Whether you’re a small startup or a large enterprise, selecting the appropriate accounting software is essential for effectively managing your finances, particularly within Malaysia’s complex regulatory framework.

In this blog, we delve into the leading accounting software solutions available in Malaysia, providing a comprehensive comparison of features, pricing, user reviews, and other critical factors.

| Software | Starting Price | Trial Period | Free version |

|---|---|---|---|

| Refrens | RM180/year | ✔️ | ✔️ |

| SQL | RM474/year | ❌ | ❌ |

| QNE | Custom | ✔️ | ❌ |

| Bukku | RM590/year | ✔️ | ✔️ |

| AutoCount | RM294/year | ✔️ | ❌ |

| Financio | RM495/year | ✔️ | ❌ |

| Biztory | RM390/year | ✔️ | ❌ |

| Quickbooks Inuit | RM699/year | ✔️ | ❌ |

| Xero | $348/year | ✔️ | ❌ |

| Wave | $170/year | ❌ | ✔️ |

Must-Have Accounting Software Features for Malaysian Businesses

- Invoicing: Creates and sends invoices, supports recurring billing, and integrates with local payment gateways for streamlined collections.

- Invoice API: Automated invoice generation, integrating seamlessly with your systems for efficient, accurate billing.

- Accounts Payable & Receivable: Manages supplier payments, customer invoicing, and overdue payments efficiently.

- Financial Reporting: Generates essential financial statements, including income statements, balance sheets, and cash flow statements, with customization options.

- SST Compliance: Automatically calculates Sales and Service Tax (SST), ensuring compliance with local tax regulations.

- Expense Tracking: Records and categorizes business expenses, helping you manage budgets and control costs effectively.

- Inventory Management: Tracks stock levels, orders, and costs, essential for businesses.

- Bank Reconciliation: Automatic bank feeds that match transactions from your bank account with those in your accounting software, simplifying the reconciliation process.

- Multi-Currency Support: Handles transactions in multiple currencies, making it ideal for businesses with international clients or suppliers.

- Integration Capabilities: Connects with other business systems (e.g., CRM, ERP) and local payment and banking systems for efficient operations.

- Data Security: Protects financial data with encryption and secure user access controls.

1. Refrens

Trusted by over 150,000 businesses in 170+ countries, Refrens is the ideal solution for businesses seeking to simplify and enhance their financial management. This resourceful cloud-based platform is designed to streamline operations for freelancers, agencies, and small to medium-sized enterprises in Malaysia.

Refrens offers a comprehensive suite of tools for managing invoicing, quotations, payments, and accounting, all within a user-friendly interface. It simplifies business processes with features like inventory management, expense tracking, and customizable reporting. With Refrens, businesses can improve their operations and focus more on growth.

Features:

- Invoicing Software: Create and manage invoices with options for multi-currency transactions, automated recurring invoicing, and automatic payment reminders.

- Malaysia e-Invoicing: Generate e-invoices compliant with Malaysian e-invoicing standards.

- Invoice API: Generate invoices automatically for your website or app with the Refrens Invoice API.

- Audit Trails: Keep track of all changes made to invoices by team members with Refrens’ audit trail feature.

- Advanced Accounting & Bookkeeping: Automatically create ledgers, journal entries, vouchers, and generate financial reports like Balance Sheet, P&L, and Trial Balance.

- Reports and Analytics: Generate comprehensive financial reports, including balance sheets, profit and loss statements, payment reports, and more, to gain valuable business insights.

- Client Management: Efficiently create, manage, and monitor client invoices, payments, and reports like client statements.

- Expense Management: Track and report various expenses, including employee salaries, reimbursements, utility bills, and other operational costs, with detailed status updates.

- Inventory Management: Seamlessly update and track inventory with each invoice, featuring detailed analysis.

- Reports and Analytics: Generate comprehensive financial reports, including balance sheets, profit and loss statements, payment reports, and more, to gain valuable business insights.

- Third-Party Integration: Seamlessly connect with third-party platforms such as Shopify, Facebook, Instagram, and others to streamline workflows.

- Multi-users & Multi-business: Manage multiple businesses. Add team members with ease. Set roles and permissions for your team and accountant.

Pricing:

