Whether you’re a freelancer, a small business owner, or managing a larger enterprise, efficient invoicing is key to maintaining smooth operations and ensuring timely payments. With the implementation of e-invoicing mandates and the need for streamlined financial management, the demand for reliable invoicing software in Malaysia has surged.

In this blog, we explore the best invoicing software options available in Malaysia, along with a detailed comparison of features, pricing, reviews, and other important factors to help you make an informed decision.

| Software | Starting Price | Trial Period | Free version |

|---|---|---|---|

| Refrens | RM180/year | ✔️ | ✔️ |

| GSTHero | Custom | – | – |

| Zoho | Free | – | ✔️ |

| Quickbooks Inuit | RM699/year | ✔️ | ❌ |

| Sage Malaysia | Custom | – | – |

| SQL | RM474/year | ❌ | ❌ |

| HashMicro | Custom | – | – |

| Financio | RM495/year | ✔️ | ❌ |

| Xero | $348/year | ✔️ | ❌ |

| Scoro | $312/year | ✔️ | ❌ |

Key Features To Look For In An Invoicing Software For Malaysian Businesses

- Invoice Customization: Allows branding with logos, colors, and custom fields.

- Payment Reminders: Sends automated prompts to ensure timely payments.

- Audit Trails: Track every modification to invoices made by team members with Refrens’ audit log feature.

- Invoice API: Streamlines invoice generation by seamlessly integrating with your systems for efficient and accurate billing.

- LHDN e-Invoicing Compliance: Supports e-invoicing that adheres to Malaysian tax regulations.

- Accounting: Seamlessly connect with accounting features to manage financials, generate balance sheets, and track profit and loss.

- Expense Tracking: Record and categorize expenses directly within the software.

- Inventory Management: Track inventory levels, automate reordering, and integrate stock management with invoicing.

- Integration: Connects with other business tools to automate workflows.

- Multi-Currency Support: Create and manage invoices in various currencies with automatic exchange rate updates.

- Automated Tax Calculation: Automatically applies SST based on location and services.

- Bank Integration: Easily integrates with Malaysian banks for reconciliation.

- Mobile Accessibility: You can manage your finances on the go with the mobile app, accessible from anywhere.

1. Refrens

Trusted by over 150,000 businesses across 170+ countries, Refrens is an all-in-one business management platform designed specifically for freelancers, agencies, and small businesses in Malaysia. This comprehensive platform streamlines daily operations by integrating invoicing, accounting, lead management, and more into a single user-friendly system.

With its robust functionality and ease of use, Refrens empowers Malaysian businesses to efficiently manage all aspects of their operations, enhancing productivity and driving growth.

Features:

- Customizable Invoice Templates: Design invoices to align with your brand identity.

- Multi-Currency Invoices: Invoice international clients with multi-currency support.

- Flexible Invoice Sharing: Share invoices via email, print, PDF, WhatsApp, or links in a single click.

- Instant Invoice Conversion: Convert invoices to credit notes or orders in one click.

- Audit Trails: Keep track of all changes made to invoices by team members with Refrens’ audit trail feature.

- Recurring Invoices: Set up automated recurring billing to reduce manual intervention and ensure consistent client payments.

- Invoice API: Quickly create invoices for your website or app with the Refrens invoice API.

- Generate E-Invoices: Provides automated, IRBM/LHDN-compliant e-invoicing with customizable templates and secure data management.

- Comprehensive Accounting: Provides hassle-free accounting with the ability to effortlessly create unlimited quotations using multiple quotation templates, tax invoices, and purchase orders for free.

- Reports and Analytics: Offers comprehensive financial reports, including profit and loss, payment, client, and expense reports, and more, to help you monitor business performance.

- Expense Management: Efficiently track and report on salaries, reimbursements, and operational costs with detailed updates.

- Inventory Management: Automatically update and track inventory with each invoice, offering detailed analysis in our management feature.

- Lead Management: Capture, track, and manage leads seamlessly through every sales stage, ensuring an organized and efficient workflow.

- Third-Party Integration: Sync seamlessly with essential platforms such as WhatsApp, Facebook, Pabbly, and more to optimize workflows and boost productivity.

