Understanding the complexities of the Goods and Services Tax (GST) can be challenging, especially for businesses with multiple branches. One crucial aspect of the GST framework is the GSTR-6 return, which is specifically designed for Input Service Distributors (ISDs). Understanding GSTR-6 is essential for ISDs as it governs the distribution of Input Tax Credit (ITC) among various units within a business.

GSTR 6 serves not just as a compliance requirement but also as a strategic tool for optimizing tax liabilities. By accurately filing this return, businesses can ensure they make the most of their eligible ITC, which directly impacts their overall financial health.

GSTR-6 plays a vital role in ensuring accurate ITC distribution among branches, promoting transparency in tax reporting, and maintaining audit-ready documentation. Timely filing helps businesses stay compliant with GST regulations, reducing the risk of penalties or legal issues.

In this blog, we will delve into the details of GSTR-6, covering everything from its definition and eligibility criteria to filing processes, common challenges, and best practices.

What is GSTR-6?

Definition of GSTR-6

GSTR-6 is a monthly return that must be filed by Input Service Distributors (ISDs) under the Goods and Services Tax (GST) regime in India. This form captures vital information related to the Input Tax Credit (ITC) received by the ISD and outlines how this credit is distributed among various branches or units of the organization. GSTR-6 is crucial for ensuring that tax credits are accurately allocated based on the services utilized across different locations, thereby maintaining compliance with GST regulations.

Who is the Input Service Distributor?

An ISD is an office of a business that receives invoices for services used by its branches or units and distributes the credit of the tax paid on those services (known as Input Tax Credit) to its other branches or units.

Suppose a large retail chain, “Urban Styles,” has multiple stores across India. The head office, based in Mumbai, hires an advertising agency to run nationwide campaigns. The agency sends the GST invoice to the head office, which pays the tax.

Since the head office isn’t the only location benefiting from the advertising, it acts as an Input Service Distributor (ISD). It calculates the appropriate portion of the Input Tax Credit (ITC) for each branch (like Delhi, Bangalore, and Chennai) that benefits from the advertising, then distribute the credit to each branch based on their share. This way, each branch receives its fair share of the tax credit, centralizing and streamlining the tax process for the entire company.

Purpose of GSTR-6 in the GST Regime

The primary purpose of GSTR-6 is to facilitate the effective distribution of ITC among the units of an organization. Here are some key objectives of this return:

- Ensure Transparency: GSTR-6 promotes transparency in the distribution of tax credits, ensuring that all branches receive their rightful share of ITC based on the services consumed.

- Enhance Compliance: By mandating ISDs to file this return, the GST regime aims to enhance compliance among businesses, helping them adhere to tax laws and avoid penalties.

- Optimize Tax Liabilities: Accurate filing of GSTR-6 allows businesses to maximize their ITC claims, leading to reduced tax liabilities and improved cash flow.

- Facilitate Auditing: The detailed reporting required in GSTR-6 aids tax authorities in auditing and monitoring the proper utilization of ITC, thus preventing tax evasion and misuse of credits.

Who Needs to File GSTR-6?

Entities Required to File GSTR-6

Filing GSTR-6 is mandatory for the following entities:

- Input Service Distributors (ISDs): All registered ISDs must file GSTR-6, as it is specifically designed to capture details of ITC received and distributed among their various units. This includes any organization that centralizes its invoice processing for input services.

- Businesses with Multiple Units: Companies operating across different locations, such as large corporations, banks, and insurance firms, that utilize a centralized system for handling invoices are required to file GSTR-6.

Exemptions from Filing GSTR-6

While many entities are obligated to file GSTR-6, certain exemptions apply:

- Non-Resident Taxable Persons: These individuals or entities that supply goods or services in India without having a permanent establishment in the country are not required to file GSTR-6.

- Composition Dealers: Taxpayers who opt for the composition scheme to pay tax at a fixed rate based on their turnover are exempt from filing GSTR-6. This scheme is intended for small businesses and simplifies compliance.

- Taxpayers Collecting TCS/TDS: Businesses that are liable to collect Tax Collected at Source (TCS) or Tax Deducted at Source (TDS) do not need to file GSTR-6. This category includes specific sellers and purchasers under the GST framework.

- OIDAR Suppliers: Suppliers providing Online Information and Database Access or Retrieval (OIDAR) services are also exempt from filing GSTR-6. This applies to businesses that provide services over the Internet to customers in India.

Eligibility Criteria for GSTR-6

Requirements for ISDs

To be eligible for filing GSTR-6, an entity must meet specific criteria as defined under the Goods and Services Tax (GST) framework. The following requirements apply to Input Service Distributors (ISDs):

- Registered Under GST: The entity must be registered under the GST Act as an Input Service Distributor. This includes obtaining a valid GSTIN (Goods and Services Tax Identification Number) that corresponds to its PAN (Permanent Account Number).

