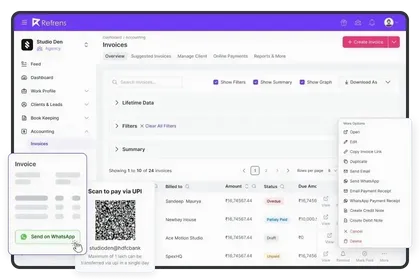

Ultimate Accounting Solution for Internet Businesses

Streamline Invoicing, Accounting, Reporting, and Compliance.

The smartest investors in the room are backing our vision.

People who understand money, match-making and all things Internet.

Comprehensive Features for Internet Companies

What our clients say about us

Frequently Asked Questions (FAQ)

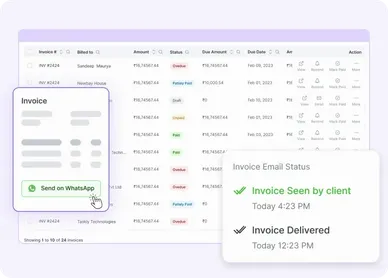

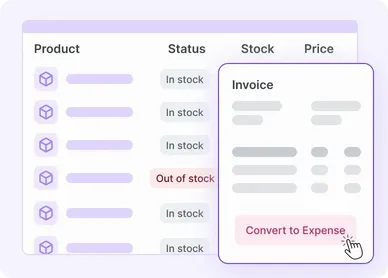

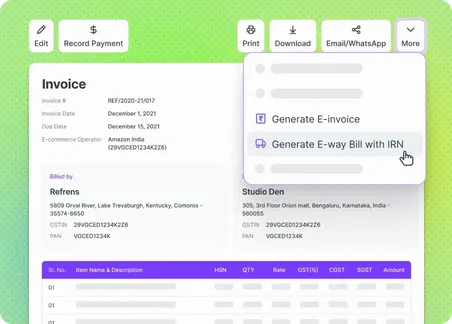

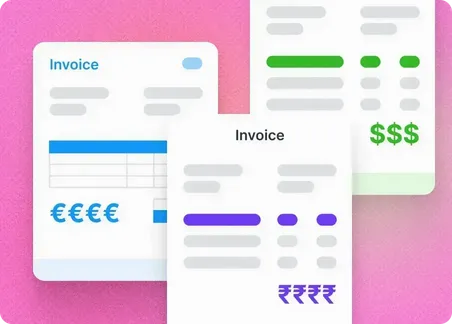

Refrens is a comprehensive platform built to streamline various business operations, from invoicing and accounting to managing expenses, inventory, and sales. With the trust of over 1.5 lakh businesses across 178 countries, Refrens simplifies everyday business tasks.

As an ISO certified organisation, we take utmost care when it comes to the security and privacy of our users’ data. For more details, visit https://www.refrens.com/privacy-policy

Refrens delivers a 99% uptime, placing us among the most reliable in the industry. You can trust Refrens to keep your business operations running smoothly without interruptions.

Yes, indeed! Refrens is engineered to expand in tandem with your business, adapting to your evolving needs. We continuously roll out new features, improvements, and updates to help you stay competitive. Our software easily scales to support more users, larger datasets, and more complex processes, without compromising on speed or performance. Plus, our cloud-based infrastructure offers exceptional scalability and reliability, allowing you to adjust resources as your business requires, ensuring seamless growth without downtime.

- Cloud Accounting Software

- |

- AI Accounting Agent

- |

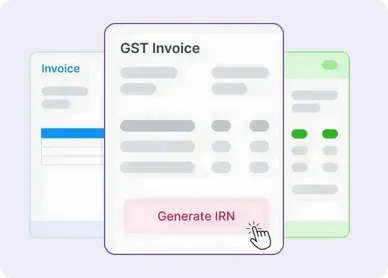

- GST Billing Software

- |

- e-Way Bill Software

- |

- e-Invoicing Software

- |

- Invoicing Software

- |

- Quotation Software

- |

- Lead Management Software

- |

- Sales CRM

- |

- Lead to Quote Software

- |

- Expense Management Software

- |

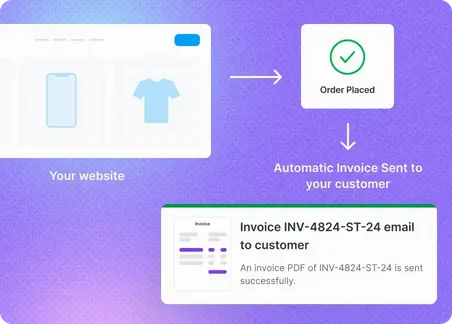

- Invoicing API

- |

- Online Invoice Generator

- |

- Quotation Generator

- |

- Quote and Invoice Software

- |

- Pipeline Management Software

- |

- Invoicing Software for Freelancers

- |

- Indiamart CRM Integration

- |

- Billing Software for Professional Services

- |

- Invoicing Software for Consultants

- |

- Inventory Management Software