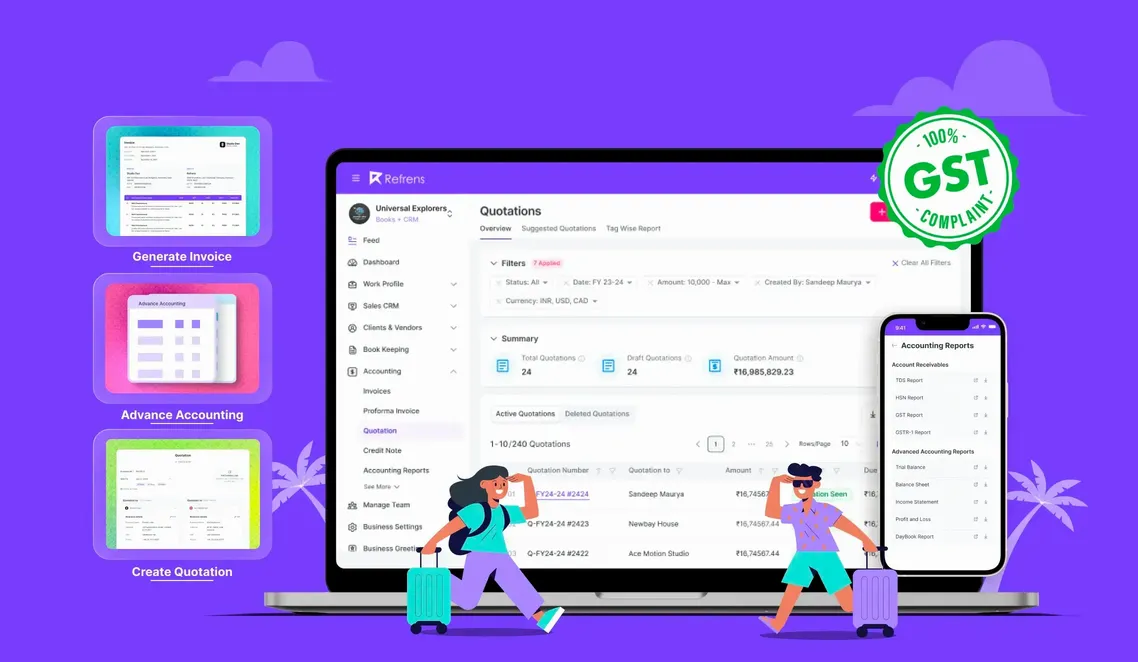

All-in-One Accounting Software for Travel Agencies

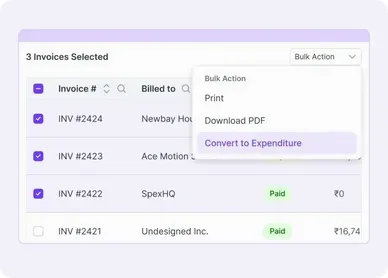

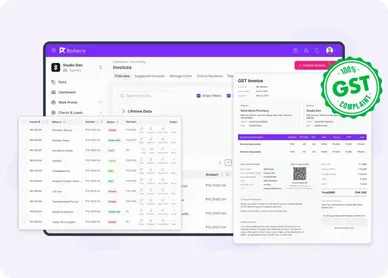

Generate professional invoices for travel packages, flight tickets, and hotel bookings in multiple currencies. Automatically calculate forex gains, discounts, additional costs, etc. Customize invoices with your brand color, logo, fonts, etc. Automate payment follow-ups for overdue invoices without any manual intervention with Refrens travel agency accounting software.

Record vendor details(like hotel & airline partners) & manage all your vendor expenses in one place. Monitor vendor-specific expenses, payments, and transactions for streamlined financial management with Refrens travel agency accounting software.

Categorize and track all agency expenses, from operational costs to client refunds. Access various insightful reports like Tag-wise Project Reports, Payment Reports, and more with Refrens accounting software for travel agencies.

