If you’re a freelance writer, designer, or developer, you’re likely looking for a payment gateway to help you accept payments from your clients, be they national or International. These payment platforms help you receive money safely and efficiently, without having to set up your own storefronts and merchant accounts, which can be time-consuming and expensive.

According to a report by Grand View Research, the global payment gateway market value is projected to expand at a CAGR of 22.1% from 2022 to 2030. With all the choices out there, how do you know which platform is right for you?

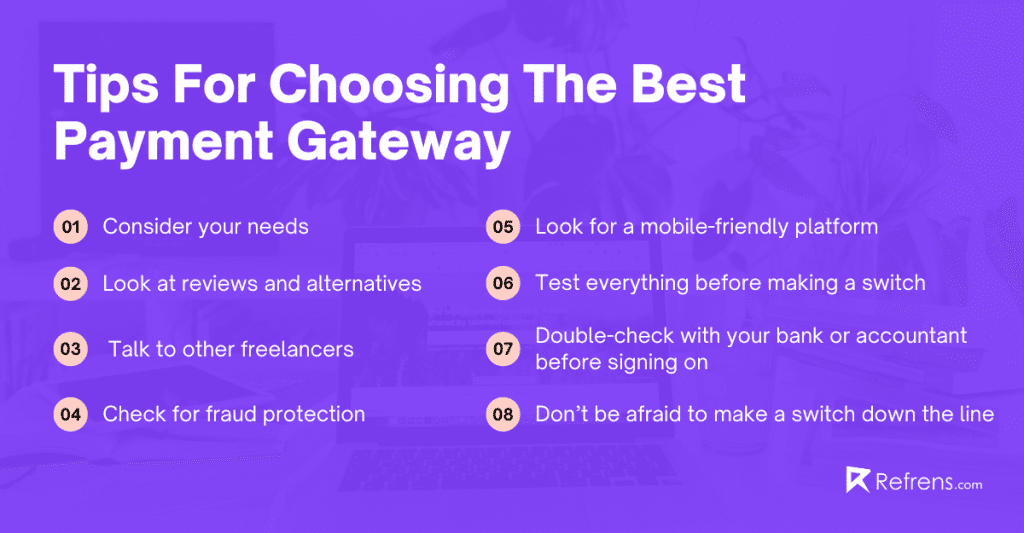

This 8-point guide will walk you through every step of finding the right payment gateway platform so you can take care of your business and get paid on time every month.

What is a Payment Gateway Platform?

A payment gateway platform is a type of software that allows businesses to accept and process credit card, debit card, and e-check payments. It typically includes a payment processor, a shopping cart, and a merchant account.

To use online payment platforms, merchants must first create an account and then integrate their website or shopping cart with the platform. Once this is done, customers can begin making payments using their credit cards or other supported methods.

Additionally, you can accept international payments in India via Refrens Payment Gateway. It has the lowest rate, quick turnaround time, and complete transparency.

How to Make Sure You’re Getting the Best Payment Gateway for Your Freelancing Business

1. Consider your needs

As a freelancer, you’re in control of your payment gateway platform. You can choose which one works best for you and your business needs. There are a few things to consider when choosing payment gateway providers.

First, consider what types of payments you’ll be taking. Will you be taking credit cards, PayPal, or other types of payments? Each type of payment has its fee structure, so you’ll need to know what kinds of payments you’ll be taking to compare fees.

Second, consider how easy it is to use the platform. You don’t want to spend hours trying to figure out how to take a payment or set up your account. Look for a platform that’s easy to use and has good customer support in case you have any questions.

Finally, consider the fees associated with the platform.

2. Look at reviews and alternatives

With so many options available, it can be difficult to know where to start. The best way to narrow down your choices and come up with a good payment gateway list is to read reviews and compare alternatives.

When looking at reviews, pay attention to the positive and negative aspects of each platform. Consider what features are most important to you and your business. For example, if you need a platform that offers automatic invoicing, make sure that feature is included in your final decision.

Once you’ve looked at all the reviews and narrowed down your choices, it’s time to start comparing alternatives. Make sure to look at the fees associated with each platform. Some charge per transaction while others have monthly subscription fees. Choose the option that makes the most financial sense for your business.

Recommended Reads: 15 Best Invoicing Software In 2024

3. Talk to other freelancers

To find the best platform for your needs, talk to other freelancers and get their recommendations.

Ask around and see what platforms your fellow freelancers are using. Find out what they like and don’t like about the different options out there. You can also search on websites like Upwork or Fiverr and see what payment options those platforms offer.

There’s no one-size-fits-all solution when it comes to payment gateway platforms, so it’s important to find one that works well for your particular business. By talking to other freelancers, you can get some great insights into which platform might be the best fit for you.

4. Check for fraud protection

As a freelancer, you’re likely to come across clients who may try to commit fraud. To enhance your protection online, consider securing your transactions with a VPN for Mac which ensures privacy and safeguards your sensitive data when working with clients.

There are a few things you can do to check for fraud protection. First, make sure the platform offers buyer protection. This will ensure you’re protected in the event that a client tries to commit fraud.

Another thing you can do is check the reviews of the platform. If there are many negative reviews about fraud, it’s likely that the platform isn’t doing enough to protect its users from fraudsters.

Finally, you can contact customer support and ask them about the measures they take to prevent fraud. If they’re not able to give you a satisfactory answer, it’s best to avoid using that platform.

5. Look for a mobile-friendly platform

It’s important to find a payment gateway that’s mobile-friendly. This will allow you to work from anywhere, on any device, and not be tied to a desk. In fact, 61% of users will never use a platform that’s not mobile-friendly.

The best platforms are able to integrate with an app so you can take payments anytime. These apps will also have essential features, such as saving customer information, providing receipts on the spot, and generating reports (like the one in this Bridge24 review).

6. Test everything before making a switch

As reported by GlobeNewswire, the AB testing software market is anticipated to reach a valuation of over $3 billion by 2023. One of the best ways to find out if the payment gateway is right for you is to test everything before making a switch.

Test the different features of each platform and see which ones work best for you and your business. Try out the different payment methods and see which ones are the most convenient for your clients. Once you’ve tested everything, you’ll be able to make an informed decision about which platform is right for your business.

Recommended Reads: Top 7 Invoice Generator Software

7. Double-check with your bank or accountant before signing on

As a freelancer, you need to make sure you’re using the best payment gateway platform for your business. The last thing you want is to sign up for a platform only to find out later that it doesn’t work with your bank or accountant.

Before signing up for any payment gateway, double-check with your bank or accountant to make sure it’ll work with their system. This will save you a lot of time and hassle in the long run.

Once you’ve found a payment gateway that works with your bank or accountant, be sure to read the terms and conditions carefully. This will help you avoid any unexpected fees or charges.

8. Don’t be afraid to make a switch down the line

It can be difficult to know what payment gateway is suited for you. The best way to find out is by comparing your needs and requirements with each service. In the event that a provider doesn’t have what you need, don’t be afraid to switch down the line.

Remember, there are plenty of other options available so it won’t hurt your business to experiment with different products until you find one that’s right for you.

Choose the Right Payment Gateway Platform for Your Business

The best payment gateway platform for freelancers is one that offers low transaction fees, is easy to use, and provides a high level of security. When choosing a platform, be sure to compare the features and fees of several different providers. By doing your research, you can find the platform that best meets your needs and helps you grow your freelance business.

Recommended Reads: Top E-Invoicing Software in India: Detailed Analysis

Recommended Reads: E-invoicing In GST: A Complete Guide

Recommended Reads: Best CRM Software with Invoicing

Recommended Reads: Top Invoicing Software For Consultants