- Active Status: The ISD’s GST registration must be active, meaning it should not be suspended or canceled. This is crucial for the ISD to comply with GST regulations and maintain its ability to distribute input tax credits.

- Compliance with GST Provisions: The ISD must adhere to all GST compliance obligations, including timely filing of other relevant returns, such as GSTR-1, GSTR-2, and GSTR-3B, as applicable.

Conditions for Filing GSTR-6

In addition to the requirements mentioned above, certain conditions must be fulfilled for an ISD to file GSTR-6:

- Timely Filing: GSTR-6 must be filed within the stipulated time frame, specifically by the 13th of the following month after the tax period. This deadline is crucial to avoid penalties and ensure smooth compliance.

- Input Tax Credit Documentation: The ISD must maintain proper records of all input tax credits received and distributed. This includes documentation related to tax invoices, debit notes, and credit notes pertaining to the services utilized by the branches.

- Allocation of Input Tax Credit: The ISD should ensure that the distribution of ITC among its branches is based on a proportional allocation, reflecting the actual usage of services by each unit. This distribution must be accurately reported in GSTR-6.

- Invoice Details: The ISD must accurately report all inward supplies from registered taxpayers in GSTR-6, including the details of ITC distributed to each branch. Any adjustments or amendments to previous returns must also be appropriately documented.

By meeting these eligibility criteria and conditions, Input Service Distributors can successfully navigate the filing process for GSTR-6, ensuring compliance with GST regulations and efficient management of input tax credits across their units.

Due Dates for Filing GSTR-6

Monthly Filing Requirement for GSTR-6

GSTR-6 is a mandatory monthly return for Input Service Distributors (ISDs) to report the distribution of Input Tax Credit (ITC) to their branches or units. The return must be filed by the 13th of the following month for each tax period.

I.e all monthly filings are due on the 13th of the following month.

For example, the filing for January must be submitted by February 13.

Extensions may be granted by the government in special cases, communicated via GSTN or CBIC notifications. Staying updated on due dates helps ISDs avoid penalties and ensure proper ITC claims.

How to File GSTR-6

Step-by-Step Guide to File GSTR-06

- Login to GST Portal:

Go to the GST Portal and log in using your credentials.

- Access the Return Dashboard:

Click on the ‘RETURN DASHBOARD’ option after logging in.

- Select the Month and Year:

In the drop-down menu, select the month and year for which you are filing the GSTR-06 return, then click on ‘SEARCH’.

- Prepare GSTR-06:

On the screen, you will see two tiles. Click on the tile labeled ‘Return for input service distributor GSTR-6’ and select ‘PREPARE ONLINE’.

- Generate GSTR-6 Summary:

Scroll down to the bottom of the page and click on ‘GENERATE GSTR-6 SUMMARY’. A confirmation message will appear, and the details will auto-populate after a moment.

Note: This step is crucial as it auto-populates the details from GSTR-06A, which includes all the input details filed by your suppliers in GSTR-1 and GSTR-05.

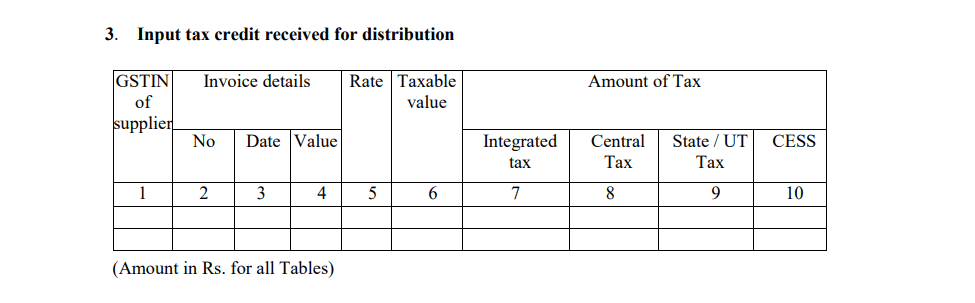

- Review Input Tax Credit Received for Distribution:

Click on ‘3 – Input tax credit received for distribution’. You will see a list of GSTINs of vendors from whom you have purchased supplies. Verify the details for each vendor by clicking on their GSTIN.

Actions Available:

- Modify Invoices: If any invoice details are incorrect, click on the ‘Edit’ icon, make the necessary changes, and click on ‘SAVE’.

- Accept Invoices: If the details match your records, select the checkbox beside the invoice(s) and click on the ‘ACCEPT’ button.

