Free Invoice Generator (Add invoice details and download it in PDF format.)

Features of invoice generator

Pricing of invoice generator

Only Pay When You Need Premium Features.

Frequently Asked Questions (FAQ)

An invoice is a document asking for the payment of the product or service sold to the buyer. An invoice is generally issued by the seller. An Invoice holds all the information about the transaction of goods or service that took place between both the parties.

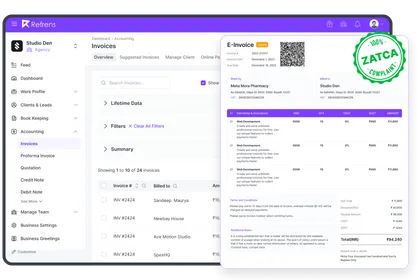

Refrens invoice generator allows you to create invoices for free without taking much time. Head over to Refrens invoice generator and start creating invoices using pre-formatted invoice templates. You can add your logo, brand colors, and multiple invoice templates and use many more such features to keep your brand consistent.

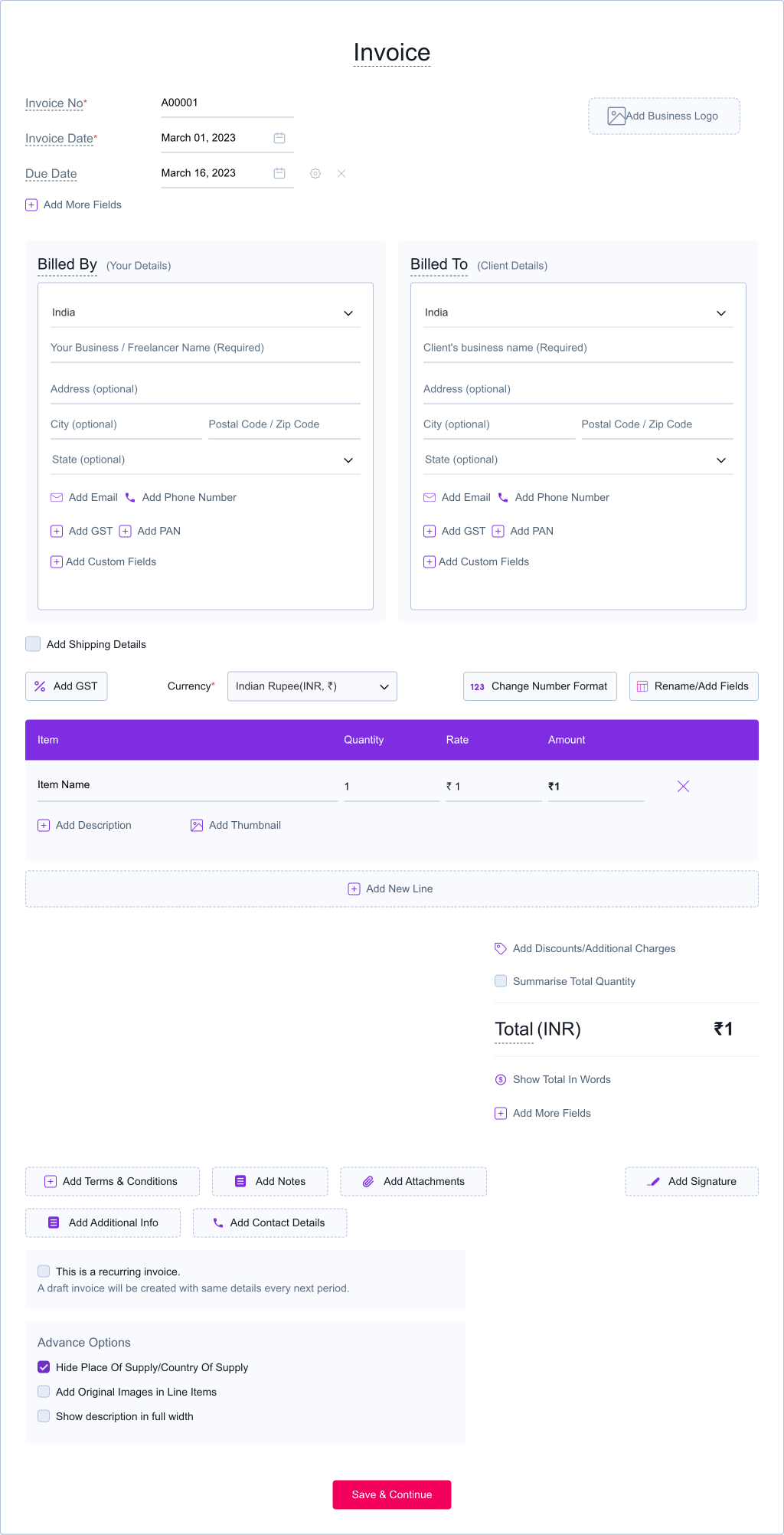

Invoice generator or free invoice maker is a software tool used to create invoices online which is similar to handwritten invoices or created using excel sheet. It includes all the basics of an invoice like company logo, invoice title, invoice date, company and client details, product or service sold, quantity, rate and information related to tax and payment details. Send PDF invoices, customize invoices with invoice templates, download or print invoices etc. which is not possible in handwritten invoices. It has become easy for small business owners to automate the invoicing process using a free invoice generator.

FREE! Refrens invoice generator is free for freelancers, agencies, small businesses, and entrepreneurs. You can generate 15 documents every year. Also, manage invoices and access free templates.

Yes, there are multiple invoice templates on Refrens you can use. Not just templates, you can also change the color of each template and font headings as well.

Yes, you can create weekly, monthly, and yearly recurring invoices on Refrens. You can also customize the dates as per your requirements.

Yes, Refrens account is necessary to use this invoice generator. While creating an account, you can access all the invoices in one place and also makes the invoice creation procedure easy.

Yes, you can add additional fields and columns as well. Refrens allow extra fields that help you to add more information about the company or product/service you offer.

Yes. All the invoices created by you are saved online. You can access all the invoices anytime just by logging into your account.

Yes, you can save and manage all the details of your client under client management tab. This feature helps you to avoid retying of customer details every time on the invoice.

Absolutely. Only you can decide who you want to share the invoices, quotations with. The documents you create are accessible only through special URLs that you share or PDFs that you download. We do not share your data with anyone for any purpose.

Yes. You can upload your logo by clicking on the logo box from the top right corner. You can upload both .jpg and .png format for the logo image.

We want to enable easy transactions for Freelancers, Service Agencies and Small Businesses. We make revenue through Refrens marketplace.

Refrens is the best free invoice generator as you can create invoices for clients without paying a single amount. You can freely customize your fields and columns, download the invoice as PDF or send it directly via email, or share it via WhatsApp and within one click you can create a payment receipt, debit note and credit note. Not only this, you can create quotations, purchase orders, proforma invoices, payment receipts, delivery challan, and expense management and can also keep the records of your inventory.