- Basic: Free

- Books Essential: RM180/year

- Books Pro: RM360/year

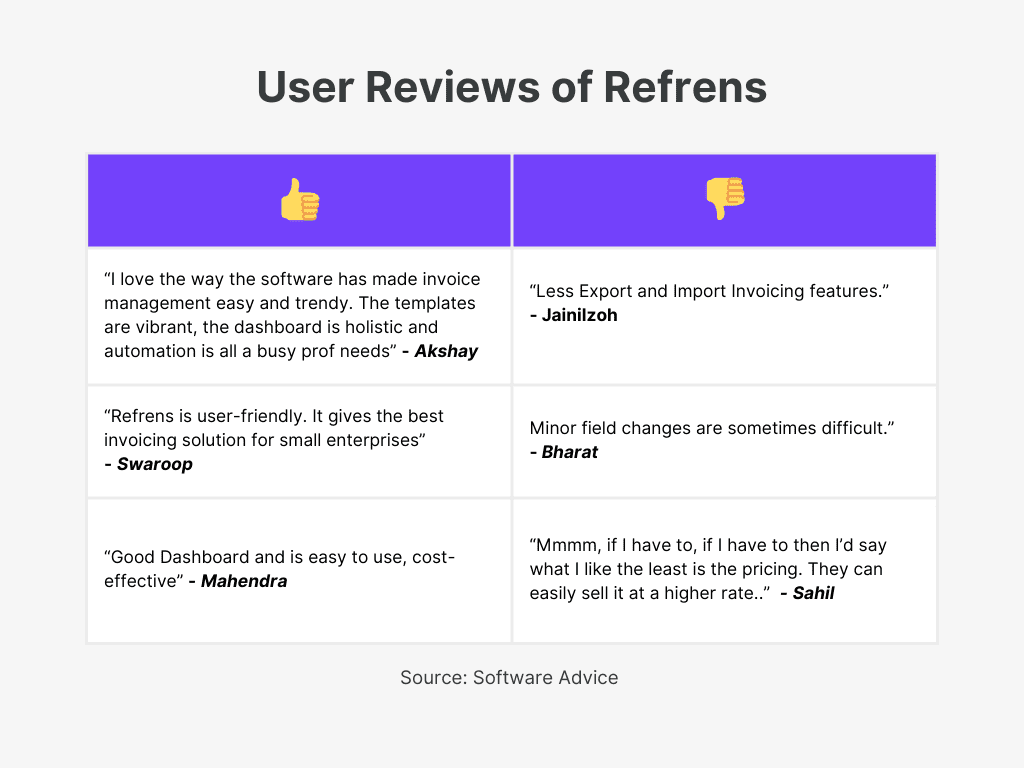

User Reviews:

2. SQL

SQL Cloud Accounting Software merges cloud flexibility with on-premise benefits, offering complete database ownership and unlimited invoicing and storage. Highly customizable, it operates smoothly offline and is trusted by over 270,000 Southeast Asian companies for scalable accounting management.

The SQL Hybrid Cloud feature enables seamless online-offline transitions, ensuring constant access to essential financial data, making it an ideal solution for businesses seeking dependable accounting tools.

Features:

- Comprehensive General Ledger: Efficiently manage and monitor your company’s financial records, ensuring accurate and up-to-date reporting.

- Customer Management: Keep your customer relationships strong with effective management of customer data and interactions.

- Supplier Management: Maintain a well-organized supply chain by keeping supplier information current and accessible.

- Inventory Management: Control your inventory with ease, preventing issues related to overstocking or understocking.

- WhatsApp Document Integration: Simplify communication by sending quotes, invoices, and statements directly to clients through WhatsApp.

- Automated Bank Reconciliation: Speed up your bank reconciliation process with automated matching for transactions across 20+ Malaysian banks.

- Sales Commission Tracking: Manage various commission structures, including profit margin and multi-rate commissions, with tailored reporting.

- Optimized Inventory Levels: Strike the perfect balance in inventory management, maximizing profitability with effective stock control tools.

- Multi-Branch Management: Seamlessly manage transactions and operations across multiple branches, ensuring consistent performance across locations.

- Enhanced Security Controls: Protect sensitive data with advanced security features, including double-layer access control to safeguard your financial information.

Pricing:

- Essential: RM474/year

- Pro: RM654/year

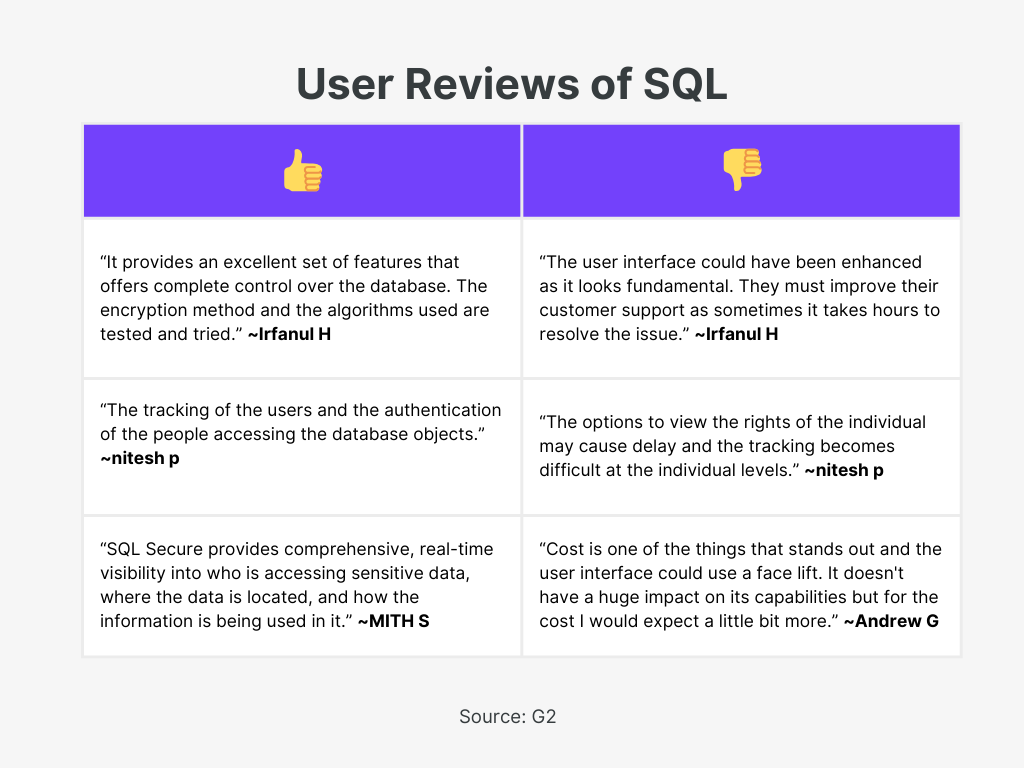

User Reviews:

3. QNE

QNE Software is redefining cloud-based accounting with its advanced AI technology. Perfect for businesses of any size, QNE provides an extensive array of tools tailored to streamline accounting, payroll, and HR tasks.

Featuring AI-powered analytics, effortless e-invoicing, and hybrid cloud functionality, QNE Software facilitates effective financial management and promotes your business’s expansion.

Features:

- Integrated Document Management: Attach invoices, bills, and other source documents directly to your transactions, making record-keeping seamless and efficient.

- SST-Ready: It is equipped to handle Sales and Service Tax (SST) requirements, with modules that generate all necessary reports and forms automatically.

- Instant Updates: Its integrated modules ensure that any updates you make are immediately reflected throughout the entire system, keeping all data synchronized.

- Fast Data Processing: Leveraging a client-server model, QNE uses MS.SQL queries to deliver rapid data processing across your network, even with heavy data loads.

- Robust Data Management: Its SQL client/server architecture supports handling significantly larger data volumes compared to traditional file-based systems.

- Flexible Access: Access your accounting data from anywhere, whether online or offline, using any device, via QNE’s multi-platform capabilities.

- Top-Tier Security: Your database is fully secured on Microsoft Azure, benefiting from automated backups and mirrored storage across two separate servers for added protection.

- Automatic Backups: Schedule backups at your convenience without interrupting ongoing work, ensuring your data is always safe and up-to-date.

Pricing:

- Contact QNE for custom pricing

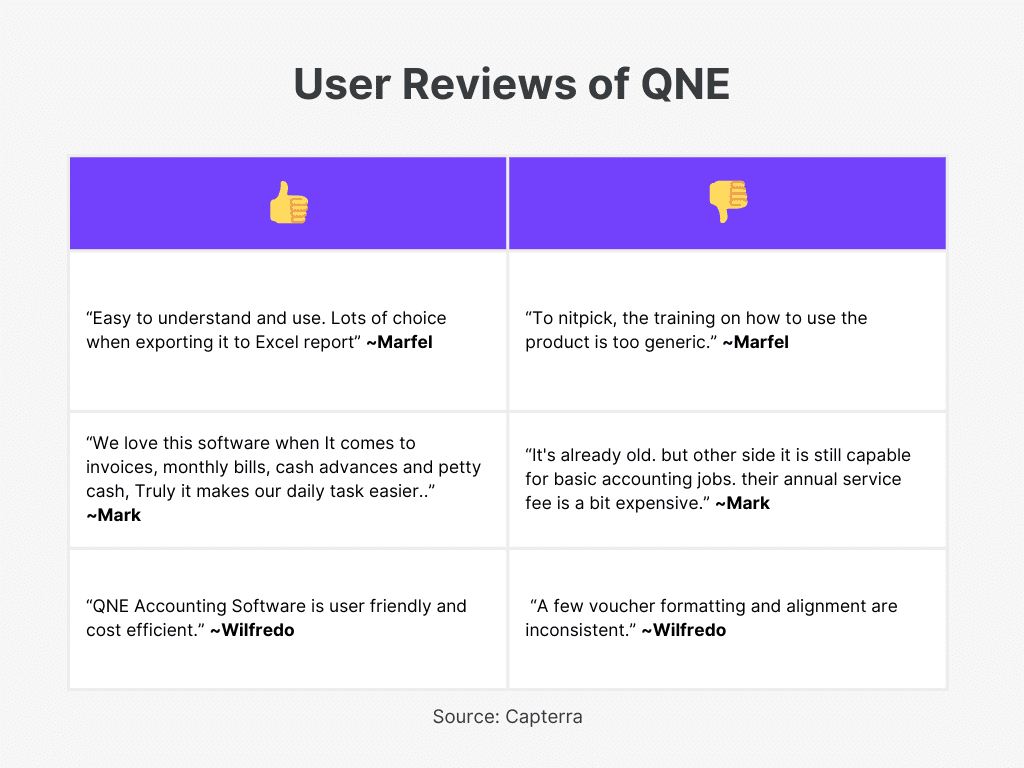

User Reviews:

4. Bukku

Bukku is a cloud-based accounting solution designed specifically for SMEs and accountants in Malaysia. With ease of use as its foundation, Bukku offers a comprehensive suite of features for invoicing, cash flow management, inventory monitoring, and financial reporting.

Bukku provides security, reliability, and cost-effectiveness, making it an ideal choice for businesses looking to enhance their accounting operations while adhering to local regulations.

Features:

- Customizable Invoicing: Personalize invoicing with custom fields, flexible number formats, and a variety of form design templates.

