Free Invoice Generator - Online Invoice Maker

Use Invoice Templates to Create Invoices Online

Download, Print, Email Invoice with Invoice Generator

Free Invoice Generator (Add invoice details and download it in PDF format.)

Features of Invoice Generator

Frequently Asked Questions (FAQ)

Refrens invoice generator allows you to create invoices for free without taking much time. Head over to Refrens invoice generator and start creating invoices using pre-formatted invoice templates. You can add your logo, brand colors, and multiple invoice templates and use many more such features to keep your brand consistent.

Refrens is the best free invoice generator as you can create invoices for clients without paying a single amount. You can freely customize your fields and columns, download the invoice as PDF or send it directly via email, or share it via WhatsApp and within one click you can create a payment receipt, debit note and credit note. Not only this, you can create quotations, purchase orders, proforma invoices, payment receipts, delivery challan, and expense management and can also keep the records of your inventory.

If you are a freelancer and want to save time and money on creating invoices, then simply opt for an invoice generator like Refrens, which provides you invoices for free. Simply go to Refrens invoice and add the details such as:

- Title of the invoice.

- Logo of your business or you can create a business for your freelance business.

- Add Invoice number, invoice date, and invoice due date.

- Now, in the Billed By section add your details.

- In the Billed To section, add your client's details.

- In the line item section, add your service name with a description of your freelance work.

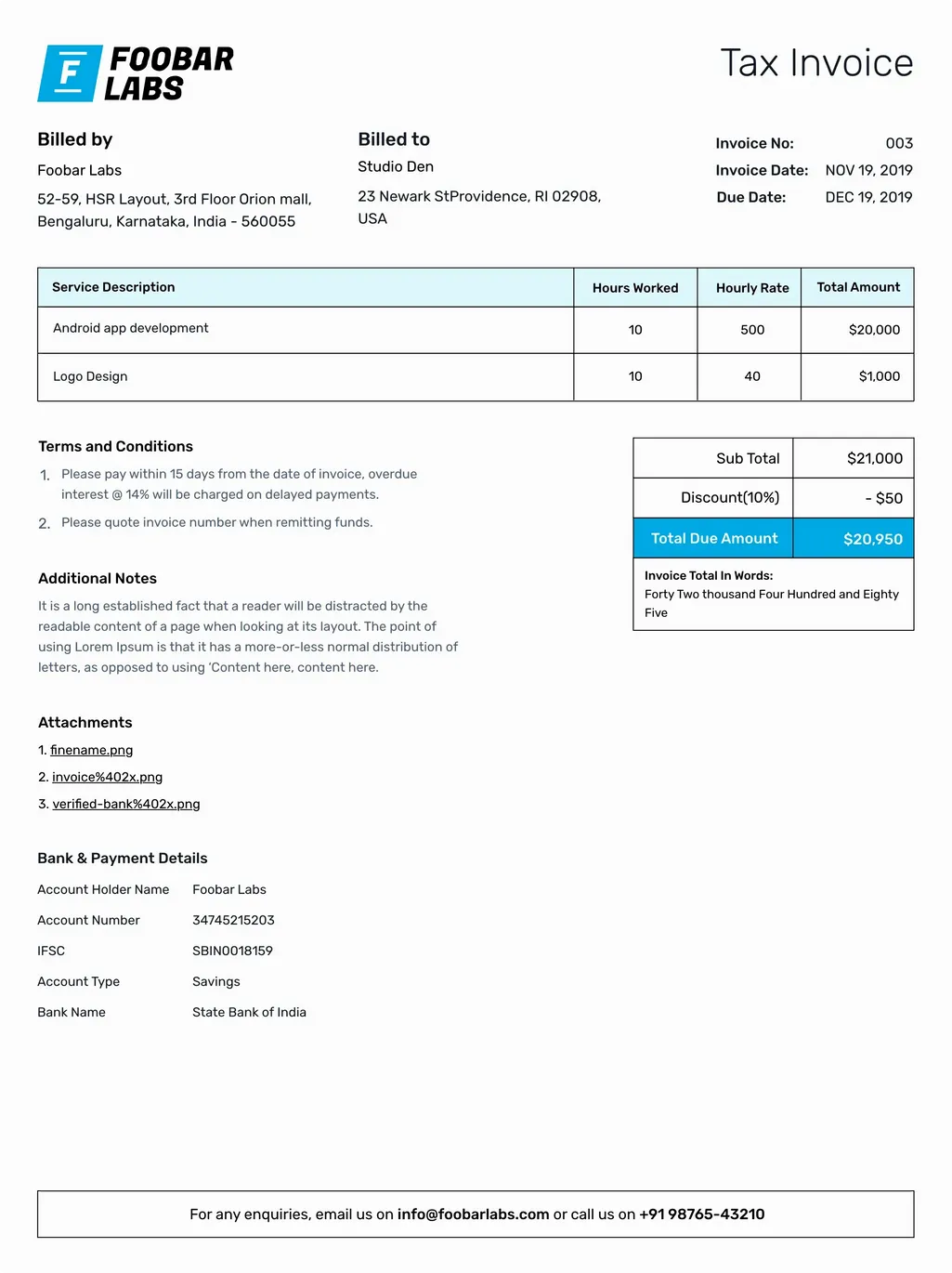

- As you are a freelancer and work hourly you should create invoices in hourly format. So click on the 'Add/Rename column' above the line item and change the 'Quantity' to 'Hours Worked' and in place of 'Rate' change to 'Rate per Hour'. Your invoice is created now.

FREE! Refrens invoice generator is free for freelancers, agencies, small businesses, and entrepreneurs. You can generate 15 documents every year. Also, manage invoices and access free templates.

Yes, it is easy to download the PDF invoice using Refrens invoice maker. , clicking on the option of "Download PDF" will make your invoice in PDF format. Moreover, you can also email the invoice, print the invoice, and send the invoice via WhatsApp or schedule for future dates.