Pricing:

- Basic: Free

- Books Essential: RM180/year

- Books Pro: RM360/year

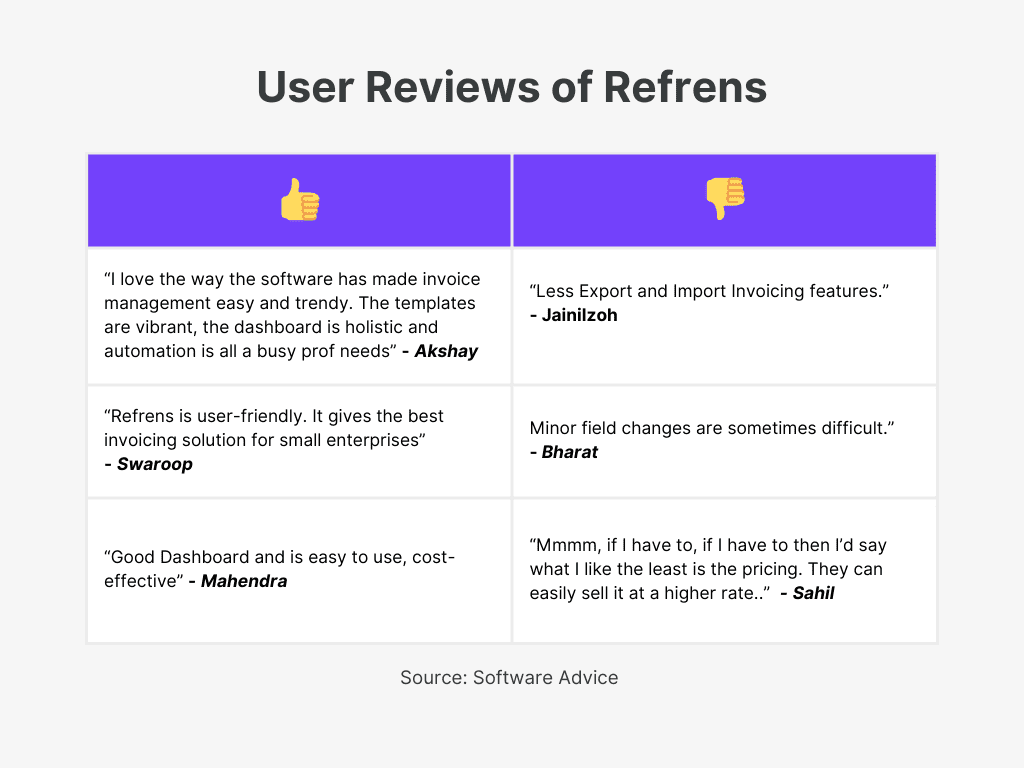

User Reviews:

2. GSTHero:

GSTHero offers e-Invoicing Automation 3.0, a comprehensive solution that is fully LHDN | PEPPOL | MDEC Compliant. It automates invoicing processes while ensuring full regulatory compliance in Malaysia.Trusted by numerous enterprises, GSTHero Malaysia e-Invoicing is committed to delivering innovative solutions that offers seamless, fast integration, tailored specifically to meet business requirements. Join us in revolutionizing compliance in Malaysia and beyond.

Features:

- Customizable Invoice: Design invoices tailored to your brand identity.

- Multi-Currency Invoices: Support invoicing for international clients in various currencies.

- Instant Invoice Conversion: Convert invoices to credit notes or orders instantly.

- Audit Trails: Track all changes to invoices with detailed audit trails.

- Recurring Invoices: Automate recurring invoices to ensure consistent client payments.

- Invoice API: Quickly create and manage invoices through a seamless API integration.

- E-Invoice Generation: Automated, LHDN/PEPPOL compliant e-invoicing with customizable templates.

- Reports and Analytics: Generate financial reports, including profit & loss, payment, client, and expense reports.

- ERP Integration: Integrate with 100+ ERPs globally, like SAP, Oracle. etc

- Accelerated Payments: Facilitate faster payments through secure online options, automated reminders, and clear payment terms.

Pricing:

- Custom pricing based on the business requirements.

3. Zoho

Zoho Invoice is a user-friendly online invoicing software for small businesses, freelancers, and consultants. It simplifies the billing process with customizable templates, automated billing, and payment reminders.

This software also integrates seamlessly with other business tools, making it an efficient solution for managing invoices and ensuring timely payments. Whether managing projects or tracking expenses, Zoho Invoice caters to the varied needs of modern professionals.

Features:

- Professional Invoice Creation: Design branded invoices with customizable templates, perfect for businesses in Malaysia.

- Easy Invoice Sharing: Share invoices via email, print, or PDF, with scheduling.

- Recurring Invoices: Automate recurring billing to save time and reduce manual work.

- Payment Handling: Accept card payments online with seamless gateway integration.

- Payment Reminder Automation: Schedule reminders to ensure timely payments and enhance cash flow.

- Quotes and Estimates: Create and convert quotes to invoices with ease.

- Real-Time Reports: Schedule real-time sales and tax reports for automatic delivery.

- Multi-Currency and Language Support: Issue invoices in multiple currencies and languages, ideal for Malaysia.

- API Integration: Seamlessly connect with Zoho and third-party apps using API.