- Instant Invoice Sharing: Quickly create and send invoices via email or WhatsApp, with built-in tracking to see if they’ve been viewed.

- Automated Payment Reminders: Ensure timely payments by setting up automatic email reminders for outstanding invoices.

- Recurring and Late Fee Invoices: Automate the creation of recurring invoices and generate late fee invoices with just a click.

- Extensive Financial Reporting: Access a comprehensive suite of over 50 financial reports to stay on top of your business’s financial health.

- LHDN-Compliant E-Invoicing: Easily submit compliant e-invoices and self-billed invoices directly to MyInvois from Bukku.

- Faster Online Payments: Streamline payment processing with online payments and automatic receipt generation, reducing manual tasks.

- Automated Account Statements: Schedule and send monthly account statements automatically via email, complete with a Pay Now option.

- Effortless Expense Management: Simplify expense tracking by uploading documents or submitting them via WhatsApp, and automate payroll imports.

- Comprehensive Inventory Management: Track inventory levels, costs, and manage stock across multiple locations with support for various units of measure.

- SST Compliance and Reporting: Automatically generate SST-02 reports and track your SST liabilities, ensuring full compliance with tax regulations.

- Multi-Currency Handling: Manage international transactions with real-time forex rates, custom rate settings, and detailed currency gain/loss reports.

- Smart Bank Reconciliation: Upload bank statements in PDF and let SmartRecon handle automatic reconciliation of your transactions.

- Open API for Seamless Integration: Use Bukku’s open API to connect with other applications, expanding the capabilities of your accounting system.

Pricing:

- Launch: RM 0.00/year

- Growth: RM 590.00/year

- Premium: RM 990.00/year

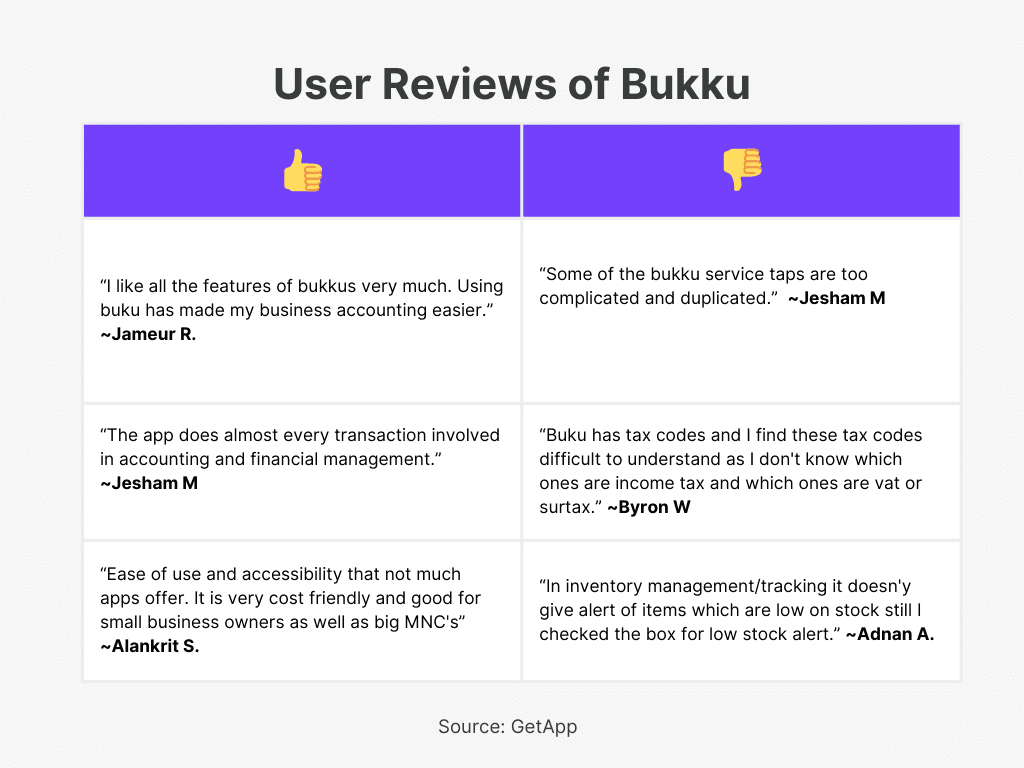

User Reviews:

5. Autocount

AutoCount Accounting Software delivers a powerful and intuitive system for financial management. Driven by Microsoft SQL Server, it ensures stable performance, immediate data availability, and robust security.

Its seamless module integration boosts efficiency and tailors to your specific business requirements. Ideal for various industries like sales, e-commerce, and payroll, AutoCount also offers cloud compatibility and point-of-sale features.

Features:

- Sales Management: Efficiently handle quotations, invoices, and credit notes, and generate detailed sales reports, including monthly analysis and profit & loss.

- Procurement Management: Manage purchase orders, invoices, and returns, and create monthly purchase analysis reports for better procurement decisions.

- LHDN e-Invoice Compliance: Easily generate and manage electronic invoices that comply with Malaysia’s tax regulations.

- Collaborative Platform: Enable multiple users, including your accountant, to collaborate on financial data in real time.

- Secure Cloud Storage: Your financial information is securely stored in the cloud, safeguarded by advanced security protocols.

