Elevate Your Expense Management With Refrens

Your One-Stop Expense Management Solution

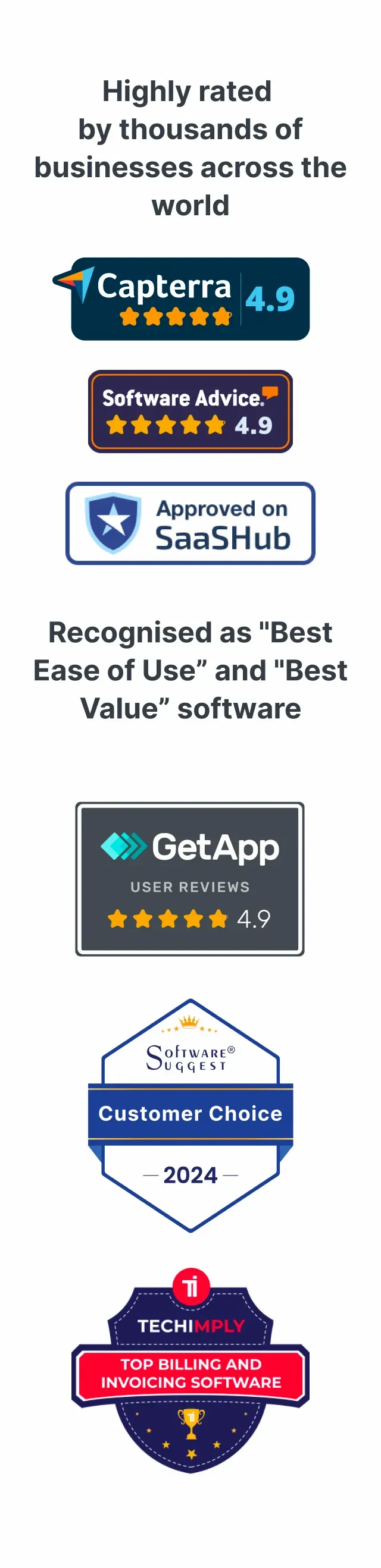

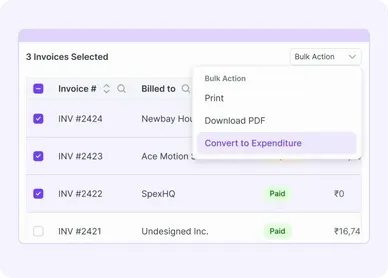

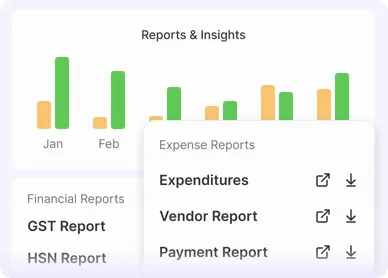

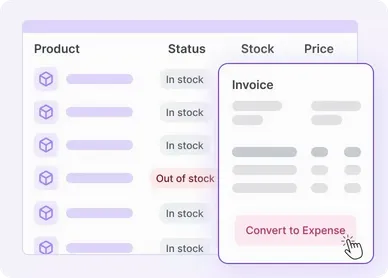

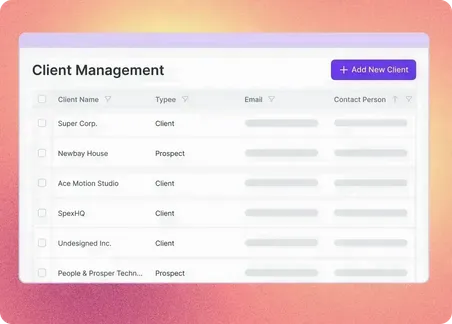

Key Features

Happy Customers

Frequently Asked Questions (FAQ)

Refrens is an all-in-one platform designed for accounting, admin, and sales teams to manage SST invoicing, accounting, expenses, inventory, sales, and other business processes.

More than 150,000 businesses across 178+ countries have simplified their daily operations with Refrens.

Your data's security and privacy are our utmost priorities. This is why over 1.5 lakh businesses worldwide rely on Refrens for their day-to-day operations. For more information, please review our privacy policy at https://www.refrens.com/privacy-policy.

Refrens ensures a 99% uptime, providing consistent and uninterrupted service to keep your business running smoothly.

Absolutely. Refrens is built to scale alongside your business. Our cloud-based infrastructure allows for seamless scalability, with regular updates and new features to accommodate your growth without compromising performance.

- Cloud Accounting Software

- |

- AI Accounting Agent

- |

- GST Billing Software

- |

- e-Way Bill Software

- |

- e-Invoicing Software

- |

- Invoicing Software

- |

- Quotation Software

- |

- Lead Management Software

- |

- Sales CRM

- |

- Lead to Quote Software

- |

- Expense Management Software

- |

- Invoicing API

- |

- Online Invoice Generator

- |

- Quotation Generator

- |

- Quote and Invoice Software

- |

- Pipeline Management Software

- |

- Invoicing Software for Freelancers

- |

- Indiamart CRM Integration

- |

- Billing Software for Professional Services

- |

- Invoicing Software for Consultants

- |

- Inventory Management Software