GSTR-4 is an annual return that must be filed by taxpayers who have opted for the GST Composition Scheme. This scheme was introduced under the Goods and Services Tax (GST) to simplify the tax filing process for small businesses. Instead of filing monthly returns like regular taxpayers, businesses under the Composition Scheme can file a single return annually in the form of GSTR-4. This eases compliance and reduces the administrative burden, making it particularly beneficial for small and medium enterprises (SMEs), manufacturers, traders, and restaurant owners.

Under the Composition Scheme, taxpayers pay tax at a fixed rate based on their turnover, without the need to maintain detailed records of every transaction. However, while the tax payments are made quarterly through the CMP-08 form, GSTR-4 consolidates the taxpayer’s annual financial data, covering details of inward and outward supplies, tax paid, and any changes from previous returns. Filing GSTR-4 on time ensures businesses remain compliant with GST regulations, avoid penalties, and maintain smooth business operations.

In this guide, we’ll walk you through everything you need to know about GSTR-4, including eligibility criteria, filing deadlines, penalties, and the step-by-step process of filing the return.

What is GSTR-4?

GSTR-4 is an annual GST return specifically designed for taxpayers who have opted for the Composition Scheme. This scheme offers simplified tax compliance for small businesses by allowing them to file just one annual return instead of multiple monthly returns required by regular taxpayers. The key objective of GSTR-4 is to consolidate the taxpayer’s annual financial data, ensuring that all inward and outward supplies, taxes paid, and any relevant adjustments are reported in a single form.

The Composition Scheme is aimed at reducing the compliance burden for small businesses, with a lower tax rate and less frequent filings. However, it’s important to note that taxpayers under this scheme cannot claim Input Tax Credit (ITC), and they must issue a “Bill of Supply” instead of a tax invoice since they are not allowed to charge GST from their customers.

GSTR-4 provides a complete picture of a business’s transactions for the financial year, including purchases, sales, and tax liabilities. By filing this return, businesses ensure that they meet the legal requirements of GST and avoid penalties associated with late or non-filing.

The return must be filed by April 30th of the following financial year, and it consolidates the tax payments made quarterly through the CMP-08 form. It covers various sections, such as turnover details, inward and outward supplies, tax paid, and amendments to previous returns, making it a comprehensive document for businesses under the Composition Scheme.

Who Should File GSTR-4?

GSTR-4 must be filed by all taxpayers registered under the GST Composition Scheme. This scheme is designed for small businesses, manufacturers, traders, and certain service providers who want to reduce their compliance burden. It allows them to pay tax at a fixed rate of turnover instead of the normal GST rates applicable to regular taxpayers.

Eligibility for Filing GSTR-4:

- Turnover Limit: Businesses with an annual aggregate turnover of up to ₹1.5 crores can opt for the Composition Scheme in most states. For service providers, the turnover limit is ₹50 lakhs.

- Types of Businesses: Small businesses engaged in the supply of goods, manufacturers (except those producing items like tobacco, ice cream, etc.), and restaurants (excluding those serving alcohol) are eligible.

- Intra-state Suppliers Only: Composition dealers can only make intra-state supplies, meaning their goods and services are restricted to within the state. Interstate suppliers are not eligible for the scheme.

- Certain Exclusions: Businesses engaged in making supplies through e-commerce platforms or providing non-restaurant services cannot opt for the Composition Scheme.

Who Shouldn’t File GSTR-4?

Not every GST taxpayer qualifies for the Composition Scheme, and hence, not everyone needs to file GSTR-4. The following categories are exempt:

Non-resident taxable persons.

Casual taxable persons.

TCS/TDS deductors.

Input service distributors.

Businesses providing Online Information Database Access and Retrieval (OIDAR) services.

Nil GSTR-4 Filing: If a composition dealer has not conducted any business during the financial year and has no inward or outward supplies, they are still required to file a Nil GSTR-4 return. This ensures that the taxpayer complies even if there are no transactions during the year.

By ensuring only eligible taxpayers under the Composition Scheme file GSTR-4, the system streamlines compliance and reduces the complexities involved in GST filing for small businesses.

What is the Due Date for Filing GSTR-4?

The due date for filing GSTR-4 is April 30th of the financial year following the one for which the return is being filed. This means that for any financial year, taxpayers under the Composition Scheme are required to file their GSTR-4 by April 30th of the next financial year.

While the tax payments for composition taxpayers are made quarterly through CMP-08, GSTR-4 is a consolidated annual return that summarizes the entire year’s transactions, including inward and outward supplies, tax liabilities, and adjustments from previous filings.

