In the world of Goods and Services Tax (GST), compliance is essential for businesses to ensure smooth operations and avoid penalties. One of the key documents in this compliance process is GSTR 6A.

GSTR-6A is an automatically generated statement that reflects inward supplies for an Input Service Distributor (ISD). It serves as a record of all the invoices received by the ISD from various suppliers during a specific tax period. Understanding GSTR-6A is crucial for ISDs as it helps them keep track of their input tax credit and ensures that they can distribute these credits accurately among their branches.

Though GSTR-6A is a read-only document, it plays a vital role in the overall GST framework. It helps ISDs verify the details of the input tax credit received from their suppliers, ensuring that they can make the necessary adjustments when filing their GSTR-6. Additionally, by reviewing GSTR-6A, ISDs can identify any discrepancies in the invoices, allowing them to address issues promptly and maintain compliance.

The primary purpose of GSTR-6A is to help ISDs track and manage input tax credits for effective distribution across branches with different GSTINs under the same PAN.

In this blog, we will delve deeper into what GSTR-6A is, how it is generated, the details it contains, and how to view it online. Let’s get started!

What is GSTR-6A?

GSTR-6A is a system-generated document that provides details of inward supplies specifically for Input Service Distributors (ISDs). This document is essential for ISDs, as it helps them maintain accurate records of their input tax credit.

What is ISD?

In the context of GST (Goods and Services Tax) in India, ISD stands for Input Service Distributor. An ISD is a registered entity, typically the head office of a business, that receives invoices for input services used across different locations of the business. The ISD distributes the input tax credit (ITC) on these services to various branches or units of the same organization based on a predetermined allocation method.

Here’s how it generally works:

- Centralization: ISD centralizes the receipt of input services for the business and can claim input tax credit on them.

- Distribution: The ISD distributes the eligible ITC to various branches or units (known as ‘recipients’) that need it, based on their actual usage.

- Tax Compliance: The ISD must file monthly returns (GSTR-6) to report the ITC distributed and ensure accurate tax compliance.

ISD helps businesses manage ITC efficiently, especially when input services benefit multiple branches across different states.

Key Characteristics of GSTR-6A

- Read-Only Format: GSTR-6A cannot be edited or filed by the taxpayer. It is merely a record generated by the GST system based on information submitted by suppliers.

- Automatic Generation: The document is automatically created from the data supplied by suppliers in their GSTR-1, GSTR-1A, GSTR-5, and GSTR-7 forms.

- Tax Period Specific: GSTR-6A is applicable for specific tax periods and may change depending on the details uploaded by the supplier until the ISD submits the GSTR-6 for that period.

Purpose of GSTR-6A

The primary purpose of GSTR-6A is to allow ISDs to track the input tax credits they have received from their suppliers. By having a clear view of these credits, ISDs can effectively distribute them among their branches that hold different GSTINs under the same PAN.

Generation of GSTR-6A

GSTR-6A is automatically generated under specific conditions that ensure ISDs have the most accurate and up-to-date information regarding their inward supplies. Understanding how GSTR-6A is generated helps taxpayers keep track of their input tax credits effectively.

Conditions for Auto-Generation

GSTR-6A is generated based on certain criteria, primarily focused on the actions of suppliers regarding their returns. Here are the main conditions for its auto-generation:

Supplier Uploads Invoices in GSTR-1 and GSTR-5:

For GSTR-6A to be created, the supplier must upload the details of their invoices in their respective GSTR-1 or GSTR-5 returns. This step is crucial, as it forms the basis for the data reflected in GSTR-6A.

Auto-Population Scenarios

GSTR-6A is populated automatically in the following scenarios:

1. Before GSTR-6 Submission

- If the supplier submits their GSTR-1 before the ISD submits their GSTR-6 for the same tax period, the supplier’s B2B transaction details are auto-populated in the GSTR-6A for that current tax period.

2. After GSTR-6 Submission

- Conversely, if the supplier submits their GSTR-1 after the ISD has already filed their GSTR-6, the details from the supplier’s return will be auto-populated in the GSTR-6A for the next tax period.

