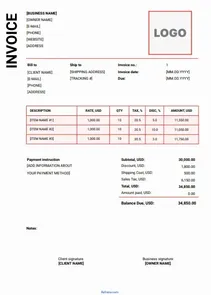

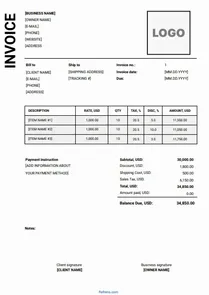

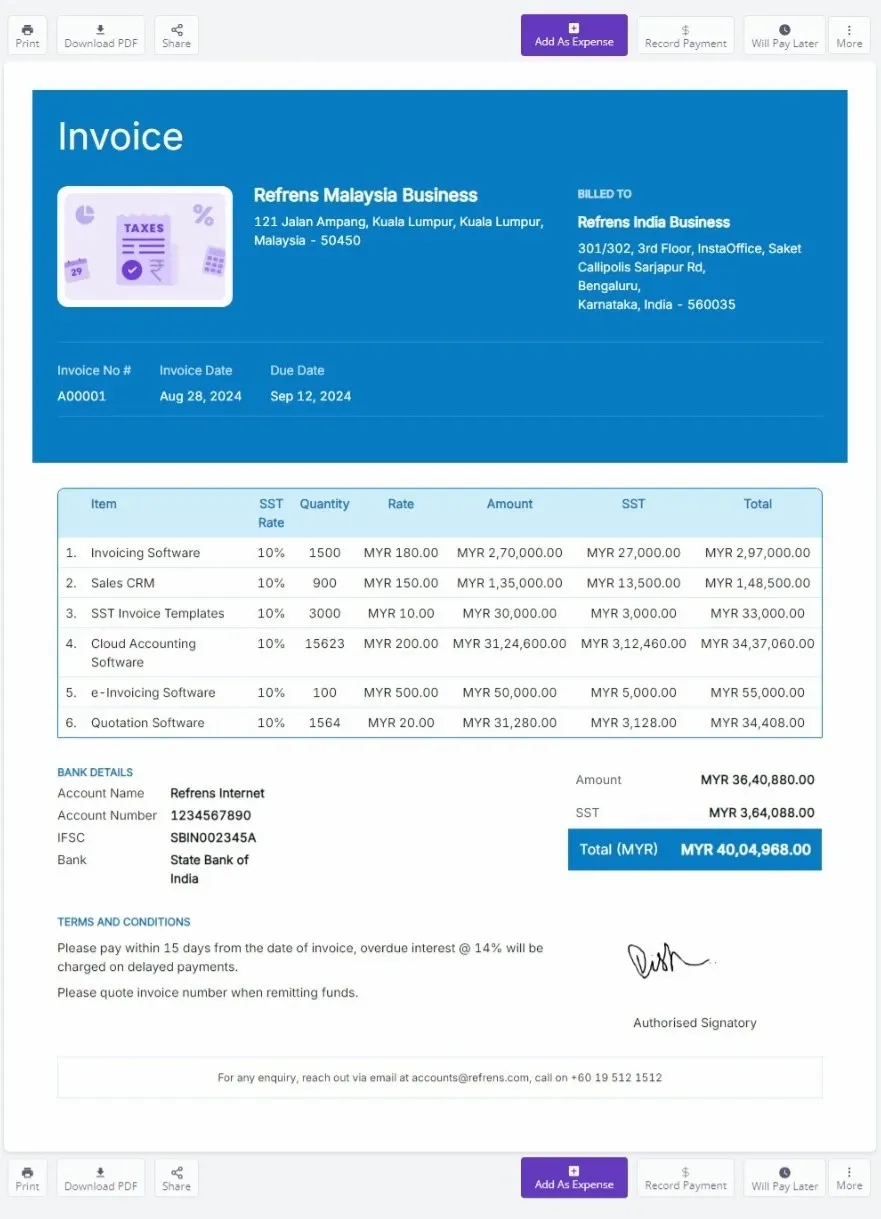

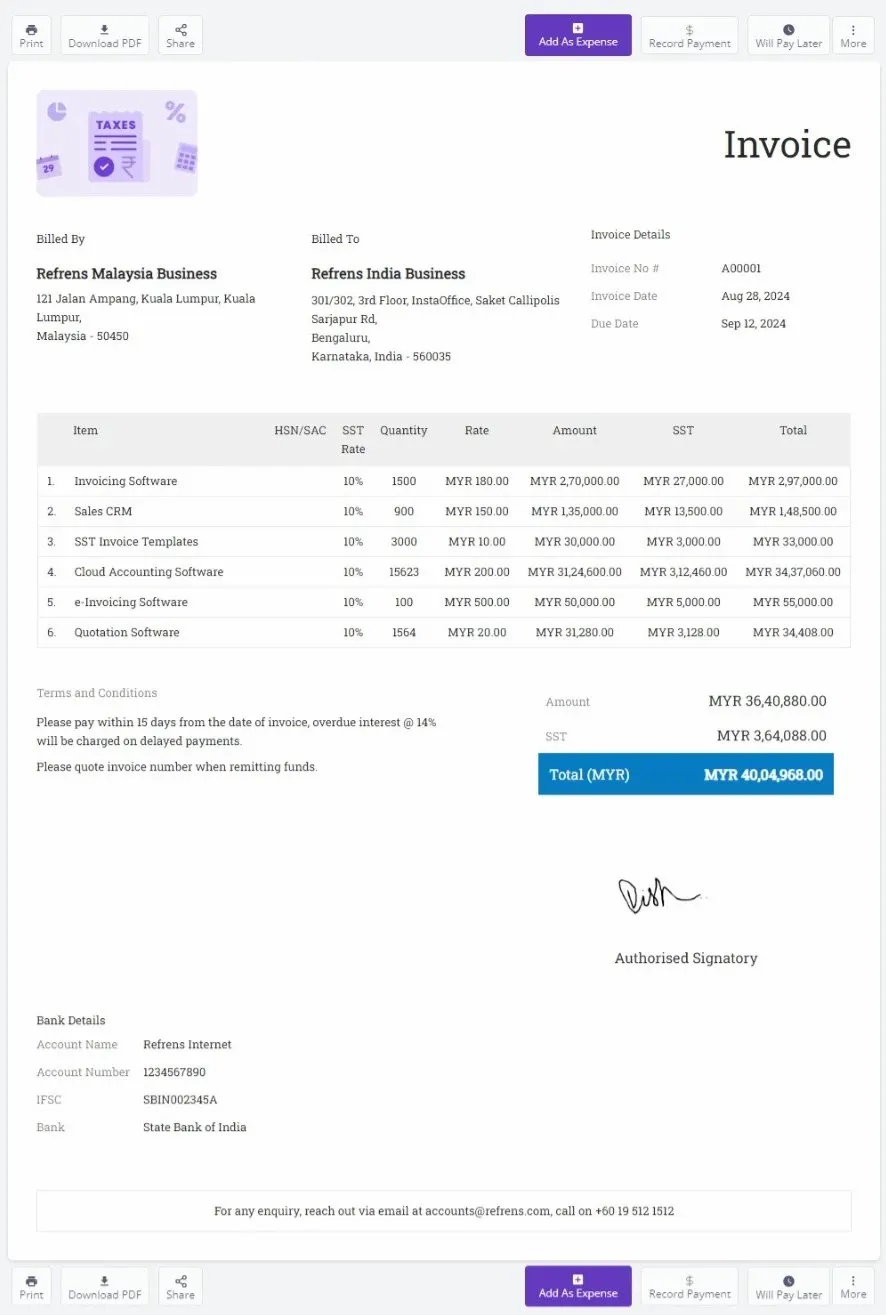

Sample SST Invoice Format

A Malaysian SST invoice includes crucial details like unique invoice number, seller and buyer information, a breakdown of services with taxable values, applicable discounts, and a clear SST calculation displaying the taxable value, SST rate (6% or 10%), and SST amount. Refrens SST invoice complies with regulations, ensuring transparency in financial transactions.

SST Invoice Template in PDF (Add invoice details and download it in PDF format.)

SST Invoice Format

What is an SST invoice?

SST invoice also known as Sales & Service Tax is a tax invoice used in Malaysia to collect taxes from businesses. If you are a SST-registered business then it becomes compulsory for you to issue an SST invoice to the clients. Every SST-registered business gets a unique SST number for the business, they have to add that SST number to the invoice and it becomes viable to collect the tax amount from the client.

What is an SST invoice format?

SST invoice format is a template that helps SST-registered businesses create invoices. Using an SST invoice format makes the invoicing creation process easy and simple. If a business starts creating the invoice format from scratch then it becomes difficult for businesses to create one as you have to create multiple columns and fields, header and footer, custom option to upload the company logo and also it becomes difficult to manage inventory from the line items.