GSTR-4 Filing Extensions and Compliance Reminders: The GST Council may extend the due dates under specific circumstances, such as during the COVID-19 pandemic when certain deadlines were extended to provide relief to businesses. However, taxpayers are advised to ensure timely filing to avoid late fees and penalties.

Consequences of Missing the GSTR-4 Due Date: Failing to file GSTR-4 by the due date can lead to financial penalties:

- Late Fee for Regular Returns: A late fee of ₹200 per day (₹100 CGST + ₹100 SGST) is applicable, subject to a maximum of ₹5,000.

- Late Fee for Nil Returns: For Nil returns, the late fee is reduced to ₹20 per day (₹10 CGST + ₹10 SGST), subject to a maximum of ₹500.

- Interest: In addition to late fees, an interest of 18% per annum is charged on any outstanding tax liability, calculated from the due date until the actual date of payment.

It’s crucial to file the return on time not just to avoid penalties but also to maintain compliance with GST regulations. Failure to file GSTR-4 could also impact a taxpayer’s ability to file subsequent returns and cause complications in the business’s financial records.

What is the Format of GSTR-4?

The GSTR-4 is a quarterly return that composition taxpayers in India need to file. It covers details of inward and outward supplies made during the quarter. Below is the format and key sections of GSTR-4:

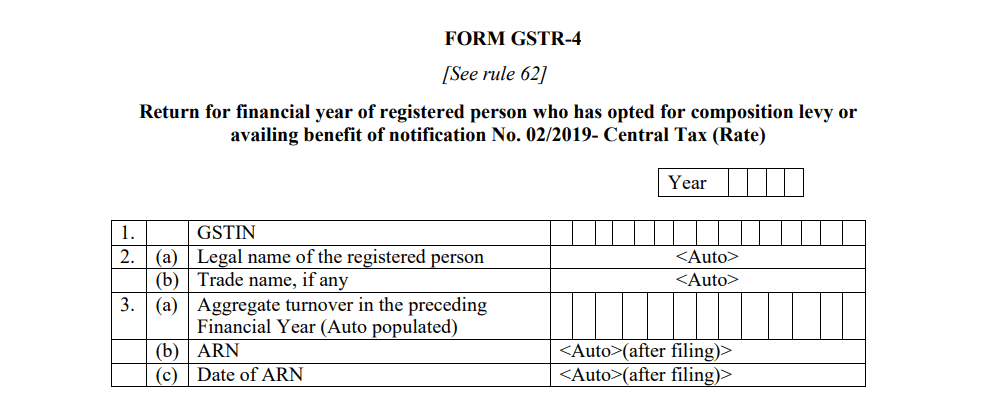

1. Basic Details

- GSTIN (Goods and Services Tax Identification Number)

- Legal name of the registered person

- Trade name (if any)

- Composition scheme applicability date

- Aggregate turnover in the previous year (optional)

