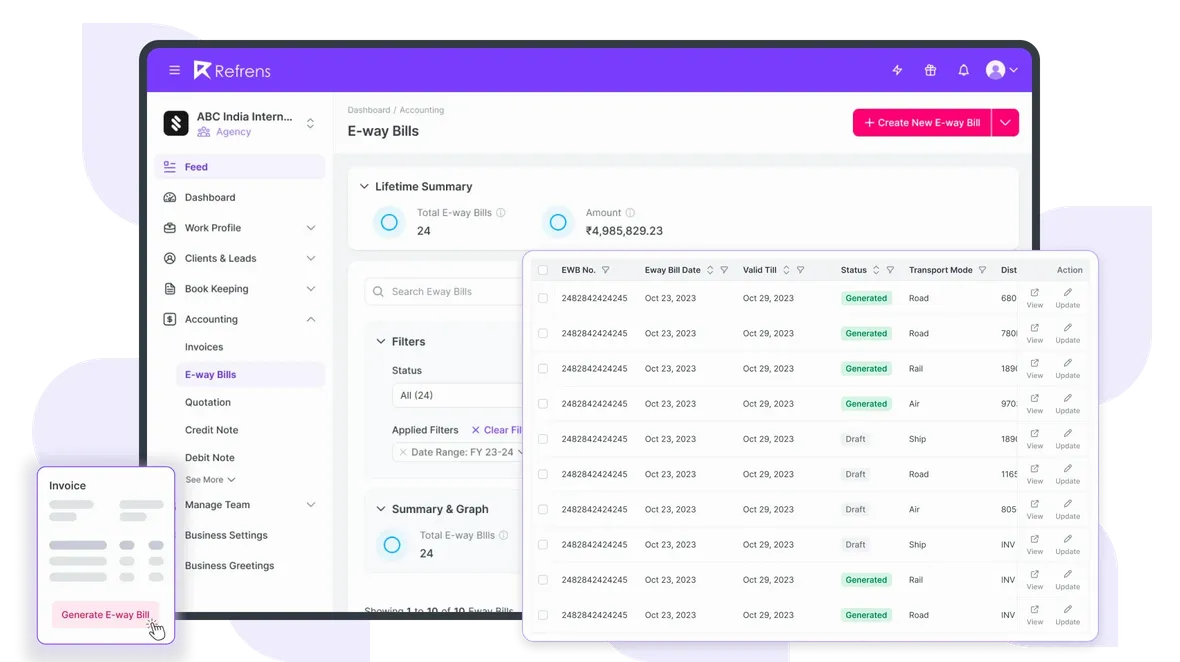

Key features of Refrens e-Way bill software

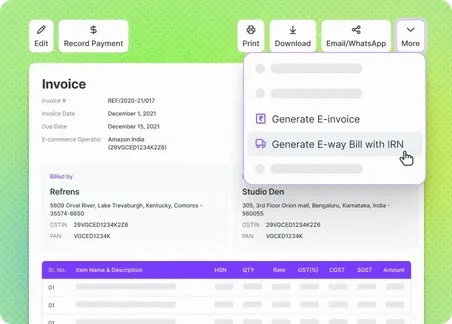

Generate eWay bills with IRN

With advanced e-way bill software, you can create both e-way bills and e-invoices with a single click, saving time and eliminating the hassle of switching between multiple platforms. Whether you’re managing a high volume of transactions or handling unique business scenarios, this solution streamlines operations and reduces errors.

eWay bill creation powered by automation

Forget the tedious task of manually entering data into the e-way bill portal. With Refrens, automation takes over, letting you generate e-way bills effortlessly. Refrens eliminates the need for repetitive data entry, ensuring accuracy and saving you valuable time. The software fetches all necessary details directly, reducing the risk of errors and speeding up the process. This advanced e-way bill generator is designed to make your workflow smoother, allowing you to create e-way bills online without any hassle.