So having an SST invoice format or invoice generator or invoicing software for your business is the best option, as it makes it easy for you to create invoices and not just create it also helps you to manage the invoice and track the SST invoices. Using software or tools like Refrens, it becomes easy for businesses to manage inventory, expenses, and purchases and also provides you with the option to create quotations and other important documents.

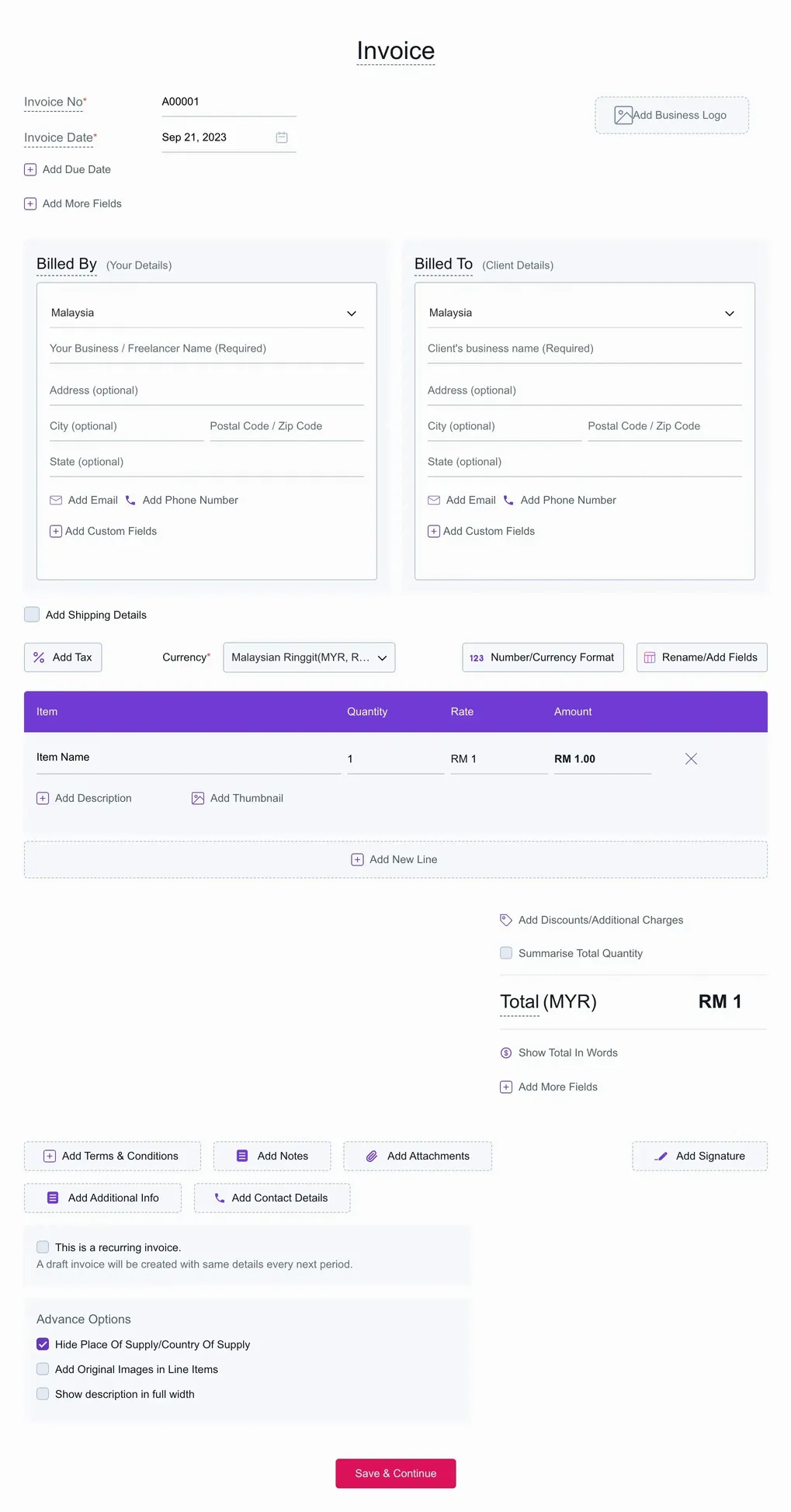

On Refrens, you will 2 options to create SST invoices and both options are viable depending upon the business type and transactions that happen every month.

