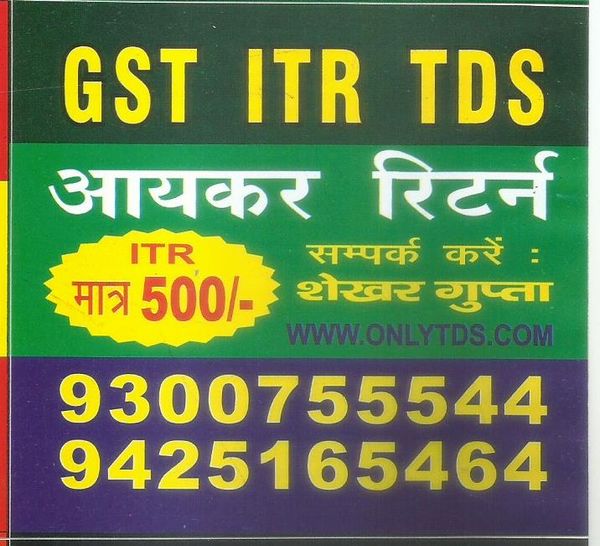

rifco tax consultats

Projects

Services

About rifco tax consultats

We are offering the services of:-

GST REGISTRATION CERTIFICATE

GST RETURN

GST OLD RETURN AT LOW COST

INCOME TAX RETURN (ITR)

INCOME TAX REFUND

UDYOG AADHAAR

PARTNERSHIP FIRM REGISTRATION

PROPRIETORSHIP FIRM REGISTRATION

TDS RETURN

DIGITAL SIGNATURE

GST REGISTRATION APPLY IN 1 DAY

GST COMPLIANCE

GST NUMBER CANCELLATION

PERSONAL MEETING ALSO AVAILABLE FOR ANY DOUBT/QUERY FEES 200/-

BEST OPTION FOR E-COMMERCE

ACCOUNTING FOR ALL TYPES OF valid ENTERPRISES/BUSINESS ENTITY.

PERMANENT ACCOUNT NUMBER (PAN)

TAX DEDUCTION AND COLLECTION ACCOUNT NUMBER (TAN)

ALL OTHER TAX FILLING AND REGISTRATION AT LOW COST

DOCUMENTS REQUIRED FOR GST REGISTRATION (PROPRIETOR/INDIVIDUAL):-

1) PAN OF PROPRIETOR/INDIVIDUAL

2) AADHAAR OF PROPRIETOR/INDIVIDUAL

3) PASSPORT SIZE PHOTO OF PROPRIETOR/INDIVIDUAL

4) LAST MONTH ELECTRICITY BILL COPY & RENT AGREEMENT

5) FIRM NAME

6) MOBILE NUMBER

DOCUMENTS REQUIRED FOR GST REGISTRATION OF (PARTNERSHIP FIRM):-

1) PAN, AADHAR, PASSPORT SIZE PHOTOGRAPH, MOBILE NUMBER & EMAIL I'D OF ALL PARTNERS

2) PARTNERSHIP DEED

3) RENT AGREEMENT

4) COPY OF LAST MONTH OF ELECTRICITY BILL & RENT AGREEMENT

5) CANCEL CHEQUE

6) AUTHORISATION LETTER ON LETTERHEAD OF THE PARTNERSHIP FIRM

Please contact via. Call/Whatsapp or send documents via. Whatsapp at 93007-55544

Liked the work?

Let’s discuss your next awesome project.