Refrens Zatca e-Invoicing Rated ⭐ 4.8/5 based on 567+ Ratings

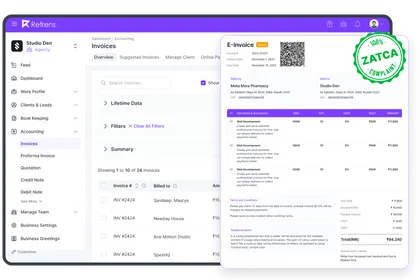

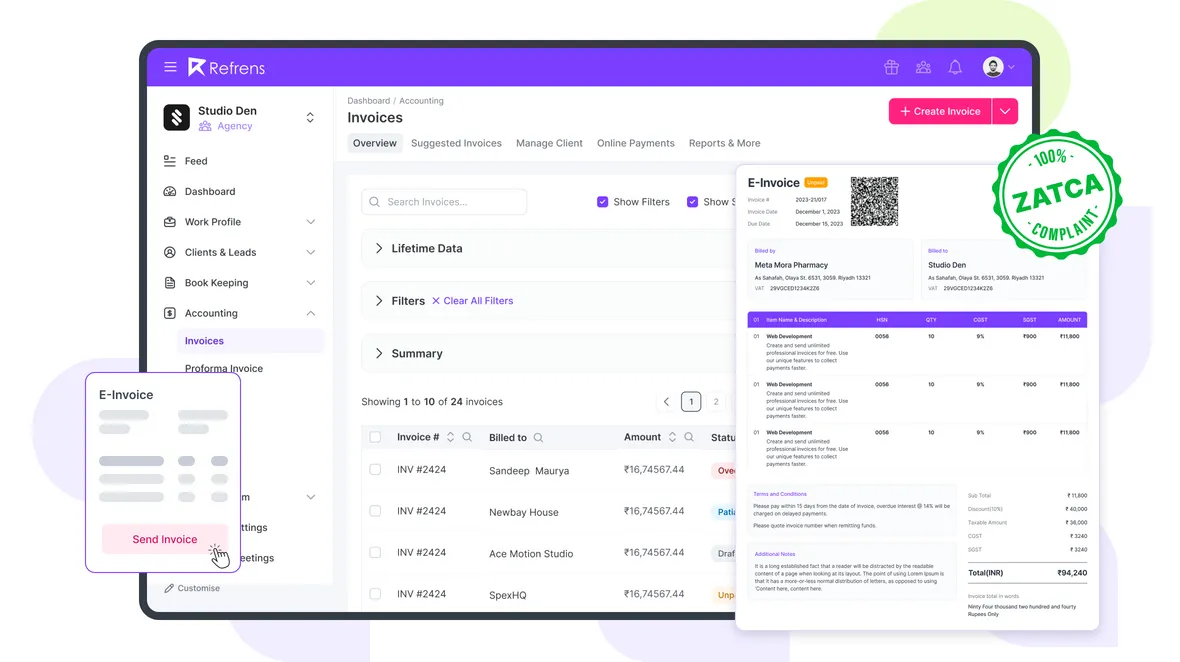

Streamline your ZATCA e-Invoicing process with Refrens

Generate e-invoices within a minute. Ensure 100% compliance. Avoid errors with automated data validations.