- Tax Handling: Automatically calculate and apply taxes for compliance in Malaysia.

Pricing:

- Zoho Invoicing is free, but for additional features like accounting, payroll, and billing solutions, you’ll need to subscribe to their paid plans.

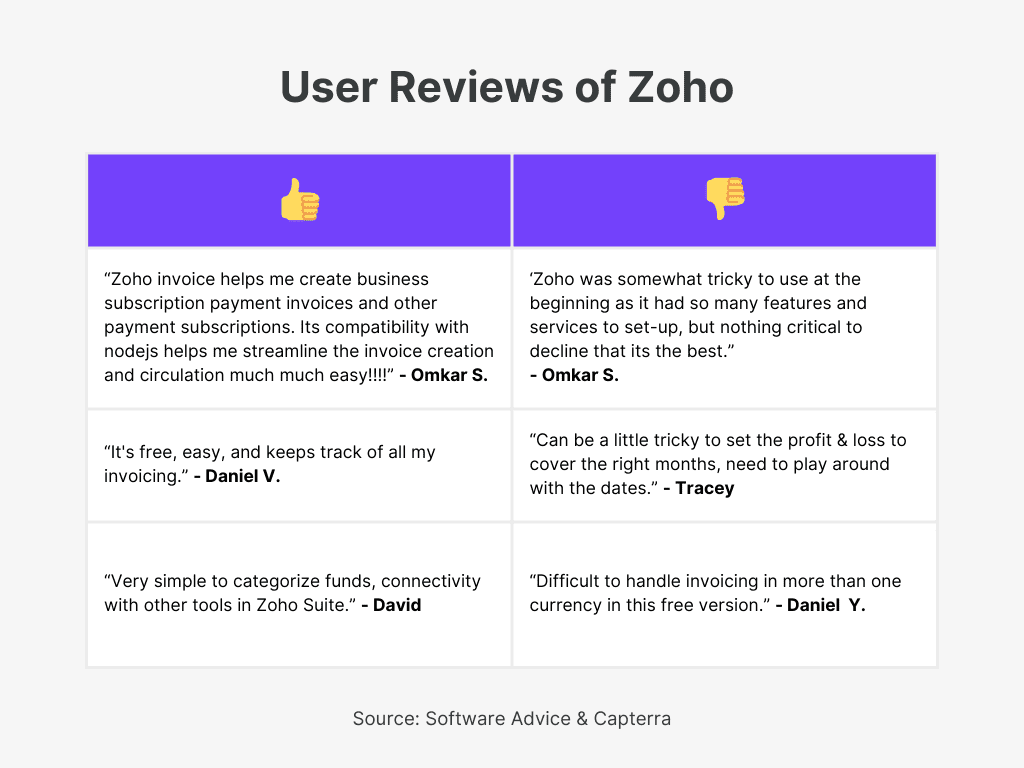

User Reviews:

4. Quickbooks Intuit

QuickBooks is a leading online accounting and invoicing software designed specifically for small businesses in Malaysia. It helps streamline financial management by allowing users to easily create and send custom invoices, track income and expenses, and manage taxes like SST.

QuickBooks enables businesses to stay organized and get paid faster. Whether you’re managing bills, tracking project profitability, or handling payroll, QuickBooks offers a comprehensive solution that simplifies accounting, making it an essential tool for small business owners.

- Customizable Invoices: Design professional invoices tailored to your brand, including your logo, colors, and shipping details, using QuickBooks’ flexible templates.

- Automated Billing: Streamline your invoicing process with recurring invoices and automated payment reminders, reducing the need for manual follow-ups.

- Real-Time Invoice Tracking: Keep tabs on your invoices with real-time updates on their status—whether they’re pending, paid, or overdue—from any device.

- Global Invoicing Capabilities: Effortlessly send invoices in multiple languages and currencies, with automatic adjustments for exchange rates, making international billing seamless.

- Expense Integration: Easily link billable expenses to invoices, ensuring that all costs incurred during a project are billed to your clients.

- Secure Online Payments: Speed up your payment process by offering clients secure online payment options through credit or debit cards.

- Detailed Financial Reporting: Generate comprehensive financial reports, including insights into income, expenses, SST, and invoice statuses, to keep your business’s finances in check.

