Your one-stop GST Accounting Software!

Best Accounting Software for Seamless GST Compliance

Key Features of Refrens GST Software

Who can use our free GST accounting software

What customers say about Refrens GST accounting software

The smartest investors in the room are backing our vision

People who understand money, match-making, and all things Internet.

Frequently Asked Questions (FAQ)

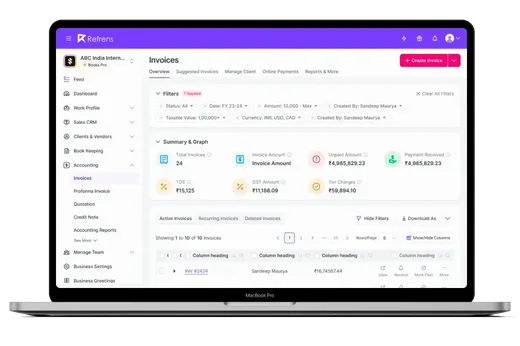

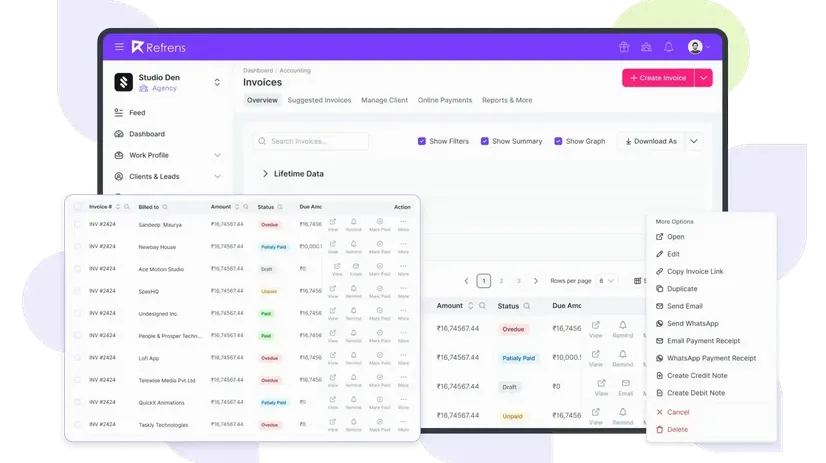

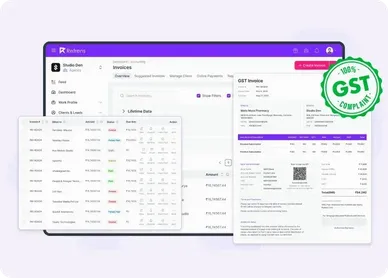

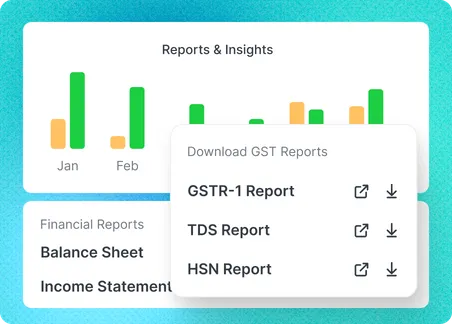

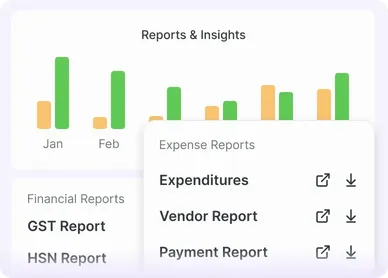

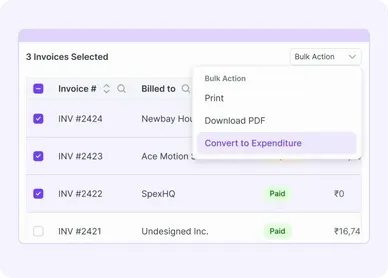

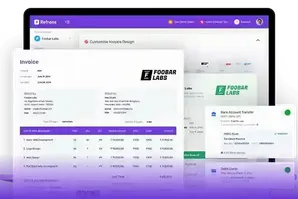

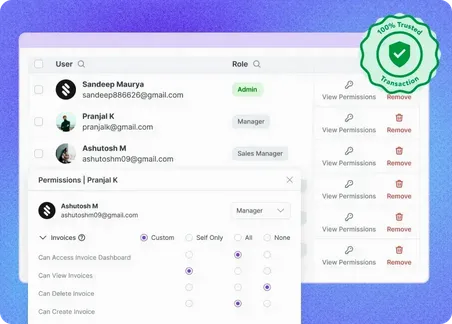

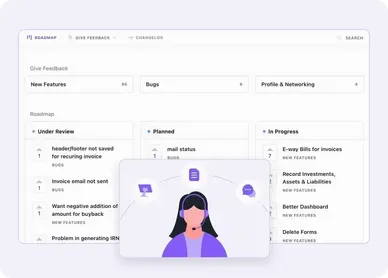

Refrens GST Accounting Software is a comprehensive accounting tool designed to simplify GST compliance, streamline financial reporting, and automate essential accounting tasks for businesses. It offers multi-currency billing, real-time data analysis, and customizable invoicing, quotation and reporting features.

No, you don't necessarily need a Chartered Accountant (CA) to file your GST returns. Many businesses, especially small to medium-sized ones, can handle GST filing themselves with the help of GST-compliant accounting software like Refrens which guides users through the process and helps automate business.

Yes, Refrens is GST-compliant software that simplifies GST invoicing, filing, and reporting, making it ideal for businesses to manage their GST and accounting tasks efficiently.