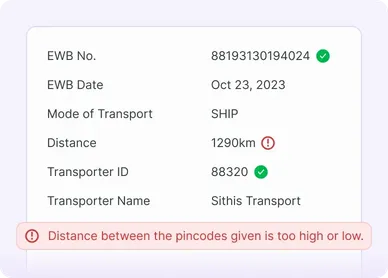

Stay compliant with auto-validation

Accuracy matters when creating e-way bills, and Refrens has you covered. The software automatically validates your data, ensuring every detail is correct and compliant with regulatory requirements. No more second-guessing or worrying about errors slipping through. Refrens performs real-time checks, flagging inconsistencies before they become a problem.

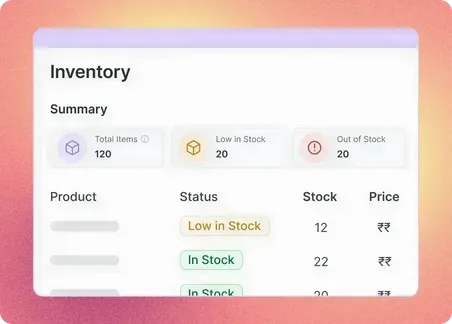

Inventory and warehouse management

Refrens simplifies inventory management by providing an intuitive platform to manage and adjust stock levels seamlessly. It ensures real-time updates, allowing businesses to maintain accurate inventory records without manual hassle. With a built-in inventory ledger, every transaction is recorded transparently, offering full visibility into inflows and outflows. The integrated purchase and sales ledger streamlines the tracking of orders, payments, and stock changes, ensuring all transactions are accounted for.

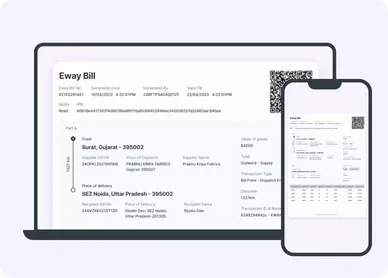

Access anywhere, anytime

Stay in control of your e-way bills no matter where you are. With Refrens’ cloud-based eway bill system, you can create and manage e-way bills from any device, at any time. The intuitive design makes it easy to navigate, whether you’re using a desktop, tablet, or smartphone. Generate E-way bills with India's leading E-way billing software

Our automated system completely removes the need for manual data entry on the e-way bill portal. Generating e-way bills has never been easier—just a single click is all it takes to streamline the process.