Not at all. Your invoices will carry no ads. On the free version, the documents will carry a small non-intrusive Refrens branding. It helps us spread the word and keep the free features going.

Documents of Premium customers will carry only your business' branding.

Yes. All the invoices created by you are saved online. You can access all the invoices anytime just by logging into your account.

When you decide to leave Refrens, you have the option to download all your customer data, invoices, quotations, and other documents at any time. This ensures that you have access to your important business information even after discontinuing your use of the platform. Refrens prioritizes data security and allows users to retain their data for their records or for transitioning to another platform if needed.

How to create a free invoice online using invoice generator?

Creating an online invoice is now super easy, and I'll guide you on how to do it for free using Refrens. All you need is a device like a mobile, laptop, or desktop with internet access. Let's dive into the simple step-by-step process:

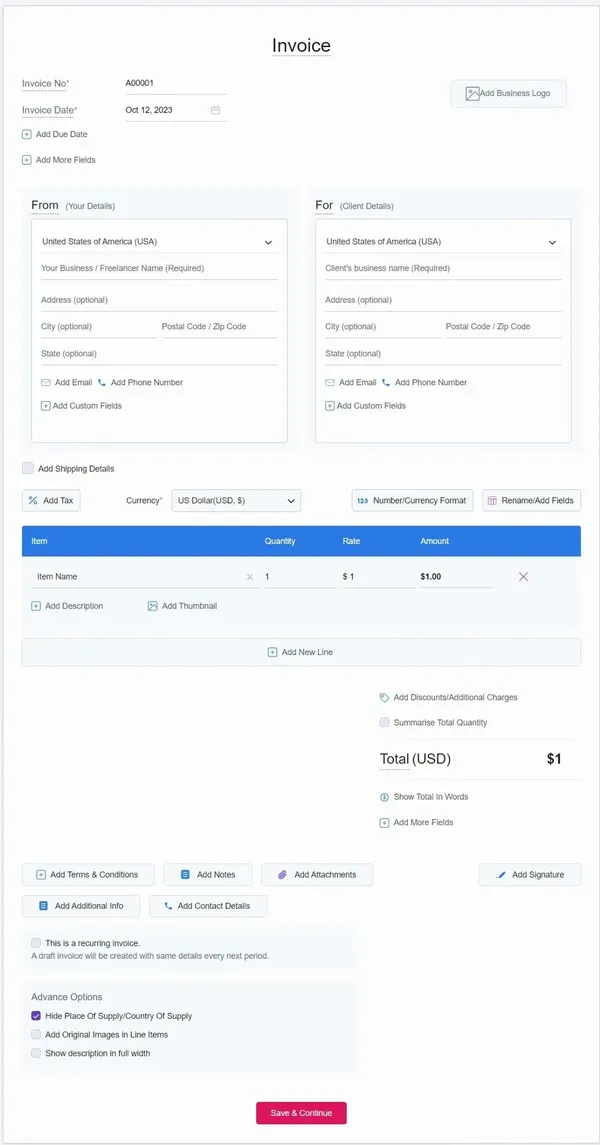

Step 1: Invoice Header

- What to do: Start by adding the invoice number, issue date, and due date.

- Why: This helps keep track of transactions and ensures timely payments. You can also add your company logo for a professional touch.

Step 2: Billed By

- What to do: Provide your business details, including name, address, email, phone number, and tax number if applicable.

- Why: This identifies the seller, making the transaction clear and trustworthy. It's also a legal requirement to include tax information.

Step 3: Billed To

- What to do: Include buyer's details - their name, address, email, and phone number.

- Why: It specifies who the invoice is for, making the process transparent and compliant with regulations.

Step 4: Tax

- What to do: Add your tax rate. The system will calculate the tax amount and the final invoice total.

- Why: This ensures proper taxation and complies with the tax regulations set by the government.

Step 5: Product/Service Details

- What to do: List the products or services, along with quantities and rates.

- Why: It provides a breakdown of items sold, helping both parties understand the transaction details.

Step 6: Discounts & Charges

- What to do: Apply discounts and extra charges if needed.

- Why: Discounts and additional charges are calculated automatically, ensuring accurate billing. This is by transparent business practices.

Step 7: Terms & Conditions

- What to do: Specify your company’s terms related to the invoice.

- Why: Clear terms facilitate faster payments and maintain transparent records, adhering to government and taxation regulations.

Step 8: Additional Notes

- What to do: Add any extra information related to the product or service.

- Why: This section allows customization for specific details tailored to the transaction, providing clarity to both parties.

Step 9: Customize Invoice

- What to do: Personalize the invoice template, colors, fonts, and add a custom letterhead.

- Why: Branding your invoice maintains consistency and professionalism, reflecting positively on your business.

Step 10: Sending the Invoice

- What to do: Send the invoice via email directly from Refrens. Alternatively, print, download, or share it through WhatsApp.

- Why: Efficient communication ensures a smooth transaction process, meeting client preferences. It aligns with business regulations for record-keeping.

By following these steps, you not only create a professional invoice but also ensure compliance with government regulations and tax requirements in Vietnam.

How to customize your invoice for free with Refrens invoice generator?

Customizing your invoices for free with Refrens Invoice Generator is a simple and user-friendly process. Here's how you can customize your invoices using the Refrens invoice generator.

Add Your Business Logo

Start by uploading your business logo. Adding your logo gives your invoice a professional and personalized look.

Customize Colors and Fonts

Utilize the "Magic Color" feature to easily change the color scheme of your invoice. You can also choose different fonts for the headings, allowing you to match the invoice style with your brand identity.

Add Fields and Columns

Refrens allows you to add multiple custom fields and columns to provide additional information or details. This feature enhances the value of the information provided in your invoices.

Enable Discounts and Additional Charges

Enable one-click discount options to offer discounts on specific items. You can also add additional charges such as packaging or shipping fees effortlessly.