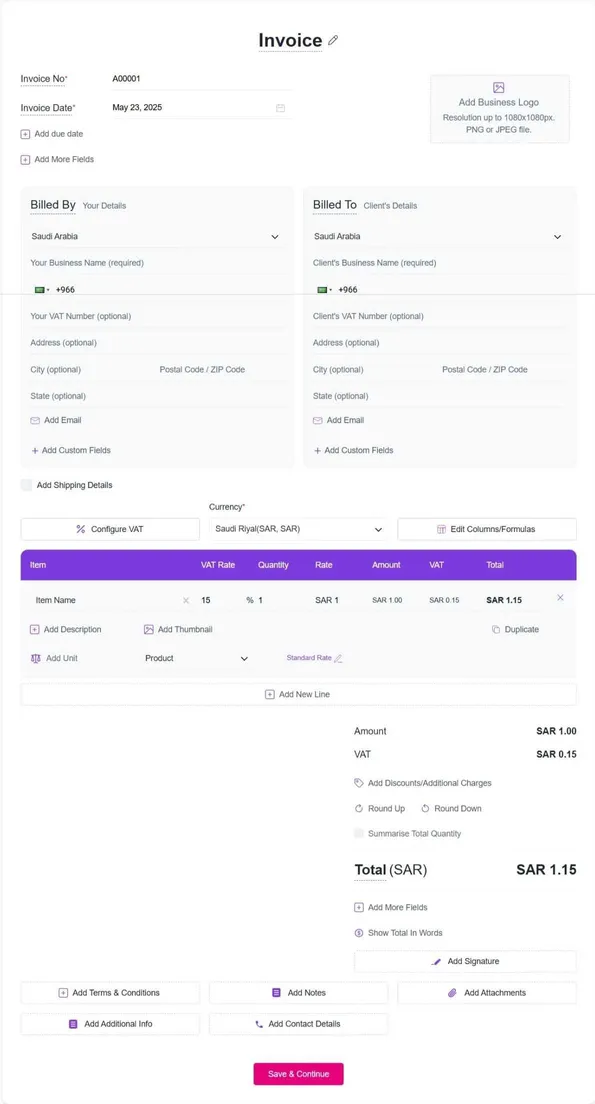

1. Create an E-InvoiceCreate completely customizable professional looking invoices in minutes with our advanced automation.

2. Get QR Code Automatically Refrens will automatically generate a QR code for you according to ZATCA guidelines.

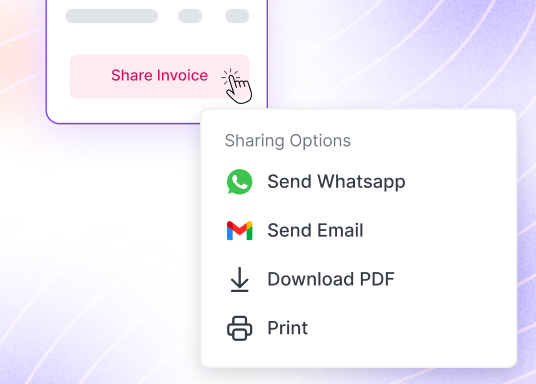

3. Share E-invoice with ClientQuickly share the e-invoice via link/print/pdf over email or WhatsApp in a few clicks.

Why Choose Refrens for ZATCA E-Invoicing?

Super Quick E-invoice Generation

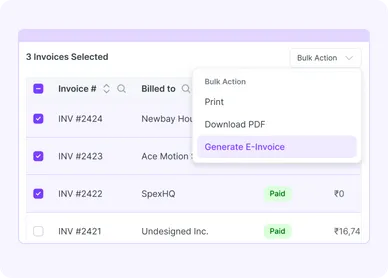

By harnessing smart automation technology, Refrens minimizes the need for manual data entry, streamlining the e-invoice creation process by up to 80%. This innovative solution not only saves valuable time but also enhances accuracy and reduces the risk of errors associated with manual input. With just a few clicks, users can generate e-invoices swiftly, empowering businesses to stay ahead in today's fast-paced digital environment.

Smart Error Checking & Data Validations

Ensure 100% legal compliance and accuracy in Zatca e-invoicing software with our advanced error checking and data validation features. Our smart system meticulously analyzes every aspect of your e-invoices, minimizing the risk of errors and discrepancies. You can rest assured that your e-invoices are error-free and legally compliant, saving you time, money, and potential headaches down the line.

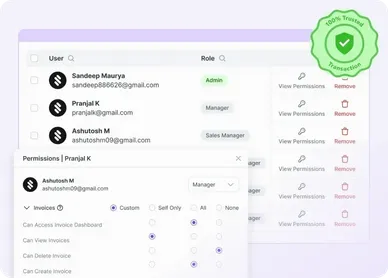

User Access Controls

Protect your sensitive data with our robust user access controls, designed to safeguard your information and ensure compliance with data security regulations. With customizable user roles and permissions, you can precisely define who has access to what, minimizing the risk of unauthorized access and data breaches.

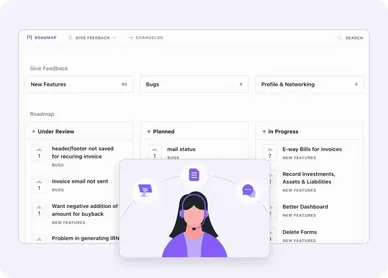

Round-the-clock Support

Need assistance? Our dedicated support team is here for you around the clock, ready to address your queries and provide expert guidance whenever you need it. Whether it's via email, chat, phone, or WhatsApp, we're just a message away, ensuring you receive the assistance you need, no matter the time or location.Additional Features of Our Zatca E-Invoicing Software

Streamline your e-Invoicing process with automationSignup for Free

Create Your First Invoice

1

Add Invoice Details

2

Design & Share (optional)

Add your business, client and item details

Change template, color, fonts, download pdf, print etc

1

Add Invoice Details

2

Design & Share (optional)

Add your business, client and item details

Change template, color, fonts, download pdf, print etc

Pricing of Invoicing Software

Only Pay When You Need Premium Features.

Made with and in Bengaluru.

Refrens Internet Pvt. Ltd. | All Rights Reserved

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.