- Reject Invoices: If the details are entirely incorrect, select the invoice(s) and click on the ‘REJECT’ button.

- Keep Pending Invoices: For uncertain details, select the invoices and click on the ‘PENDING’ button.

- Add Missing Invoice Details: For any invoices missed by your supplier, click on ‘ADD MISSING INVOICE DETAILS’, fill in the required details, and click ‘SAVE’.

Note: You can modify these actions any number of times before filing the return.

- Debit Notes/Credit Notes:

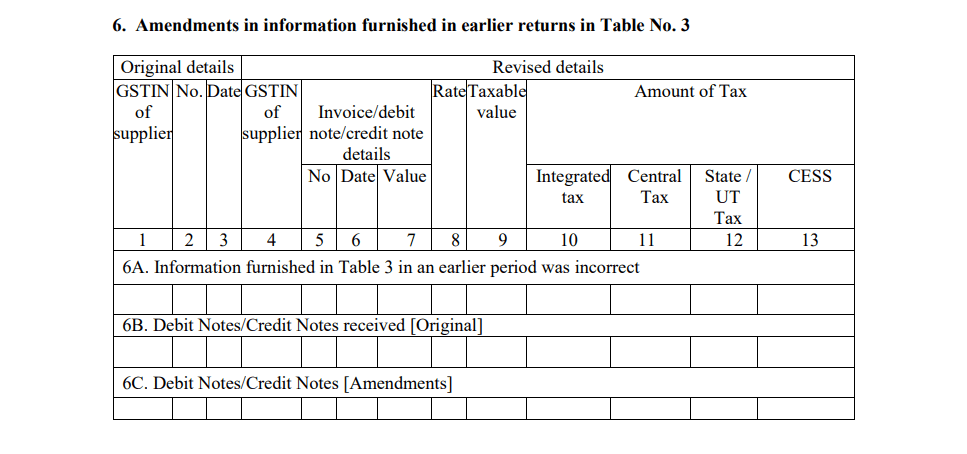

Click on ‘6B – Debit Notes/Credit Notes Received’. Similar actions as in the previous step apply here: Accept, Reject, Modify, Keep Pending, or Add Invoice details.

- Distribution of Input Tax Credit:

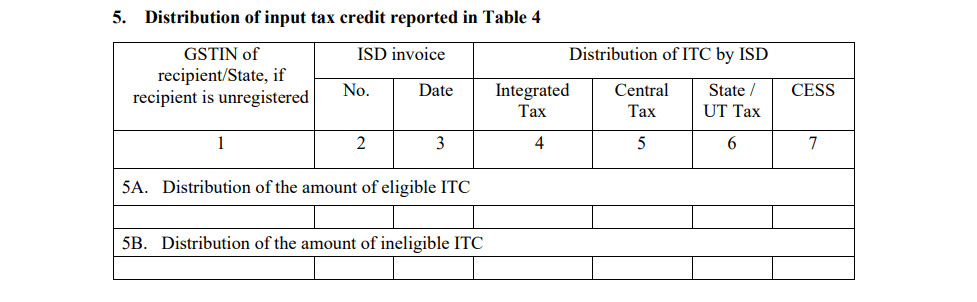

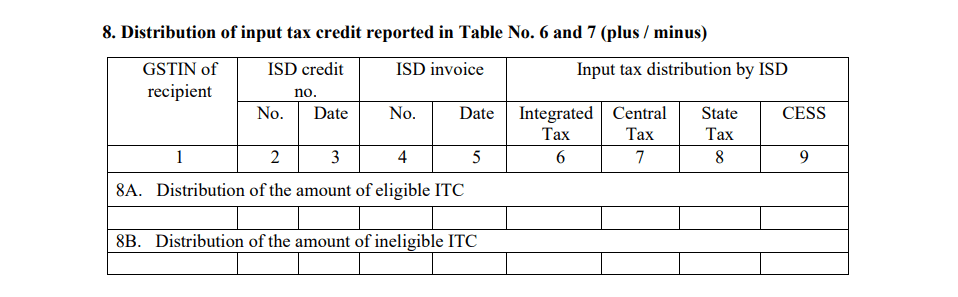

Click on ‘5, 8 – Distribution of input tax credit (ISD Invoices & ISD Credit notes)’.

Click on ‘Add Document’ and enter the required details:

- Eligibility of ITC: Indicate whether the ITC is eligible or ineligible for credit.

- Unit Type: Specify if it is a registered or unregistered unit.

- GSTIN of Registered Recipient: Provide the GSTIN.

- ISD Document Type: Choose between Invoice or Credit Note.