Pricing:

- Simple Start: RM 699/year

- Essentials: RM 1014/year

- Plus: RM 1329/year

- Advanced: RM 2656/year

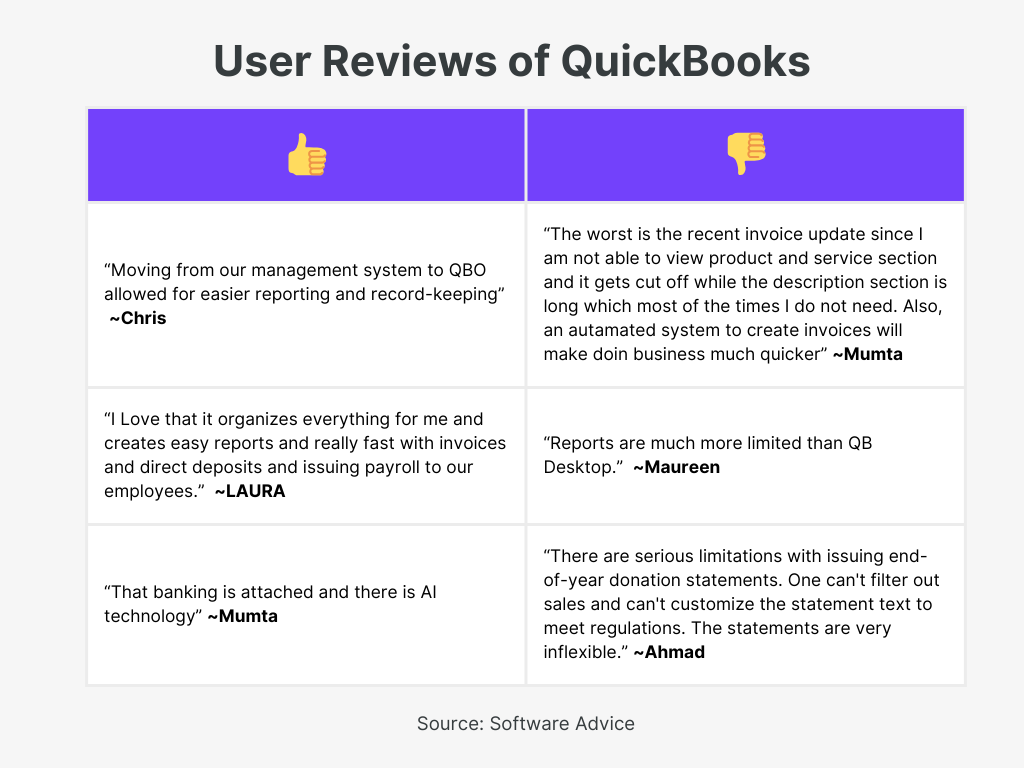

User Reviews:

5. Sage Malaysia

Sage is a trusted accounting and business management software provider, used by millions of businesses globally, including in Malaysia. With robust invoicing, payroll, reporting, and compliance tools, Sage simplifies financial management for businesses of all sizes.

Whether you’re a small business streamlining operations or a larger enterprise seeking ERP capabilities, Sage’s software enhances productivity, cash flow, and accuracy.

Features:

- Instant Invoicing: Generate and track invoices in real-time, speeding up payment processes and improving cash flow management.

- Customizable Invoicing: Adapt the software to your business’s unique needs, ensuring it fits seamlessly into your existing processes.

- Precision Digital Invoices: Create accurate digital invoices that minimize errors and disputes, enhancing the reliability of your billing.

- Quick Quote Conversion: Effortlessly convert quotes into invoices with just a few clicks, streamlining your workflow and saving valuable time.

- E-Invoicing Efficiency: Send professional, eco-friendly invoices via email, streamlining the invoicing process and reducing paperwork.

- Accelerated Payments: Facilitate faster payments through secure online options, automated reminders, and clear payment terms.

- Integrated Financial Tools: Seamlessly connect your invoicing with your bank, accounting software, and other systems for a more efficient financial process.

- Real-Time Insights: Access real-time data and insights on your business’s performance instantly, empowering you to make informed decisions.

Pricing:

- Custom pricing based on the business requirements.