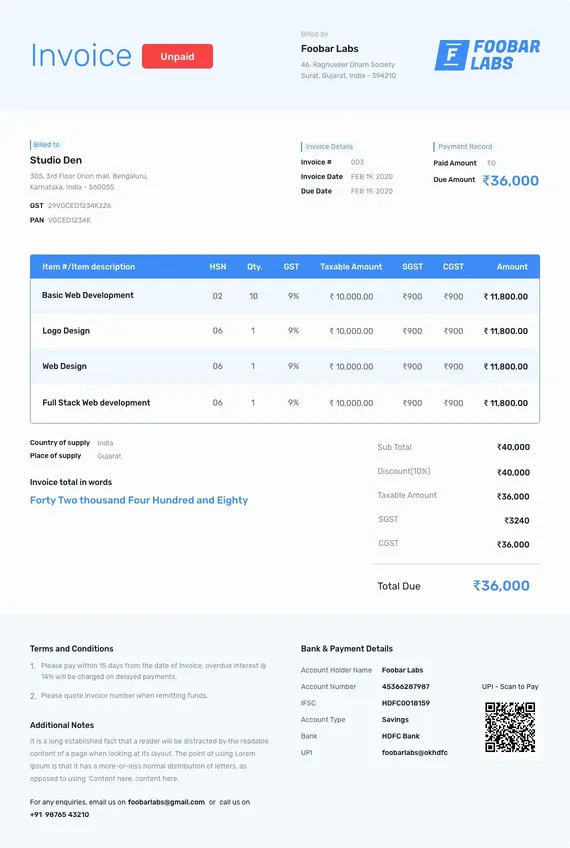

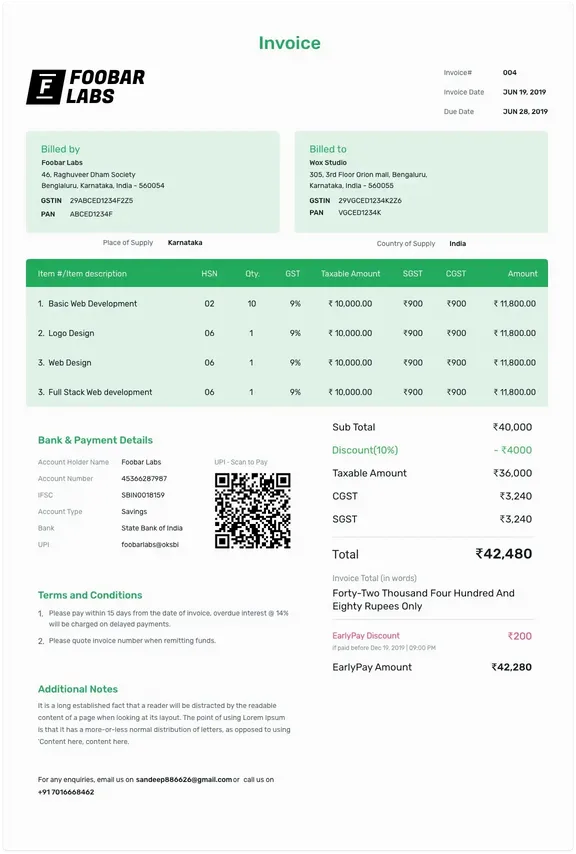

Choose from Multiple Invoice Templates

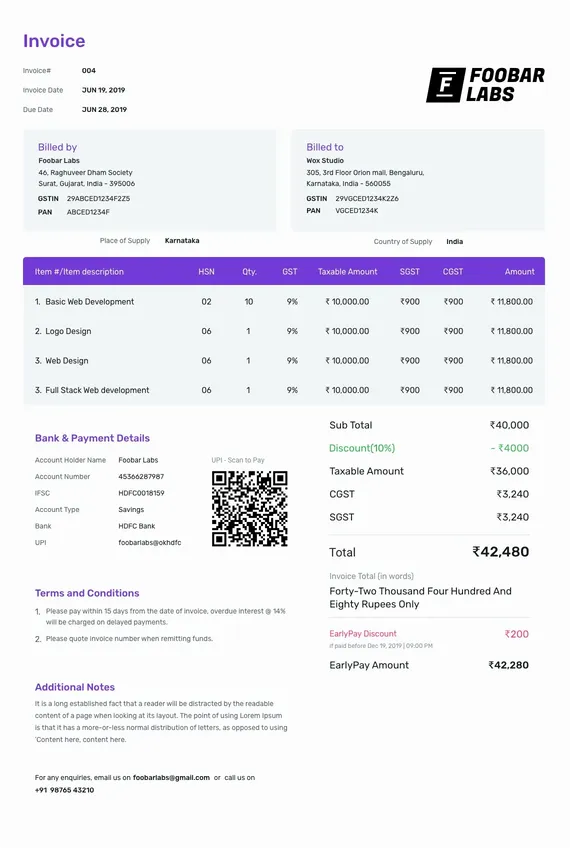

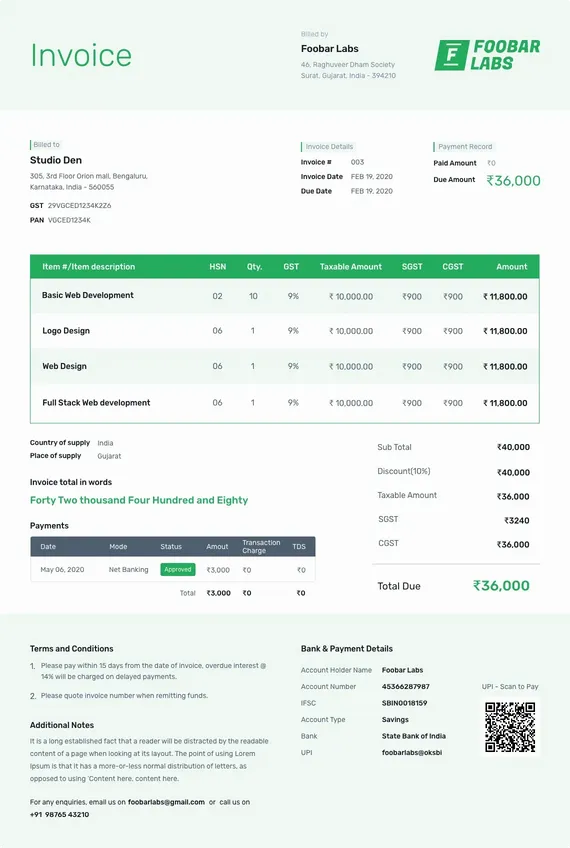

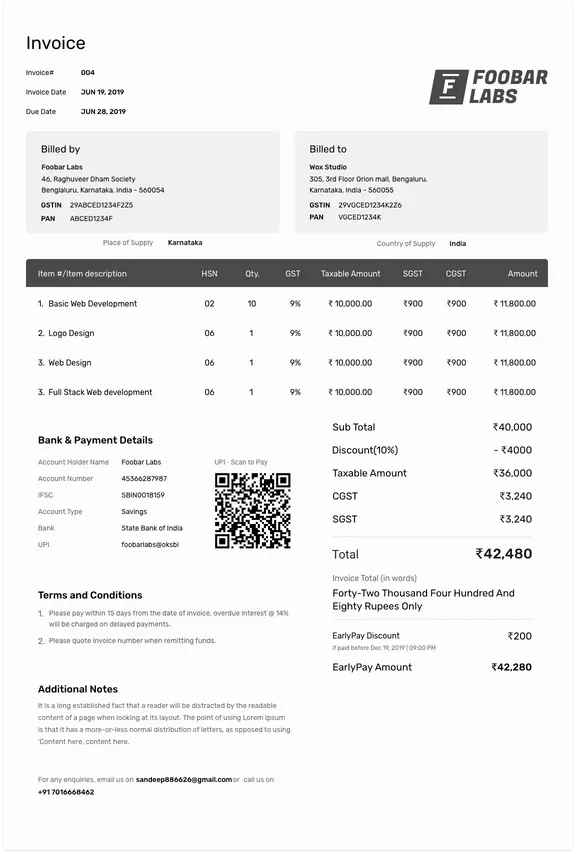

Refrens offers four different invoice templates tailored to various needs:

- Professional Invoice Template: Suitable for professionals like software developers, lawyers, designers, freelancers, IT professionals, and photographers.

- Letterhead Invoice Template: A unique template allowing customization of colors and font headings, providing a fresh and distinctive look.

- Business Invoice Template: Designed for all types of businesses, including small to medium enterprises, startups, and entrepreneurs.

- Print-Friendly Invoice Template: A black and white compact invoice template that is easy to print and share.

Quotation Templates

Refrens also offers a quotation template for creating professional and detailed quotations for your clients.

Offline Templates

If you prefer creating offline templates, Refrens provides Excel and Word quote templates, Word invoice templates for your convenience.

By following these steps and utilizing the features provided by Refrens Invoice Generator, you can customize your invoices for free, ensuring a polished and professional representation of your business in all your financial transactions.

What are the invoicing mistakes to avoid when you create invoices online?

Creating invoices online is a crucial aspect of any business, and avoiding common invoicing mistakes is essential to maintain professionalism and ensure smooth transactions. Here are some invoicing mistakes to avoid when creating invoices online:

Incorrect Invoice Date

Ensure that the invoice date is accurate and reflects the date when the invoice was created. This helps in tracking payment timelines accurately.

Incomplete Details

Include comprehensive details of both the vendor/service provider and the client. Provide detailed information about the products or services offered, including descriptions, quantities, rates, and total amounts.

Spelling Mistakes and Language Clarity

