best Practices for Managing GST Payments

- To avoid needing installment payments in the first place, taxpayers should ensure proper financial planning and maintain sufficient reserves to meet GST liabilities on time.

- Regular filing of returns and timely payments can help businesses avoid late fees, interest, and the risk of receiving GSTR-3A notices.

By opting for GST payment in installments, businesses can manage their cash flow better while still adhering to tax compliance. However, they must ensure they follow the installment schedule carefully to avoid further complications.

GST Portal Notifications for GSTR-3A

The GST portal is equipped with features that help taxpayers stay informed about their filing deadlines and any missed returns. When it comes to GSTR-3A notices, the system automatically generates alerts and notifications to remind taxpayers to comply with their GST obligations. Here’s how the notification process works and what to expect:

1. Pre-Due Date Reminders

- Before the due date for filing returns like GSTR-3B, the GST portal typically sends reminder notifications to registered taxpayers via SMS and email. These reminders act as a heads-up for taxpayers, ensuring they don’t miss the deadline.

- These alerts mention the due date for filing the GST return and urge the taxpayer to complete the filing on time to avoid penalties and late fees.

2. Post-Due Date Alerts

- If the taxpayer fails to file the return by the due date, the GST portal will send another notification immediately after the deadline passes. This notification informs the taxpayer that they have missed the due date and encourages them to file the return as soon as possible to minimize penalties and interest charges.

- These post-due date alerts are sent through SMS and email, notifying the taxpayer of the potential consequences of non-compliance.

3. Issuance of GSTR-3A Notice

- Once a taxpayer has missed the return filing deadline, and after the post-due date notifications have been sent, the GST system generates a GSTR-3A notice. This notice is issued to taxpayers who fail to file their returns within the stipulated time frame.

- The GSTR-3A notice is made available on the GST portal, and the taxpayer will receive a notification (via SMS and email) informing them that a GSTR-3A notice has been issued.

- The notice is also accessible in the taxpayer’s dashboard on the GST portal under the “Notices and Orders” section.

4. How to View and Download GSTR-3A Notice

Taxpayers can easily view and download the GSTR-3A notice through the GST portal by following these steps:

- Log in to the GST portal using your credentials.

- Navigate to the “Services” menu and select “User Services”.

- Under this section, click on “View Notices and Orders”. Here, you will find the GSTR-3A notice issued for non-filing.

- Taxpayers can download the notice in PDF format for their records and review the details.

5. Additional Notifications

- After the GSTR-3A notice is issued, the taxpayer will continue to receive notifications from the GST portal reminding them to take action. These notifications urge the taxpayer to file the overdue return within 15 days of the notice issuance.

- If no action is taken within the 15-day window, additional alerts may be sent, indicating that the taxpayer is at risk of further penalties, including best judgment assessment under Section 62 of the CGST Act.

6. Ensuring Compliance Through Portal Notifications

- The GST portal’s notification system is designed to help taxpayers stay informed about their compliance status and encourage timely filing. By paying attention to these alerts, taxpayers can avoid missing deadlines and prevent the issuance of GSTR-3A notices.

- It is important to ensure that the contact details (mobile number and email ID) linked to the GST registration are accurate and up-to-date so that all important notifications are received.

Benefits of Portal Notifications:

- Timely Reminders: The system helps businesses remember their filing deadlines, reducing the risk of late fees and penalties.

- Clear Communication: The notifications provide clear instructions on the necessary steps to resolve non-compliance issues.

- Accessibility: The GSTR-3A notice and other communications are easily accessible on the GST portal, ensuring taxpayers can take prompt action.

Staying informed through GST portal notifications is key to maintaining compliance and avoiding costly penalties. Regularly checking the portal for updates and responding to notices in a timely manner will help businesses avoid any complications related to GSTR-3A notices.

Best Practices to Avoid GSTR-3A Notices

Receiving a GSTR-3A notice can lead to additional financial burdens in the form of penalties and interest, along with the risk of legal action. However, by following a few best practices, businesses can avoid receiving these notices and ensure compliance with GST regulations.

