A Comprehensive Accounting Software for Startups

Happy Customers

One Software For All Your Accounting Needs

The smartest investors in the room are backing our vision.

People who understand money, match-making and all things Internet.

Frequently Asked Questions (FAQ)

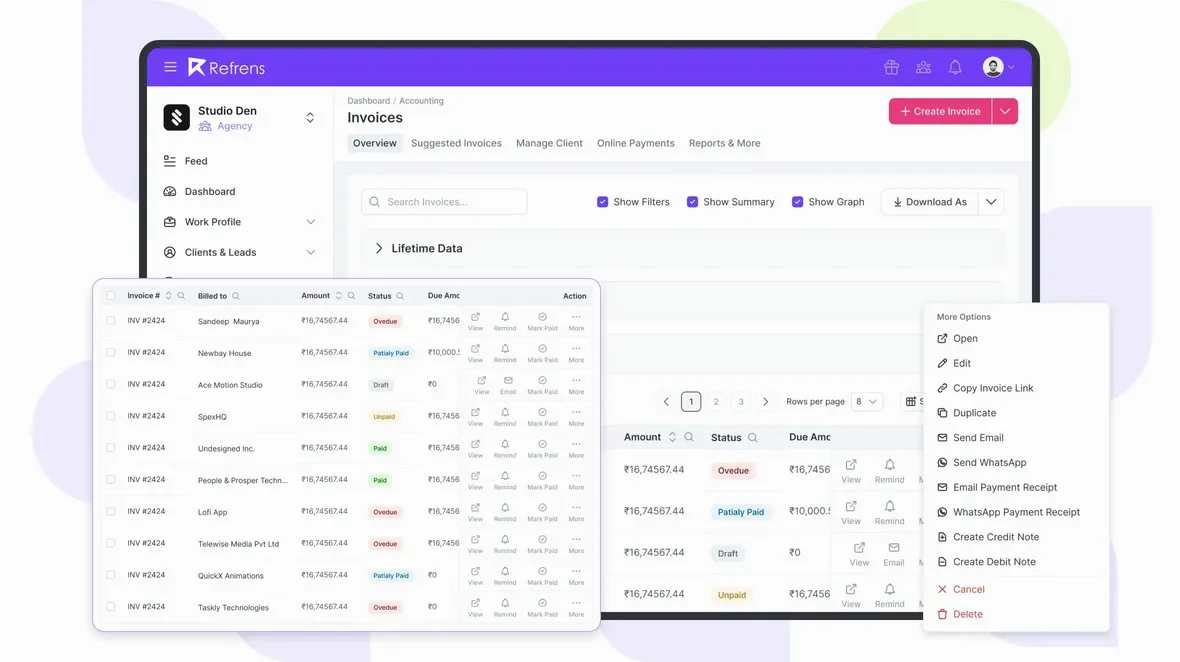

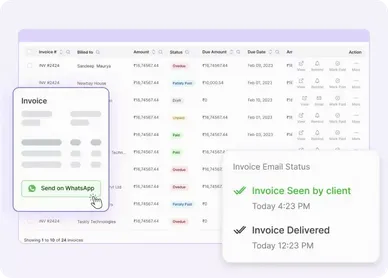

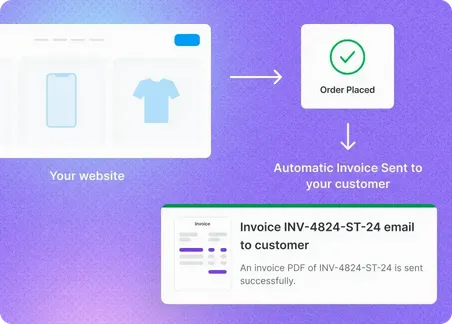

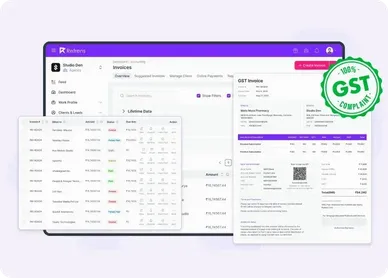

Refrens is the most comprehensive accounting software for startups. 150k+ entrepreneurs, agencies, accountants, and freelancers use Refrens to manage their finances end-to-end. Whether it is invoicing, payments, or reporting - everything can be managed and automated through Refrens’ accounting software.