FREE! Refrens invoice generator is free for every small business, agency, startup, and entrepreneur. You can generate 15 documents every year. Also, manage invoices and access free templates.

Refrens GST Software is an accounting tool designed to help businesses manage GST compliance easily. It offers features like GST-compliant invoicing, automated filing, multi-currency billing, and customizable financial reports. This software simplifies GST tasks, making it suitable for small and medium-sized businesses looking to streamline their accounting processes and ensure tax compliance.

- Easy billing with GST-compliant invoicing

- Accurate GST return filing, including forms like GSTR-1, GSTR-3B, and GST CMP-08

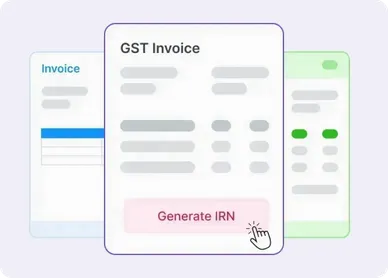

- Integrated solution for hassle-free e-invoicing and e-way bill generation

- Error prevention, detection, and correction features for smooth billing and return filing

- Regular updates to ensure compliance with the latest GST regulations

- Accounting Software

- |

- GST Billing Software

- |

- e-Way Bill Software

- |

- e-Invoicing Software

- |

- Invoicing Software

- |

- Quotation Software

- |

- Lead Management Software

- |

- Sales CRM

- |

- Lead to Quote Software

- |

- Expense Management Software

- |

- Invoicing API

- |

- Online Invoice Generator

- |

- Quotation Generator

- |

- Quote and Invoice Software

- |

- Pipeline Management Software

- |

- Invoicing Software for Freelancers

- |

- Indiamart CRM Integration

- |

- Billing Software for Professional Services

- |

- Invoicing Software for Consultants

- |

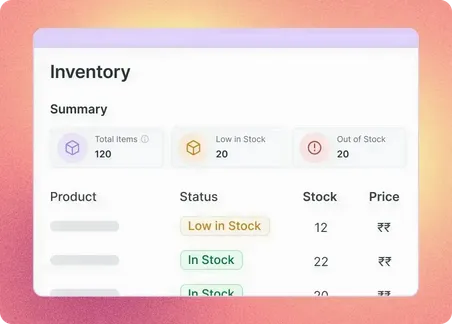

- Inventory Management Software