- Comprehensive Accounting Tools: Streamline financial processes with features like cash book management and journal voucher entry.

- SST Compliance: Ensure compliance with Sales and Service Tax (SST) regulations, seamlessly integrated into the platform.

- Multi-Currency Handling: Manage transactions in multiple currencies, perfect for businesses with international operations.

- Inventory Management: Track inventory across multiple locations, manage product variants, and analyze profit margins for better inventory control.

- Customizable Reports: Tailor financial report layouts to fit your business’s specific needs.

- Integration API: API support allows integration of AutoCount with other systems, enhancing flexibility and connectivity.

Pricing:

Desktop Based

- AutoCount Express Plus Edition: RM2800

- AutoCount Basic Edition: RM4200

- AutoCount Pro Edition: RM6000

Cloud-Based

- Standard: RM100/month

- Advanced: RM140/month

6. Financio

Managing business finances can be daunting, but that’s where Financio steps in. Developed by ABSS, Financio is a cutting-edge cloud-based solution designed to streamline accounting, payroll, and tax management for small businesses.

Available in Malaysia, Singapore, and other regions, this advanced tool automates everyday financial tasks, freeing you to concentrate on what truly matters—expanding your business. With robust features and an intuitive interface, Financio makes it easy to take control of your finances, effortlessly and efficiently.

Features:

- Electronic Invoicing: Effortlessly create and send polished invoices via email with just a few clicks, streamlining your billing process.

- Automated Accounting: Simplify bookkeeping by automating invoice creation, payment recording, and expense tracking, with automatic entries and tax records that minimize errors.

- Collaborative Tools: Easily share messages and files related to transactions with customers and suppliers, whether or not they use Financio.

- Real-Time Multi-User Collaboration: Invite unlimited users and set customizable permissions to allow your team to collaborate effectively.

- Instant Reports and Live Dashboard: Generate real-time profit & loss statements, balance sheets, and other financial reports with live charts on demand.

- Multi-Location Inventory Management: Stay on top of your inventory with smart tracking across multiple locations, optimizing stock availability.

- Enhanced Security: Your data is protected with banking-level security measures, both in storage and during data transfers.

Pricing:

- Accounting Essentials: RM495/year

- Accounting Premier: RM825/year

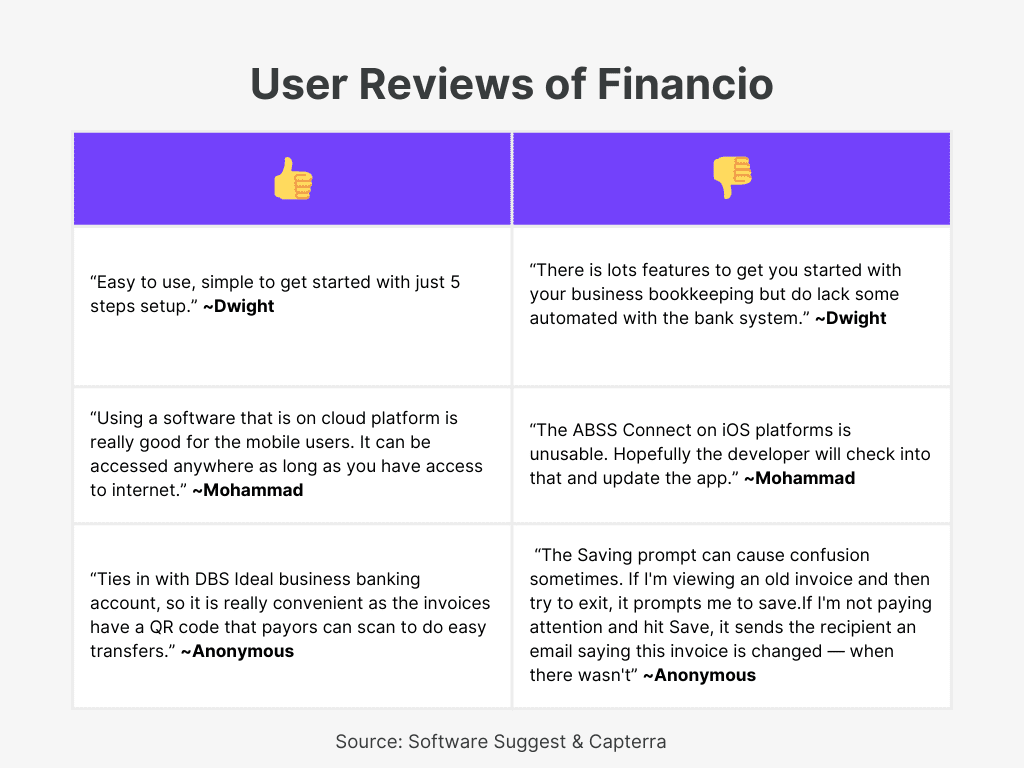

User Reviews:

7. Biztory

Biztory Cloud Accounting delivers an all-inclusive set of tools aimed at simplifying and safeguarding your financial management. The software automates e-Invoicing with LHDN-compliant submissions, eliminating the need for manual input into the MyInvois portal.

The platform supports paperless workflows, minimizing the need for physical documents and manual processes. It also includes features for handling sales, invoicing, cash flow, purchases, inventory, and taxes.