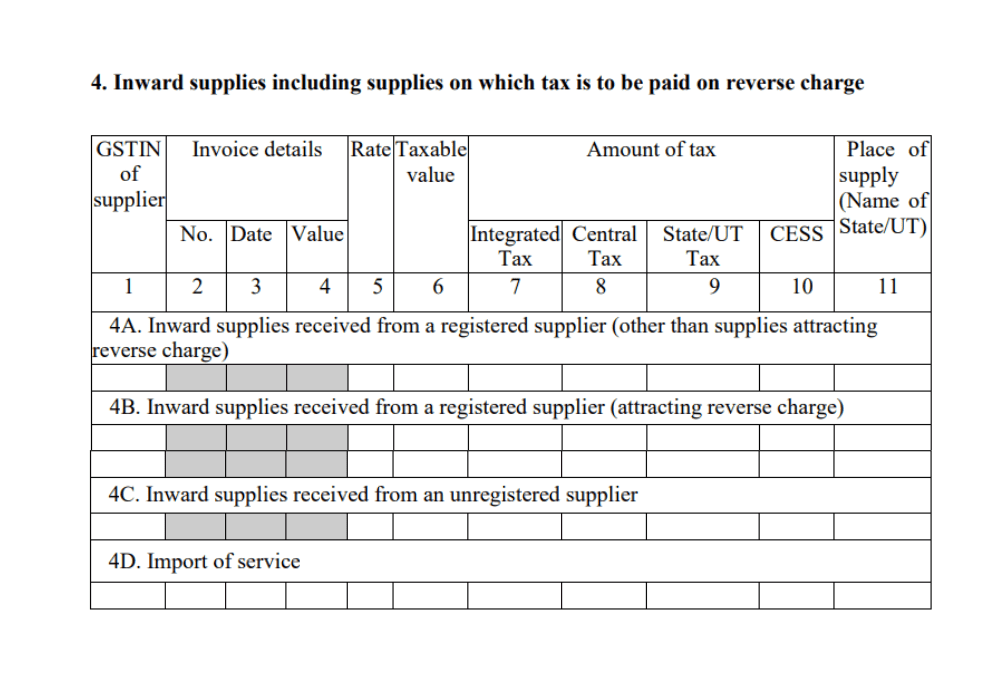

2. Inward Supplies (Received from Registered and Unregistered Persons)

- Details of purchases and supplies received from registered and unregistered dealers.

- Separate sections for supplies received from registered dealers (liable to reverse charge) and those from unregistered dealers.

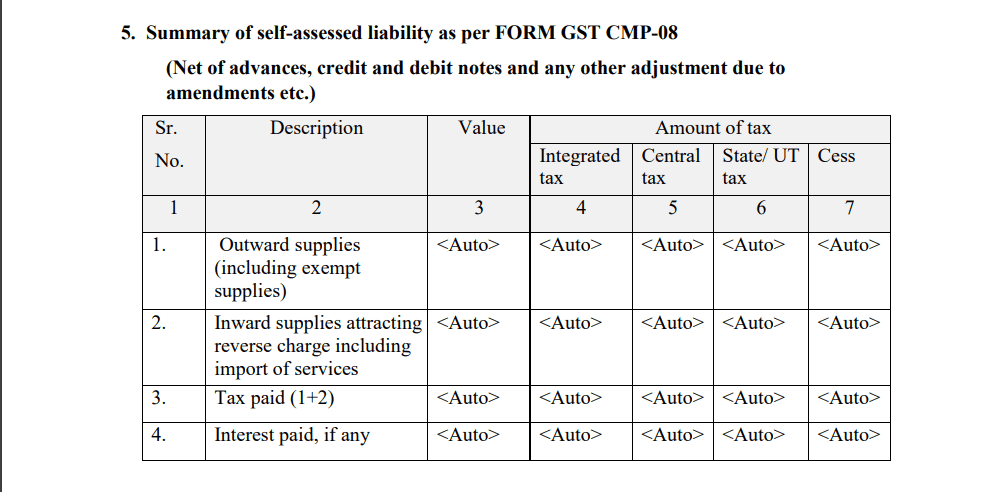

3. Summary of self assessed liabilities as per Form GST CMP-08

- Summary of taxable outward supplies made.

- This includes turnover details of exempted, nil-rated, and non-GST outward supplies.