Avoid spelling mistakes and use clear, simple language when creating invoices. Steer clear of technical jargon or abbreviations that might confuse the client.

Incorrect Total Calculation

Double-check all calculations to avoid discrepancies in the total amount. Ensure that the agreed-upon price and quantity match the details on the invoice. Additionally, accurately calculate and display any applicable taxes or discounts.

Missing or Unclear Payment Terms

Clearly outline the payment terms on the invoice. Specify the due date, accepted payment methods, and any late payment fees or discounts for early payments. Unclear or missing payment terms can lead to confusion and delays in payment.

Lack of Invoice Numbering

Assign a unique and sequential invoice number for each invoice. Properly numbered invoices help in organizing records and tracking payments effectively.

Absence of Detailed Descriptions

Provide detailed descriptions for each product or service listed on the invoice. Clearly outline what was delivered, including specifications if applicable. Vague or ambiguous descriptions can lead to disputes.

Not Sending the Invoice Promptly

Send the invoice promptly after completing the agreed-upon work or delivering the products. Timely invoicing ensures that clients are aware of their obligations and helps maintain a steady cash flow.

Ignoring Follow-Ups

Follow up on overdue invoices promptly. Sending reminders and statements ensures that clients are aware of outstanding payments, increasing the chances of timely settlement.

How to send invoices using Refrens invoice maker?

Using Refrens Invoice Maker to send invoices is a seamless and efficient process. Here's how you can send invoices using Refrens:

Create Your Invoice

Use Refrens Invoice Maker to create a professional invoice. Include all necessary details such as invoice number, items/services sold, quantities, rates, total amount, and payment terms.

Send Invoice Directly from the System

Refrens Invoice Maker allows you to send the invoice directly to your client from the system. You don't need to switch to your email account. This saves you time and effort.

Download as PDF or Print

If you prefer, you can download the invoice as a PDF file or print it for your records.