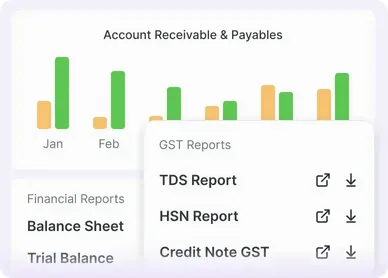

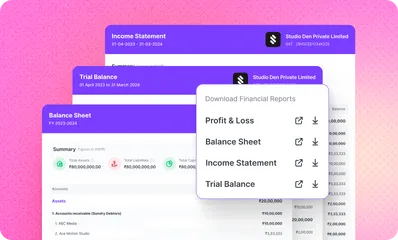

Automatically pass journal entries, create ledgers, and update voucher books based on your accounting documents like invoices, expenses, credit/debit notes, etc. Generate financial reports in one click and stay on top of your finances with Travel agency accounting software

Identify the best-performing travel packages with project-wise profitability reports. Gain business insights with all necessary financial reports like balance sheets, profit & loss statements, trial balance, and more, with Refrens travel agency accounting software.

Ensure seamless GST filing with automated tax calculations. Generate tax-compliant invoices, e-invoices, GST reports & more with just one click!

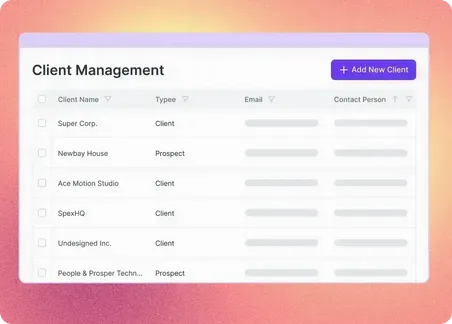

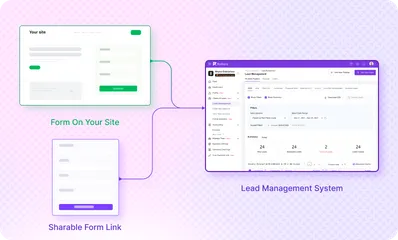

Capture & manage leads from multiple sources like Refrens forms, Instagram, Facebook, and more. Track inquiries, manage sales pipelines, monitor deal progress, and generate detailed reports—all from a centralized dashboard with Refrens travel agency accounting software.

Get reliable, round-the-clock support via chat, call and email. Enjoy a comprehensive knowledge base, an intuitive interface, regular updates, and a public roadmap for your convenience!

More from Refrens Pharmacy Billing Software

The smartest investors in the room are backing our vision.

People who understand money, match-making and all things Internet.

Happy Customers

Frequently Asked Questions (FAQ)

Absolutely! Refrens billing software is available on both desktop and mobile platforms. You can access it via the web on your computer or use the Refrens app, available on Google Play Store and App Store, to manage your business on the go.

You can contact the Refrens support team from 9:00 AM to 6:00 PM. Support is available through chat, email at care@refrens.com, or via phone for quick assistance.

Yes, the software is 100% GST-compliant. You can generate GST invoices, e-invoices, e-way bills, and GSTR reports effortlessly. It also maintains an audit trail for seamless tax filing and compliance.

Yes, our support team is available 24/7 via chat, email, or phone to assist you with any issues or questions regarding the software.

Refrens promises an uptime of 99% - which is among the best in the industry. Our robust system ensures that you are able to ensure your business operations without any interruptions.

Yes, our software is designed to adapt and scale effortlessly as your business expands. We continually improve the platform with new features and updates to meet your evolving needs. Whether you're adding more users or handling more complex tasks, Refrens offers the flexibility and power to support your growth without compromising performance. Our cloud-based infrastructure ensures that resources can be adjusted as needed, ensuring seamless growth with no downtime.

Absolutely. Only you can decide who you want to share the invoices, quotations with. The documents you create are accessible only through special URLs that you share or PDFs that you download. We do not share your data with anyone for any purpose.

- Accounting Software

- |

- GST Billing Software

- |

- e-Way Bill Software

- |

- e-Invoicing Software

- |

- Invoicing Software

- |

- Quotation Software

- |

- Lead Management Software

- |

- Sales CRM

- |

- Lead to Quote Software

- |

- Expense Management Software

- |

- Invoicing API

- |

- Online Invoice Generator

- |

- Quotation Generator

- |

- Quote and Invoice Software

- |

- Pipeline Management Software

- |

- Invoicing Software for Freelancers

- |

- Indiamart CRM Integration

- |

- Billing Software for Professional Services

- |

- Invoicing Software for Consultants

- |

- Inventory Management Software