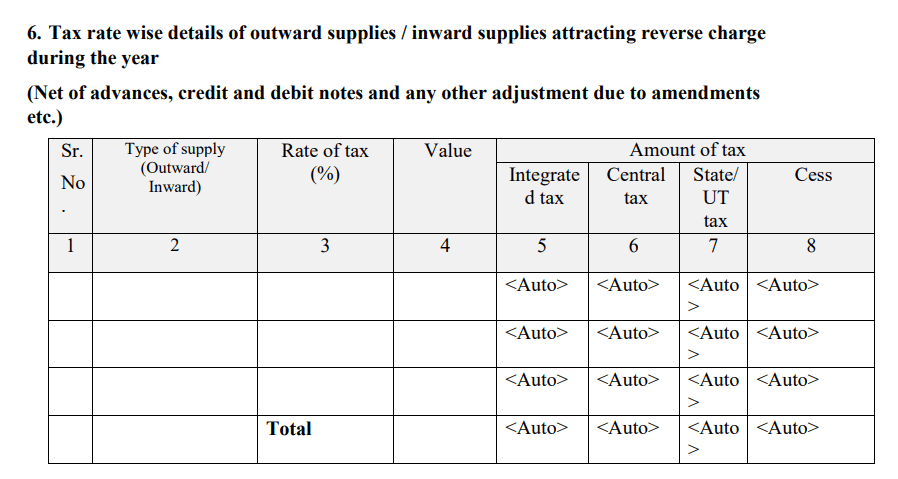

4. Tax rated wise detail of outward supplies/inward supplies attracting reverse charge during the year

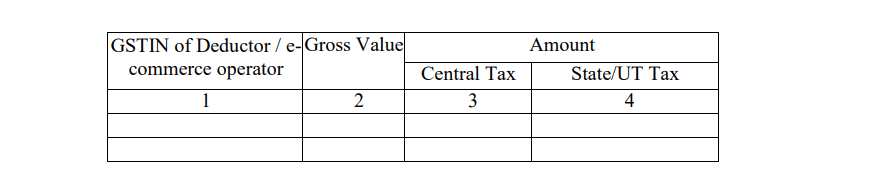

5. TDS/TCS Credit received

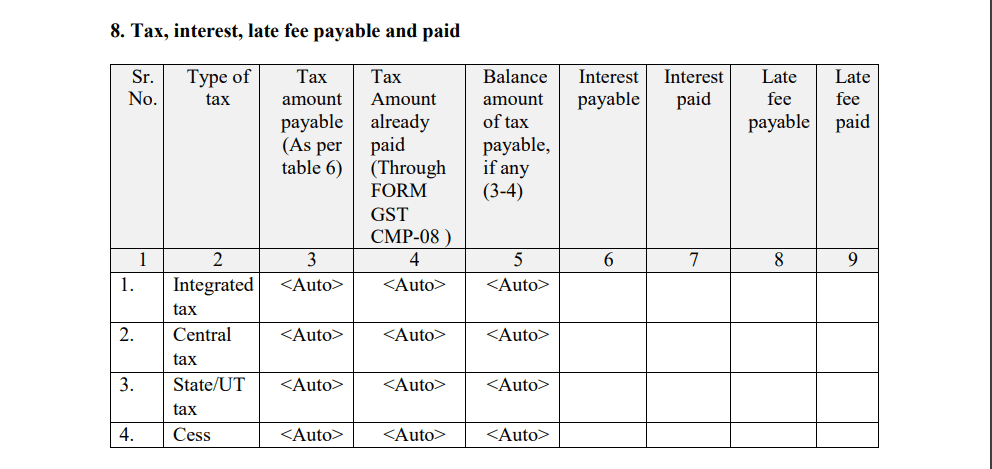

6. Interest, Late Fees, and Penalties

- If applicable, details of any interest, late fees, or penalties payable.

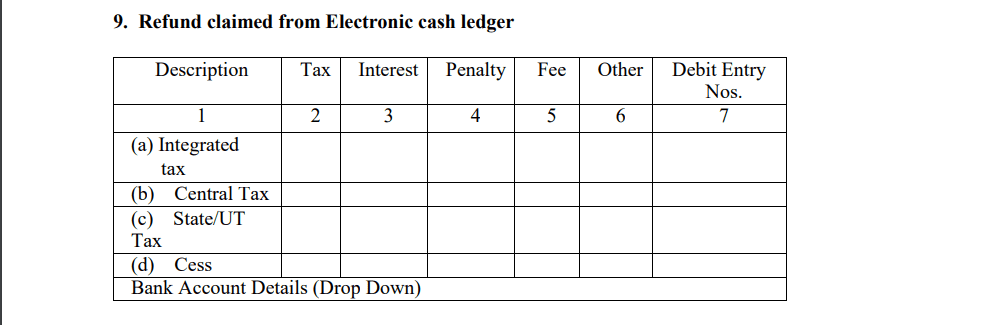

7. Refund Claimed from Electronic Cash Ledger (If any)

- Summary of refund claimed (if any) from the electronic cash ledger.

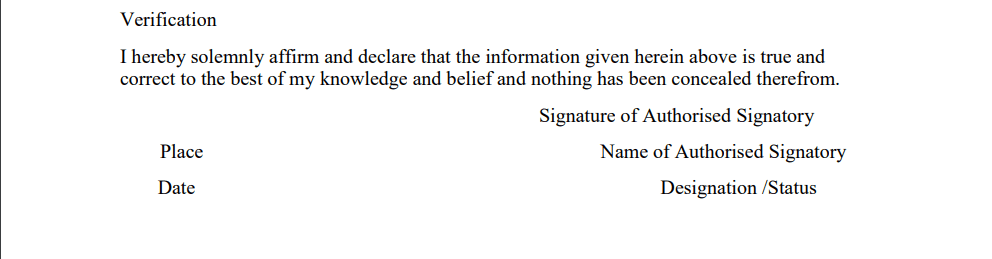

8. Verification

- A declaration that the information provided is correct and complete.

- Digital signature or authentication by an authorized person.

This format ensures compliance with the GST law and helps composition taxpayers file their quarterly returns efficiently.

Key Points to Remember:

– Once GSTR-4 is filed, it cannot be revised.