Use WhatsApp Share Feature

Refrens provides a WhatsApp share feature. If you're more comfortable with WhatsApp, you can instantly share the invoice with your client through WhatsApp. This is a convenient and quick way to reach your client.

Track and Remind

It's essential to track your invoices. Refrens Invoice Maker allows you to check whether the invoices have been opened by your client. If not, you can send reminder emails to prompt payment.

Include Bank Account Details and Email

When creating an invoice, add your bank account details and email to your customer. Alternatively, you can share the invoice link directly by copying the link. Your customer can then make secure online payments through the provided link.

Accept Partial Payments and Customize Invoices

Refrens Invoice Maker offers the flexibility to accept partial payments and advance payments. You can customize and manage your invoices according to your specific needs.

Monitor Invoice Status

Easily identify the status of your invoices, whether they are paid, unpaid, or overdue. This helps you keep track of your finances and outstanding payments.

By utilizing Refrens Invoice Maker, you can streamline the invoicing process, send invoices promptly, and increase your chances of getting paid faster. The platform's features allow for efficient communication and tracking, ensuring a smooth invoicing experience for both you and your clients.

How to send a payment reminder with an online invoice maker?

Sending a payment reminder using Refrens Invoice Maker is a straightforward process. Here's how you can do it:

Set the Due Date

When creating an invoice using Refrens Invoice Maker, ensure that you set a due date for the invoice. If you don't specify a due date, the system automatically sets it to 30 days from the invoice creation date.

Automated Reminder Emails

Refrens Invoice Maker automatically sends reminder emails to your clients as the due date approaches. These automated reminders serve as gentle nudges to remind clients about pending payment.

Manual Reminder Emails

If needed, you can also send manual payment reminder emails to your clients. In the Refrens Invoice Maker platform, look for an option that allows you to manually send reminders. This option typically enables you to customize the reminder message according to your preferences.

Personalized Communication

Craft a polite and professional reminder email, including details such as the invoice number, due date, and a brief message requesting payment. Personalized communication can be more effective in prompting timely payments.

Follow-Up Timing

Choose an appropriate time to send the reminder. It's often beneficial to send a friendly reminder a few days before the due date as well as a follow-up reminder a few days after the due date has passed. This approach ensures that you're proactive in your communication.

Encourage Online Payments

In your reminder email, provide a secure link or instructions for online payment. Making the payment process as easy as possible increases the likelihood of prompt payment.

Professional Tone

Maintain a professional and respectful tone in your reminder emails. Avoid sounding overly demanding or aggressive, as this can strain client relationships.

How to send a payment receipt with online invoice maker?

Sending a payment receipt using a free invoice maker is a simple process. Here's how you can do it:

Mark the Invoice as Paid

Firstly, make sure to mark the invoice as paid in your free invoice maker platform. This action indicates that the client has made the payment.

Automatic Generation

Many free invoice maker tools automatically generate a payment receipt once the invoice is marked as paid. The payment receipt includes details like invoice number, issue date, due date, vendor’s name and information, client’s name and information, product/service name and description, and the payment method used (cash, cheque, online mode).

Review and Customize

Review the generated payment receipt to ensure that all the details are accurate. Most platforms allow you to customize the receipt template according to your preferences.

Send the Receipt

Once you have reviewed and ensured the accuracy of the payment receipt, use the free invoice maker platform to send the receipt to your client. This can usually be done with a single click or by selecting the option to send the payment receipt.

Email Confirmation

The receipt is typically sent via email to the client. The email should include a polite and appreciative message, acknowledging the payment and expressing gratitude for their business.

File a Copy

Keep a copy of the payment receipt for your records. Most free invoice maker platforms allow you to download the receipt as a PDF, which you can then save on your computer or cloud storage.

By using a free invoice maker, you can efficiently generate and send payment receipts to clients, acknowledging their payments in a professional and organized manner.

Essential elements of an invoice generator

Some elements are extremely important when you create an invoice online. One must add all these elements to the invoice. If any of these are missing, the chances of the invoice getting rejected will increase. So one should keep all these points when creating the invoice. If you are using any invoice generator software, you must check if the following elements are present or not to avoid future mistakes.

- Invoice Header

Every invoice should have a header section. It should be short and simple. Our online invoice generator software allows you to add the header. The invoice header should convey the purpose of the invoice. In the invoice header, you can also add a company logo or personal logo.

You should also add the invoice number. The invoice number should be unique for every invoice you create. Having a unique invoice number can help you to track the invoice easily. The invoice number can be formatted in various ways. For example, 00001, or if you want to add a datewise invoice number then you can add 2020/INV/001. You can do both on Refrens free invoice maker, the system will take the next unique invoice number automatically.

After adding the invoice number, the next important element is the invoice date and due date. It helps the client to clear the confusion about when the invoice is received and the due date of the invoice payment.

The next important element is the reference number, and it can be anything like a purchase order number created via purchase order template number or proforma invoice number or quotation number via quotation maker. Having a reference number can easily know the details by referring to the previous documents.

- Company/Freelancer Name

When creating an invoice, it is important to add a legal company or freelancer's name and all the details like address, phone number, and email address. It should be different from the client's information so that the client can differentiate the address between both parties.

- Name and Details of the Client

Add the client/company name with address, phone number, and email address. Using our free invoice maker, once you add the client details, it gets auto-saved and can be reused when creating the next invoice for the same user, thus saving time by not adding the details again from scratch.

- Shipping details

If you supply physical products, then it is necessary to add shipping details to the invoice. Shipping details include the name of the person to be delivered, address, city, state, date of delivery, and transport details.

- Products/Services Name & Description

You must add the product/service name and description on the line item. If you have multiple products or services then all the items should be added in different rows. You can also add the image of the product to the item description. Our online invoice generator allows you to add images to the item description so that your client can get a clear vision of the product they are going to purchase. Other than this information, quantity or hours worked, unit price or hourly rate should also be added.

