India’s Top B2B Traders Manage Their Accounting on Refrens

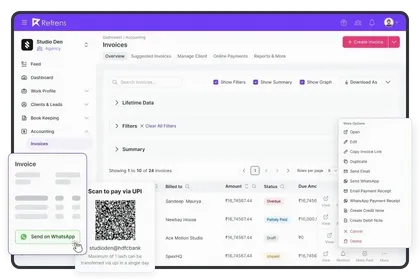

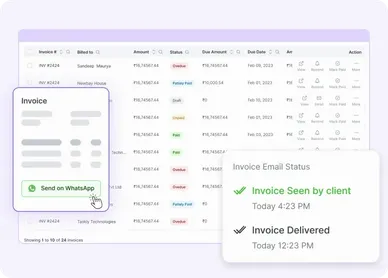

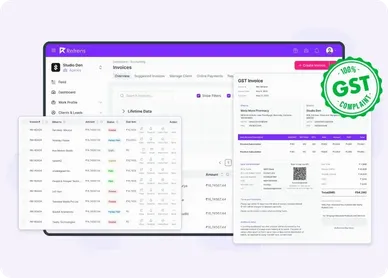

One software for invoicing, accounting, and inventory needs.

What our clients say about us

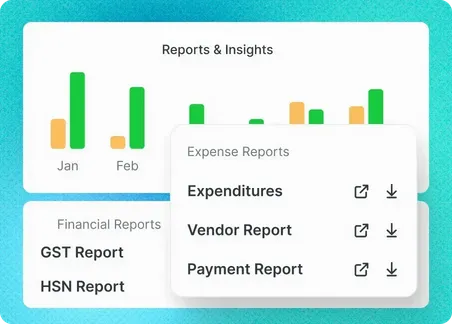

Everything You Need for Your B2B Trading Business

The smartest investors in the room are backing our vision.

People who understand money, match-making and all things Internet.

Frequently Asked Questions (FAQ)

Refrens is a leading platform designed to manage various aspects of business operations, including invoicing, accounting, expenses, inventory, sales, and more. Trusted by over 1.5 lakh businesses in 178 countries, Refrens supports daily business activities with ease.

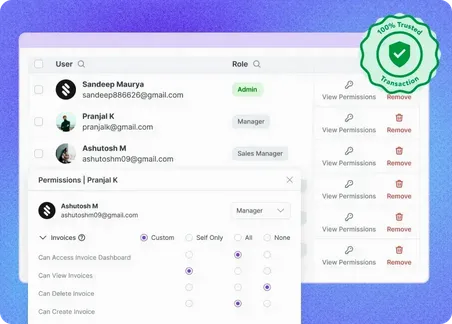

As an ISO certified organisation, we take utmost care when it comes to the security and privacy of our users’ data. For more details, visit https://www.refrens.com/privacy-policy

Refrens guarantees a 99% uptime, which ranks among the highest in the industry. You can count on Refrens for uninterrupted business operations and dependable service.

Absolutely! Refrens is designed to grow alongside your business, adapting to your needs at every stage. We regularly introduce new features, enhancements, and updates to keep your business ahead of the curve. Our software scales effortlessly to handle more users, larger data volumes, and increasingly complex tasks, all while maintaining top performance and efficiency. Additionally, our cloud-based infrastructure offers unmatched flexibility and reliability, allowing you to adjust resources as needed, ensuring your business continues to thrive without any hiccups.

- Cloud Accounting Software

- |

- AI Accounting Agent

- |

- GST Billing Software

- |

- e-Way Bill Software

- |

- e-Invoicing Software

- |

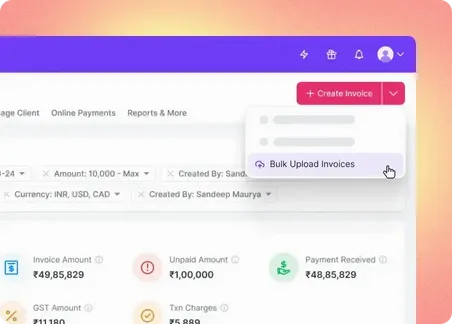

- Invoicing Software

- |

- Quotation Software

- |

- Lead Management Software

- |

- Sales CRM

- |

- Lead to Quote Software

- |

- Expense Management Software

- |

- Invoicing API

- |

- Online Invoice Generator

- |

- Quotation Generator

- |

- Quote and Invoice Software

- |

- Pipeline Management Software

- |

- Invoicing Software for Freelancers

- |

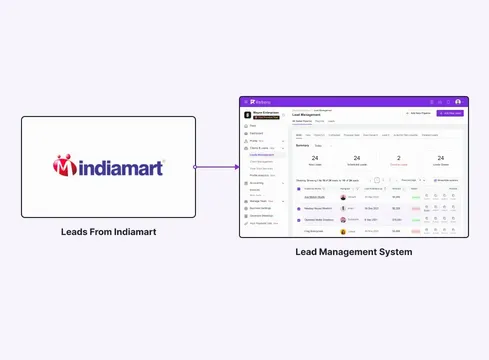

- Indiamart CRM Integration

- |

- Billing Software for Professional Services

- |

- Invoicing Software for Consultants

- |

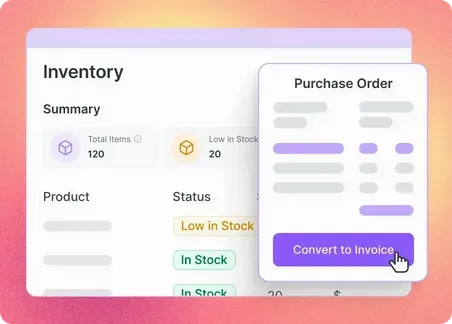

- Inventory Management Software