Here are some key strategies to help avoid GSTR-3A notices:

1. File GST Returns on Time

- The most effective way to avoid a GSTR-3A notice is to ensure that all GST returns are filed on or before the due dates. Whether it’s GSTR-3B (for regular taxpayers) or GSTR-4 (for composition taxpayers), filing returns on time helps avoid late fees, interest, and the risk of notices.

- Use automated systems: Many businesses use cloud accounting software that is integrated with the GST system to generate reminders for GST return filing. Automated reminders can help ensure that deadlines are not missed.

2. Maintain Proper Financial Records

- Accurate and up-to-date financial records are essential for filing GST returns on time. Ensure that all sales, purchases, input tax credits (ITC), and other relevant financial data are recorded properly and are easily accessible when preparing returns.

- Reconcile invoices: Ensure that your outward and inward supplies match with the details on the GST portal. This reduces discrepancies during return filing and prevents delays.

3. Use Professional Help for Compliance

- For businesses that find the GST filing process complex, seeking professional help from a GST consultant or tax professional can ensure timely and accurate filing. Professionals can help you avoid mistakes, understand the complexities of GST returns, and ensure that you meet all your compliance obligations.

- They can also help in cases where businesses face financial difficulties and need advice on how to manage their GST liabilities.

4. Use the GST Portal Efficiently

- The GST portal provides many tools that can help businesses manage their GST filings more efficiently. Ensure that you regularly log in to the portal to:

- Check for any pending returns: Use the portal to track upcoming due dates and verify whether returns for previous periods have been filed.

- Download GSTR-2A and GSTR-2B: These forms help you reconcile your ITC with the data filed by your suppliers, ensuring accuracy in your returns.

- Review notifications: Regularly check the “Notices and Orders” section for any alerts or notices from the GST authorities.

5. Reconcile Your Input Tax Credit (ITC)

- Input tax credit (ITC) reconciliation is important for avoiding errors in your GST returns. Make sure that the ITC you claim in your returns matches the invoices uploaded by your suppliers. If there are discrepancies, resolve them before filing your return.

- Regular reconciliation can also prevent ITC mismatches that could trigger a GSTR-3A notice or even lead to the rejection of ITC claims.

6. Avoid Overlooking Important Notifications

- As mentioned earlier, the GST portal sends multiple notifications through SMS and email to remind taxpayers about upcoming deadlines and missed returns. It’s crucial to ensure that the contact details associated with your GST registration are correct and regularly monitor your email and phone for alerts.

- By paying attention to these notifications, you can avoid missing filing deadlines and stay compliant.

7. Plan for Cash Flow to Pay GST Liabilities

- One common reason for not filing returns on time is a lack of cash flow to pay the GST liabilities. To avoid this situation:

- Plan your finances in advance to ensure you have enough liquidity to meet your GST obligations each month.

- Consider setting aside a portion of your revenue specifically for paying GST. This can help prevent the accumulation of unpaid taxes, which could lead to penalties.

8. Use the QRMP Scheme (for Eligible Taxpayers)

- If you are a small taxpayer with a turnover of up to ₹5 crores, consider opting for the Quarterly Return Filing and Monthly Payment of Taxes (QRMP) scheme. Under this scheme, you file GSTR-3B quarterly instead of monthly, but you still pay your taxes every month.

- This can reduce the administrative burden of filing returns every month and give you more time to manage your cash flow, helping you avoid late filing.

9. Review Past Filings for Accuracy

- Occasionally, review your past GST returns to ensure they were filed accurately. Mistakes in previous filings can lead to complications in future filings and even result in the issuance of GSTR-3A notices. Identifying and correcting these errors early can help prevent non-compliance issues.

10. Stay Updated with GST Laws and Changes

- The GST system is subject to regular updates and changes in regulations. Stay informed about the latest GST amendments, compliance requirements, and new schemes introduced by the government. This knowledge can help you avoid unintentional non-compliance and ensure that your returns are filed according to the latest rules.

Difference Between GSTR-3A and GSTR-3B

While both GSTR-3A and GSTR-3B are terms associated with GST compliance, they serve entirely different purposes. Understanding the distinction between the two is crucial for businesses to avoid confusion and ensure they meet all their tax obligations correctly.