Our free invoice generator allows the user to add multiple columns to the line item. You can also customize the columns by changing the name or dragging them up or down as per the priority. Same as adding, you can also hide certain columns if you don’t want to show them to your client.

- Tax and Fees

Add tax rate, and tax amount along with extra charges or fees you are willing to add such as packaging charges, and freight charges. You can also allow discounts to the client.

- Terms & Conditions

This section of the invoice is the most overlooked part. You must add the terms and conditions of the company and products as well. You can also add the payment terms and preferred payment methods. Penalties or extra fees that will be added to the breaching of the agreement should also be included on the invoice.

- Invoice Footer

The invoice footer includes an additional notes section, where you can add more information that you wish your client should know about it. It also includes the signature, where you can add a signature image or digital signature. At the bottom, you can add your email address and contact information.

How to make an invoice for freelancers with invoice maker?

Guide to creating an invoice for a freelancer with free invoice maker

It is always harder for freelancers to get paid once the service is rendered. First, freelancers offer a service, and then an invoice is issued. Whereas, in other industries, the vendor charges the advance cost. And if you fail to collect payments then it becomes unbearable to run and manage a business. In this process, invoicing setup is one of the important parts to collect payment faster. Here is a quick and simple guide to creating invoices for freelancers or service providers.

A quick overview of what your invoice should look like:

- Unique invoice number and other reference numbers

- Invoice created date

- Invoice due date

- Your business name and contact information

- Your client's name and contact information

- Service name and description

- Quantity, Rate, and the taxable amount

- Payment terms

- Additional Notes

- Signature

- Online payment link

1. Setup Invoicing Terms

Every project you take has different terms and conditions or requirements. So, it is essential to build and send a personalized invoice agreement to your clients. For instance, some of the service policies will change like due date, price, and discount.

It is always important to issue an invoice as per the client invoicing process, this helps you to get paid faster. In short, there should be terms and policies agreed upon and signed by both parties. Here, the best document to create is a quotation using quotation software, which gives an idea to the client of how much is to be paid once the work is completed.

2. Make Your Invoice Short, Clear, and Error-Free

When creating an invoice, be specific to the service you are offering to your client. More importantly, your invoice must be error-free. Error in the invoice can easily lead to its rejection. In addition, using technical jargon in the invoice is not recommended especially when the invoice will go into multiple hands before getting accepted. Each invoice should be understandable and should have a short and simple description.

3. Payment Policy Terms

It is a good practice to send invoices at a scheduled time. Having a payment policy term is good for getting paid faster. If it is a recurring client, then select a specific day and time to send invoices. If you have a one-time project or recurring project then outlining the payment process at the beginning of the project makes it much easier to collect a payment, and then follow up throughout the project. This gives your client an idea about when to expect the invoice and payment of the project.

4. Offer Multiple Payment Options

You need to be feasible in accepting different payment options. Just because you don’t provide enough payment options to your client, is a good reason to hold on to your invoice and delay your payment. But it doesn’t mean using multiple payment gateways for a single payment. Simply opt for an invoice generator online like Refrens which provides the feature of a payment gateway within the invoice creation process. For instance, Refrens provides an online payment option for debit and credit cards.

Free Invoice Generator & Invoice Maker

Invoice definition - What is an invoice?

An invoice summarizes the transactions between the buyer(customer) and the seller(vendor) for the sales of goods or services. It showcases the total amount to be paid for the services or products rendered by the customer. It holds all the necessary information like buyer details, seller details, reference number, product/service description, quantity, rate, tax amount, terms, and conditions of the payment. It also has information about the available payment mode for the buyer.

Online invoice - What is an online invoice?

Creating invoices online, whether through platforms like Google Docs, Google Sheets, online invoice templates, or dedicated invoice software such as Refrens, is recognized as online invoicing. The information contained in online invoices parallels that of traditional invoices. Opting for online invoicing brings forth several advantages, including ease of creation and time savings, allowing for a more streamlined focus on business growth. Unlike traditional end-of-month challenges associated with creating and organizing invoices, an online invoice maker like Refrens minimizes or eliminates paperwork, reducing the risk of invoice loss. With Refrens, users can effortlessly generate, manage, send, and track all invoices in one centralized location, ensuring easy access and eliminating concerns about misplacing important documents. Furthermore, Refrens offers the unique benefit of creating invoices online without any associated costs, providing users with the advantage of free invoices for a lifetime.

Invoice purpose - What is an invoice used for?

An invoice serves as a crucial business document with multifaceted purposes, primarily centered around accounting and financial transactions. Here are the key uses and importance of invoices in a business context:

Payment Transaction Record: An invoice acts as an official record of a financial transaction between a seller (vendor) and a buyer (client). It provides a detailed breakdown of the products or services provided, along with their corresponding costs.

Payment Collection Tool: Invoices serve as a formal request for payment from the client to the vendor. They outline the total amount due, payment terms, and any applicable discounts or late fees. In this way, invoices facilitate the smooth and systematic collection of payments.

Sales Tracking: Businesses use invoices to track sales activities accurately. Each invoice corresponds to a specific sale, allowing businesses to monitor and analyze their sales performance over time. This data is valuable for assessing growth and making informed business decisions.

Inventory Management: For businesses dealing with physical products, invoices play a role in inventory management. They help in keeping track of the quantity and type of products sold, aiding in maintaining optimal stock levels and preventing stockouts.

Tax Documentation: Invoices are essential for tax compliance. They provide a detailed breakdown of taxable transactions, making it easier for businesses to calculate and report their tax liabilities accurately. This documentation is crucial during tax return filing.

Proof of Transaction: Invoices serve as legal and financial proof of a transaction occurring between the vendor and the client. In case of disputes or discrepancies, having a documented invoice becomes instrumental in resolving issues and providing evidence of the agreed-upon terms.

Pending Payments Tracking: Businesses can use invoices to keep track of outstanding payments. Invoice due dates help in monitoring the timeline for payment collection, sending reminders, and managing cash flow effectively.