– Negative values are allowed for amendments to inward supplies.

– The return must be filed even if there is no business activity (Nil Return).

Prerequisites for Filing GSTR-4

Before you can proceed with filing GSTR-4, there are certain prerequisites that must be met to ensure a smooth filing process. Ensuring that all conditions are fulfilled beforehand can help avoid errors, delays, or potential penalties.

Here are the key prerequisites for filing GSTR-4:

- Opting for the Composition Scheme:

The taxpayer must have opted for the GST Composition Scheme. This scheme is available to small businesses with a turnover of up to ₹1.5 crore (or ₹75 lakhs in special category states), and for service providers with a turnover limit of ₹50 lakhs.

- Filing of CMP-08 for All Quarters:

Composition taxpayers are required to file CMP-08 quarterly, which is a statement-cum-challan used to declare their self-assessed tax liability and make tax payments for the quarter. GSTR-4 consolidates these quarterly filings, so all CMP-08 forms for the financial year must be filed before submitting GSTR-4.

- Maintaining Proper Records:

Accurate and detailed records of inward and outward supplies are necessary to file GSTR-4. This includes purchases from registered and unregistered suppliers, sales made during the financial year, and any reverse charge transactions.

Composition taxpayers must maintain records of their sales and purchases to ensure that the details in GSTR-4 are accurate and complete.

- Payment of All Outstanding Tax Liabilities:

Any outstanding tax, interest, or late fees should be paid before filing GSTR-4. If the taxpayer has not made the necessary payments through CMP-08, they need to clear all dues before proceeding with the annual filing.

If there’s insufficient balance in the electronic cash ledger, the taxpayer will need to create a challan to make the payment.

- Aggregate Turnover for the Previous Financial Year:

The taxpayer must have the exact details of their aggregate turnover for the previous financial year ready, as this information needs to be entered in GSTR-4. The turnover details will affect the overall tax calculation, so they must be precise.

- GST Portal Login Credentials:

Ensure that you have the necessary login credentials to access the GST portal. Without these, you cannot proceed with the online filing process.

- Digital Signature Certificate (DSC) or Electronic Verification Code (EVC):

For businesses or individuals required to file returns with DSC or EVC, ensure that these are active and ready to use. The return cannot be submitted without proper verification.

- TDS/TCS Credit Details (if applicable):

Suppose the taxpayer has received any Tax Deducted at Source (TDS) or Tax Collected at Source (TCS) credits during the financial year. In that case, they should be aware of the details, as this information will be auto-populated in GSTR-4.

By ensuring these prerequisites are met, taxpayers can avoid complications and ensure that their GSTR-4 filing is accurate, complete, and timely. This will help avoid penalties and maintain compliance with GST regulations.

Step-by-Step Guide to Filing GSTR-4 Online

Filing GSTR-4 online through the GST portal is a straightforward process if all the necessary details and prerequisites are in place.

Below is a step-by-step guide to help composition taxpayers file their GSTR-4 return efficiently:

Step 1: Log in to the GST Portal

- Visit the GST portal.

- Enter your GSTIN (Goods and Services Tax Identification Number), username, and password to log in.

- Complete the CAPTCHA verification and click Login.

- Once logged in, go to the Services section in the main menu.

- From there, select Returns and then click on Annual Return.

- In the Annual Return section, choose GSTR-4 from the available options.

Step 3: Select the Relevant Financial Year

- A drop-down menu will appear, prompting you to select the financial year for which you are filing the return.

- Select the applicable year and proceed.

Step 4: Click on ‘Prepare Online’

- After selecting the financial year, click on the Prepare Online button under GSTR-4.

- If you are filing a Nil return (no business activity during the year), select the option to file

- Nil GSTR-4.

Step 5: Enter Aggregate Turnover for the Previous Financial Year

- The system will prompt you to enter the aggregate turnover for the previous financial year.

- Ensure that the turnover details are accurate, as this information will be used to calculate your tax liability.

Step 6: Enter Details of Inward and Outward Supplies

- Fill in the required details for each section:

- Inward Supplies (Table 4): Enter details of all purchases (inward supplies) made during the year, including from registered suppliers, unregistered suppliers, and any import of services.

- Outward Supplies (Table 6): Provide details of your sales (outward supplies) for the year, including any reverse charge liabilities.

- Make sure to enter data in the correct tables (as per the GSTR-4 format), and double-check for any discrepancies.

Step 7: Review Auto-populated Sections

- Certain sections, such as the Summary of CMP-08 payments (Table 5), will be auto-populated with data from the quarterly CMP-08 forms you have already filed.

