Invoicing can be puzzling, but it doesn’t have to be. This article is your shortcut to understanding all things invoicing. Whether you’re a business owner or a freelancer, we got you covered.

What is an Invoice?

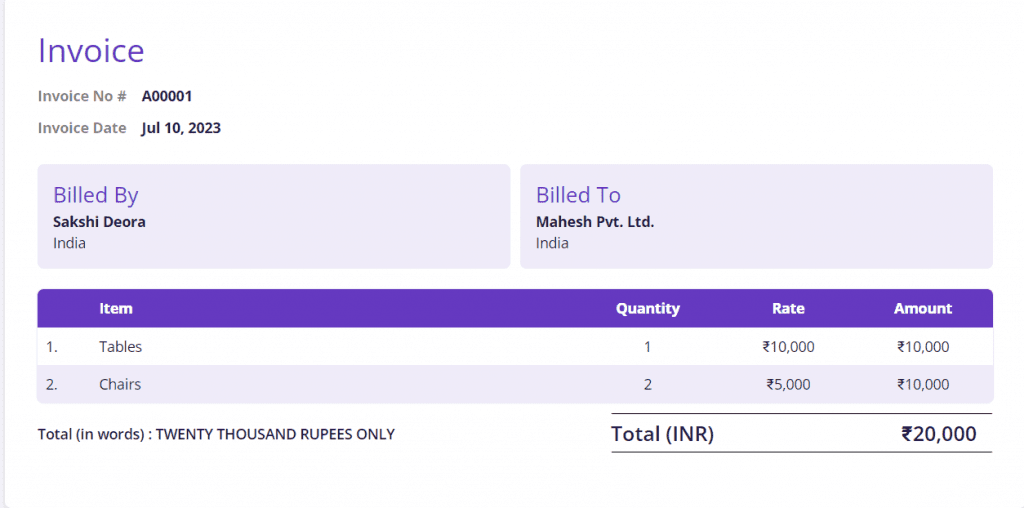

An invoice is a document that provides a detailed record of a business transaction. It typically includes information such as the products or services sold, their quantities, prices, and the total amount due. Invoices are crucial for businesses to request payment from customers and maintain financial records.

To learn more about invoicing and how to invoice a client, refer our comprehensive guide on Invoice Like A Pro

What is a Proforma Invoice?

A proforma invoice is a preliminary bill sent to a customer before the actual goods or services are delivered. It outlines the estimated costs, terms of sale, and other relevant details. Proforma invoices are often used for customs purposes, to secure funding, or to confirm a purchase agreement.

What is an Invoice Number?

An invoice number is a unique identifier assigned to each invoice issued by a business. It helps both the seller and the buyer track and reference specific transactions. Invoice numbers are usually sequential and aid in organizing financial records.

An example of an invoice number could be “INV2023001.”

In this case:

- “INV” stands for “invoice,” indicating the type of document.

- “2023” represents the year the invoice was generated, which is 2023.

- “001” is a sequential number, indicating that this is the first invoice issued in the year 2023.

Invoice numbers are typically unique to each invoice and may follow a format or numbering system established by the issuing company to help with the organization and tracking of transactions.

How to Create an Invoice?

To create an invoice, follow these steps:

- Include your business name, contact details, and logo.

- Add the recipient’s information (customer’s name and address).

- Assign a unique invoice number and date.

- List the products or services provided, their quantities, prices, and subtotal for each.

- Calculate the total amount due, including taxes and any discounts.

- Specify payment terms and methods.

- Include any additional notes or terms if necessary.

- Save or print the invoice and send it to the customer.

Check our detailed guide on How To Create An Invoice.

What is the HSN Code in the Invoice?

The HSN (Harmonized System of Nomenclature) code in an invoice is like a special code that helps classify and identify the products being sold. It’s used for tax purposes and makes it easier to figure out the right tax rate for each item on the invoice. So, that code tells the government what you are selling, and helps calculate the taxes correctly.

What is a Commercial Invoice?

A commercial invoice is a document used in international trade. It provides a detailed account of the goods being shipped, their value, and other information required for customs and regulatory purposes. It serves as a billing statement and proof of the transaction for both the buyer and seller.

What is a PO Invoice?