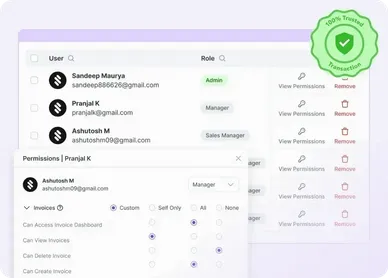

We take utmost care of data security & privacy. Our systems are frequently updated with the latest security updates to ensure that your data is safe and secure. Do check out our detailed privacy policy here.

Yes, we provide instant & reliable support over chat, email, and phone. We will also provide a dedicated account manager to help you out whenever required.

Yes, Importing your data from other accounting systems is super easy. However, if you need a helping hand, do reach out to us on chat support or at care@refrens.com.

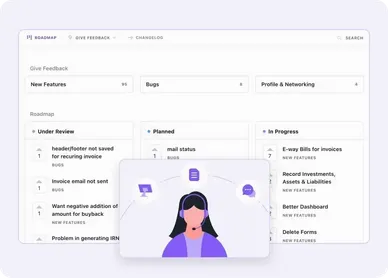

Absolutely! Our software is designed to seamlessly adapt and scale alongside your business, ensuring that it meets your evolving needs at every stage of growth. We are also committed to continuously enhancing the software by rigorously adding new features, functionality, and improvements so that your business can always stay ahead of the curve.

As your business expands, our software can accommodate an increasing number of users, manage larger volumes of data, and handle more complex tasks without compromising on performance or efficiency. We regularly update our software to incorporate new technological advancements, industry best practices, and customer feedback, ensuring that you always have access to the latest and most innovative solutions.

Additionally, our cloud-based infrastructure offers unparalleled scalability and reliability, with the ability to adjust resources on-demand to cater to your business's specific needs. This means that you can be confident that our software will support your growth without any disruption or downtime.

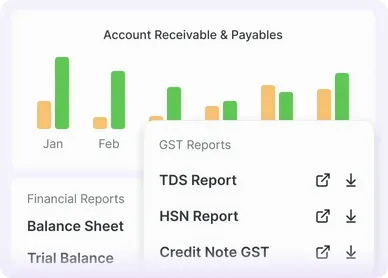

- Accounting Software

- |

- GST Billing Software

- |

- e-Way Bill Software

- |

- e-Invoicing Software

- |

- Invoicing Software

- |

- Quotation Software

- |

- Lead Management Software

- |

- Sales CRM

- |

- Lead to Quote Software

- |

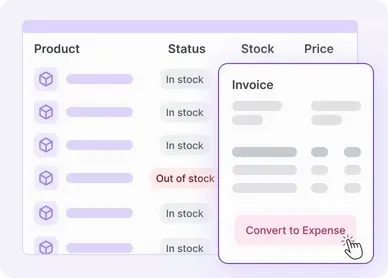

- Expense Management Software

- |

- Invoicing API

- |

- Online Invoice Generator

- |

- Quotation Generator

- |

- Quote and Invoice Software

- |

- Pipeline Management Software

- |

- Invoicing Software for Freelancers

- |

- Indiamart CRM Integration

- |

- Billing Software for Professional Services

- |

- Invoicing Software for Consultants

- |

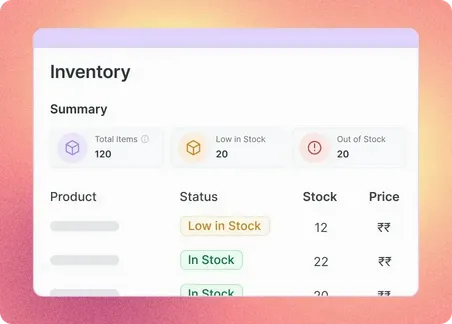

- Inventory Management Software