Features:

- Manage Your Quotation & Invoice: Easily create and send invoices & quotations with just a click, even while on the go.

- Manages Cash Flow: Track sales, expenses, and overdue business accounts to get a clear understanding of your business performance.

- Simplify Your Accounting & Taxes: Generate key financial reports such as Profit & Loss, Balance Sheet, and Statement of Account with ease. Biztory also includes a Tax Estimator to help estimate your total tax payable.

- Manages Inventory: Monitor your purchase expenses and current stock levels. You can also issue purchase invoices directly from Biztory to your suppliers.

- Cloud-based Accessibility: Access and manage your business metrics and cash flow from anywhere with an internet connection.

- Daily Data Backup: All your data is backed up daily and stored in a firewall-protected server to ensure security against hackers and virus attacks.

- Customer Support & Training: Offers customer support, online demo sessions, offline one-on-one consultations, and training workshops to enhance user experience.

Pricing:

- Basic: RM390/year

- Growth: RM1,290/year

- Pro: RM2,490/year

- Elite: Custom Pricing

8. QuickBooks Intuit

QuickBooks is a cloud-based accounting solution tailored for small businesses in Malaysia, providing a straightforward way to manage finances by tracking income, expenses, invoices, and inventory. With real-time accessibility across all devices, SST compliance, and strong data security.

QuickBooks enables you to concentrate on business growth while maintaining financial order. It integrates smoothly with local banks for effortless transactions and reconciliations.

Features:

- Custom Invoicing: Create and schedule custom recurring invoices, send invoices on the go, and receive automatic late-payment reminders.

- Recurring Transactions: Set up recurring transactions and bills to automate regular payments and financial processes.

- Payment Matching: Automatically match payments with invoices to simplify your accounting process.

- Track Income & Expenses: Easily monitor your income and expenses to stay on top of your business finances.

- Track SST: Manage and track your SST (Sales and Service Tax) with ease.

- Inventory Management: Track inventory levels and receive low-stock alerts to manage your stock efficiently.

- Scheduled Reports: Set up scheduled reports to receive regular updates on your business’s financial status.

- Real-Time Data Access: Access your business finances anytime, anywhere, and on any device with real-time financial data.

- Collaboration Tools: Invite your accountant, bookkeeper, or employees to collaborate in the cloud, with customizable access privileges.

- App Integration: Integrate with a wide range of business apps, including eCommerce, inventory, expense management, and CRM apps, to streamline your operations.

- Data Security: QuickBooks uses industry-recognized security safeguards, including SSL certificates, password-protected logins, automatic data backup, and an always-on activity log and audit trail.

- Mobile App Access: Manage your finances on the go with the QuickBooks mobile app, available on both the App Store and Google Play.

Pricing:

- Simple Start: RM 699/year

- Essentials: RM 1,014/year

- Plus: RM 1,329/year

- Advanced: RM 2,656/year

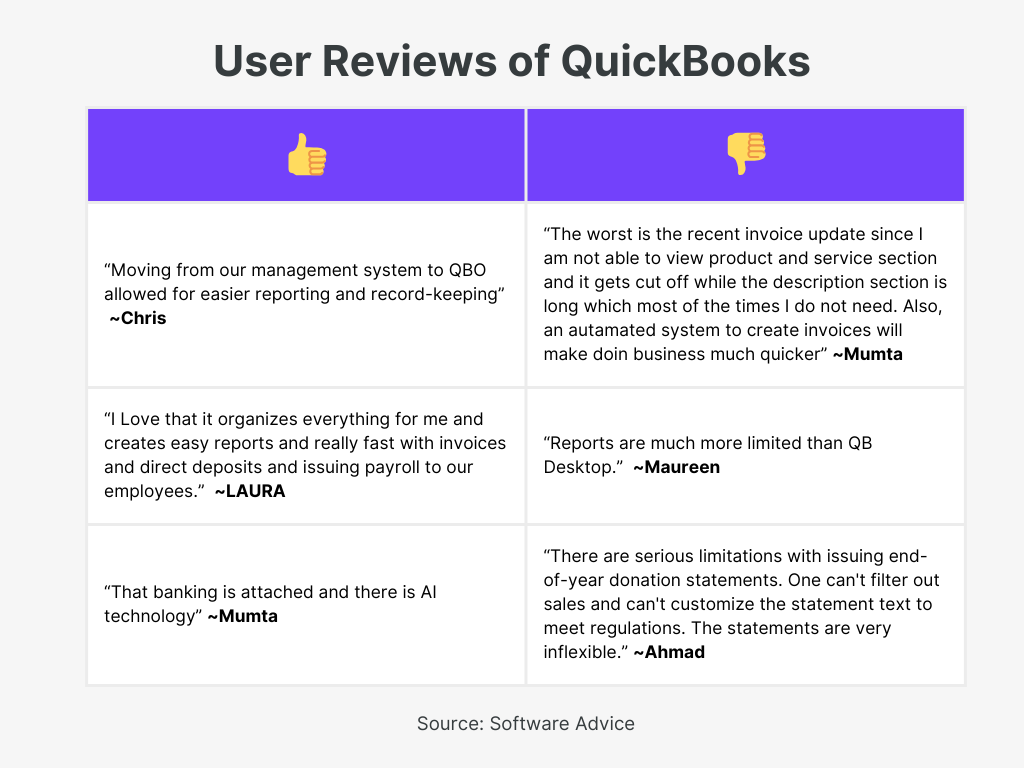

User Reviews:

9. Xero

Xero is an intuitive online accounting software designed specifically for small businesses in Malaysia. It offers a comprehensive suite of tools to manage your finances efficiently, including invoicing, expense tracking, and smooth bank integration. With Xero, you can keep your bookkeeping organized, track cash flow, and collaborate seamlessly with your accountant in real time.