One way is to that the businesses to get the SST invoice format directly in Word and Google Docs invoice template. Businesses can download that SST invoice template edit the template based on the requirement and send it to the client. However, this method is not feasible for businesses that have multiple transactions in a week or month. The business has to duplicate the same SST invoice format again and again has to use it multiple times and also needs to store all these invoices on a local desktop or laptop. And the month or year-end, when the business has to calculate the revenue, profit and loss, and cash flow then it becomes harder for them as sampling the invoice in template format does not help you in generating the business reports. So businesses with fewer transactions can use this method to create SST invoices.

The second method is to use Refrens accounting software to create, manage and track all your SST invoices in one place. And not just invoicing, you can also manage quotations, expenses and all other documents that are important for your businesses. More than documents, you can create reports that are essential for your business growth such as invoice reports, SST reports, trial balance, profit and loss statements, balance sheets and many such reports.

Do we need to display SST calculation in invoice Malaysia?

While there is no strict legal requirement in Malaysia that mandates the display of SST (Sales and Services Tax) calculations on invoices, it is generally recommended to include a clear breakdown of the total amount, including any applicable taxes, for transparency and clarity. Providing a detailed invoice with SST calculations offers the following benefits:

Transparency: Displaying the SST calculation provides transparency to your clients, helping them understand how the total amount is composed.

Client Understanding: Clients appreciate a clear breakdown of costs, including taxes. It helps them understand the different components contributing to the total amount.

Legal Compliance: While it may not be a legal requirement, including SST details can contribute to your business appearing transparent and compliant with tax regulations.

Professionalism: A detailed and well-structured invoice enhances the overall professionalism of your business. It demonstrates a commitment to clarity and openness in financial transactions.

Avoids Misunderstandings: Providing a breakdown of SST helps avoid any misunderstandings or disputes related to tax calculations.

When creating invoices in Malaysia, businesses often choose to include a separate section that outlines the SST calculation. This section typically includes details such as the taxable amount, the SST rate, the calculated SST amount, and the final total amount.

What are the prescribed particulars of SST service invoices in Malaysia?

As per Malaysian Custom Departments, the business can issue invoices of:

Sales Tax

- Issuing invoices following Malaysian Customs Department guidelines is essential for businesses. For Sales Tax (SST), registered manufacturers selling taxable goods must provide invoices in hard copy or electronically, including essential details in either the national language or English.

- Credit and Debit Notes under SST are exclusive to registered taxable service providers, allowing for necessary adjustments in returns with the required particulars.

Service Tax

- In Service Tax, registered individuals providing taxable services must issue invoices in hard copy or electronically, in the national language or English. Registered taxable service providers have the same privilege for Credit and Debit Notes, facilitating seamless adjustments while adhering to proper line items.

Whether issuing an SST invoice, Sales Tax invoice, or Service Tax invoice, businesses aim for efficiency and accuracy in compliance with Malaysian Customs Department regulations.

How to issue invoice under SST for services?

When issuing an SST (Sales and Services Tax) invoice for services in Malaysia, it's essential to include specific details to comply with tax regulations. Here's a step-by-step guide on how to create an SST invoice for services:

Invoice Number/Date/Due Date: Include a unique invoice number, the issuance date, and the due date for payment.

Seller's Information with SST Registered Number: Provide the seller's information, including the business name, address, and contact details. Additionally, include the SST registration number issued by the Royal Malaysian Customs Department.

Buyer's Information: Include the buyer's information, such as the client's name, address, and contact details.

Line Items with Proper Taxable Value: List the services provided as line items on the invoice. For each line item, include the taxable value, which is the amount subject to SST. Clearly state the description of the services.

Add Discount or Cess if Applicable: If there are any applicable discounts or cess, clearly specify them on the invoice.

Add Terms & Conditions/Additional Notes/Signature/Contact Details: Include any relevant terms and conditions related to the services or payment. Add additional notes if necessary. Provide a space for the authorized person's signature. Include contact details for further communication.

SST Calculation: Include a separate section that breaks down the SST calculation. This should include the taxable value, the applicable SST rate (either 6% or 10%), and the calculated SST amount for each line item. Sum up the SST amounts to get the total SST for the invoice.

Total Amount Calculation: Calculate the total amount by summing up the taxable value and the total SST amount.

Payment Details: Specify the payment terms, methods accepted, and any late payment penalties if applicable.

Footer: Include a footer with the SST registration number, business registration number, and any other required information.

The Evolution of SST Invoice Formats in Malaysia

The SST invoice format in Malaysia has evolved significantly since the Sales and Service Tax (SST) was reintroduced in 2018. Understanding these changes is essential for businesses to remain compliant and manage their invoicing efficiently. Let’s explore how the SST invoice format has changed over time and why these updates matter.