Legal Protection: In the event of legal disputes or audits, invoices act as supporting documents to validate the legitimacy of business transactions. They provide evidence of the products or services delivered, agreed-upon pricing, and payment terms.

What is the difference between an invoice and a receipt?

An invoice is a document asking for payment. Whereas the receipt is proof of payment done by the buyer to the seller. A receipt is a proof that the buyer has received the goods or services from the seller. You can create both invoice and payment receipts on Refrens using Invoice Maker.

What is an invoice format?

An invoice format is the invoice template or layout. An invoice format breaks all the elements of an invoice in a simple format so that it becomes easy for you to create an invoice online. For different professions, there are different invoice formats like consultant invoice format.

Who can issue the invoice?

Generally, the supplier issues the invoice for the goods or services they offer to the customer.

What is the difference between an invoice and a bill?

Yes, both are the same and portray the same information. The only difference is that the invoice is issued by the supplier or the business providing the products or services. The same invoice is recorded as a bill for the customer or the person receiving the products or services.

How does an online invoice save you time?

Using an invoice maker like Refrens can help you save a lot of time and energy, thus helping you focus on growing your business. Here are some of the reasons:

Easily generate invoices instantly.

Autosave your client data and item description for further use.

Organize all your invoices in seconds.

Get essential business reports.

Use professional templates that are compatible with printers.

Track all your invoices - know if the customer opened your mail.

Share your invoices quickly via email or WhatsApp share.

Check Invoice status - paid, unpaid, overdue, part-paid.

Access your invoice and client data from anywhere in the world.

Use other free tools offered by Refrens.

What are the types of invoices in invoice generator?

There are a total of 6 types of invoices created in a business according to the needs and requirements. All the invoices mentioned below carry different purposes in invoicing. Creating the right type of invoice for the right client at the right time is extremely important to get sales done and get paid faster.

Standard Invoice

A standard invoice is a normal invoice created by the vendor for the client which includes all the basic details like invoice date, invoice number, payment due date, vendor address, client address, product or service name with quantity, rate, subtotal, and total amount.

Proforma Invoice

A Proforma invoice is a non-legal invoice created for the supplier to make the agreement between both parties for the payment terms and commit to delivering the products or services at a specified date and time. You can create the proforma invoice template here.

Service Invoice

A service invoice is usually created by service-based businesses that do not deal with the products. Service businesses like digital marketers, lawyers, Shopify developers, consultants, etc. charge their clients hourly rather than quantity-wise for the services.

Using our free invoice generator, you can easily use the “Add/Rename Column” feature to hide, add or edit the column name and can charge hourly.

Commercial Invoice

Commercial invoices are used by the export/import business owners which include slightly more information than a standard invoice. It has all the information similar to standard invoices and extra information like shipping details, country of supply, place of supply, total packages to be delivered, and weight of the packages.

Recurring Invoice

Recurring invoices are created by businesses who charge fixed prices from their client and are charged either on a weekly or monthly basis like apartment rent, bills, subscriptions, or any fixed price software. A recurring invoice is created and sent to the client every month until the client cancels or ends the contract or subscription.

Credit Note

A credit note is issued by the supplier when the client returns the product for reasons like damage or mistake.

Here on Refrens, you can create all the above invoices easily without any hassle using our online invoice maker.

Invoice number -Basics explained in invoice generator

What is an invoice number?

An invoice number is one of the most important elements of the invoice. Invoice number helps to track and organize each invoice you create. When creating an invoice, the invoice number should be unique for every invoice, and it should be sequentially followed. Invoice numbers can contain both numbers and alphabets.

For example: When the first invoice is created, you can assign invoice number either 001 or INV/001. The same should be followed when creating the second invoice, it can be either 001 or INV/002.

How to assign invoice numbers when using an online invoice maker?

There are numerous methods to add the invoice number when using the invoice maker. Of which the best methods are as followers.

Sequential Method

This is the most common and easy method to assign the invoice number and is also used by most businesses. Here your invoice number is in increasing order and starts from 1.

For example: Invoice No 001, Invoice No 002, Invoice No 003 and so on or 2021/INV/001, 2021/INV/002, 2021/INV/003, and so on.

Date Wise Method

Here, you use the date and unique number as the invoice number. For example: If you are issuing the invoice on April 23, 2021, then you can have invoice number 2021-04-23-001. Here it becomes easy to track the invoice, date-wise.

Project Id Method

Many businesses work on different projects or gigs at the same time. Here you can assign the project number as the invoice number. For example, if you have completed project number 185, then you can assign invoice number 185. If you are undertaking a big project and have multiple sub-projects in it, then you can assign invoice numbers 185-001 and so on.

Client Id Method

This is one of the rare methods, as very rare businesses assign client IDs to their clients. Suppose you have undertaken the project of a client whose client id is 387, then you can issue the invoice with invoice number 387-001.

Use invoice generator to make sequential invoice number

You can use Refrens free invoice generator, to create invoices online for free with the invoice numbers. As you assign the first invoice number the system will automatically take the next invoice number in increasing order. using our online invoice generator, you can use all the above methods to assign the invoice number and can track, organize and send the invoice to the client.

Invoice generator for non-accountants

Refrens Invoice generator is specially developed for non-accountants so that it becomes easy and simple for non-accountants to create invoices instantly without having to follow too many steps.

Simple User Interface - Refrens online invoice generator is designed to be easy to use and user-friendly, with intuitive interfaces and clear instructions. This makes it simple for non-accountants to create and send invoices without prior accounting experience or training.

Templates and Customization Options - Refrens invoice generator offers templates and customization options that allow users to personalize their invoices to match their brand and preferences. This makes it easy for non-accountants to create professional-looking invoices that meet their needs.