- Invoice Number, Date of Invoice, Credit Note Number, and Date (if applicable)

- Tax Amount: Enter the tax amount.

Click ‘SAVE’ after filling in the details.

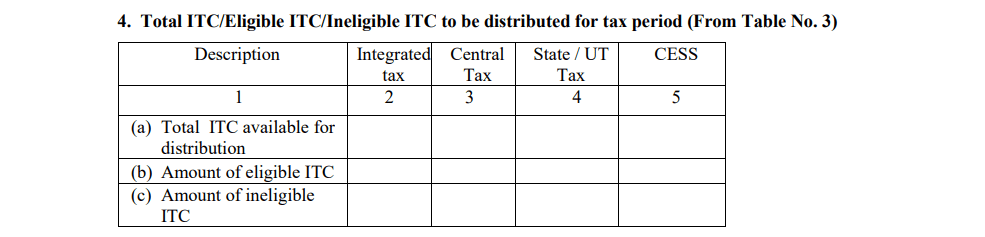

- Calculate ITC:

Click on ‘CALCULATE ITC’. This action will display the total ITC, eligible ITC, and ineligible ITC.

- Preview and Submit:

After completing the above steps, preview your return. Once satisfied, submit the return. The status of the return will change to ‘Filed’ on the ‘RETURN DASHBOARD’.

Filing GSTR-06 involves logging into the GST portal, generating a summary, reviewing invoices, distributing input tax credits, and finally submitting the return. Ensure to check all details carefully to avoid discrepancies.

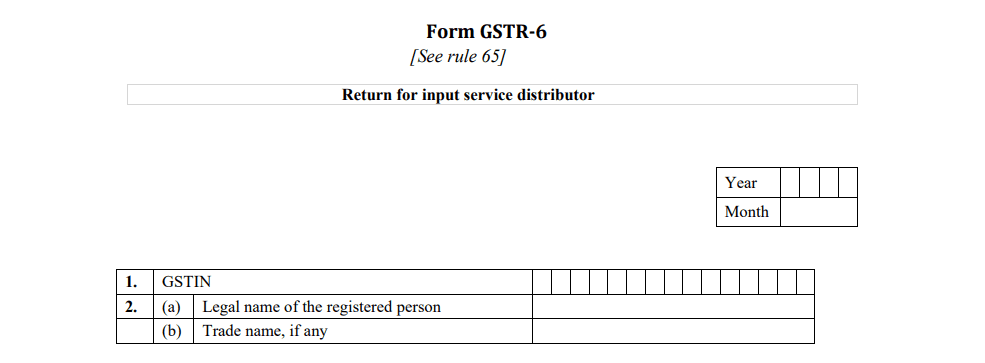

Components of GSTR-6

The GSTR-6 form is structured into various sections, each serving a specific purpose in the reporting of Input Tax Credit (ITC) distribution. Understanding the components of GSTR-6 is essential for accurate filing and compliance. Below is an overview of the structure of GSTR-6 and a description of each section.

Overview of the Structure of GSTR-6

GSTR-6 is divided into several key components that require detailed information. Each section must be filled out carefully to ensure proper reporting of ITC. The main sections include:

- GSTIN of ISD

- Name of Registered Person

- ITC Received for Distribution

- Total ITC, Eligible ITC, and Ineligible ITC

- Distribution of ITC

- Amendments from Previous Returns

- ITC Mismatches and Adjustments

- Distribution of ITC

- Redistribution of ITC

- Late Fees

- Refund Claims from Electronic Cash Ledger

Description of Each Section in GSTR-6

- GSTIN of ISD:

This section requires the Input Service Distributor’s 15-digit Goods and Services Taxpayer Identification Number (GSTIN). It is crucial to identify the taxpayer and ensuring that the return is associated with the correct GST account.

- Name of Registered Person:

The registered name of the ISD will be auto-populated based on the GSTIN entered. This information confirms the identity of the taxpayer submitting the return.

- ITC Received for Distribution:

This part of the form captures the details of all Input Tax Credit (ITC) received by the ISD during the reporting period. It is essential to include both eligible and ineligible ITC.

- Total ITC, Eligible ITC, and Ineligible ITC:

In this section, ISDs must segregate the total ITC into eligible and ineligible categories. This breakdown is vital for proper distribution among branches.

- Distribution of ITC:

This is a critical component where the ISD specifies how the ITC has been allocated to different branches or units. The details should include the GSTIN of each recipient and the corresponding amount of ITC distributed.

- Amendments from Previous Returns:

Any changes or corrections to previously filed returns can be documented here. This section allows ISDs to rectify mistakes related to inward supplies or distribution of ITC.