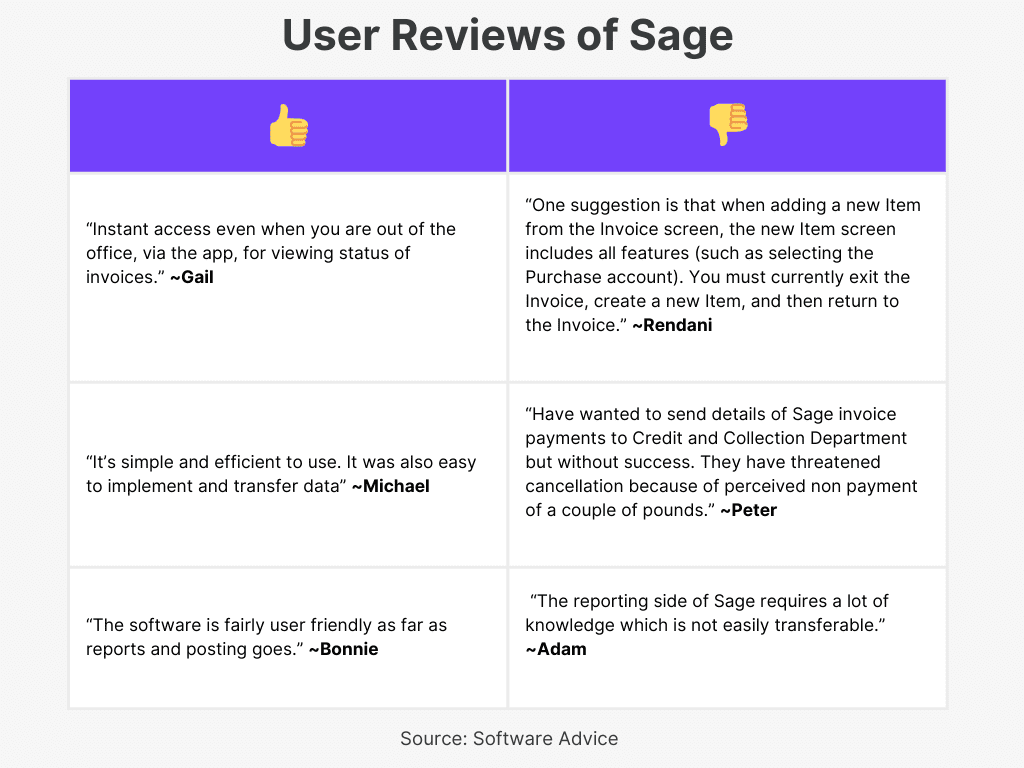

User Reviews:

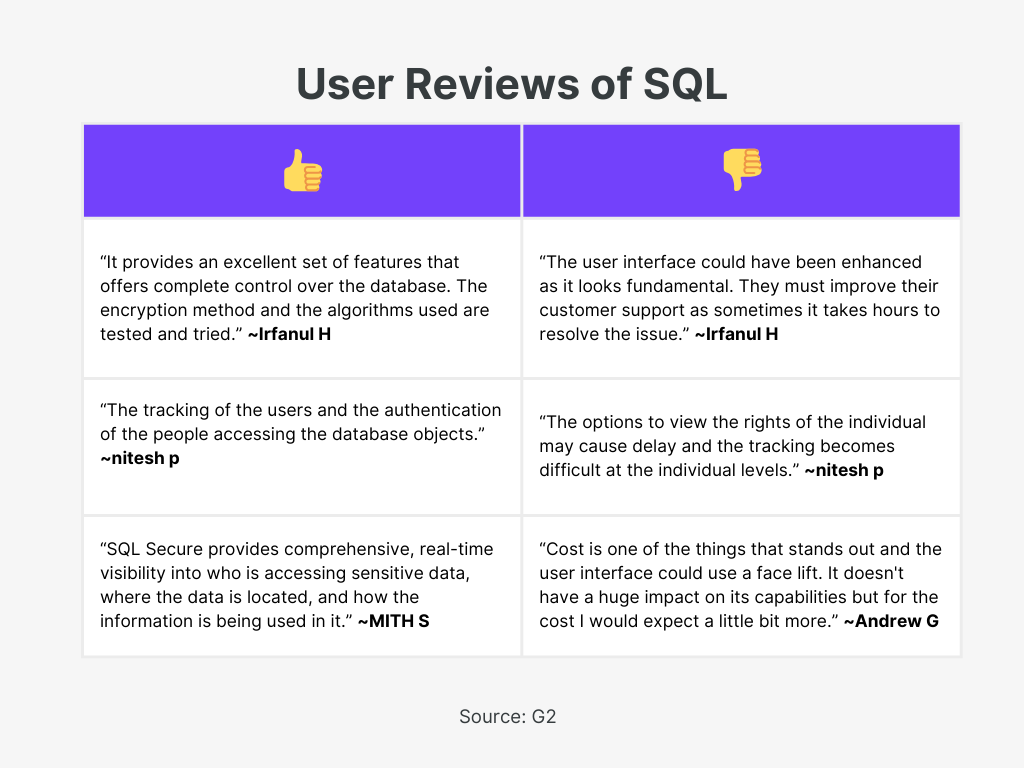

6. SQL

Invoicing is crucial to your business’s financial health, and SQL Account makes it effortless. Trusted by over 270,000 Malaysian companies, SQL Account streamlines invoicing with seamless LHDN e-invoicing integration, customizable invoices, and real-time payment tracking.

Beyond invoicing, SQL Account enhances your entire financial workflow with advanced inventory management and comprehensive reporting. Paired with SQL Payroll for easy payroll management, these tools drive efficiency and success in Malaysia’s business landscape.

