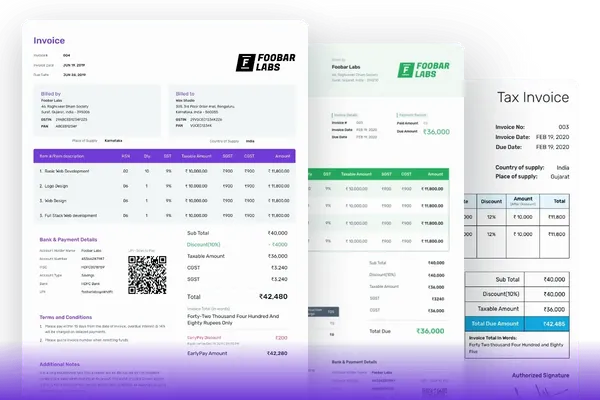

Commercial invoice template in PDF (Add invoice details and download it in PDF format.)

Frequently Asked Questions (FAQ)

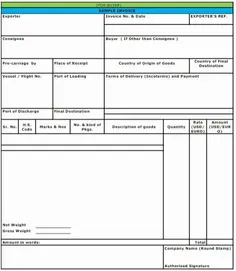

A commercial invoice is a document mostly used by exporters as proof of sale. Once the invoice is issued by the seller and the same is accepted by the buyer, it acts as evidence that a transaction between both parties has happened. It is one of the most important documents when you are trading overseas, and is mainly used to inform the customs officer for the clearance of invoice and taxable amount.

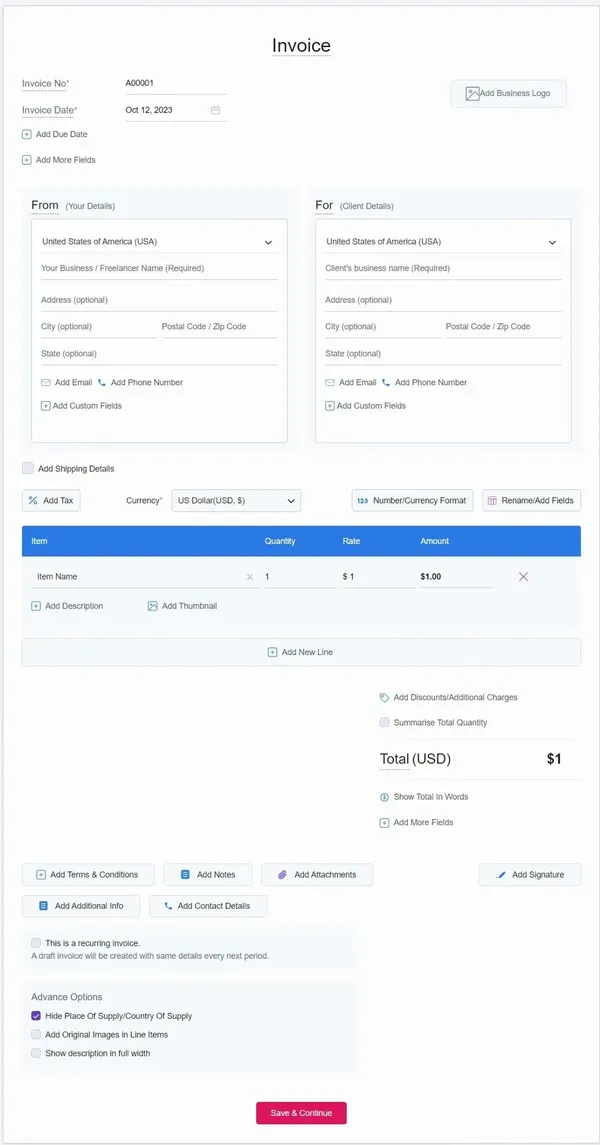

When creating a commercial invoice, you have to fill out some details to the blank commercial template like:

- Using our commercial template, invoice number, invoice date, and due date are auto-populated which avoid the repetitive task.

- In billed by, add your information which should include your company name, address, email, contact number, etc.

- Similar to billed by, add your clients' information in the billed to section.

- Add shipping details like sender and receiver details, shipping company name & delivery, or tracking number.

- In the line item, add your product name and description, with quantity and amount.

- Fill out tax information and the taxable amount of the invoice.

- Add your terms & conditions, additional notes, and the signature of an authorized person.

Following are the important elements of a commercial invoice:

- Add 'Commercial Invoice' as a title.

- Add invoice number, invoice date and due date.

- Seller's information like logo, company name, address, contact number.

- Buyer's details like name and address of the buyer.

- Shipping information like shipping company name, tracking or delivery number.

- Product name with net quantity, gross quantity(with packaging), rate.

- Shipping or freight charges, discounts (if any).

- Taxable amount of the product.

- Terms & conditions with additional notes.

- Signature of an authorized person.

Commercial invoice is a document used when international trading happens and is issued by the exporters (sellers).

Yes, it is important to breakdown the shipping details and cost of shipping in detail, so that it become easy to understand the total cost and the expenses incurred on shipping for the buyer.

Yes, using Refrens commercial invoice template you can easily customize the template as per the needs by adding the custom columns and fields or by hiding the unwanted columns. You can also change the color of the invoice.

Yes you can freely add your logo to the invoice. There is no branding of Refrens on the invoice.

Generally, a commercial invoice is not required for documents. Commercial invoices are typically used for the shipment of goods, not documents, since they detail the value and description of the shipped items for customs clearance. However, certain carriers or destinations might have specific requirements, so it's advisable to check with your shipping provider.

A commercial invoice is a legal document between the seller and buyer that details the sold goods' value, description, and other pertinent transaction information, used for customs clearance.

A proforma invoice, on the other hand, is more of a quotation or a preliminary bill of sale sent to buyers in advance of a shipment or delivery of goods. It outlines the goods or services to be sent and the expected charges but is not used for customs.

"Terms of Sale" on a commercial invoice refer to the agreed Incoterms between the buyer and seller, indicating the delivery terms, risk, and cost responsibilities. Examples include FOB (Free on Board), CIF (Cost, Insurance, and Freight), and DDP (Delivered Duty Paid).

- Invoice Templates

- |

- Quotation Templates

- |

- Proforma Invoice Templates

- |

- Purchase Order Templates

- |

- Freelance Invoice Templates

- |

- Quote Templates

- |

- Invoice Templates Word

- |

- Invoice Templates Excel

- |

- Printable Invoice Templates

- |

- Blank Invoice Templates

- |

- Tally Bill Format

- |

- Tax Invoice Templates

- |

- IT Service Invoice Templates

- |

- Photography Invoice Templates

- |

- Videography Invoice Templates

- |

- Social Media Invoice Templates

- |

- Digital Marketing Invoice Templates

- |

- Graphic Design Invoice Templates

- |

- Content Writing Invoice Templates

- |

- Web Development Invoice Templates

- |

- Service Invoice Templates

- |

- Rental Invoice Templates

- |

- Medical Invoice Templates

- |

- Landscaping Invoice Templates

- |

- Plumbing Invoice Templates

- |

- Cleaning Invoice Templates

- |

- Law Firm Invoice Templates

- |

- Consulting Invoice Templates

- |

- Estimate Templates

- |

- Interior Design Invoice Templates

- |

- Trucking Invoice Templates

- |

- DJ Invoice Templates

- |

- Catering Invoice Templates

- |

- Auto Repair Invoice Templates

- |

- Towing Invoice Templates

- |

- Musician Invoice Templates

- |

- Handyman Invoice Templates

- |

- Roofing Invoice Templates

- |

- Commercial Invoice Templates