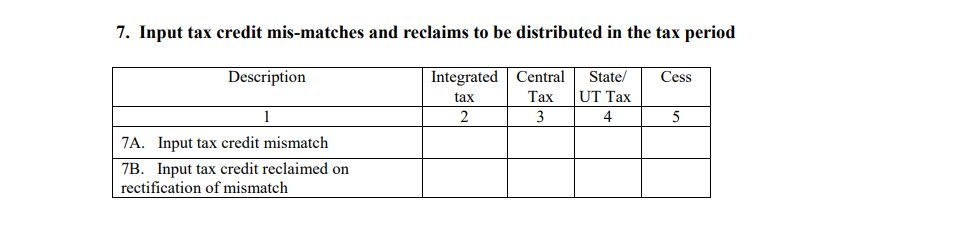

- ITC Mismatches and Adjustments:

This part addresses any discrepancies in ITC. If there are mismatches between what was originally reported and the actual figures, these adjustments must be recorded in this section.

- Distribution of ITC:

This section requires the ISD to specify how the ITC is distributed to various branches or units. It includes the GSTIN of each recipient and the amount of ITC allocated, ensuring proper distribution across all units.

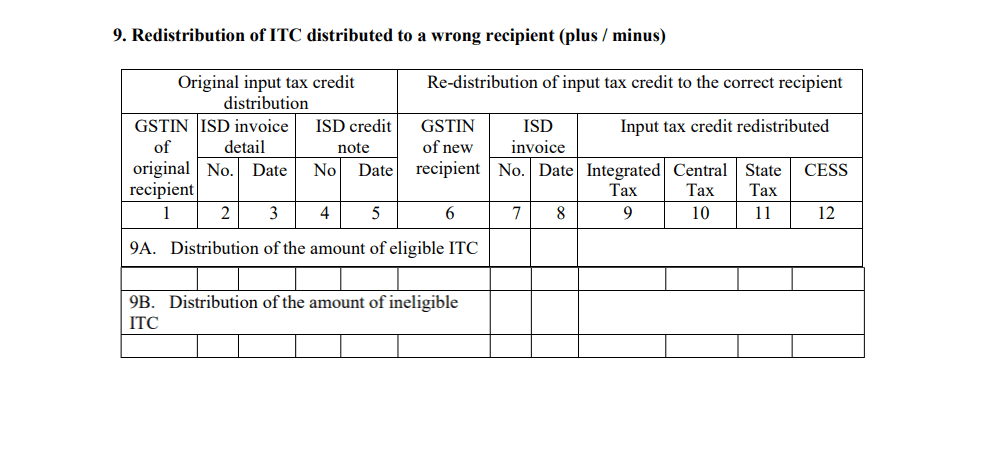

- Redistribution of ITC:

If ITC was incorrectly allocated to a unit in a prior period, ISDs can use this section to redistribute the credit correctly to the appropriate recipients.

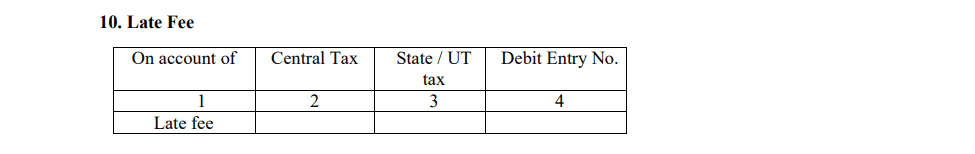

- Late Fees:

ISDs are required to report any late fees incurred due to delayed filing. This section ensures transparency and helps maintain compliance with the GST regulations.

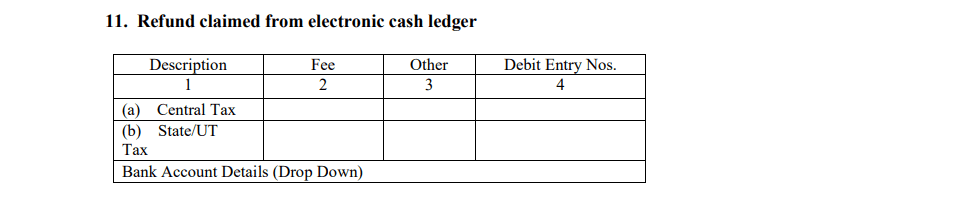

- Refund Claims from Electronic Cash Ledger:

This final section documents any refund claims that the ISD wishes to process from their electronic cash ledger. Accurate reporting here is necessary for maintaining proper cash flow.

Understanding these components and filling them out accurately is crucial for ISDs to manage their ITC effectively and comply with GST regulations.

What if a mismatch in ITC is reported in GSTR-6 and GSTR-2A?