1. Nature and Purpose

- GSTR-3A: GSTR-3A is not a return; it is a notice issued by GST authorities to taxpayers who fail to file their GST returns on time. The purpose of GSTR-3A is to alert non-filers and encourage them to file their pending returns within a specified period to avoid penalties and further legal action.

- GSTR-3B: GSTR-3B, on the other hand, is a monthly self-declaration return that regular taxpayers must file. It is used to summarize the total outward and inward supplies, input tax credit (ITC), and tax liability for a particular tax period. This form helps businesses declare their tax liabilities and pay the GST due for each month.

2. What Each Form Involves

- GSTR-3A: It is a reminder notice generated by the GST system when returns like GSTR-3B, GSTR-4 (for composition taxpayers), or other relevant forms are not filed by their respective due dates. GSTR-3A does not involve filling out tax details; rather, it asks the taxpayer to file their pending return and settle any dues.

- GSTR-3B: GSTR-3B requires taxpayers to report total taxable value, claim ITC, and calculate the tax liability for the month. It involves providing a summary of sales (outward supplies), purchases (inward supplies), and taxes payable. Taxpayers must pay the amount due at the time of filing GSTR-3B.

3. Timing and Filing Frequency

- GSTR-3A: GSTR-3A is generated and issued by the GST authorities only when the taxpayer fails to file their return on time. It is not a regular return but a notice sent after the due date of the relevant GST return.

- GSTR-3B: GSTR-3B is filed monthly by regular taxpayers or quarterly for taxpayers under the QRMP (Quarterly Return Filing and Monthly Payment of Taxes) scheme. It must be filed on or before the 20th of the following month to avoid penalties.

4. Consequences of Non-Compliance

- GSTR-3A: If a taxpayer ignores the GSTR-3A notice and fails to file the return within the given time (usually 15 days), the authorities may conduct a best judgment assessment under Section 62 of the CGST Act. This can result in higher tax liabilities, late fees, interest, and even legal action such as the seizure of goods or bank accounts.

- GSTR-3B: Non-filing of GSTR-3B leads to the imposition of late fees and interest on the outstanding tax liability. Late fees are ₹100 per day for CGST and SGST each, and the interest on unpaid taxes is 18% per annum. In case of consistent non-compliance, the taxpayer may also face a GSTR-3A notice, escalating the issue.

5. Filing Process

- GSTR-3A: GSTR-3A does not involve filing details directly; it is simply a reminder to file the overdue returns such as GSTR-3B. Taxpayers who receive a GSTR-3A notice must log in to the GST portal and file the missed return (e.g., GSTR-3B) for the specific period.

- GSTR-3B: GSTR-3B must be filed online through the GST portal. Taxpayers need to provide data on their sales, purchases, input tax credits, and tax payable for the relevant period. After entering these details, they must pay the GST due and submit the form before the deadline.

Conclusion

GSTR-3A is a crucial part of the GST compliance system, serving as a formal notice issued to taxpayers who have not filed their returns on time. It is a reminder from the GST authorities to ensure that businesses adhere to their tax filing obligations promptly and avoid legal and financial consequences.

Key Takeaways

- Understanding GSTR-3A: GSTR-3A is a formal notice issued by GST authorities to remind taxpayers of their missed filing deadlines. It is not a return but a warning about the consequences of non-compliance.

- Prompt Action Required: Taxpayers must respond to the GSTR-3A notice within 15 days by filing the overdue returns and paying any outstanding taxes, penalties, or interest to avoid further legal actions.

- Consequences of Ignoring: Failing to address the GSTR-3A notice can lead to severe consequences, including best judgment assessments, increased tax liabilities, and potential cancellation of GST registration.

- Importance of Compliance: Maintaining timely compliance with GST filing obligations is crucial to avoid penalties, interest charges, and legal troubles. Regular filing and proper financial record-keeping can prevent the issuance of GSTR-3A notices.

- Utilizing the GST Portal: Taxpayers should regularly check the GST portal for notifications, reminders, and updates regarding their filing status to stay informed and compliant.

- Professional Help: Seeking assistance from GST consultants or tax professionals can help navigate the complexities of GST filing and ensure timely compliance, especially for businesses facing financial difficulties.

FAQs

- What is GSTR-3A?