Automated Processes - Online invoice generators automate many of the time-consuming and manual processes associated with traditional invoicing, such as recurring invoices, email scheduling, payment reminders, one-click conversion from invoice to another document like a debit note or credit note without creating them from scratch. Moreover, there is no need to add the client details whenever creating the invoice, the system stores the details of your client and you can use it anytime when creating the invoice. When using Refrens invoice maker, you can effortlessly manage all the invoices in one place and create in-depth reports based on the invoice and the payment you received from the client.

Additionally, it helps to generate journal entries, vouchers, balance sheets and many more. This makes it easy for non-accountants to manage their invoicing process without prior experience or training.

Mobile Accessibility - Refrens invoice generator is accessible from any device be it a laptop, desktop, mobile or tablet, all you need is an internet connection, making it easy for non-accountants to create and send invoices from anywhere and anytime.

Customer Support - Refens invoice maker offers customer support, either through live chat, email, or phone. This makes it easy for non-accountants to get help when they need it, reducing the frustration and confusion often associated with traditional invoicing methods.

Online invoice generator to create invoice

Every entrepreneur wants to grow their business at a larger scale, knowing the fact most of them are shifting their business from offline to online. As the business grows it becomes difficult to handle the transaction process for your invoicing cycle. Still, you can create an invoice using Google Docs or Google Sheets but that won’t give you an insight into your business in the long run. Also, it is very painful and hard to create invoices using Google Docs or Sheets.

So using Refrens online invoice generator, you can easily create invoices instantly and can send them to your client via email or even through WhatsApp share. Not just invoicing, you can store and access all the essential information like client data, payment reports, and tax reports. Easily create tax invoices in one go without prior knowledge of taxation.

Use the bulk upload invoice feature, if you are in the business of creating all your invoices at the end of the month which eventually saves you a lot of time. The online invoice generator also supports multiple currencies and more than 200+ countries. If you have a business with global clients, you can change the currency on your invoice with just one click. You can also add your bank details to get paid directly to your bank account on time with the invoice generator.

How to upload bulk invoices using an online invoice maker?

If you are one of those business owners who create invoices online at the end of the month, it is very painful to create invoices even if you are using an online invoice maker. Creating an invoice and sending it to your client and repeating the same process is time-consuming, especially when you have many invoices to build by the end of the month.

But need not worry about it; Refrens free invoice maker allows you to upload bulk invoices that auto-generate invoices once the sheet gets uploaded to the system. Using the bulk invoices feature, you can create both TAX invoices, and Non-TAX invoices. To upload bulk invoices, add your client's data and the information of the products/services you are offering in a CSV sheet provided by the Refrens. Next, upload the CSV to the system, and your invoice gets created.

What are the different business reports provided by Refrens online invoice generator?

Refrens provide all the necessary reports, which are useful for the users to summarize their business performance. You can make seamless business decisions by overviewing the Reports supplied by the Refrens free invoice generator. Reports help you to improve marketing plans, budget planning and develop a future forecast.

Refrens provide client reports, payment reports, TDS reports, vendor reports, and invoice reports.

What are the alternatives to using an online invoice generator?

When you search for the invoice online, you can find many websites that provide you with the invoice template. No doubt that invoice templates on some of the websites are really good. You only need to download the template for free and can easily add the details to the invoice using Google Sheets or Google Docs. However, after creating a few invoices, you will know that creating and maintaining the invoice is time-consuming.

As you will not be able to keep track of your invoices it will become difficult to find old invoices. You can not save the client details. You always have to copy the original invoice and then rename it with a new one. All this process is time-consuming. The best way is to use an invoice generator that helps you to do all this work easily and quickly. Our invoice generator online helps you to create invoices for free with all the invoices saved in the system itself and can organize the invoices without any hassle.

What are the benefits of using a Refrens free invoice generator?

Here are some of the reasons why you save your time and hard work when creating an online invoice using Refrens’ online invoice generator.

Client Management - manage all your clients in one place. Access the information when required.

Use professional invoice templates that are compatible with letterheads and easy to print.

Essential Reports to analyze your business and client transactions.

Add fields and columns to the invoice as per the requirements.

Add multiple users and businesses - if you have multiple businesses or users, you can add them for generating the invoices.

Organize all your invoices in one place. You can organize them by date filter, by selecting clients, and also by your invoice status(paid, unpaid, partly paid, overdue).

Bulk upload invoices - create multiple invoices on a single upload.

Create recurring invoices for daily, weekly, and monthly purposes.

Send or share invoices by downloading invoices as PDFs, printing them, emailing them to the client, and also sharing them on WhatsApp.

What is the cost of an online invoice generator?

You will always wish to have the best for your business. Invoicing is one of those important aspects of your business. So having a perfect invoice generator that fits your business requirements is a must. But when finding the perfect solution, pricing is also one of the things that concern business owners especially small business owners or freelancers.

When you find one, you will notice different pricing models. Some invoice generators may charge a fee for each invoice you create. Some charge a monthly fee pricing model. Then there is certain invoice software that is completely free. You can create invoices for free with all the essential features like invoice templates, customization, recurring invoices, and other features that are generally seen in paid software. Generally, they charge a small payment gateway fee if you wish to accept payment online through this software.

Refrens don’t follow either of these revenue models. Refrens make revenue from the marketplace by connecting the best freelancers and agencies to the businesses for the completion of their work. Refrens Marketplace.

Countries Supported

us Invoice Generator | id Invoice Generator | pk Invoice Generator | my Invoice Generator | za Invoice Generator | ke Invoice Generator | ae Invoice Generator | sg Invoice Generator | ph Invoice Generator | bd Invoice Generator | ng Invoice Generator | gb Invoice Generator | au Invoice Generator | sa Invoice Generator | lk Invoice Generator | ca Invoice Generator | zw Invoice Generator | in Invoice Generator | om Invoice Generator | qa Invoice Generator | kw Invoice Generator | bh Invoice Generator