If there is a mismatch in the Input Tax Credit (ITC) reported in GSTR-6 (filed by Input Service Distributor) and GSTR-2A (auto-generated from suppliers’ GSTR-1), here are the steps you can take:

- Identify the Discrepancies:

- Compare the details in GSTR-6 with the ones in GSTR-2A to spot the discrepancies. This could be related to invoice details, credit amounts, or supplier reporting.

- Communicate with Suppliers:

- Contact the suppliers to confirm whether they have filed their GSTR-1 correctly. In case of a mistake, request them to correct it by amending their returns in the subsequent filing period.

- Reconciliation Process:

- Conduct a reconciliation of the ITC claimed in GSTR-6 with the actual invoices received and reported by suppliers in GSTR-1 to ensure accuracy.

- Amendment in GSTR-6:

- If the mismatch is due to incorrect data reported in GSTR-6, you can amend your GSTR-6 return in the following period.

- File GSTR-9 and GSTR-9C (Annual Return and Audit):

- During the annual filing process, ensure that the reconciliation is accurate to avoid issues in the audit.

Taking these steps will help ensure that any discrepancies are rectified and prevent future compliance issues with ITC.

Benefits of Timely Filing GSTR-6

- Avoids Late Fees and Penalties:

One of the most immediate benefits of timely filing is the avoidance of late fees. As noted earlier, delayed filing incurs a penalty of ₹50 per day (₹25 CGST + ₹25 SGST), which can add up quickly.

- Ensures Continuity of ITC Claims:

Filing GSTR-6 on time allows businesses to continuously claim their entitled ITC, ensuring smooth cash flow. This is especially important for businesses operating with tight margins.

- Enhances Operational Efficiency:

Timely compliance with GSTR-6 filing fosters an organized approach to tax management. This organization can lead to better financial planning and operational efficiency within the organization.

- Strengthens Financial Credibility:

Regular and accurate tax filings enhance a business’s financial credibility. This can be beneficial for securing loans, attracting investors, or negotiating favorable terms with suppliers.

- Promotes Good Relationship with Tax Authorities:

Consistently meeting filing deadlines and maintaining accurate records establishes a good rapport with tax authorities. This positive relationship can be advantageous during audits or inquiries.

In summary, GSTR-6 is not just a regulatory requirement; it is an essential tool for businesses to manage their tax liabilities effectively, maintain compliance, and reap the benefits associated with timely filing.

Common Challenges in Filing GSTR-6

Filing GSTR-6 can present several challenges for Input Service Distributors (ISDs). Understanding these challenges is crucial for businesses to navigate the filing process effectively. Below are some common issues encountered during GSTR-6 filing.

1. Reconciling ITC Distribution with Recipient Units

- Complexity of ITC Allocation:

One of the primary challenges is accurately reconciling the Input Tax Credit (ITC) distribution among various branches or units. Each unit may have different consumption levels, making it difficult to allocate credits proportionately.

- Communication Gaps:

Effective communication between the ISD and its recipient units is essential for accurate reconciliation. Any miscommunication regarding invoices or credits can lead to discrepancies in ITC allocation.

- Record Keeping:

Maintaining accurate records of inward supplies and the corresponding distribution of ITC is crucial. Businesses often struggle to keep thorough documentation, which can complicate the reconciliation process.

2. Managing Time Lags in Credit Distribution

- Delays in Invoice Processing:

Time lags can occur between receiving invoices at the ISD level and distributing credits to the branches. These delays may impact the ability to file GSTR-6 on time and can affect the cash flow of the units involved.

- Dependence on Supplier Timeliness:

The timely filing of GSTR-6 is often contingent on suppliers submitting their GSTR-1 forms. Delays on the suppliers’ end can disrupt the flow of information and hinder the ISD’s ability to claim credits promptly.

3. Addressing Discrepancies with GSTR-2A

- Mismatch Issues:

GSTR-2A serves as a crucial reference point for ISDs, reflecting the ITC available based on suppliers’ filings. Any discrepancies between the data in GSTR-6 and GSTR-2A can lead to complications during the filing process.

- Error Resolution:

Identifying and resolving mismatches can be a tedious task. It often requires thorough cross-checking of records, which can consume significant time and resources.

- Impact on Compliance:

Failure to reconcile discrepancies with GSTR-2A can result in incorrect ITC claims, potentially leading to penalties or legal issues. This pressure emphasizes the importance of accuracy in both filings.

Strategies to Overcome Challenges

To mitigate these challenges, businesses can adopt the following strategies:

- Implement Robust Record-Keeping Practices:

Establish a systematic approach to document management to ensure all invoices and distributions are accurately recorded.