Cases Where GSTR-1 Data Auto-Populates into GSTR-6A

Several specific situations lead to the auto-population of data from GSTR-1 into GSTR-6A:

- If an ISD taxpayer has not submitted their GSTR-6 but the supplier has already uploaded their GSTR-1, the data from GSTR-1 or GSTR-5 will populate the corresponding tax period’s GSTR-6A.

- If any B2B details from GSTR-6 are rolled over to the next tax period, they will become part of GSTR-6 for that following period but will not appear in the GSTR-6A for the next tax period.

Timing and Relevance of Auto-Generated Details

The auto-generated details in GSTR-6A are crucial for ISDs as they provide real-time insights into the input tax credits they can distribute. It is important for taxpayers to regularly check GSTR-6A to ensure they capture all available credits promptly. This vigilance helps in maintaining compliance with GST regulations and ensures that the ISD can make timely adjustments in their GSTR-6 filings.

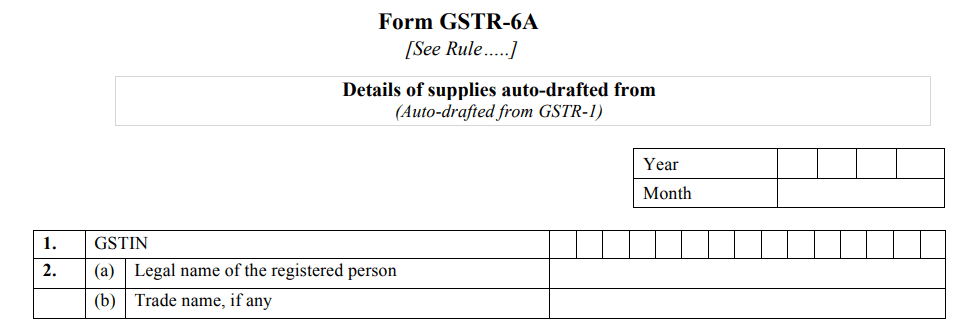

Format of GSTR-6A

Understanding the format of GSTR-6A is essential for Input Service Distributors (ISDs) to ensure that all required information is captured accurately. GSTR-6A is structured to provide a clear and organized representation of the inward supplies received by the ISD.

Below is the required information that must be included in the GSTR-6A format:

Required Information

1. GSTIN Number

- GSTIN (Goods and Services Tax Identification Number): The unique 15-digit number assigned to the registered person (ISD). It is crucial to provide the correct GSTIN to ensure proper identification and compliance.

2. Legal and Trade Names

- Legal Name of the Registered Person: The full legal name under which the ISD is registered for GST purposes. This name must match the records on the GST portal.

- Trade Name, If Any: If the ISD operates under a different name (trade name), it should be included here. This helps in identifying the business correctly.

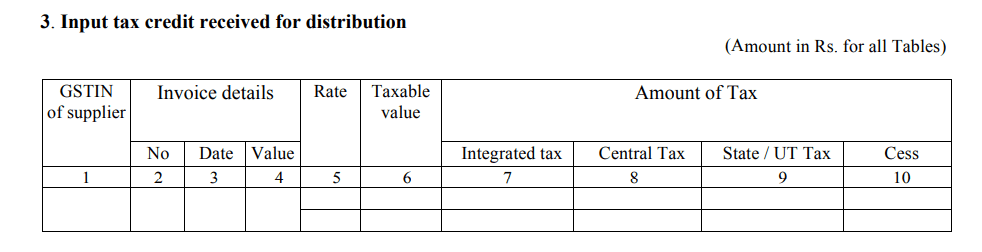

3. Breakdown of Input Tax Credit Distribution

- Input Tax Credit Received for Distribution: This section should detail the input tax credit available for distribution among the ISD’s branches. It must include:

- GSTIN of Supplier: The GSTIN of the supplier from whom the credit is received.

- Invoice Details: Specifics about the invoices, including:

- Invoice Number: Unique identification number of the invoice.

- Invoice Date: The date when the invoice was issued.

- Taxable Value: The total value of the goods or services before tax.

- Rate of Tax: The applicable GST rate.

- Amount of Tax: The total tax amount calculated, including integrated tax, central tax, state/UT tax, and cess.