Features:

- Customizable Invoices: Design invoices with templates and branding.

- Flexible Fields: Tailor invoice fields to suit your specific business needs, offering greater customization and control.

- Batch Email Invoices: Securely send multiple invoices at once via email, saving time and enhancing operational efficiency.

- E-Invoice Integration: Seamlessly issue LHDN-compliant e-invoices directly from the platform, ensuring tax compliance.

- WhatsApp Integration: Conveniently send invoices to clients via WhatsApp, making communication faster and more accessible.

- Multi-Currency Invoicing: Generate invoices in various currencies, with automatic exchange rate updates to simplify international transactions.

- Automated Bank Reconciliation: Reconcile accounts with 20+ Malaysian banks.

- Real-Time CTOS Integration: Instantly access CTOS credit reports within SQL Account, enabling informed business decisions.

Pricing:

- Essential: RM474/year

- Pro: RM654/year

User Reviews:

7. HashMicro

HashMicro’s ERP software empowers over 1,750 enterprises with streamlined operations and enhanced productivity. Its AI-powered, fully integrated system offers customizable tools for automated invoicing, accounting, and more, tailored to various industries’ needs.

Features:

- Peppol e-Invoicing Integration: Connect to Malaysia’s Peppol network for standardized, automated invoicing.

- Automated Invoicing: Automate invoice creation and sending based on set criteria.

- Real-Time Data: Access current financial data, including invoice and payment statuses.

- Accrual & Amortization: Automate accruals and amortizations for precise financial reporting.

- Customizable Invoice Templates: Create invoices with templates that reflect your brand.

- Analytical Reporting: Generate detailed financial reports to monitor performance.

Pricing:

- Custom pricing as per business requirements.

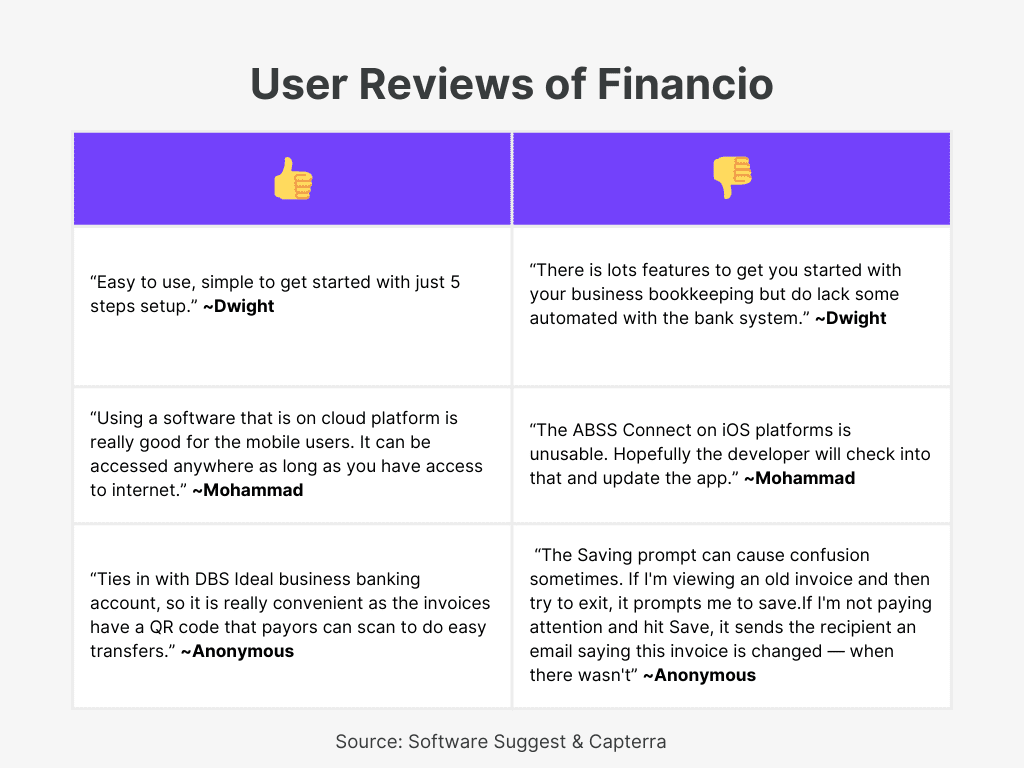

8. Financio

Financio, developed by ABSS, is a cloud accounting software that streamlines invoicing, accounting, and payroll for small businesses in Malaysia and beyond. With Financio, you can easily create, send, and manage online invoices, automate recurring billing, and integrate your financial tasks on a single platform.