- Enhance Communication Channels:

Foster open communication between the ISD and recipient units to clarify any uncertainties regarding ITC distribution.

- Utilize Technology Solutions:

Leverage accounting software and automation tools to streamline the reconciliation process and reduce manual errors.

- Regular Training and Updates:

Conduct training sessions for the accounting team to stay informed about changes in GST regulations and best practices for filing GSTR-6.

By proactively addressing these common challenges, businesses can enhance their GSTR-6 filing process and ensure compliance with GST regulations.

Recent Updates and Changes to GSTR-6

Staying updated on the latest changes and enhancements related to GSTR-6 is crucial for Input Service Distributors (ISDs) to ensure compliance and streamline their filing processes. Here are some significant updates and changes that have recently been introduced:

1. Auto-Population of ITC Data

- Enhanced Automation:

The GSTR-6 form now features auto-population capabilities, where input tax credit (ITC) data is automatically filled from suppliers’ GSTR-1 and GSTR-3B returns. This change reduces the need for manual data entry and minimizes errors during the filing process.

- Improved Accuracy:

With the auto-population feature, ISDs can ensure more accurate reporting of ITC, as the data reflects what has already been filed by the suppliers. This enhances transparency and efficiency in the filing process.

2. Enhancements in Filing Processes

- User-Friendly Interface:

The GST portal has undergone updates to provide a more user-friendly interface for filing GSTR-6. These improvements aim to simplify navigation and improve the overall user experience.

- Streamlined Filing Steps:

Recent updates have made it easier for taxpayers to access the GSTR-6 form and complete the filing process. Clearer guidelines and step-by-step instructions are now available on the GST portal.

- Real-Time Data Verification:

Enhanced real-time data verification ensures that any discrepancies are flagged immediately during the filing process. This feature allows ISDs to correct errors on the spot, reducing the chances of rejections.

3. Government Notifications Affecting GSTR-6

- Timely Notifications:

The government periodically issues notifications that can affect GSTR-6 filing requirements, such as changes in due dates or filing procedures. ISDs must stay vigilant and regularly check for any announcements from the Central Board of Indirect Taxes and Customs (CBEC) regarding GSTR-6.

- Flexible Filing Extensions:

In response to various challenges faced by businesses, the government has shown flexibility in extending filing deadlines for GSTR-6. Notifications outlining these extensions are typically issued during critical periods, such as financial year-end or in response to natural calamities.

- Updates on Exemptions:

The government may also revise exemptions related to GSTR-6 filing. It’s essential for ISDs to keep abreast of such changes to ensure they are compliant and aware of their filing obligations.

By being aware of these recent updates and changes to GSTR-6, Input Service Distributors can better navigate the filing process, enhance their compliance efforts, and optimize their input tax credit claims.

Comparison with Other GST Forms

Understanding the differences between GSTR-6 and other GST forms is essential for Input Service Distributors (ISDs) to navigate the compliance landscape effectively. Below is a comparison of GSTR-6 with other relevant GST forms:

1. GSTR-6 vs. GSTR-1

- Purpose:

GSTR-6: Specifically designed for Input Service Distributors (ISDs) to report the distribution of input tax credits (ITC) to their branches or units.

GSTR-1: A monthly return filed by all regular taxpayers detailing outward supplies of goods and services.

- Filing Requirement:

GSTR-6: Mandatory for registered ISDs, irrespective of their turnover.

GSTR-1: Mandatory for all registered taxpayers whose aggregate turnover exceeds the specified limit (₹20 lakhs for most states).

2. GSTR-6 vs. GSTR-2A

- Nature:

GSTR-6: A return filed by ISDs to declare ITC distribution.

GSTR-2A: An auto-generated statement reflecting the inward supplies of goods and services based on the GSTR-1 filed by suppliers.

- Usage:

GSTR-6: Used by ISDs to claim ITC and report distributions among various branches.

GSTR-2A: Used by recipients (including ISDs) to verify the ITC available to them, aiding in the reconciliation process.

3. GSTR-6 vs. GSTR-3B

- Scope:

GSTR-6: Focuses on the distribution of ITC by ISDs among their branches.

GSTR-3B: A summary return that captures outward supplies, ITC claimed, and tax liabilities. All registered taxpayers must file this.

- Filing Frequency:

GSTR-6: Filed monthly by ISDs.

GSTR-3B: Also filed monthly, but by all regular taxpayers.

4. GSTR-6 vs. GSTR-5

- Applicability:

GSTR-6: Applicable to Input Service Distributors for reporting ITC distribution.

GSTR-5: Specifically for non-resident taxpayers who supply goods or services in India.

- Content:

GSTR-6: Includes ITC distribution details among units.