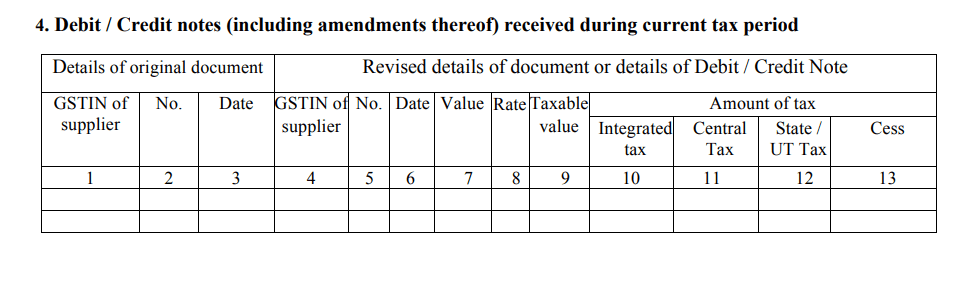

4. Details of Debit/Credit Notes

- Debit/Credit Notes (Including Amendments) Received During Current Tax Period: This section captures all debit and credit notes issued during the current tax period. It includes:

- GSTIN of Supplier: The GSTIN of the supplier associated with the debit or credit notes.

- Document Number and Date: Identification details of the original document related to the debit/credit note.

- Revised Details: Any amendments made to the original debit/credit notes, including updated values, rates, and tax amounts.

Viewing GSTR-6A Online

GSTR-6A is a read-only, auto-generated statement for Input Service Distributors (ISDs). Since it is not meant to be filed like other GST returns, there is no process for filing GSTR-6A. However, here is how you can view GSTR-6A on the GST portal:

Steps to View GSTR-6A

To view GSTR-6A, taxpayers can follow these steps:

Step 1: Log In to the GST Portal

Start by logging into the official GST Portal.

Step 2: Enter Login Details

Enter the username and password to access the account.

Step 3: Access the Returns Dashboard

Navigate to the ‘Services’ tab, select ‘Returns,’ and then click on ‘Return Dashboard.’ Alternatively, you can directly select ‘Return Dashboard.’

Step 4: Choose Financial Year and Return Filing Period

On the ‘File Returns’ page, select the required ‘Financial Year’ and ‘Return Filing Period’ from the drop-down menu for the specific return period.

Step 5: Click Search

Press the ‘Search’ button.

Step 6: Prepare Returns Online

The ‘File Returns’ page displays the due dates for filing returns, organized by tiles. Locate the GSTR-6A tile and select ‘Prepare Online’ to enter details directly on the GST Portal.

Viewing Details in Various Sections

Each tile represents different tables with relevant details. Click on any tile to view specific details.

Input Tax Credit Received for Distribution

- Click on Input Tax Credit Tile

Select the ‘Input Tax Credit Received for Distribution’ tile to view input tax credit details available for distribution. - Click Supplier’s GSTIN

Under the ‘Supplier Details’ column, click on ‘Supplier’s GSTIN’ to see a list of invoice items under ‘Uploaded by Supplier.’ - Click Invoice Number

Under the ‘Invoice Number’ column, select an invoice number to view item-level details.

Viewing Debit/Credit Notes

To check the debit and credit notes for the current tax period, follow these steps:

- Access Debit/Credit Notes Section

Click on the ‘Debit/Credit Notes (including amendments thereof) received during the current tax period’ tile to see all relevant notes. - Click Supplier’s GSTIN

Under the ‘Supplier’s Details’ column, select ‘Supplier’s GSTIN’ to view invoice line items listed under ‘Uploaded by Supplier.’ - Select Credit or Debit Note Number

Click on the ‘Credit or Debit Note No’ in the respective column to display item-level details.

Key Points to Remember:

– No Filing Required: GSTR-6A does not require filing. It is a read-only document that auto-populates based on the supplier’s submissions.

– No Modifications Allowed: You cannot modify GSTR-6A. If corrections are needed, they should be addressed in GSTR-6.