Tailored for the multi-cultural Malaysian market, Financio also offers a multilingual interface and seamless bank integration. It’s the efficient, all-in-one solution for modern business management, helping you save time and focus on growth.

Features:

- Instant Invoicing: Personalize your invoices with your company’s branding, including logos, colors, and layout, to reinforce your brand identity with every invoice.

- Automated Billing: Set invoices to send on a recurring schedule.

- e-Invoicing: Easily send professional invoices via email.

- Auto Data Entry: Update accounting records automatically.

- Unified Platform: Seamlessly integrate your accounting, invoicing, and banking activities within a single platform, enhancing operational efficiency and data consistency.

- Multilingual UI: Use the platform in English, Chinese, or Bahasa Melayu.

- Bank Integration: Seamlessly import bank statements directly into the platform, simplifying bank reconciliation and ensuring accurate financial records.

- User Permissions: Customize and control user access levels, ensuring that team members have the appropriate permissions based on their roles and responsibilities.

- Tax Management: Automate the tracking and calculation of taxes, making it easier to prepare for tax filings and ensuring compliance with local tax regulations.

Pricing:

- Accounting Essentials: RM495/year

- Accounting Premier: RM825/year

User Reviews:

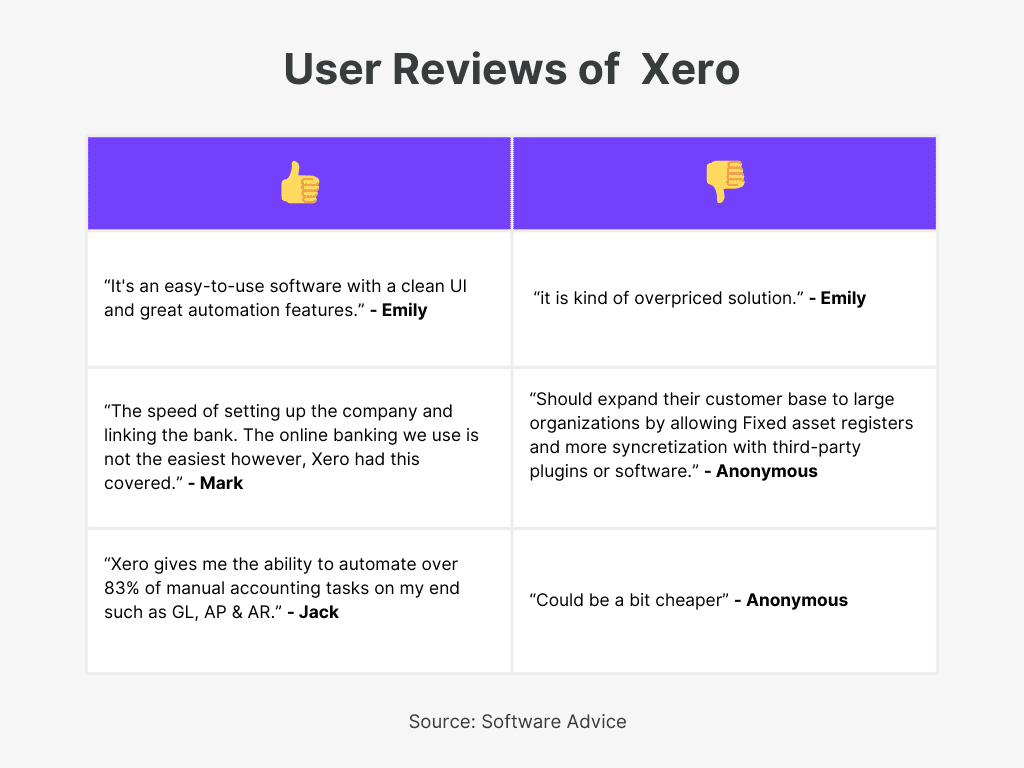

9. Xero

Xero is the trusted accounting solution for over 4.2 million users worldwide, offering fast, intuitive tools for small businesses, accountants, and bookkeepers. With features like e-invoicing, expense tracking, and seamless bank connections, Xero simplifies financial management, helping you focus on growth. Xero caters to businesses of all sizes with plans customized to meet diverse needs.

Features:

- Customizable Invoices: Customize with payment terms and custom messages.

- Multiple Payment Options: Accept debit, credit, Apple Pay, Google Pay, and direct debits via Stripe.

- Click-to-Pay Invoices: Add a ‘Pay Now’ button for faster payments.

- Automatic Payment Reminders: Automate reminders to prompt payments around due dates.

- Mobile Invoicing: Create and send invoices on the go with the Xero mobile app.

- Invoice Tracking: Monitor status, view customer interactions, and receive payment alerts.

- Repeating Invoices: Automate recurring invoices for consistent billing.