Generate eWay bill online

1

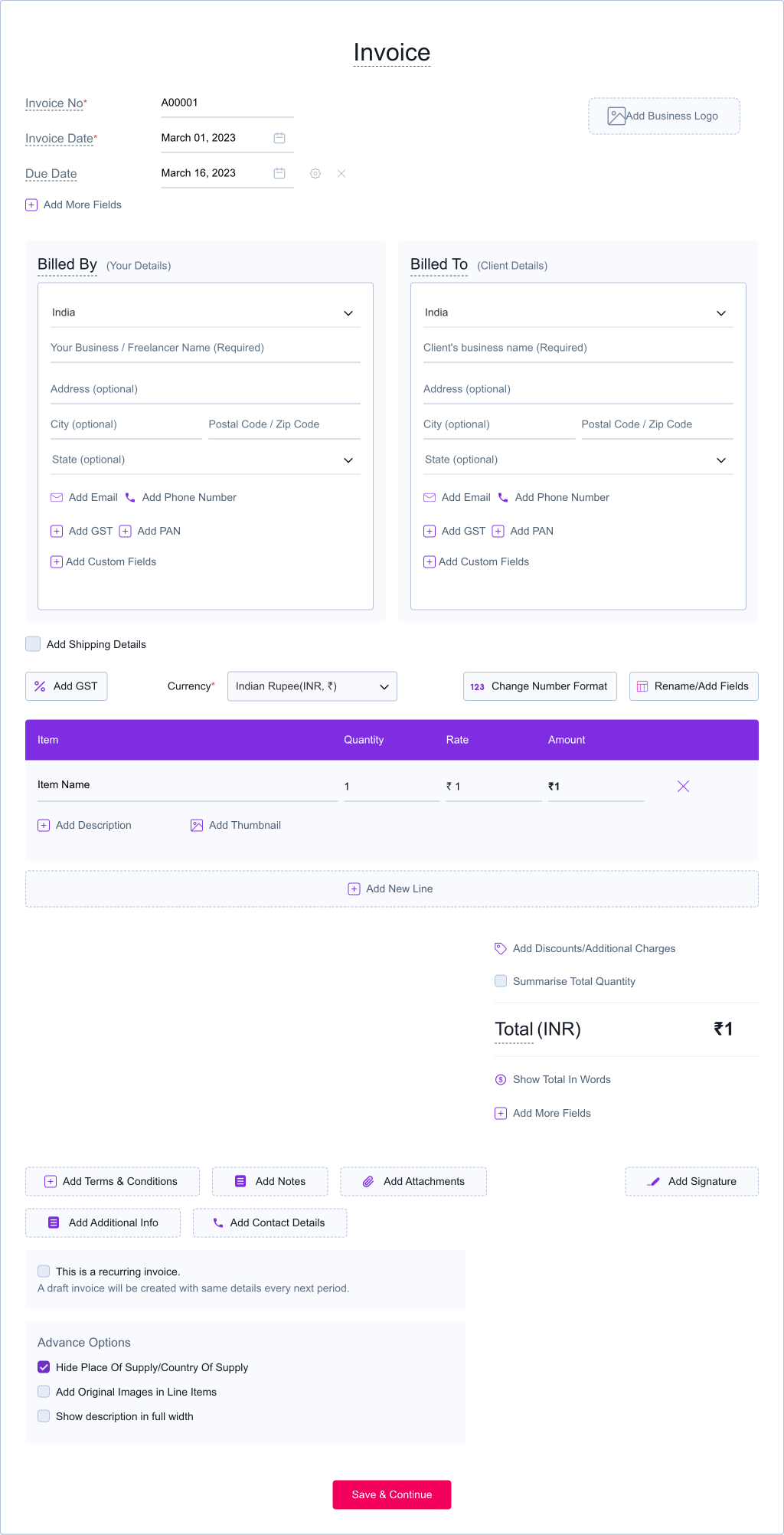

Add Invoice Details

2

Design & Share (optional)

Add your business, client and item details

Change template, color, fonts, download pdf, print etc

1

Add Invoice Details

2

Design & Share (optional)

Add your business, client and item details

Change template, color, fonts, download pdf, print etc

Streamline your e-way bill process with automationGet Started - It's FREE

Happy Customers

We are using Refrens for generating both E-invoicing and e-way bills, and we keep recommending it to our business partners.

HimanshuFounder, Packaged Food

Earlier it used to take 10 minutes to generate an E-way bill from the portal. With Refrens it only takes a few seconds!

Shivansh TulsyanCEO, Binny Textiles

We switched to Refrens after trying a few other software. Refrens is definitely easier to use.

Harsh S.Trader, Textiles Trading

The smartest investors in the room are backing our vision.

People who understand money, match-making and all things Internet.

Vijay Shekhar SharmaFounder, Paytm

Anupam MittalFounder, Shaadi.com

Kunal ShahFounder, CRED

Company

Products

- Cloud Accounting Software

- |

- AI Accounting Agent

- |

- GST Billing Software

- |

- e-Way Bill Software

- |

- e-Invoicing Software

- |

- Invoicing Software

- |

- Quotation Software

- |

- Lead Management Software

- |

- Sales CRM

- |

- Lead to Quote Software

- |

- Expense Management Software

- |

- Invoicing API

- |

- Online Invoice Generator

- |

- Quotation Generator

- |

- Quote and Invoice Software

- |

- Pipeline Management Software

- |

- Invoicing Software for Freelancers

- |

- Indiamart CRM Integration

- |

- Billing Software for Professional Services

- |

- Invoicing Software for Consultants

- |

- Inventory Management Software

Refrens for CAs

Made with and in Bengaluru.

Refrens Internet Pvt. Ltd. | All Rights Reserved

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.