Differences Between GSTR-6 and GSTR-6A

Understanding the differences between GSTR-6 and GSTR-6A is crucial for Input Service Distributors (ISDs) to effectively manage their GST compliance. Below are the key distinctions and functionalities of each form:

Key Distinctions

| Feature | GSTR-6 | GSTR-6A |

| Nature of Document | GSTR-6 is a mandatory return that needs to be filed by ISDs. | GSTR-6A is an auto-generated, read-only statement of inward supplies. |

| Purpose | Used to distribute input tax credits among different branches of the ISD. | Serves as a record of all invoices received from suppliers, auto-populated from GSTR-1. |

| Filing Requirement | ISDs must file GSTR-6 for each tax period. | ISDs do not file GSTR-6A; it is generated based on suppliers’ submissions. |

| Modification Capability | GSTR-6 allows ISDs to edit and update information before submission. | GSTR-6A cannot be edited or modified, as it is a read-only document. |

| Data Source | GSTR-6 includes data entered by the ISD, along with details from suppliers. | GSTR-6A is generated automatically based on supplier data uploaded in GSTR-1. |

| Impact on Input Tax Credit | Filing GSTR-6 directly impacts the distribution of input tax credits. | GSTR-6A provides information that supports the ISD’s understanding of their input tax credits but does not directly affect their distribution. |

| Access and Viewing | GSTR-6 can be filed and accessed through the GST portal. | GSTR-6A can be viewed online but not filed. |

Functionalities

- GSTR-6:

It is a functional return that involves filing and includes active management of input tax credits.

ISDs can report their input tax credit distributions and any amendments related to previously filed information.

- GSTR-6A:

It acts as a reconciliation tool for ISDs to compare the invoices received from suppliers against what has been filed in GSTR-6.

It allows ISDs to monitor and ensure that all invoices are accounted for before filing their GSTR-6.

Conclusion

GSTR-6A is a vital component of the Goods and Services Tax (GST) framework, specifically designed for Input Service Distributors (ISDs). Understanding its purpose, generation process, and the details it contains is crucial for effective GST compliance.

Key Takeaways:

– Read-Only Document: GSTR-6A serves as a read-only record of inward supplies, allowing taxpayers to review details submitted by their suppliers without the ability to make modifications.

– Auto-Generation: This form is automatically generated based on the invoices uploaded by suppliers, ensuring that ISDs have access to accurate and timely information for their GST returns.

– No Filing Required: Since GSTR-6A is not a filing requirement, it acts as a supporting document that helps ISDs make informed decisions in their GSTR-6 submissions.

– Facilitates Input Tax Credit: By providing detailed insights into input tax credits and debit/credit notes, GSTR-6A plays a significant role in helping ISDs maximize their eligible tax credits.

By being aware of the functionalities and limitations of GSTR-6A, ISDs can navigate their GST responsibilities more effectively. This understanding not only aids in compliance but also helps in optimizing tax credits, ensuring smoother financial operations.

As the GST landscape continues to evolve, staying informed about forms like GSTR-6A is essential for all businesses involved in the distribution of input services.

Common FAQs about GSTR-6A

Understanding GSTR-6A can raise several questions among taxpayers. Here are some common FAQs that address key concerns:

Can Changes Be Made to GSTR-6A?

GSTR-6A is a read-only document, meaning that taxpayers cannot make any changes to it. This form is auto-generated based on the data submitted by suppliers in their GSTR-1, GSTR-1A, GSTR-5, and GSTR-7. If discrepancies or errors are found, taxpayers should address them in their GSTR-6 filings instead.

What Actions Can Be Taken Based on GSTR-6A?

- Actions in GSTR-6

While GSTR-6A does not allow for modifications, it plays a crucial role in informing taxpayers about their input tax credits. The details in GSTR-6A can help taxpayers decide:

- Accept or Reject Invoices: After reviewing the information in GSTR-6A, ISDs can accept or reject the invoices in their GSTR-6.

- Claim Input Tax Credit: ISDs can use the data in GSTR-6A to claim input tax credits for the eligible invoices in their GSTR-6 filings.

Is Downloading GSTR-6A Possible?

Taxpayers can download GSTR-6A for future reference. This can be done in Excel format from the GST portal. This feature allows ISDs to keep a record of their inward supplies, making it easier to manage their accounting and compliance tasks.