Why Hire a Chartered Accountant?

Hire a CA for End-to-End Accounting, GST & Compliance!

MS Legal Consultant

Chartered AccountantAgency | Jl. Bukit Leyangan Damai Raya No. 53 A, Leyangan, Ungaran Timur, Indonesia

Services Offered by Our Chartered Accountants

Hire a CA and get comprehensive support for company registration, name reservation, and incorporation document drafting (MoA & AoA). We will help you select the right business structure based on your industry, size, and compliance needs. Seamlessly ensure a smooth registration process and stay compliant with all post-incorporation formalities with Refrens CA services.

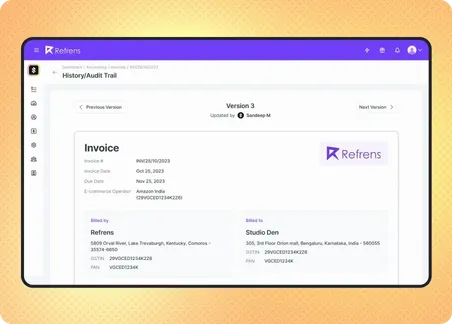

Hire a Chartered Accountant and maintain error-free financial records.

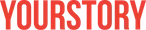

We handle invoice recording, expense tracking, bank reconciliation, accounts payable & receivable, and more. Our CAs also generate profit & loss statements, balance sheets, cash flow reports, and all other financial reports to keep your finances on track.

Hire CA to ensure timely and accurate GST return filing.

We manage GSTR-1, GSTR-3B, and ITC reconciliation for both regular and composition scheme businesses. Our highly qualified team helps businesses claim the maximum Input Tax Credit (ITC), prevent filing errors, and comply with changing GST regulations.

Get expert assistance in TDS return filing for salaries, rent, contractor payments, interest, and professional fees. We cover all TDS forms, including Form 24Q, 26Q, and 27EQ, and reconcile your TDS with Form 26AS. Hire a Chartered Accountant on Refrens to ensure accurate TDS calculations, avoiding penalties and compliance issues.

Stay compliant with tax/statutory audit requirements with our professional CA services.

We conduct a detailed financial statement evaluation to ensure compliance with accounting standards and tax laws. Whether it's a statutory audit or tax audit, we provide end-to-end support for seamless compliance.

Hire a chartered accountant on Refrens and file your Income Tax Returns (ITR) with accuracy and confidence!

We handle filings under Section 44AD (Presumptive Income), corporate ITR, and self-assessment tax filings. Our CAs can assist you with responding to IT notices and ensure easy compliance with all income tax requirements to avoid penalties and legal issues.

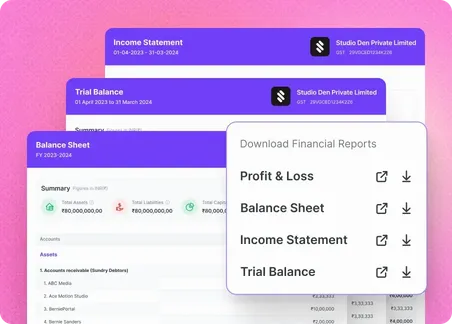

Why Choose Refrens?

How Our Expert CA Services Simplify Your Tax Journey

For more queries, reach out to +916353485608

What customers say about Refrens accounting software

The smartest investors in the room are backing our vision.

People who understand money, match-making and all things the Internet.

Frequently Asked Questions (FAQ)

A Chartered Accountant provides expertise in tax planning, compliance, financial management, and auditing, ensuring your business remains compliant while maximizing profitability.

Our CAs handle tax filing, compliance, financial advisory, auditing, and company incorporation services.

Yes, our Chartered Accountants provide remote services, making it convenient for businesses anywhere in India to access expert financial support.

Our pricing depends on the services you require and the complexity of your business needs. Contact us for a personalized quote.

Our team includes seasoned Chartered Accountants with expertise across industries and a strong understanding of Indian tax and business laws.

Yes, you’ll have a dedicated Chartered Accountant who will work closely with your business to provide personalized financial support.

The required documents depend on the CA service you need. For GST filing, TDS, or ITR filing, you may need your PAN, Aadhaar, past tax returns, and financial statements. For company incorporation, documents like business registration certificates, MoA & AoA, and identity proofs of directors are required. When you hire a chartered accountant through Refrens, we guide you through the exact documentation needed for your specific service.

If you’re unsure which CA service is right for your business, don’t worry! Simply share your requirements—whether it’s company incorporation, tax filing, GST compliance, auditing, or business advisory. Our experts will assess your needs and recommend the best chartered accountant services tailored to your business.

Yes! Whether you need a one-time tax consultation, annual audit, or ongoing bookkeeping and compliance support, you can hire a CA based on your business needs. We offer flexible CA services to suit startups, freelancers, small businesses, and enterprises.

Absolutely. We prioritize data security and confidentiality. When you hire a chartered accountant through Refrens, all your financial records, tax filings, and compliance documents are securely stored with cloud encryption and strict access controls. Your sensitive data remains protected at all times.

- Accounting Software

- |

- GST Billing Software

- |

- e-Way Bill Software

- |

- e-Invoicing Software

- |

- Invoicing Software

- |

- Quotation Software

- |

- Lead Management Software

- |

- Sales CRM

- |

- Lead to Quote Software

- |

- Expense Management Software

- |

- Invoicing API

- |

- Online Invoice Generator

- |

- Quotation Generator

- |

- Quote and Invoice Software

- |

- Pipeline Management Software

- |

- Invoicing Software for Freelancers

- |

- Indiamart CRM Integration

- |

- Billing Software for Professional Services

- |

- Invoicing Software for Consultants

- |

- Inventory Management Software