GSTR-3A is a notice issued by the GST authorities when a taxpayer fails to file their GST returns on time. It is not a return but rather a formal reminder to file overdue returns and pay any pending tax liabilities along with applicable penalties and interest.

- Who Receives a GSTR-3A Notice?

Any taxpayer who is registered under GST and fails to file their required GST returns, such as GSTR-3B or GSTR-4, will receive a GSTR-3A notice. It applies to all categories of taxpayers, including regular taxpayers, composition dealers, and others who are required to file GST returns.

- What Should I Do After Receiving a GSTR-3A Notice?

Upon receiving a GSTR-3A notice, the taxpayer must immediately file the pending GST returns and pay any outstanding taxes along with the applicable late fees and interest. This must be done within 15 days of receiving the notice to avoid further penalties or legal actions, such as assessment under Section 62.

- What Happens if I Do Not File the Return Within 15 Days of Receiving the GSTR-3A Notice?

If the taxpayer fails to file the return within 15 days, the GST authorities may initiate a best judgment assessment under Section 62 of the CGST Act. This means the tax department will assess the taxpayer’s liability based on available data, and the taxpayer may end up owing higher taxes, penalties, and interest.

- Can I File the Return After 15 Days?

Yes, you can still file the return after the 15-day window, but it must be done before the assessment order is issued by the tax authorities. If the return is filed before the assessment order, the GSTR-3A notice may be withdrawn, but penalties and interest will still apply.

- What is the Late Fee for Non-Filing of Returns?

The late fee for failing to file GST returns is ₹100 per day under CGST and ₹100 per day under SGST, totaling ₹200 per day. For composition taxpayers, the late fee is reduced to ₹50 per day (₹25 CGST + ₹25 SGST). The maximum limit for late fees is ₹5,000.

- What is the Interest for Late Payment of Tax?

If a taxpayer has an outstanding tax liability and delays the payment, they will be charged 18% interest per annum on the unpaid amount. The interest is calculated from the due date of the return until the actual payment is made.

- Can the Department Cancel My GST Registration for Not Filing Returns?

Yes, if a taxpayer continuously fails to file GST returns, the authorities can issue a show-cause notice for the cancellation of GST registration. If the taxpayer does not regularize their compliance, the GST registration may be canceled, which can significantly impact business operations.

- Will I Receive Any Notification from the GST Portal Before the GSTR-3A Notice?

Yes, the GST portal sends multiple reminders to taxpayers via SMS and email before the due date of filing the return. If the return is not filed by the due date, another reminder is sent immediately after the deadline. If the return is still not filed, the GSTR-3A notice is issued.

- What Happens if My GST Registration is Canceled?

If your GST registration is canceled, you are no longer authorized to collect GST from customers or claim Input Tax Credit (ITC). You will need to file GSTR-10 (the final return) to settle your liabilities, and you may need to reapply for registration if you wish to restart your business under the GST framework.

- What is the Difference Between GSTR-3A and GSTR-3B?

GSTR-3A is a notice issued for non-filing of returns, whereas GSTR-3B is a monthly self-declaration return that taxpayers are required to file, summarizing their tax liability for a specific period. GSTR-3B must be filed on time to avoid receiving a GSTR-3A notice.

- Will I Be Penalized if I File a Return After Receiving a GSTR-3A Notice?

Yes, if you file the return after the due date, you will be liable to pay late fees and interest. However, filing the return before the assessment order is issued can prevent further legal action, such as asset seizure or registration cancellation.

- Can I Request to Pay GST in Installments?

Yes, if a taxpayer is unable to pay their outstanding GST liability in one go, they can apply to the GST Commissioner to pay in installments. This request must be made before any legal action is initiated, and it is subject to approval by the tax authorities. Installments can be spread over a maximum of 24 months.

- Can I File Returns If My GST Registration is Canceled?

Even if your GST registration has been canceled, you are still required to file any pending returns and pay any outstanding tax liabilities. Failure to do so may lead to further penalties and legal proceedings.

- What if I Receive a GSTR-3A Notice but Have Already Filed My Returns?

If you believe you have already filed your returns but still receive a GSTR-3A notice, you should immediately check your GST filing status on the portal. If it is an error, you can contact the GST helpdesk or raise a ticket on the GST portal to resolve the issue.