The platform is fully adaptable to your unique business needs, ensuring easy compliance and stress-free tax reporting.

Features:

- Invoicing: Quickly create, send, and track custom invoices, and manage overdue bills.

- Automated Reminders: Set automatic reminders for timely invoice and bill payments.

- Bank Connections: Automatically import transactions by linking your bank accounts to Xero.

- Accounting Dashboard: Monitor finances daily with the accounting dashboard, tracking bank balances, invoices, and bills.

- Real-Time Collaboration: Collaborate with your accountant using up-to-date financial data from anywhere.

- Financial Reporting: Generate profit and loss, balance sheets, and cash flow reports.

- SST and Tax Compliance: Automate SST tracking and reporting to meet Malaysian tax laws.

- Expense Tracking: Capture, categorize, and submit expenses easily for reimbursement.

- Inventory Management: Monitor inventory levels, manage stock, and track sales efficiently.

- Third-Party Integrations: Connect Xero with apps like Stripe and Vend via the Xero App Store.

- Multi-Currency Support: Manage multi-currency transactions for international business.

- Data Security: Protect your financial data with encryption and regular backups.

Pricing:

- Starter: $348/year

- Standard: $552/year

- Premium: $744/year

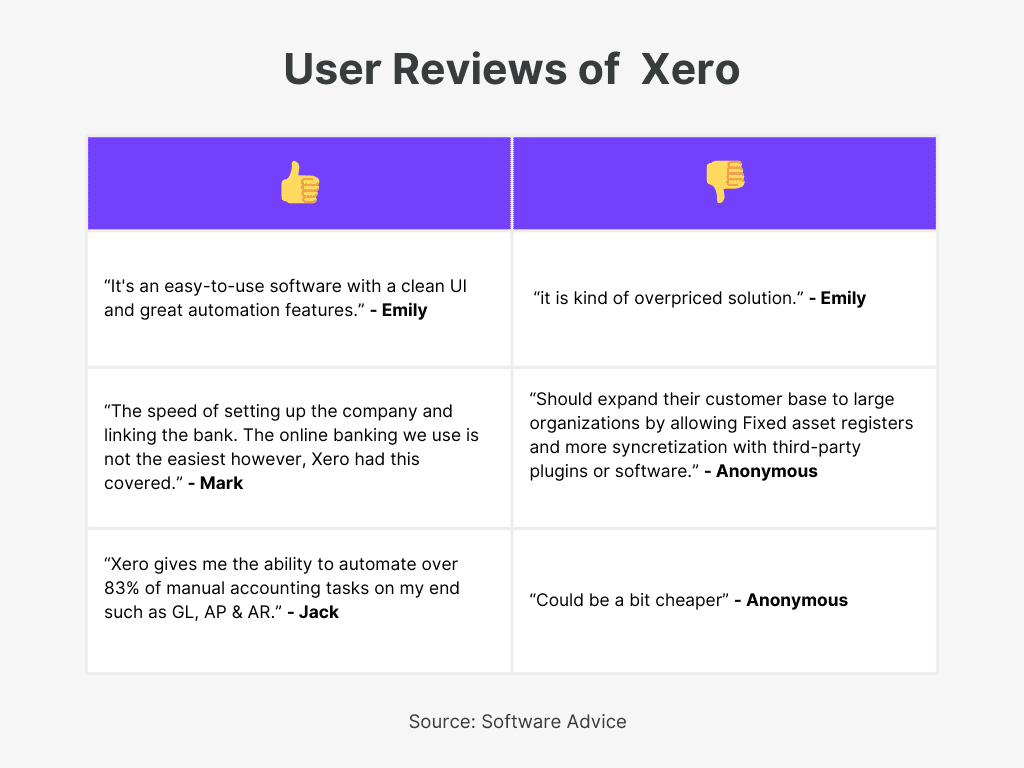

User Reviews:

10. Wave

Wave is transforming financial management for small businesses with an all-in-one platform. Designed for simplicity, Wave combines invoicing, payments, accounting, and payroll in one easy-to-use system. Wave simplifies your finances, helping you focus on growth.

From creating professional invoices to processing payments and accessing expert advice, Wave removes the hassle of financial tasks.

Features:

- Invoicing and Payments: Create and manage invoices and payments effortlessly, including options for recurring billing to streamline your workflow.

- Automated Cash Flow Management: Automatically track income, expenses, and cash flow, giving you a clear picture of your business’s financial health.

- Hassle-Free Tax Preparation: It’s organized dashboard simplifies tax filing by neatly categorizing income, expenses, and invoices.

- Bank and Credit Card Integration: Connect your bank accounts and credit cards to automatically import and categorize transactions, reducing manual work.

