Leave the accounting stress on us

Services We Offer!

Why Us

The smartest investors in the room are backing our vision.

People who understand money, match-making and all things Internet.

Frequently Asked Questions (FAQ)

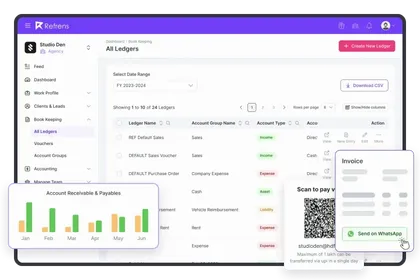

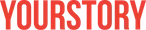

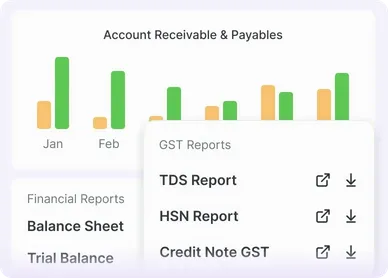

We offer a comprehensive range of services, including managing day-to-day financial tracking, categorizing transactions, maintaining ledgers, preparing periodic financial reports, creating financial statements, managing accounts payable and receivable, budgeting, forecasting, and ensuring compliance with tax regulations.

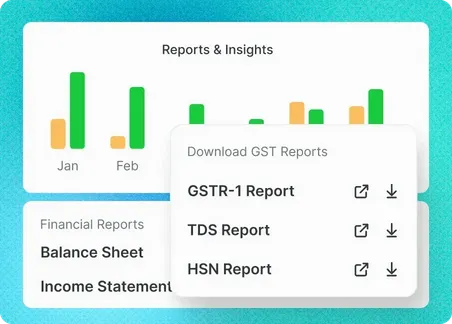

Additionally, we handle GST-related tasks such as preparing and filing GSTR-1, GSTR-3B, and GSTR-9, TCS/TDS calculations, ITC reconciliation, and compliance guidance. Our services are flexible and can be customized to suit your business needs, whether you require specific solutions or a complete financial management package.

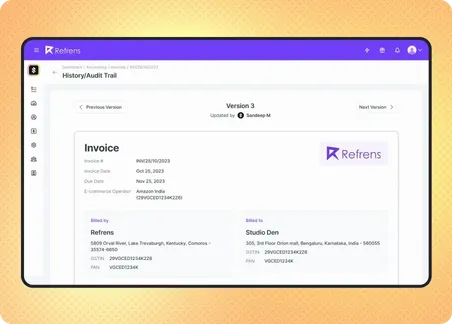

We use advanced tools and follow industry-standard practices to ensure your data is accurate, secure, and compliant with legal regulations.

Yes, our accounting and bookkeeping services are fully online and remote, ensuring accessibility and convenience for businesses anywhere.

Yes, you will have a dedicated accountant who understands your business and manages your registrations, tax planning, and financial strategies.

Our team consists of highly qualified and experienced accountants and bookkeepers who have worked with businesses across various industries.

Our team is available during business hours, but we also ensure prompt responses to urgent queries or support requests.

Our pricing depends on the services you choose and the scope of your requirements. Contact us for a personalized quote.

None. There are no hidden charges or setup fees. We only charge a small payment gateway fees of 1.5% on ACH or Wire Transfer and 4% or less on Credit/Debit Cards.

- Accounting Software

- |

- GST Billing Software

- |

- e-Way Bill Software

- |

- e-Invoicing Software

- |

- Invoicing Software

- |

- Quotation Software

- |

- Lead Management Software

- |

- Sales CRM

- |

- Lead to Quote Software

- |

- Expense Management Software

- |

- Invoicing API

- |

- Online Invoice Generator

- |

- Quotation Generator

- |

- Quote and Invoice Software

- |

- Pipeline Management Software

- |

- Invoicing Software for Freelancers

- |

- Indiamart CRM Integration

- |

- Billing Software for Professional Services

- |

- Invoicing Software for Consultants

- |

- Inventory Management Software