- Convert Quotes to Invoices: Convert accepted quotes into invoices effortlessly.

- Bulk Invoice Management: Manage multiple invoices at once for efficiency.

- Secure Online Invoices: Enhance security with online invoicing, safer than PDFs.

Pricing:

- Starter: $348/year

- Standard: $552/year

- Premium: $744/year

User Reviews:

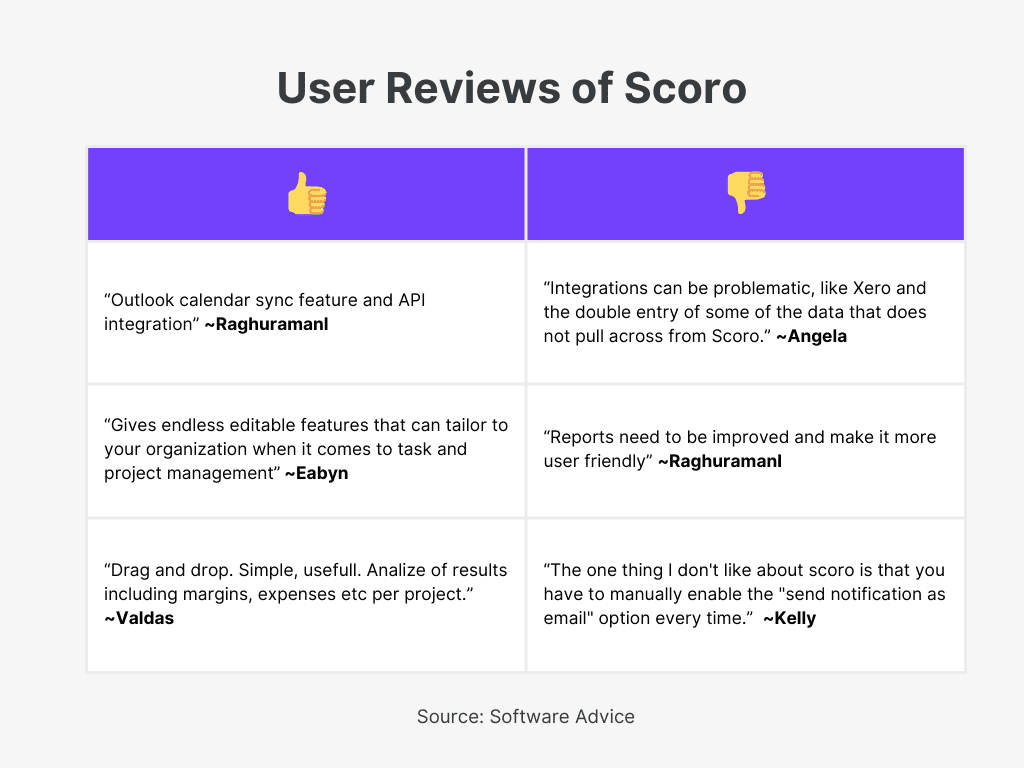

10. Scoro

Scoro is Malaysia’s comprehensive all-in-one work management solution, ideal for consultancies, agencies, and professional service businesses. It integrates project, resource, and financial management into a single platform, with the addition of an efficient invoicing feature for streamlined billing processes.

Scoro’s robust capabilities, including resource planning, financial tracking, and cross-team collaboration, help Malaysian businesses enhance operations and increase profitability.

Features:

- Automated Invoicing: Easily create recurring invoices for various billing needs.

- Modifiable Invoices: Convert quotes into tailored invoices with partial billing.

- Time and Material Billing: Bill accurately based on time and materials.

- Retainer Invoicing: Automate monthly invoices for retainer clients.

- Billing Forecasting: Predict cash flow with work-based billing forecasts.

- Global Financial Management: Manage multi-currency finances and global reports.

- Stripe Integration: Accelerate payments with Stripe and automated reminders.

- Real-Time Visibility: Provide real-time access to accounts receivable and balances.

- Cost Management: Track and control expenses for financial oversight.

- App Integration: Connect Scoro with essential tools for streamlined operations.

Pricing:

- Essential: $312/year

- Standard: $444/year

- Pro: $756/year

- Ultimate: Custom

User Reviews:

Conclusion

Selecting the perfect invoicing software for your business can transform your financial management, boosting accuracy, efficiency, and compliance with local standards.

Whether you opt for comprehensive platforms like Refrens and Zoho or specialized systems such as SQL Account and GSTHero, there’s a solution tailored to meet the unique needs of your operation.

Integrating the ideal software not only streamlines your billing processes but also enhances cash flow management, allowing you to focus on scaling your business. Dive into these top choices and discover the software that will elevate your business to new heights. Start your journey toward streamlined success today!