- Similarly, details related to TDS/TCS credit received (Table 7) will be auto-filled if applicable.

- Review these sections carefully to ensure accuracy.

Step 8: Pay Any Outstanding Tax Liabilities

- If your electronic cash ledger does not have sufficient funds to cover your tax liability, you will need to create a challan and pay the balance before proceeding.

- Option 1: If your cash ledger has sufficient balance, the tax will be adjusted automatically.

- Option 2: If there is an outstanding liability, generate a challan by clicking on Create Challan, make the payment, and then proceed.

- Ensure that all applicable taxes, interest, and late fees are paid before submission.

Step 9: Preview and Verify the Return

- Before final submission, you can preview the GSTR-4 form. Download the form in PDF or Excel format and thoroughly check all details to ensure everything is accurate.

- Make sure that all entries for inward supplies, outward supplies, and tax liabilities are correct, as GSTR-4 cannot be revised once filed.

Step 10: File the Return Using DSC/EVC

- Once all details are verified and payments are made, proceed to file the return:

- If you are required to use a Digital Signature Certificate (DSC), attach it and complete the filing process.

- Alternatively, you can verify using an Electronic Verification Code (EVC).

- After submitting, you will receive an Application Reference Number (ARN) as confirmation that your return has been successfully filed.

Step 11: Acknowledgment

- Upon successful submission, you will receive a confirmation message on the portal, as well as an acknowledgment email and SMS.

- You can download the filed GSTR-4 return for your records.

By following these steps, taxpayers can file their GSTR-4 return accurately and on time, ensuring compliance with GST regulations.

Common Errors and Corrections in GSTR-4

While filing GSTR-4, it’s important to ensure accuracy in the information provided, as errors or omissions can lead to non-compliance, penalties, and complications in future filings. Here are some common errors that taxpayers make when filing GSTR-4 and how to correct them:

1. Incorrect Turnover Details

- Common Error: Taxpayers often make mistakes when reporting the aggregate turnover for the previous financial year. Misreporting turnover can lead to an incorrect tax liability calculation.

- Correction: Double-check your records to ensure the aggregate turnover matches the sales recorded for the financial year. Use accurate sales data and verify the information before filing.

2. Missing Inward or Outward Supply Details

- Common Error: Not reporting all inward and outward supplies accurately, especially those subject to reverse charge, can result in discrepancies. Some taxpayers may forget to include supplies from unregistered suppliers or import of services.

- Correction: Review your purchase and sales records thoroughly to ensure that all supplies are captured. Specifically, make sure to report inward supplies from registered suppliers (with and without reverse charge) and from unregistered suppliers.

3. Incorrect Application of Tax Rates

- Common Error: Taxpayers sometimes apply the wrong tax rates when reporting outward supplies or reverse charge inward supplies.

- Correction: Cross-check the applicable tax rates (CGST, SGST, IGST, and Cess) based on the nature of the supplies. Ensure that you have applied the correct tax rates as per the latest GST regulations.

4. Non-reconciliation of CMP-08 Data

- Common Error: Data reported in GSTR-4 should match the details declared in the quarterly CMP-08 filings. If there is a mismatch, it could lead to discrepancies in the overall tax liability.

- Correction: Before filing GSTR-4, review the CMP-08 statements for each quarter and ensure that the totals reconcile with the data entered in GSTR-4.

5. Failure to Pay Outstanding Tax Liabilities

- Common Error: Some taxpayers forget to pay any outstanding tax liabilities, interest, or late fees before filing, which can result in an incomplete submission.

- Correction: Check your electronic cash ledger to ensure that you have sufficient balance to pay any outstanding taxes. If required, generate a challan and pay the dues before submitting the return.

6. Incorrect Information in Auto-Populated Fields

- Common Error: The GSTR-4 form auto-populates certain fields, such as TDS/TCS credit received and CMP-08 payments. Occasionally, these fields may contain errors if previous filings were incorrect.

- Correction: Review all auto-populated fields carefully. If any discrepancies are found, ensure that they are addressed before proceeding with the filing. Amendments may need to be made to previous returns to correct the auto-populated data.

7. Misreporting of Amendments

- Common Error: Taxpayers sometimes forget to report amendments made to previous inward or outward supplies, leading to discrepancies between filings.

- Correction: Use the Amendments section in GSTR-4 to correct any errors from previous filings. Ensure that all adjustments are accurately recorded in the relevant tables.