A PO (Purchase Order) invoice is issued by a supplier in response to a purchase order issued by a buyer. It reflects the agreed-upon terms and conditions specified in the purchase order, including the products or services, quantities, prices, and delivery details.

What is a Non-PO Invoice?

A non-PO (Non-Purchase Order) invoice is created without a prior purchase order. It is often used for unplanned expenses or services that were not covered by a formal purchase order. Non-PO invoices typically require additional approvals and documentation.

What is a Tax Invoice in GST?

In GST (Goods and Services Tax), a tax invoice is an essential document provided by a registered seller to a buyer. It includes details about the goods or services sold, the price, and the applicable GST. This authoritative document acts as evidence for tax payments and is crucial for claiming input tax credits.

How to Make a Proforma Invoice?

Creating a proforma invoice is straightforward. It involves drafting an invoice-like document with details of the expected sale, including product descriptions, quantities, prices, and terms of sale. However, it should be clearly marked as a “Proforma Invoice” and not used for official billing.

To know in detail how to create a proforma invoice, we have a detailed step-by-step guide that will assist you in generating proforma invoice with ease >> How To Create A Proforma Invoice?

What is PO and Non-PO Invoice?

A “PO” or Purchase Order invoice is generated in response to a formal purchase order issued by a buyer, detailing agreed-upon terms. In contrast, a “Non-PO” or Non-Purchase Order invoice is created without a prior purchase order and is often used for unplanned expenses or services.

What is the Invoice Date?

The invoice date is the specific day when the invoice is issued. It indicates the date on which the seller formally requests payment from the buyer for goods or services provided. This date is crucial for tracking payment deadlines and determining tax liability.

What is a Purchase Invoice?

A purchase invoice, also known as a supplier invoice, is a document received by a buyer from a seller. It outlines the products or services purchased, their prices, and any applicable taxes. Purchase invoices are crucial for businesses to record expenses and claim input tax credits.

What is an Invoice Copy?

An invoice copy is a duplicate or replica of the original invoice. It contains the same information as the original and serves as a backup document for record-keeping purposes. It is often retained by the seller or buyer as proof of the transaction.

What is a Sales Invoice?

A sales invoice is a document issued by a seller to a buyer, providing details of the products or services sold, their prices, and any applicable taxes. It is an authoritative record of a sales transaction and is used for billing and accounting purposes.

What is the Difference Between an Invoice and a Bill?

The terms “invoice” and “bill” are often used interchangeably. Both represent a payment request. However, “invoice” is commonly associated with a detailed document that provides product or service specifics, while “bill” can be a more general request for payment without itemized details.

Where is the Invoice Number on a Receipt?

The invoice number is typically found near the top of a receipt, close to the date of the transaction. It is a unique identifier that helps match the receipt to the corresponding invoice, making it easier to track and reference the transaction.

What is a Product Invoice?

A product invoice is a type of invoice used to bill customers for physical goods or products. It includes details about the items sold, their quantities, prices, and any applicable taxes or discounts.

What is a Consular Invoice?

A consular invoice is a specialized document required by some countries for the importation of certain goods. It is typically certified by a consular official and includes details about the products, their value, and other information needed for customs clearance.

What is a PO Number in an Invoice?

A PO (Purchase Order) number in an invoice refers to the unique identifier associated with a specific purchase order issued by a buyer. It helps both the buyer and seller match the invoice to the corresponding purchase order for accurate record-keeping.

What is the SAC Code in an Invoice?

SAC (Service Accounting Code) is a unique code used to classify services under the GST system. It is included in invoices for services to help determine the applicable GST rate.

What is UOM in an Invoice?

UOM stands for “Unit of Measurement” in an invoice. It specifies how a product or service is measured or counted, such as pieces, kilograms, hours, etc. This information helps clarify the quantity being billed.

Are Invoices Contracts?

Invoices are not contracts in themselves. They are billing documents that detail the transaction’s terms and items. However, they can be part of a broader contractual agreement between parties when terms and conditions are referenced or incorporated into the invoice.

Do Invoices Have to Be Signed?

Invoices do not always have to be physically signed, but some businesses choose to do so for added authenticity. However, electronic signatures or digital authentication methods are often accepted as valid alternatives.

How to Invoice Without a Company?

You can still issue invoices as an individual or freelancer. Include your name, contact details, client information, description of services or products, rates, total amount, payment details, and due date. This functions as a personal invoice.