- Financial Health Monitoring: Generate comprehensive, easy-to-read reports that allow you to monitor your business’s financial performance over time.

- Double-Entry Accounting: Professional-grade, double-entry accounting ensures accuracy and compliance, making it easy for accountants to work with your data.

- Secure Data Handling: Uses 256-bit encryption and automatic backups to protect your financial data and provide peace of mind.

- Mobile Access: Manage your finances on the go with Wave’s mobile app, ensuring you stay productive wherever you are.

Pricing:

- Starter Plan: $0

- Pro Plan: $170/year

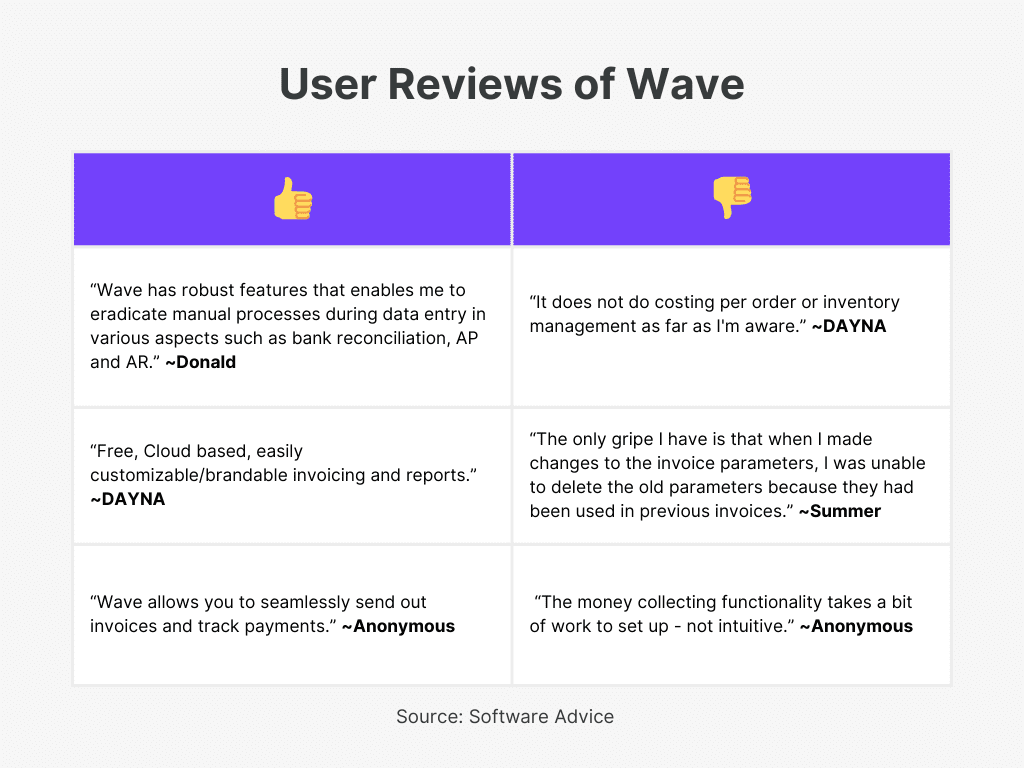

User Reviews:

Essential Factors to Consider When Choosing Accounting Software

- Data Security and Privacy: Check for robust security features and privacy compliance.

- Compliance with Local Regulations: Verify software compliance with SST.

- Budget Fit: Ensure software costs, including purchase and subscription fees, align with your budget.

- Ease of Use: Select user-friendly software with minimal training requirements for quick adoption.

- Company Size Compatibility: Choose software suited to your business size, whether small or large.

- Integration Capabilities: Ensure seamless integration with CRM, ERP, and local banking systems.

- Backup and Recovery: Confirm reliable data backup and recovery options to prevent data loss.

- Implementation Costs: Account for setup, training, and data migration expenses within your budget.

- User Reviews and Reputation: Research user feedback and software reliability for informed decision-making.

Conclusion

In conclusion, the diverse range of online accounting software options available in Malaysia caters to various business sizes and needs, offering features such as invoicing, financial reporting, SST compliance, and multi-currency support.

By thoroughly evaluating your business requirements, budget, and the specific features each software provides, you can make an informed decision that enhances your financial operations and supports your growth.

Investing in the right accounting software not only simplifies your financial management but also ensures compliance, improves efficiency, and sets the foundation for long-term success in Malaysia’s competitive business environment.

Frequently Asked Questions (FAQs)

- Which accounting software is mostly used in Malaysia?

The widely used accounting software in Malaysia includes SQL, Quickbooks Intuit, Financio, and Refrens. - Top Accounting Software Options for Windows Desktop On-Premises in Malaysia?

The leading on-premises accounting software options for Windows desktops in Malaysia are SQL, AutoCount, and QNE. - Which is the best Cloud-Based Accounting Software in Malaysia?

The best cloud-based accounting software options in Malaysia include Refrens, QuickBooks, and Financio. - What are the top accounting software solutions for SMEs in Malaysia?

Accounting software solutions for SMEs in Malaysia are Refrens and SQL. - What are the top accounting software solutions for Large Businesses in Malaysia?

Accounting software solutions for large businesses in Malaysia are QuickBooks Inuit and Xero.