8. Filing GSTR-4 Without Reviewing

- Common Error: Submitting GSTR-4 without previewing and reviewing the form for errors can lead to mistakes being filed with the GST authorities.

- Correction: Always preview the form by downloading it in PDF or Excel format before filing. Carefully review the details for accuracy, especially tax liabilities, supply details, and payments.

Can GSTR-4 Be Revised?

Unfortunately, GSTR-4 cannot be revised once it has been submitted. This makes it crucial to ensure that all the information entered is accurate before final submission. If any errors are discovered after filing, they must be corrected in the next financial year’s return.

How to Correct Errors After Filing GSTR-4?

If you’ve made an error in your GSTR-4 filing that cannot be corrected immediately, you can make adjustments or amendments in the following financial year’s GSTR-4 return. Here’s how:

- Use the Amendment Tables in the subsequent GSTR-4 filing to rectify any errors made in the previous return.

- Ensure that you maintain proper documentation and records to support any amendments made.

By staying vigilant and taking care of these common issues, composition taxpayers can avoid errors in their GSTR-4 filing, ensuring a smooth and compliant GST filing experience.

Late Fees and Penalties for Non-Filing of GSTR-4

Filing GSTR-4 on time is crucial for businesses under the Composition Scheme to avoid financial penalties and maintain compliance with GST regulations. Failing to file by the due date can result in late fees, interest, and restrictions on future filings. Here’s an overview of the penalties and consequences for late or non-filing of GSTR-4:

1. Late Fees for Non-Filing or Late Filing of GSTR-4

When GSTR-4 is not filed on time, the taxpayer becomes liable to pay a late fee. The late fee is calculated on a daily basis until the return is filed, subject to a maximum limit.

- For Regular Returns:

- Late Fee: ₹200 per day (₹100 CGST + ₹100 SGST), up to a maximum of ₹5,000.

- This penalty applies for each day the return remains unfiled after the due date (April 30th of the following financial year).

- For Nil Returns:

- Late Fee: ₹20 per day (₹10 CGST + ₹10 SGST), subject to a maximum of ₹500.

- This reduced penalty applies if the taxpayer has no business transactions during the financial year and is filing a Nil return.

It’s important to note that these penalties accumulate daily until the return is filed, but they are capped at the maximum limits mentioned above.

2. Interest on Outstanding Tax Liability

In addition to the late fee, taxpayers who have any outstanding tax liability at the time of filing will be charged interest on the unpaid amount.

- Interest Rate: 18% per annum on the unpaid tax amount.

- Interest Calculation: The interest is calculated from the due date (April 30th) until the date the outstanding taxes are paid.

For example, if a taxpayer has an outstanding tax liability of ₹10,000 and delays payment for 30 days, the interest payable will be ₹10,000 x 18% / 365 x 30 days = ₹147.95.

3. Impact of Non-Filing of GSTR-4

Failing to file GSTR-4 on time can have significant consequences beyond financial penalties:

- Inability to File Future Returns: If GSTR-4 is not filed, the taxpayer may be restricted from filing future GST returns, including the next financial year’s returns. This can lead to further complications with compliance.

- Restrictions on E-way Bill Generation: Non-filing of GSTR-4 may also block the generation of e-way bills, which are required for the transport of goods in certain cases. This can disrupt business operations, especially for taxpayers involved in the movement of goods.

- Loss of GST Composition Scheme Eligibility: Continuous failure to comply with GSTR-4 filing requirements could result in the taxpayer being ineligible for the Composition Scheme in the future, forcing them to switch to regular GST filings, which are more complex and frequent.

Timely filing of GSTR-4 ensures that composition taxpayers avoid these penalties, maintain compliance, and keep their business operations running smoothly.

Key Differences Between GSTR-4 and CMP-08

Here’s a table outlining the key differences between GSTR-4 and CMP-08:

| Aspect | GSTR-4 | CMP-08 |

|---|---|---|

| Purpose | Annual return for composition dealers. | Quarterly statement for tax payment by composition dealers. |

| Filing Frequency | Annually (once a year). | Quarterly (four times a year). |

| Details Required | Summary of outward supplies, inward supplies, taxes paid, and ITC claimed. | Summary of self-assessed tax liability on outward supplies. |

| Due Date | 30th April of the following financial year. | 18th of the month following the quarter. |

| Form Type | Return form for composition dealers. | Statement-cum-challan for tax payment. |

| Filing Objective | To report the overall business activities and tax liabilities for the entire year. | To declare tax liabilities and make tax payments for the quarter. |

| Amendments | Cannot amend after submission. | Cannot amend after submission. |

| Late Fees & Penalties | Late fees applicable for delayed filing. | Late fees and interest applicable for delayed tax payment. |

Frequently Asked Questions (FAQs) on GSTR-4

Here are some of the most commonly asked questions about GSTR-4, which will help provide clarity on the filing process, penalties, and other aspects of this annual return for composition taxpayers:

- Is GSTR-4 mandatory for all composition taxpayers?