GSTR-5: Captures details of outward supplies made by non-resident taxpayers and the corresponding tax liabilities.

6. GSTR-6 vs. GSTR-6A

Purpose:

- GSTR-6: Filed by Input Service Distributors (ISDs) to report the distribution of input tax credits (ITC) to their branches or units.

- GSTR-6A: An auto-drafted form generated for ISDs based on the details of inward supplies reported by the suppliers in their GSTR-1. It is a read-only form used to verify the information for GSTR-6.

Usage:

- GSTR-6: Used by ISDs to distribute ITC and finalize their monthly return.

- GSTR-6A: Used by ISDs to cross-check and validate the details of inward supplies and ITC claimed before filing GSTR-6.

Nature:

- GSTR-6: A form that needs to be filed by ISDs to fulfill compliance obligations.

- GSTR-6A: An automatically generated form for information verification purposes, not required to be filed.

By understanding the distinctions between GSTR-6 and these other GST forms, Input Service Distributors can ensure compliance while effectively managing their tax obligations and maximizing their input tax credit claims.

Conclusion

In conclusion, GSTR-6 plays a pivotal role in the Goods and Services Tax (GST) framework, specifically for Input Service Distributors (ISDs). This monthly return is essential for accurately reporting and distributing input tax credits (ITC) among various branches or units of a business.

Key Takeaways:

Mandatory Compliance: Filing GSTR-6 is a mandatory requirement for all registered ISDs, ensuring transparency and accountability in the distribution of ITC.

Timely Filing: Adhering to the filing deadlines is crucial to avoid penalties and to maintain compliance with GST regulations. The due date for GSTR-6 is the 13th of the month following the tax period.

Understanding the Components: Familiarizing oneself with the components and structure of GSTR-6 helps ensure accurate reporting, which is vital for both tax compliance and financial management.

Best Practices: Implementing best practices, such as maintaining accurate records and utilizing GST software, can greatly simplify the GSTR-6 filing process and reduce the likelihood of errors.

Staying Updated: Businesses must stay informed about recent updates and changes related to GSTR-6 to ensure they remain compliant and can adapt to any new requirements swiftly.

By understanding GSTR-6 and its implications, ISDs can effectively manage their tax obligations and contribute to a streamlined GST ecosystem. For businesses navigating the complexities of GST compliance, leveraging professional assistance and technology can enhance the efficiency of the GSTR-6 filing process, ultimately leading to better financial outcomes.

FAQs

1. What is the difference between GSTR-6 and GSTR-6A?

GSTR-6 is the monthly return filed by Input Service Distributors (ISDs) to report the distribution of input tax credit (ITC), while GSTR-6A is an auto-generated, read-only form that contains the details of inward supplies received by the ISD from suppliers, based on their GSTR-1 submissions.

2. Is GSTR-6 applicable for all types of businesses?

No, GSTR-6 is specifically applicable only to registered Input Service Distributors (ISDs). Other types of businesses that do not qualify as ISDs do not need to file GSTR-6.

3. What information is auto-populated in GSTR-6?

Certain details, such as inward supplies from registered taxpayers and corresponding ITC data, are auto-populated in GSTR-6 based on the submissions made by suppliers in their GSTR-1 forms.

4. Can an ISD claim credit for services used solely in one branch?

An ISD can only claim and distribute credit for input services received at the head office, and the distribution must be based on the proportionate use of those services across all branches.

5. What should I do if there is a mismatch in ITC reported in GSTR-6 and GSTR-2A?

If there is a mismatch, you should reconcile the differences by verifying the details reported in GSTR-6 against the records from your suppliers. Necessary corrections should be made in your next GSTR-6 filing.

6. How can I track the status of my GSTR-6 filing?

You can track the status of your GSTR-6 filing through the GST portal. Upon successful submission, you will receive an acknowledgment, and any subsequent updates regarding the return will be communicated via SMS and email.

7. Can I file GSTR-6 using third-party GST software?

Yes, many businesses choose to file GSTR-6 using third-party GST software that integrates with the GST portal, making the filing process more efficient.

8. What are the consequences of not filing GSTR-6 on time?

Failure to file GSTR-6 on time can result in penalties, affect your ITC claims, and potentially lead to further scrutiny from tax authorities.

9. Is there any specific format for GSTR-6?

Yes, GSTR-6 must be filed in the prescribed format set by the GST Council, which includes various tables for reporting ITC, credit distribution, and other relevant details.

10. What should I do if I encounter technical issues while filing GSTR-6?

If you encounter technical issues, you can contact the GST helpdesk or your GST service provider for assistance. Additionally, checking the GST portal for system maintenance updates may also help.