Key Features of Refrens e-Invoicing Software

Effortlessly Streamline Your GST e-Invoicing with Refrens Software

Basic Features of e-Invoicing Software

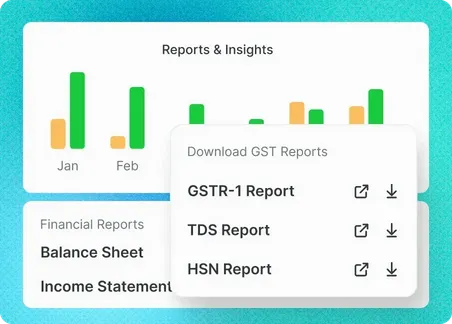

More from Refrens e-Invoice Software

Happy Customers

Pricing of e-Invoicing Software

Only Pay When You Need Premium Features.

The smartest investors in the room are backing our vision.

People who understand money, match-making and all things Internet.

Frequently Asked Questions (FAQ)

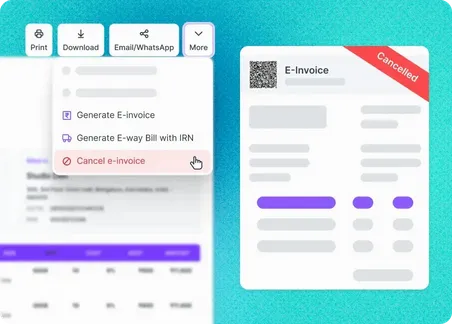

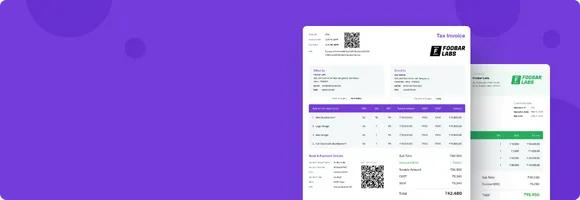

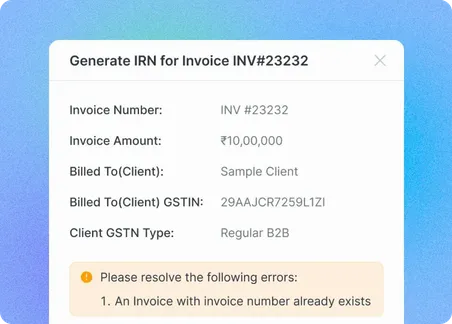

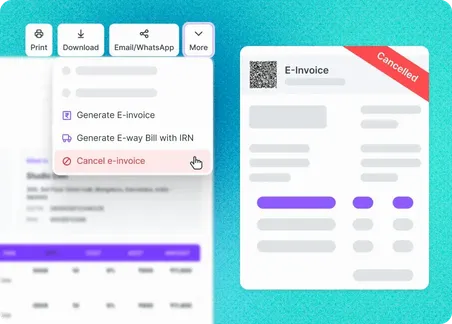

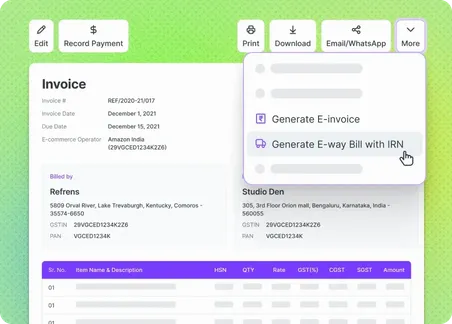

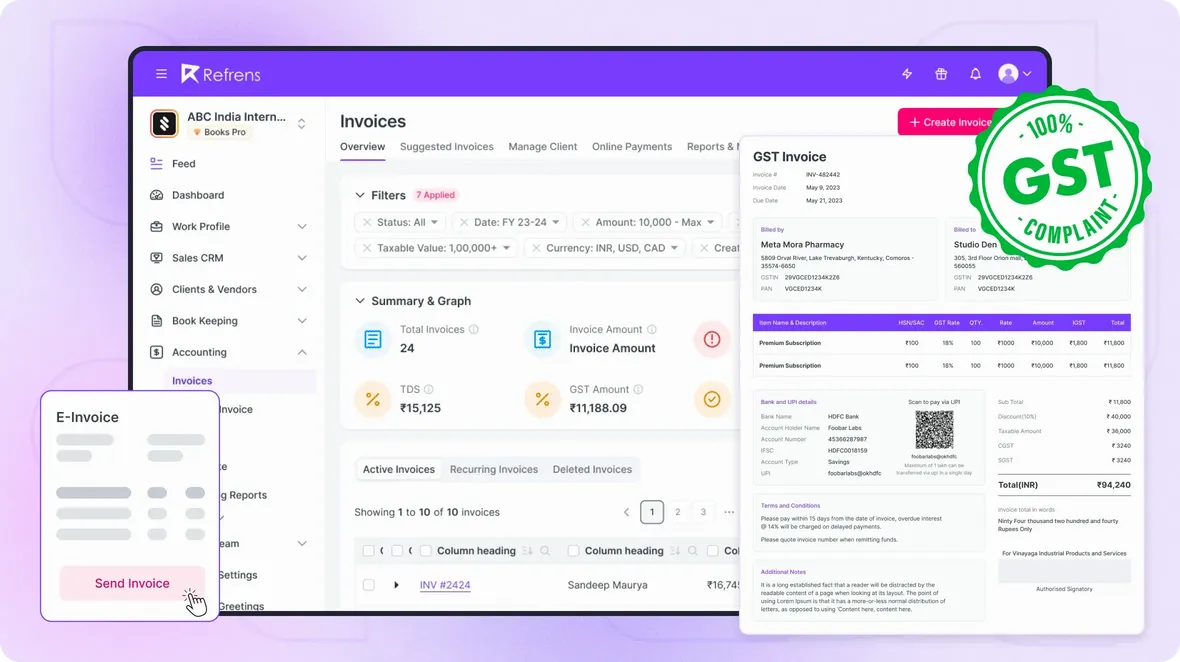

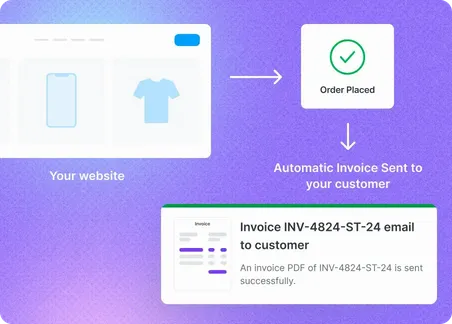

e-Invoicing in Refrens is easy and hassle-free. Refrens is GSP authorized, which means you can easily connect to IRP. Refrens e-Invoice makes easy to create invoice with all mandatory fields with smart validations. Easy to generate QR Code & IRN and send it to the customer.

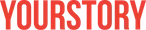

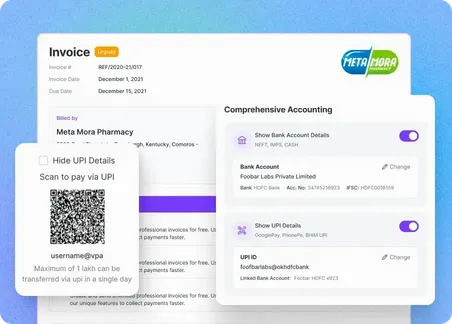

e-Invoice is similar to a normal invoice with an IRN (Invoice Reference Number provided by GST system) and a QR code. On Refrens.com, You can choose from multiple invoice templates in 250+ colors. All the templates follow prescribed format and standards. You can further customize the e-Invoice by adding custom fields, custom logo, digital signature and attachments.