Yes, filing GSTR-4 is mandatory for all taxpayers registered under the GST Composition Scheme, regardless of whether there were any transactions during the financial year. Even if no business activity took place, a Nil GSTR-4 must be filed.

- Can GSTR-4 be revised after filing?

No, GSTR-4 cannot be revised once it has been submitted. If any errors are discovered after filing, they must be corrected in the next financial year’s GSTR-4 return by using the Amendments section.

- What happens if GSTR-4 is not filed on time?

Failing to file GSTR-4 by the due date (April 30th of the following financial year) will result in:- Late fees: ₹200 per day (₹100 CGST + ₹100 SGST) for regular returns, subject to a maximum of ₹5,000.

- For Nil returns, the late fee is ₹20 per day (₹10 CGST + ₹10 SGST), capped at ₹500.

- Interest: 18% per annum on any outstanding tax liability.

- Additionally, non-filing can lead to the blocking of future return filings and e-way bill generation.

- Who is not required to file GSTR-4?

The following categories of taxpayers are not required to file GSTR-4:- Non-resident taxable persons.

- Casual taxable persons.

- TCS/TDS deductors.

- Input service distributors.

- Suppliers of Online Information Database Access and Retrieval (OIDAR) services.

- Is it mandatory to file GSTR-4 if I was registered under the Composition Scheme for only a part of the financial year?

Yes, if you were registered under the Composition Scheme for any part of the financial year, you are required to file GSTR-4 for that period, even if you later switched to the regular scheme or canceled your registration.

- Do I need to file GSTR-4 if I have no transactions during the financial year?

Yes, you must file a Nil GSTR-4 if there were no transactions (no inward or outward supplies) during the financial year. Failing to file Nil GSTR-4 can also attract penalties.

- What is the due date for filing GSTR-4?

The due date for filing GSTR-4 is April 30th of the financial year following the one for which the return is being filed. For example, GSTR-4 for FY 2023-24 must be filed by April 30, 2025.

- How can I preview GSTR-4 before filing?

Before submitting GSTR-4, you can preview the return by downloading it in PDF or Excel format from the GST portal. This allows you to check the details for accuracy and ensure that all required information has been entered correctly.

- Can GSTR-4 be filed offline?

Yes, the GSTR-4 offline tool is available for taxpayers to prepare their returns. You can download the tool from the GST portal, fill in the required details offline, and then upload the JSON file to the portal for submission.

- What if I do not have sufficient balance in my electronic cash ledger?

If you do not have enough balance in your electronic cash ledger to cover your tax liability, you can create a challan through the GST portal and pay the outstanding amount before filing GSTR-4.

- What should I do if I receive error messages during the filing process?

Error messages during the filing process can occur due to incorrect data entry or discrepancies in auto-populated fields. You should carefully review the form, correct any errors, and re-submit. If the error persists, it may be helpful to contact the GST helpdesk for support.

- How can I view and download my filed GSTR-4?

After filing GSTR-4, you can view and download the filed return by logging into the GST portal and navigating to the Returns Dashboard. Select the relevant financial year and GSTR-4, then click Download to retrieve a copy of the filed return.

- What if I need to make changes to my GSTR-4 after filing?

Since GSTR-4 cannot be revised after submission, any changes or amendments must be made in the next financial year’s GSTR-4 return. This can be done through the Amendment Tables.

- Is a CA certification required for filing GSTR-4?

No, there is no requirement for a Chartered Accountant (CA) certification to file GSTR-4. Taxpayers can file the return on their own through the GST portal or with the help of a tax professional.

Conclusion

Filing GSTR-4 is crucial for all composition taxpayers to stay compliant with GST regulations. Timely and accurate filing not only avoids penalties but also helps maintain smooth business operations.

Key Takeaways:

– GSTR-4 is an annual return for composition taxpayers, consolidating financial data for the year.

– Quarterly tax payments are made through CMP-08, but GSTR-4 provides a year-end summary.

– Even Nil returns must be filed to avoid penalties.

– Errors can only be corrected in the next financial year.

– Staying updated with due dates ensures compliance and helps avoid late fees.