A Brief History of SST in Malaysia

Before 2015, Malaysia had two main taxes: the Sales Tax and the Service Tax. These taxes were applied separately, with the Sales Tax charged on the manufacturing and importation of goods, and the Service Tax applied to certain services. In 2015, Malaysia replaced these taxes with the Goods and Services Tax (GST), a single tax system intended to simplify tax collection. However, in 2018, the government decided to switch back to the SST system, which led to the need for a new SST invoice format.

Changes in the SST Invoice Format

When SST was reintroduced in 2018, businesses had to adjust their invoicing practices to align with new requirements. The sst invoice format now needed to clearly distinguish between sales tax and service tax. This meant adding specific details to invoices, such as the type of tax applied, the tax rate, and the total tax amount. For instance, the Sales Tax, which is a one-time tax applied at the point of import or manufacture, can range from 5% to 10% depending on the goods. On the other hand, the Service Tax applies to a range of services at a rate that was recently increased from 6% to 8% for most services as of March 2024. Some services, like food and beverage or logistics, still remain at the 6% rate.

Why These Changes Matter?

These updates to the SST invoice format are crucial for several reasons. Firstly, they help businesses correctly calculate and report their taxes, reducing the risk of errors and penalties. Secondly, they ensure transparency in business transactions, as customers can see the exact amount of tax charged on goods and services. Lastly, using the correct sst invoice template helps businesses stay compliant with the latest government regulations.

Moving Towards Digital Invoicing

In recent years, there has been a push towards digital invoicing. The Royal Malaysian Customs Department encourages businesses to adopt electronic invoicing methods. Digital invoices are easier to manage, reduce paperwork, and help businesses maintain accurate records. This shift also aligns with global trends towards digital transformation, making it easier for businesses to comply with tax regulations and streamline their operations.

Staying Compliant with SST Invoicing

To stay compliant with the evolving sst invoice format, businesses need to use up-to-date templates that meet all legal requirements. This includes ensuring that all relevant details are included in the invoice, such as the type of tax, tax rates, and total amounts. By keeping their invoicing practices current, businesses can avoid penalties and ensure smooth transactions.

The Role of QR Codes in Modern SST Invoices in Malaysia

QR codes have become a powerful tool in modern invoicing, especially in Malaysia, where businesses are required to issue SST invoices. Adding QR codes to these invoices isn't just about keeping up with technology; it offers practical benefits that enhance payments, verification, and record-keeping, making the process smoother for both businesses and customers.

1. Easy Payments with QR Codes

QR codes on SST invoices Format make it simple for customers to pay. Instead of manually entering payment details, customers can simply scan the QR code with their smartphone. This quick scan directs them straight to a payment page, where they can complete their transaction in seconds. This method not only speeds up the payment process but also reduces the chances of errors. Faster payments mean businesses get their money quicker, which is always a good thing.

2. Quick and Secure Verification

Using QR codes on SST invoice templates also helps verify the invoice's authenticity. When customers or tax officials scan the code, they are instantly directed to the digital version of the invoice. This makes it easy to confirm that the details on the invoice match what is in the system, reducing the risk of mistakes or fraud. The QR code acts like a digital stamp of approval, showing that the invoice is genuine and the transaction is legitimate.

3. Better Digital Record-Keeping

QR codes help with more than just payments and verification—they also make digital record-keeping easier. Every time a QR code is scanned, the invoice details can be automatically recorded in the company’s accounting software. This automation means less paperwork and fewer mistakes, making it easier to keep track of all transactions. Businesses can save time and avoid the hassle of sorting through piles of paper invoices, all while keeping everything neatly organized and accessible in a digital format.

4. Boosting Compliance with Tax Rules

Malaysia’s tax rules require businesses to keep accurate records, and QR codes on SST invoices help meet these requirements. By using QR codes, companies ensure that their invoices are easy to verify and submit to tax authorities. This digital method helps avoid any potential issues with missing or incorrect data, reducing the risk of penalties. Being able to quickly and accurately provide all necessary documents shows that a business is committed to following the rules and regulations.

5. Enhancing Customer Experience

Customers appreciate convenience, and QR codes on SST invoice samples provide just that. With a simple scan, customers can access all the information they need to make a payment or verify an invoice. This ease of use can enhance the overall customer experience, making them more likely to return for future business. It’s a small touch that can make a big difference in customer satisfaction.