Yes. Please write to irn@refrens.com for access.

Yes. Your data is stored securely with encryption and cloud protection. We are ISO/IEC 27001:2022 certified. Your data stays private and is safely stored on the cloud.

Yes, you can create weekly, monthly, and yearly recurring invoices on Refrens. You can also customize the dates as per your requirements.

Yes, you can create bulk invoices by uploading the simple excel sheet in Refrens e-Invoicing software.

- Cloud Accounting Software

- |

- AI Accounting Agent

- |

- GST Billing Software

- |

- e-Way Bill Software

- |

- e-Invoicing Software

- |

- Invoicing Software

- |

- Quotation Software

- |

- Lead Management Software

- |

- Sales CRM

- |

- Lead to Quote Software

- |

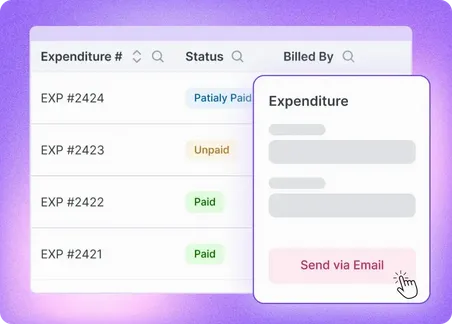

- Expense Management Software

- |

- Invoicing API

- |

- Online Invoice Generator

- |

- Quotation Generator

- |

- Quote and Invoice Software

- |

- Pipeline Management Software

- |

- Invoicing Software for Freelancers

- |

- Indiamart CRM Integration

- |

- Billing Software for Professional Services

- |

- Invoicing Software for Consultants

- |

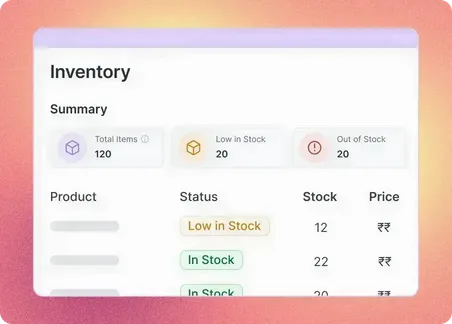

- Inventory Management Software